Inflation has accelerated to 40-year highs, hitting 7.5% year-over-year in January, consistently clocking in higher than analyst expectations.1 This has spurred the U.S. Federal Reserve into action, with the central bank pivoting monetary policy and seeking to rein in inflation without snuffing out the economic recovery. As they seek this objective, expectations for the timing and trajectory of interest rates have continued to ratchet higher.2 After January’s consumer price index reading was released, the market expectations saw the potential for a 50 basis point (bps) hike in March, and an additional four 25 bps hikes before the end of the year.3 This prospective tightening could mark the end of the accommodative policies enacted to combat the economic slowdown in the wake of the virus. In such an environment, investors may need to consider how different asset classes will be impacted.

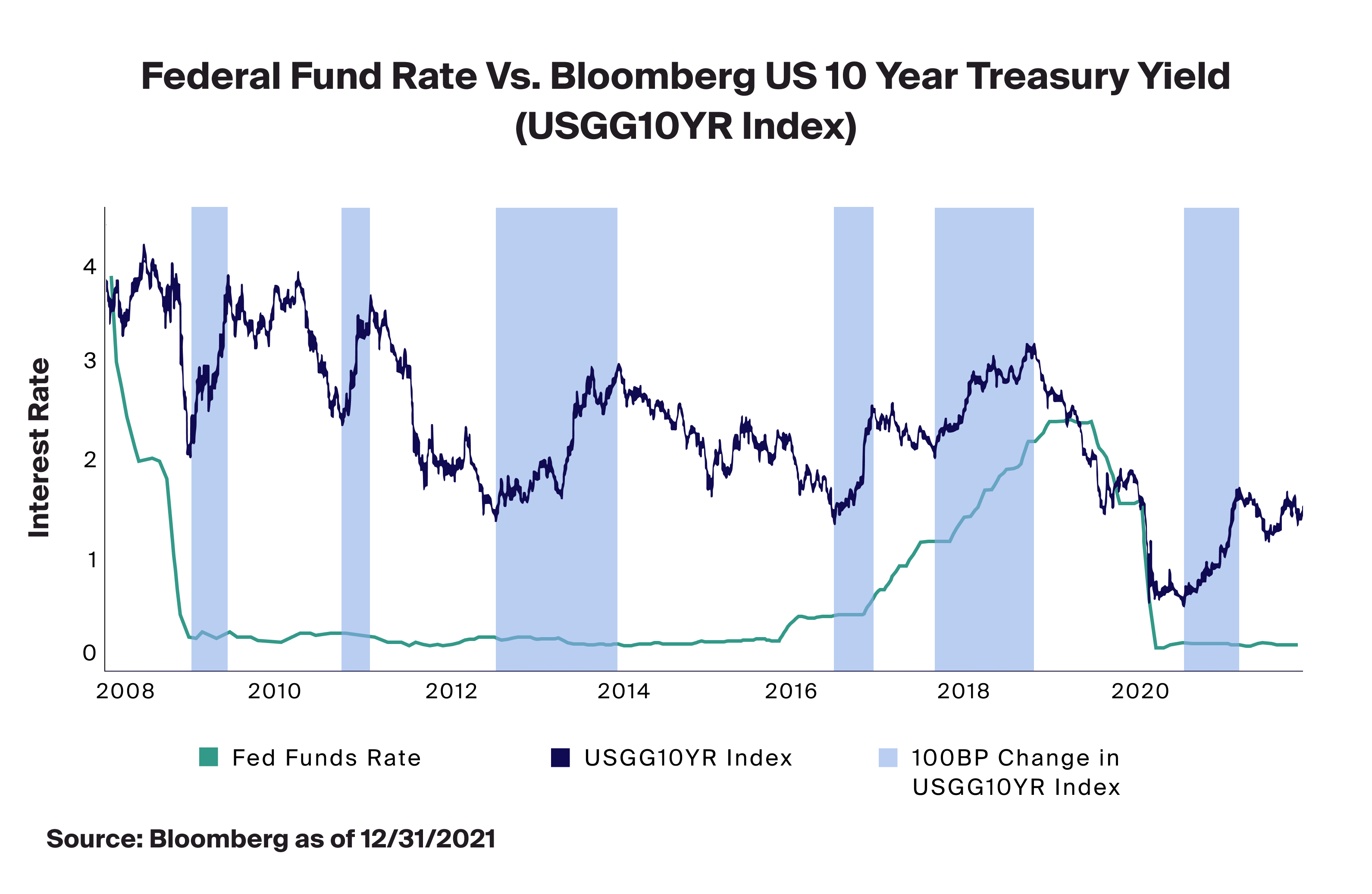

To assess the potential impact of rising rates, we looked at those periods since the global financial crisis (GFC) when the yield on the U.S. 10-Year Treasury bond increased 100 bps or more. Additionally, we analyzed how different asset classes performed over these periods in both public and private markets. Throughout this time, these instances (of an increase of 100 bps or more) occurred six times as shown below. Analyzing these six instances, and how the major asset classes performed, may foreshadow of how they could potentially perform in similar rising rate environments in the future.

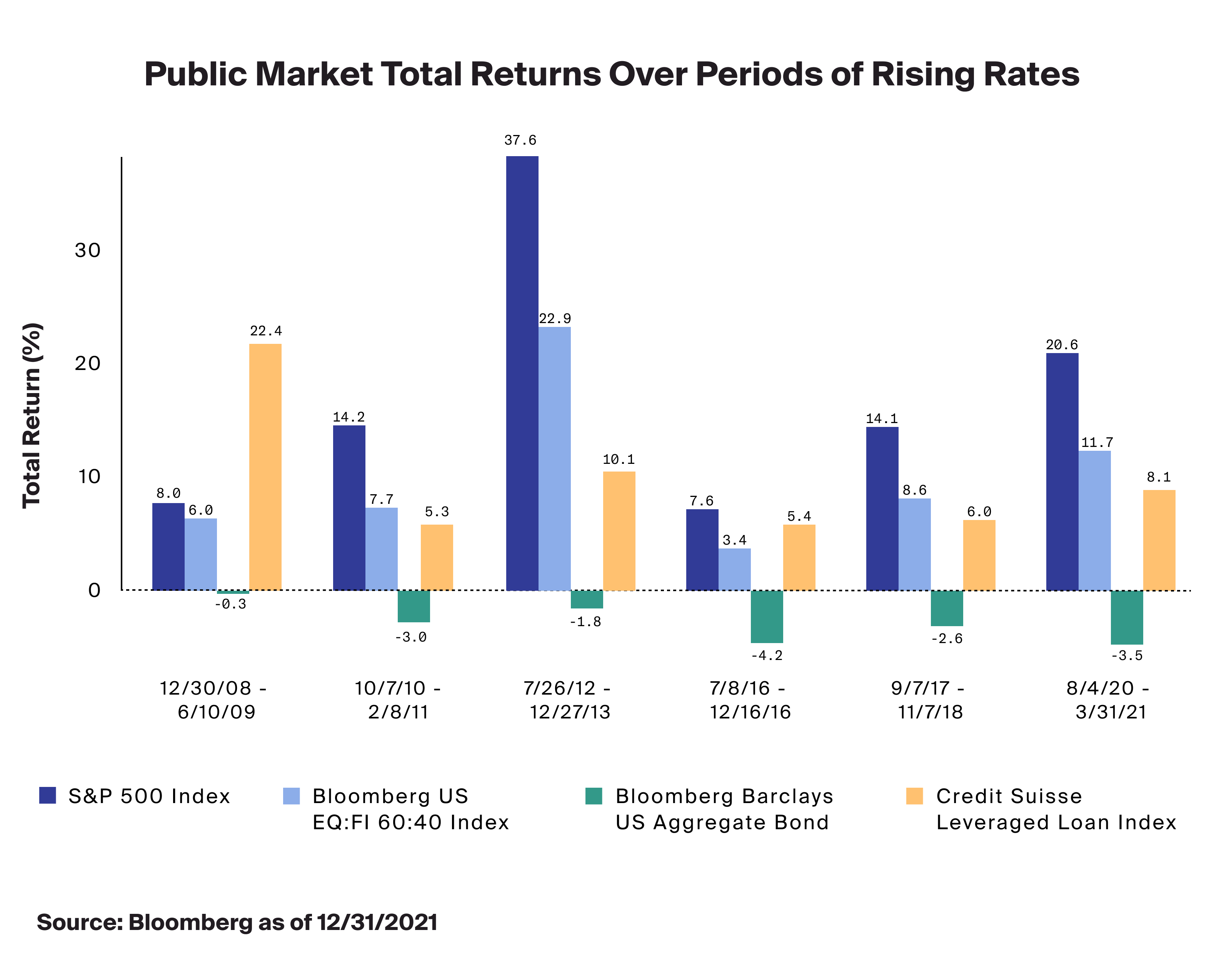

Public Market Performance in Periods of Rising Rates

Historically, rising interest rates have generally been positive for stocks as rates typically move higher in response to strong economic growth, which is generally a catalyst for inflation. Looking at the six instances above, we can see that the average annualized return for the S&P 500 Index was 25.7%. This helped contribute to the positive performance of the 60/40 stock/bond portfolio, which would have provided an average annualized return of 14.5% as represented by the Bloomberg US EQ:FI 60:40 Index. Given the inverse relationship between interest rates and bond prices, we saw over these periods that bonds, as represented by the Bloomberg U.S. Aggregate Bond Index (an investment grade, fixed-rate bond index), declined in all six periods, and had a lower average annualized return of -4.6%. This negative performance dragged down the performance of the diversified 60/40 portfolio. As floating rate loans are typically less sensitive to moves in interest rates given their ability for their coupon payments to increase relative to a benchmark reference rate, looking at the Credit Suisse Leveraged Loan Index we see better performance relative to bonds as the index returned 18.9%.

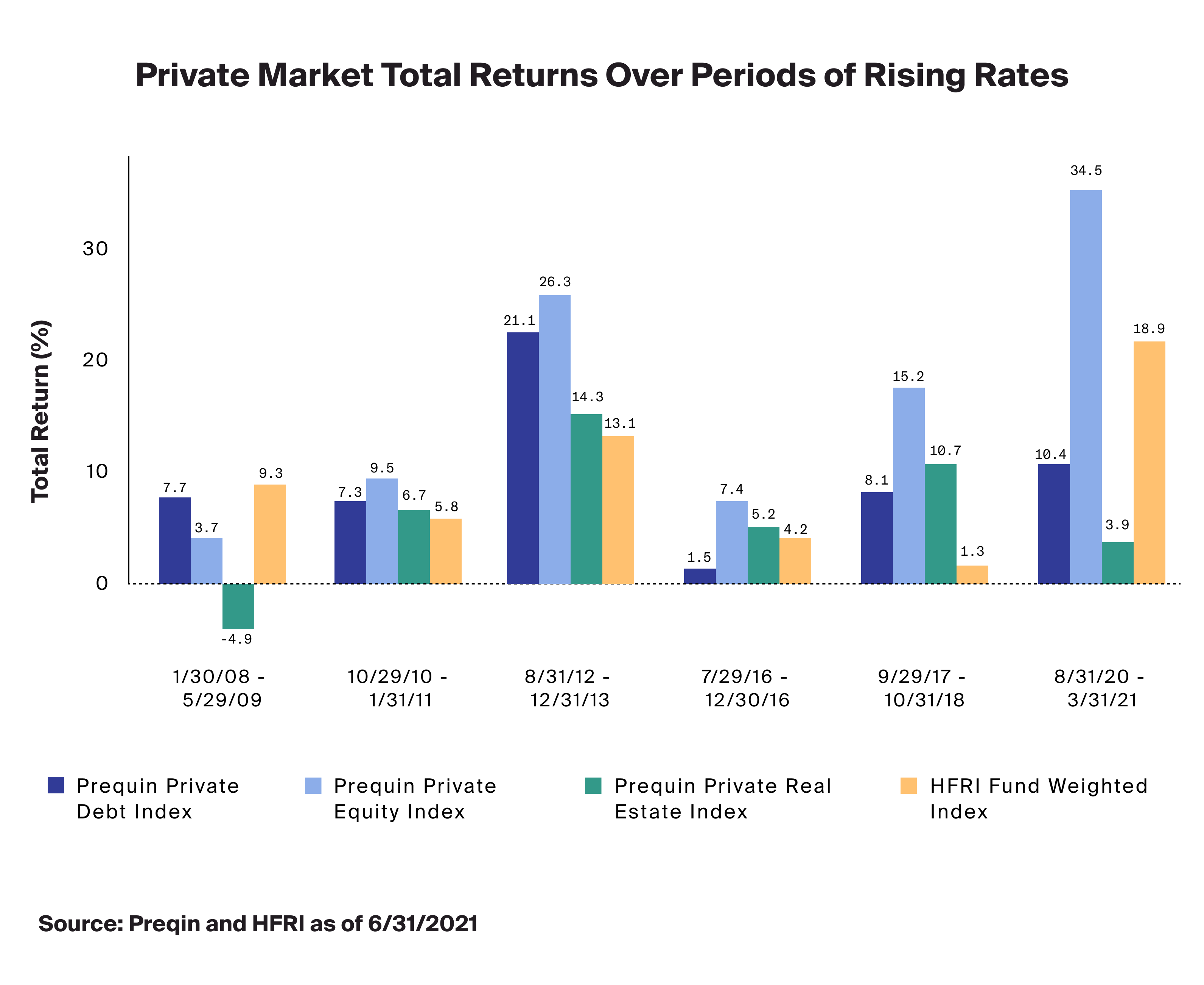

Private Market Opportunities

Private market strategies are increasingly being used by financial advisors to access enhanced return drivers, to diversify risk, or to supplement income. From our analysis, advisors may also use alternatives to expand their investment options to help navigate periods of rising rates. Private equity has provided investors with an average annualized return of 22.5% as represented by the Preqin Private Equity Index during cycles of rising rates, which compares favorably with its public market equivalent, the S&P 500 Index. Additionally, private real estate, which is typically able to pass on the effects of inflation in the form of higher rents and property values, also gained over the same period with the Preqin Real Estate Index returning an average annualize return of 7.5%. Private credit, which is largely floating rate in nature and includes highly negotiated loans that pay a premium interest rate, had an average annualized return of 13.6% as represented by the Preqin Private Debt Index. Finally, hedge funds also exhibited an attractive return with the HFRI Fund Weighted Composite Index returning 14.5% average annualized return over these phases of rising interest rates. An additional potential benefit of hedge funds is that they are also lowly correlated with global bonds over the longer-term with a correlation of approximately 0.2-0.34, furthering the ability for investors to potentially minimize the impact of rising rates on their traditional bond allocations.

Diving Deeper

While this discussion has largely focused on each alternative asset class broadly, in the coming weeks we will drill down deeper into the specific elements of these asset classes to investigate how and why they tend to perform positively during times of rising rates. It seems clear from this initial discussion however, that alternative investments may be a powerful tool in managing portfolios’ impact and exposure to rising rates.