What Is Direct Lending?

Direct lending is a private debt strategy where non-bank lenders provide loans directly to private companies, bypassing traditional intermediaries like banks. These loans are typically senior secured, privately negotiated, and often backed by covenants that can protect the interests of a lender.

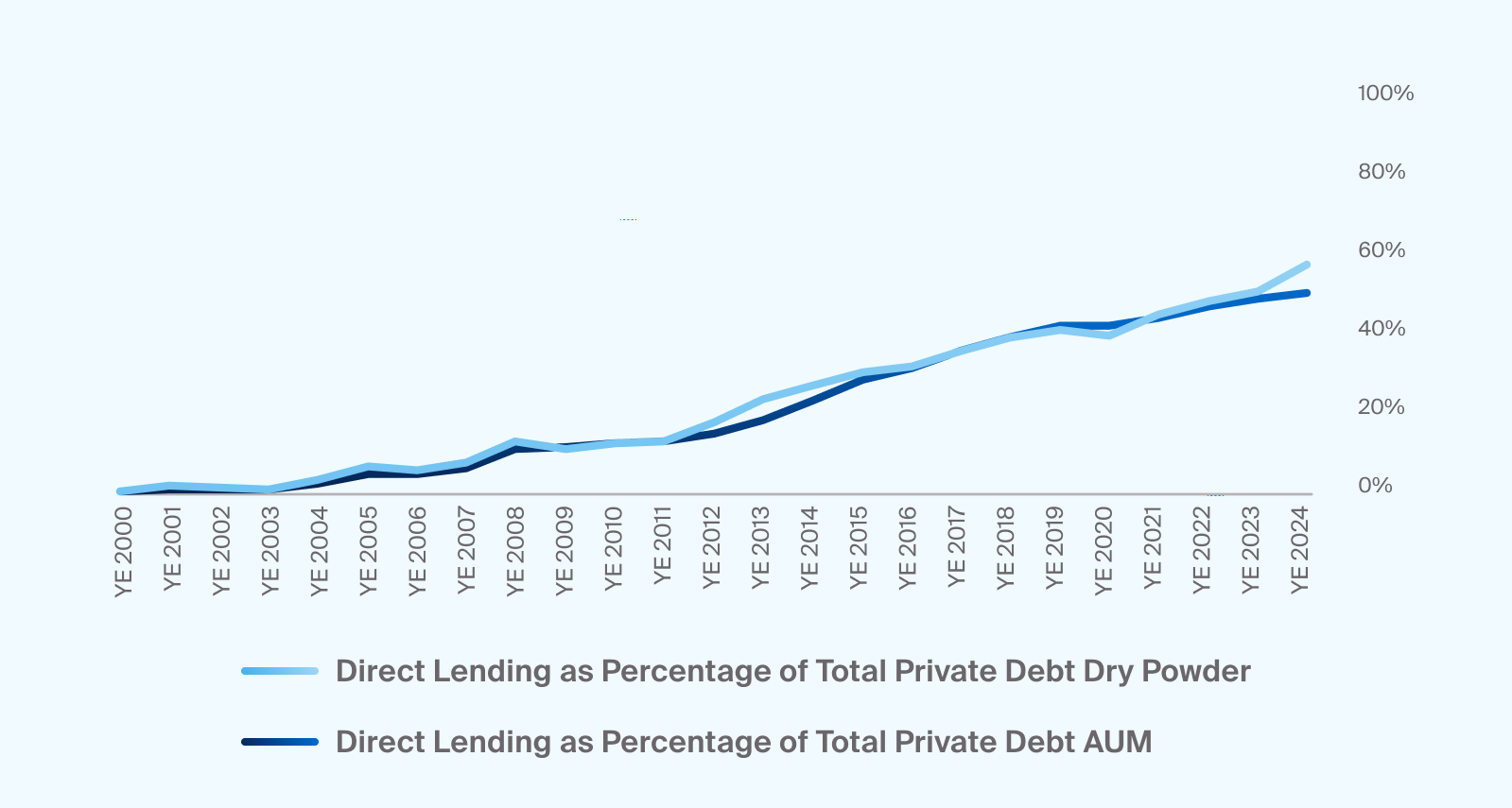

Direct lending is now the largest private debt substrategy, and its market share has expanded significantly since the Global Financial Crisis (GFC) (Exhibit 1). This trend reflects its continued growth in the long term.1

Source: Preqin, Global Report: Private Debt 2025

Direct lending has steadily grown as a share of total private debt since the GFC (Exhibit 1)

The strategy rose to prominence years following the global financial crisis, when heightened banking regulations started limiting traditional lenders' appetite for riskier borrowers. Private lenders stepped in to fill the gap, particularly for companies too small to issue public debt or secure bank financing.2 Today, direct lending has grown as an option even for large cap companies turning to these strategies for capital.3

How Direct Lending Works

To better understand how direct lending works in practice, let’s walk through a hypothetical scenario.

Example of a Direct Lending Deal

As an example, a private company could seek capital to acquire a competitor. The company may be too small to issue public debt and doesn’t meet the strict lending criteria of traditional banks. Instead, it works with a private credit manager to secure a tailored loan.

For the borrower, direct lending can provide speed, confidentiality, and a streamlined process. Unlike public or syndicated issuance, which may take months and involve regulatory filings, a direct lending agreement can often close in weeks. More expedited underwriting processes like these, while more convenient, may overlook or introduce certain risks for both parties.

For the lender, a direct loan may offer an opportunity to originate a customized credit solution with specific structural protections. Working directly with the company—and, in many cases, its sponsor—the lender can conduct its own underwriting, negotiate terms like covenants and collateral, and monitor performance closely over the life of the loan. This hands-on approach can potentially impact yields and loss rates, particularly when the lender has sector expertise or a strong relationship with the sponsor.

What Are Key Features of Direct Lending?

Private, Bilateral Origination

Direct lending deals often involve a single lender or a small group. While many direct loans are bilateral (i.e., between one lender and one borrower), there are structural variations. In “club deals,” a small group of lenders may participate together while negotiating collectively with the borrower. Some lenders also offer unitranche structures, which blend senior and subordinated debt into a single loan facility. This can streamline capital structures and eliminate the need to coordinate multiple tranches across different lenders.

Focus on Middle-Market Companies

Borrowers are typically private companies with $10–100 million in EBITDA. Many of these companies pursue capital for buyouts, expansion, or recapitalizations. But with smaller scale and no credit rating, they’re often shut out of public debt markets designed for larger, investment-grade issuers. Direct lending aims to fill that capital gap by targeting companies that can demonstrate strong cash flows and enterprise value. This approach may allow borrowers to sidestep the time and cost of public issuance while gaining access to flexible financing.

Income-Focused, Low Volatility Strategies

Typically, direct lending is designed for income generation. Its low correlation to public markets potentially indicates potential for diversification away from public markets.4 The valuation of these strategies is usually based on loan performance, not on market sentiment. Further, underlying loans aren’t broadly syndicated or publicly traded, which generally limits liquidity but may lead to higher yields via an illiquidity premium.5

Senior Secured, Floating-Rate Loans

Strategies are primarily composed of senior secured loans, which are first-lien obligations of the borrowing company.6 This structure grants lenders priority in the capital hierarchy to be repaid before junior creditors and equity holders in the event of default. Additionally, direct loans often feature floating-rate coupons tied to benchmarks like the Secured Overnight Financing Rate (SOFR) or the Prime Rate. This floating-rate structure can help mitigate interest rate risk by adjusting coupon payments in line with prevailing market rates.7

Why Advisors and Asset Managers May Allocate to Direct Lending

What are some drivers of direct lending’s continued relevance? We explore some below.

Yield and Covenant Protections in Direct Lending

One of direct lending’s appeals is its potential to generate higher yields compared to traditional fixed income, partly due to an illiquidity premium that have historically averaged 175-200 basis points (bps) since 2018.8

But the appeal isn’t just about return; it can also be about control.

Most direct loans feature maintenance covenants, which involve ongoing performance tests related to leverage, interest coverage, or cash flow generation. The aim is to help lenders spot underperformance early and negotiate restructuring terms or capital adjustments before defaults occur. In contrast, incurrence covenants (common in high-yield bonds) are only triggered when a borrower takes a defined action, such as issuing new debt or making a large acquisition, offering lenders less real-time protection.

This blend of higher yield and risk management is one potential reason advisors may fit direct lending into strategies seeking risk-adjusted yield with defensive characteristics.

The Value of Sponsor-Backed Borrowers

Many companies receiving direct loans are backed by private equity sponsors, which can add another layer of protection and discipline. For lenders, a sponsor’s involvement can mean:

More robust due diligence upfront

Stronger corporate governance and reporting standards

A potential source of additional capital in tough situations

A clearer path to exit (e.g., sale, IPO, recapitalization)

Sponsors are aligned with lenders in wanting the company to succeed, and their oversight can materially reduce default risk and improve recovery rates when problems arise.

Operational Access and Managerial Insight

Because direct lending is relationship-driven and privately originated, lenders typically maintain regular access to company management throughout the life of the loan. This access can enable more frequent monitoring, faster response times, and a deeper understanding of the borrower’s operating environment.

In contrast to public bonds or syndicated loans, where investors are often passive, direct lenders often act as hands-on creditors, which can translate to stronger outcomes during periods of financial stress.9 Like in private equity, some private debt managers even have dedicated value creation teams that work with their portfolio companies on growth efforts as a way to bolster their investment.

Key Considerations and Risks When Investing in Direct Lending

Though it historically has a lower average default rate than other forms of private debt, direct lending is not without its risks.10

Illiquidity

Direct loans are not traded on public markets, and investments are highly illiquid. Lenders are typically committed for the full term of the loan, and therefore, funds that focus on direct lending may be similarly illiquid. Secondaries have gained traction in private markets and, in some cases, may offer these strategies limited opportunities for liquidity.

Credit Risk

Private credit firms often make direct loans to sub-investment-grade companies that may not qualify for traditional bank financing due to their size, leverage, or credit profile. As a result, these borrowers may face a higher risk of default.

Valuation Opacity

Because direct loans are privately negotiated and not marked to market, they are typically valued using internal models. These techniques can obscure credit deterioration and create lags in fund-level performance reporting.

Floating-Rate Borrower Stress

While floating rates can benefit lenders, rising interest costs may put pressure on borrowers’ cash flows and debt service capacity. This dynamic can increase the risk of covenant breaches or payment defaults in a high-rate environment.

Fund-Level Leverage

Some private credit funds use leverage at the portfolio level to enhance returns, amplifying both gains and losses. In periods of market volatility, funds that use leverage may face refinancing risk if credit terms tighten or NAVs drop. This can trigger margin calls or forced asset sales, amplifying downside exposure and impairing overall fund liquidity.

Manager Selection

Advisors should also consider manager selection risk. Because direct loans are privately originated and marked to model, outcomes can vary meaningfully based on the manager’s underwriting discipline, deal sourcing capabilities, and risk monitoring practices.