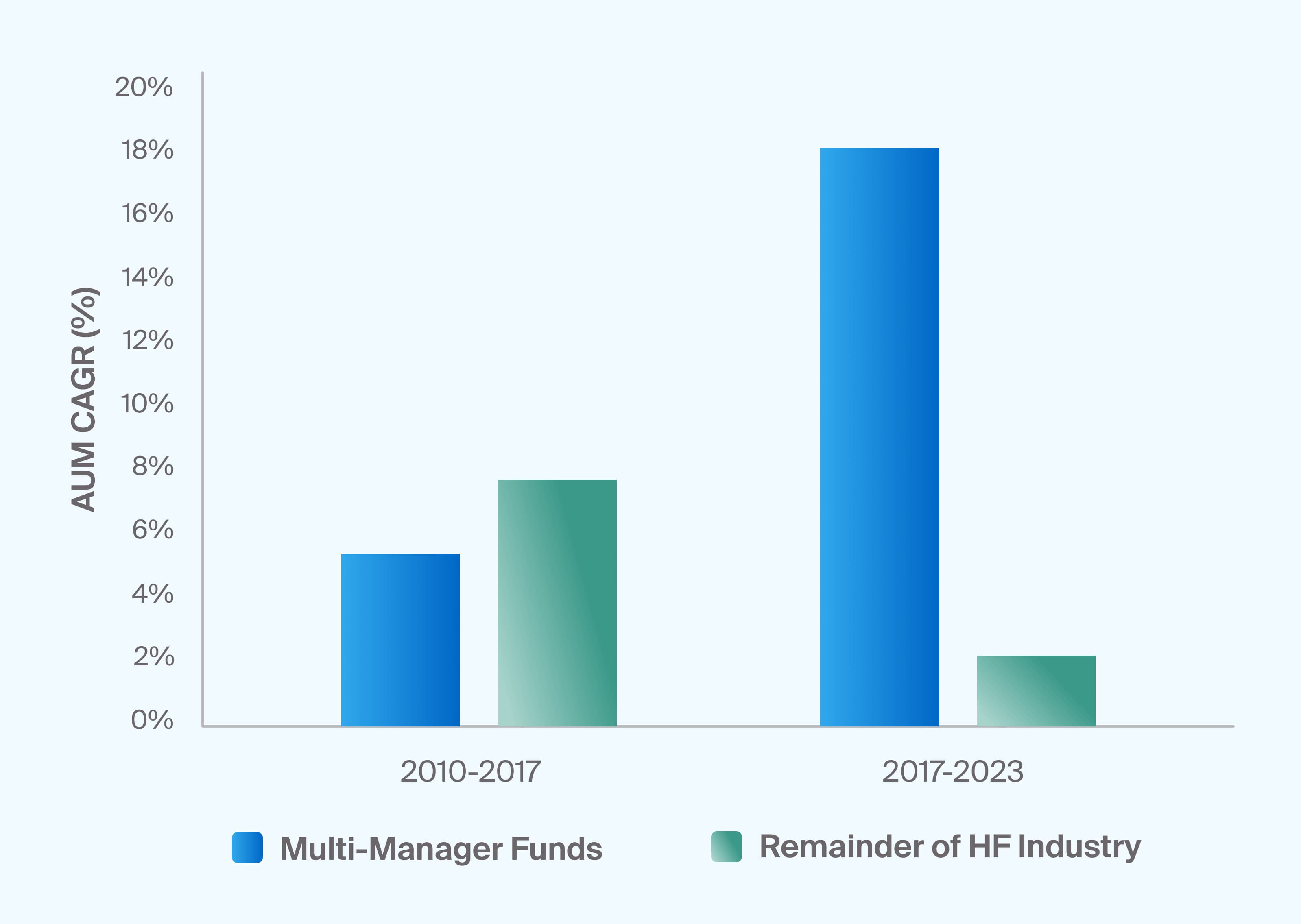

In recent years, multi-strategy hedge funds have become the fastest-growing segment of the global hedge fund industry, with $4.1 trillion in assets under management, in 2024.1 From 2017 to 2023, multi-strategy hedge fund assets under management increased by 175% (Exhibit 1), while other hedge fund categories grew their AUM by 13%.2 Multi-manager hedge funds may represent a more recent—and improved—iteration of funds of hedge funds, which were widely used in the early to mid-2000s.

Source: Goldman Sachs, GBM Prime Insights & Analytics, as of June 30, 2023.

Multi-Manager Hedge Fund AUM Growth (Exhibit 1)

What Are Multi-Strategy Hedge Funds?

Multi-strategy hedge funds combine uncorrelated hedge fund exposures in one investment vehicle, employing dynamic asset allocation that allows flexibility to respond to market events.3

Multi-strategy hedge funds operate under two main structures: “one-book” and platform strategies. “One-book” strategies have a single Profit and Loss (P&L) account and allow collaboration and transparency across investment teams. Platform strategies comprise multiple autonomous trading teams that have become known as pods.4,5 These teams compete for centrally allocated capital and run strategies across equities, commodities, foreign exchange, and other markets, including specialist risk takers.

In general, firms compensate portfolio managers based on their own performance rather than the team’s aggregate results. The number of portfolio managers can exceed 100 in large firms, while smaller ones can be more concentrated.6

Multi-manager hedge fund providers have increased their scale and entered a fierce competition for talent while expanding investment strategies and investing in infrastructure, technology, and data.7

Collective headcount at multi-manager firms more than tripled to over 18,000 in 2023 from approximately 5,300 in 2015, while the headcount in the rest of the hedge fund industry only expanded by about 10%—from 44,000 to 48,400.8

It is important to note that multi-strategy hedge funds are not homogeneous. While multi-strategy hedge fund managers seek absolute return with diversification and downside protection, many adopt different business models, focus areas, concentration levels, risk parameters, liquidity requirements, and fee structures.9

The Evolution of Funds of Hedge Funds and the Rise of Multi-Strategy Hedge Funds

In the early 2000s, funds of hedge funds, a conceptual predecessor to multi-strategy funds, were the main way investors could gain access to strategy-diversified hedge funds. But in 2008 these funds lost assets, market share, and favor among investors. As a result, many prominent hedge fund names of that era either disappeared or merged with other funds.10

In the aftermath of the Global Financial Crisis, investors turned to single-manager hedge funds.11 Early 2020s market volatility has renewed interest in these strategies.12

They have since gained favor as they build upon older approaches by reducing fee layering and aiming to ensure capital deployment. Hedge funds typically require investors to contribute capital upfront to enable the fund to deploy it quickly as investment opportunities arise.13

With multiple teams and the use of leverage, multi-strategy hedge funds can ensure capital remains invested.14 In addition, a substantial portion of multi-manager hedge fund shops, or 40%, allocate to externally managed strategies, which also helps capital deployment.15

Multi-Strategy Hedge Fund Investment Objectives and Potential Benefits

Composite Returns Through Diversified In-House Strategies

Multi-strategy hedge funds aim to deliver returns of multiple in-house portfolio managers, resembling an index of different managers. These investment strategies seek absolute return—with low correlation to broad markets—while also preserving capital.

Tactical Flexibility With Disciplined Risk Management

These funds tend to be nimble, allowing managers to implement tactical asset allocation moves quickly. At the same time, firm-level risk controls prevent any single strategy from exceeding its share of risk budgets or dominating returns.16

Operational Efficiency via Shared Services

By centralizing shared services such as finance, human resources, legal, internal audit, and strategic oversight, multi-strategy platforms may generate capital efficiencies and reduce administrative duplication across teams.

A Manager-Centric Investment Environment

Multi-strategy hedge fund managers emphasize a firm structure that fosters autonomy and stability. By insulating investment teams from fundraising and operational distractions, the model aims to attract and retain high-performing portfolio managers.17

Main Investment Strategy Categories for Multi-Strategy Hedge Funds

Multi-strategy hedge funds employ a wide range of investment strategies, including the four main categories below:18

Event-Driven Strategies

Event-driven funds seek to profit from price changes that result from corporate events, such as bankruptcy, mergers and acquisitions, or activist-investor-led actions.19

Equity Long/Short Strategies

Equity long/short strategies employ investment styles such as value vs. growth, large cap vs. small cap, discretionary vs. quantitative, and industry specialization. These strategies aim to buy stocks expected to increase in value and sell (or “short”) individual stocks or broad market segments expected to decline.20,21

Relative Value Strategies

Relative value funds pursue price differences between financial securities, such as stocks or bonds, while maintaining low to neutral overall market exposure. This approach tends to generate a return profile similar to an income stream, with potentially differentiated return sources.22

Macro Strategies

Macro funds trade on macroeconomic trends or economic policy changes across asset classes. Top-down approaches, coupled with the ability to take advantage of higher market volatility, may generate positive absolute returns when broader markets are selling off.

Potential Risks and Considerations

Fee Structure

Many multi-strategy hedge funds have adopted “pass-through fee” structures, which consist of charging expenses, such as compensation, technology, operational, and legal spending, to clients.23

Leverage

Multi-strategy hedge funds may use significant amounts of borrowing to magnify their positions.

Lack of Transparency and Industry Standards

Multi-strategy hedge funds self-define themselves in industry databases, which classify multi-strategy as having more than one hedge fund within an investment strategy.24

Capacity Constraints

Strong track records of successful managers have raised hurdles for investors to access strategies and negotiate terms.25

Liquidity Constraints

Multi-strategy hedge funds often have monthly to quarterly liquidity constraints, with notice periods between 30 and 90 days. Managers who have performed strongly in recent years might impose longer locks and investor-level gates.26

Cross Margining

Within a multi-strategy platform, teams that made and lost money can cancel each other out regarding returns while still generating fees.27