Advisors seeking a hedge to inflation, income-driven return streams, and diversification may consider private infrastructure.

What Is Private Infrastructure?

Infrastructure, generally, refers to the physical structures, facilities, and systems vital to a functioning society. It’s the silent enabler in our daily lives: the roads we drive on, the bridges we cross, the water we drink, the energy we use, and the digital networks that connect us. These assets can be broadly categorized into various sectors, each serving unique purposes and demands, and are funded in a few ways by governments and private investors.

What Are Private Infrastructure Investments?

The concept of private infrastructure investment, in particular, has evolved over time—especially as the development of infrastructure assets expanded from largely a government-only enterprise to a growing opportunity for private investors.1

Traditionally, infrastructure assets were differentiated not only by their function in supporting essential community services but also by their relatively high upfront capital costs. The development of these assets also generally came with substantial regulatory obstacles and high barriers to entry, among other attributes that we’ll cover later in this article.

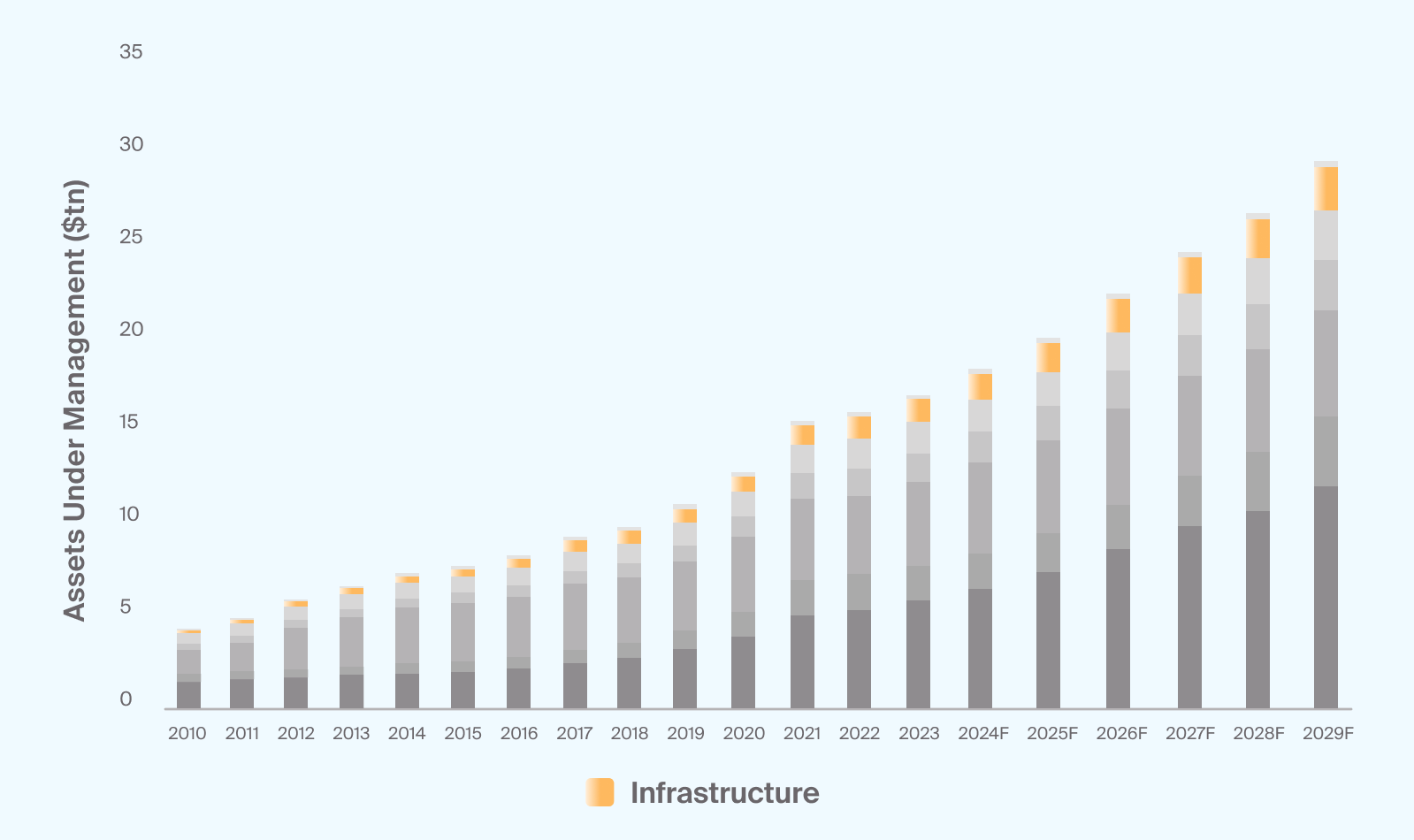

As the private sector gains a stronger foothold in the space—and grows in tandem with alternatives more broadly (Exhibit 1)—these characteristics have evolved, expanding the scope of private infrastructure investing to include more types of assets and different ways to finance them. This evolution appears to reflect the dynamic nature of private infrastructure investments, which can provide a wide array of opportunities for advisors seeking to diversify their portfolios.

Source: Preqin Future of Alternatives 2029; 2024-2029 are Preqin's forecasted figures.

Private infrastructure AUM has generally increased with the growth of alternatives (Exhibit 1)

What Are Examples of Private Infrastructure?

Private infrastructure assets may span across multiple sectors, each with its own set of characteristics and potential investment opportunities. While infrastructure traditionally encompassed areas like transportation, utilities, and telecommunications, it has expanded to include newer sectors such as digital infrastructure, renewable energy, and healthcare facilities. These categories may overlap, for example, in the case of infrastructure that supports electric vehicles.

Transportation and Logistics: Assets in the transportation and logistics sector may include highways, toll roads, railways, airports, ports, parking structures, and equipment leasing.

Utilities: Infrastructure may support the transmission of essential services like water, electricity, and natural gas. Recycling plants or waste and water treatment facilities may also fall into this category.

Energy: This sector covers oil and gas production, power generation, transmission, and distribution; it also increasingly incorporates renewable energy sources, like wind farms, hydroelectric dams, and solar arrays, as well as energy storage or clean fuel production.

Telecommunications and Digital: Infrastructure, such as cell towers, undersea cables, fiber optic networks, and data centers, supports global communications.

Social: Social infrastructure might include healthcare facilities, schools, and government buildings.

What Are Some Key Attributes of Infrastructure Assets?

Private investment in infrastructure assets may offer unique advantages due to their distinct characteristics—some of which we list below.2 As mentioned before, over time, these attributes have become more fluid and may not be required for an asset’s inclusion within a private infrastructure fund. One example is that, as technology evolves, infrastructure investments adapt. For instance, the proliferation of electric vehicles is changing the landscape of transportation infrastructure, which now includes charging stations.

Essential Service: Infrastructure assets tend to provide essential services that society relies upon daily. This inherent demand often makes them recession resistant.

Long Asset Life: Infrastructure assets typically have extended lifespans, which can span decades or even centuries. This longevity often signals enhanced stability for investors.

Inelastic Demand: The demand for many infrastructure services is relatively insensitive to economic downturns. People will need water, power, and transportation regardless of the economic climate.

High Barriers to Entry/Monopolistic: Infrastructure often requires substantial capital investments and regulatory approvals. This creates high barriers to entry, reducing competition and potentially leading to monopolistic market positions.

Stable and Predictable Cash Flows: Though past performance is no guarantee of future results, infrastructure assets typically generate predictable cash flows, making them potentially attractive for income-focused investors.

What Are the Potential Benefits of Infrastructure Investments?

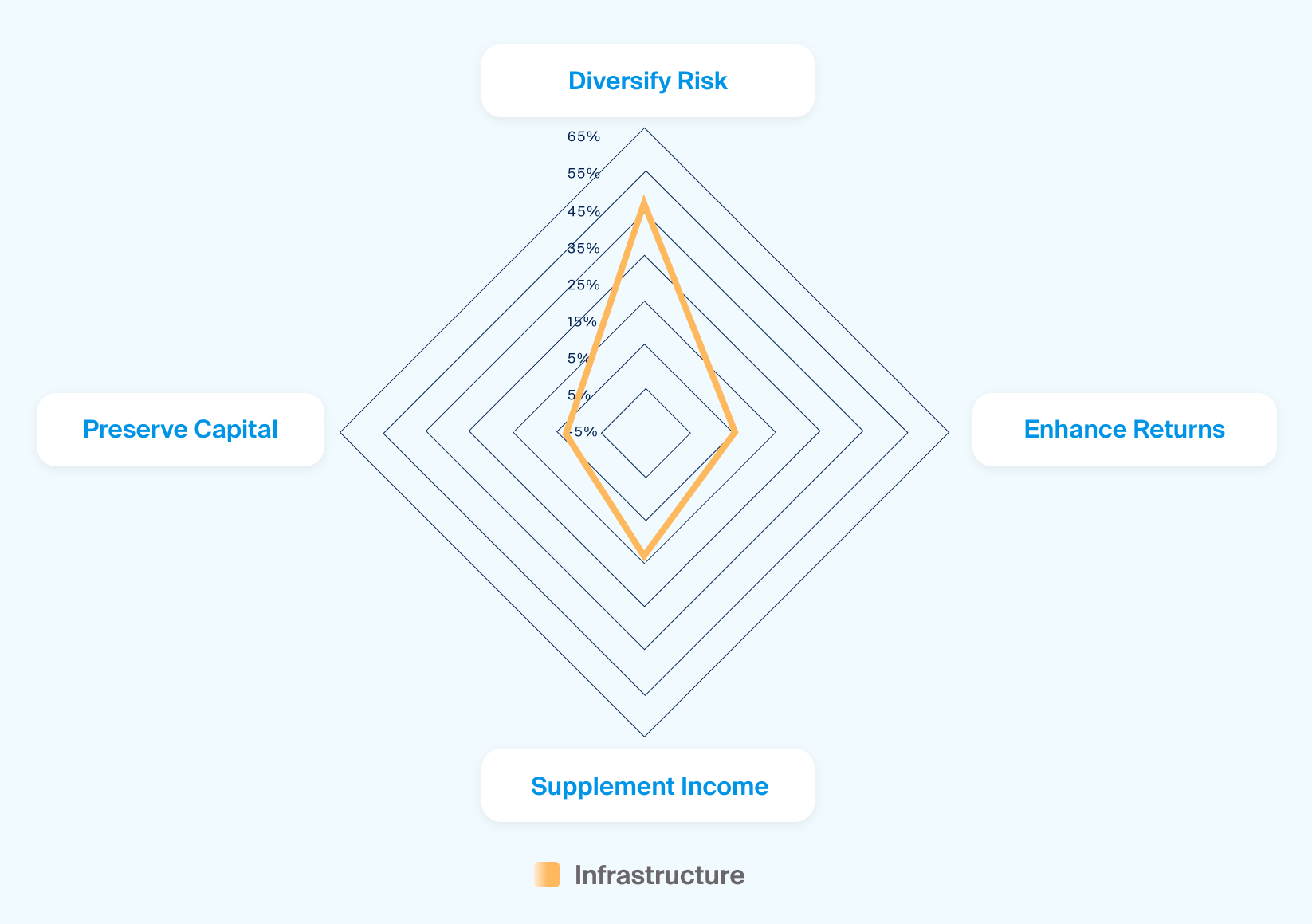

Financial advisors may choose to allocate to private infrastructure funds to target some of the following potential benefits (Exhibit 2).

Inflation Hedge: Infrastructure investments often come with contractual arrangements that include periodic price increases, providing a hedge against inflation.3

Low Correlation to Other Asset Classes: Infrastructure investments tend to have a low correlation with traditional asset classes like stocks and bonds, potentially providing portfolio diversification.4

Downside Protection: The vital nature of infrastructure services, along with the often monopolistic and contractual nature of many infrastructure assets, can provide potential downside protection during economic downturns, as demand can remain relatively stable.5

Income Generation: Infrastructure assets generally have predictable income streams, though past performance is no guarantee of future results.

Source: Source: CAIS and Mercer, “The State of Alternative Investments in Wealth Management 2023,” December 2023.

Risk diversification and supplementing income are the top reasons advisors tend to allocate to infrastructure (Exhibit 2)

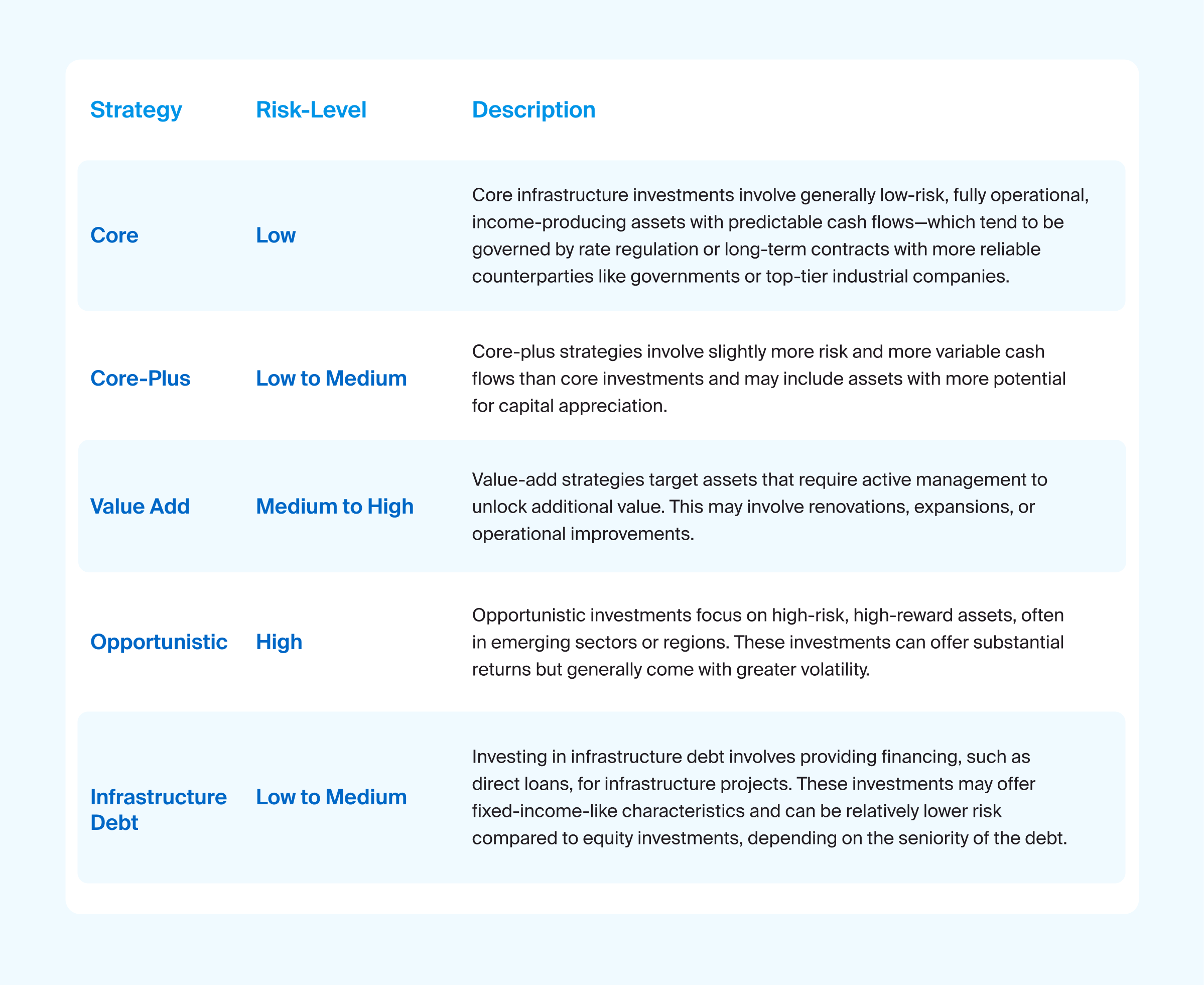

What Types of Strategies Do Private Infrastructure Funds Typically Employ?

Private infrastructure funds may pursue various strategies, based on their risk tolerance and objectives.

What Types of Strategies Do Private Infrastructure Funds Typically Employ?

What Are Some Ways to Access Infrastructure Investments?

Advisors may consider several types of vehicles and fund structures for gaining exposure to infrastructure assets in their portfolios. Two major distinctions are whether a fund is publicly listed or unlisted and whether the fund uses a finite-life or evergreen structure.

Listed vs. Unlisted: Investors can invest in publicly traded infrastructure companies or funds, or they can opt for private investments in unlisted infrastructure funds or assets. Unlisted funds may offer general partners greater control over the timing of investments; however, they often come with longer investment horizons. Listed funds, by contrast, may offer relatively more liquidity but are more exposed to shorter-term market volatility.6

Traditional Finite-Life, Drawdown vs. Evergreen, Fully Funded: Many traditional private infrastructure funds require investors to commit capital upfront, which is then drawn down over the life of the fund (drawdown) while evergreen, fully funded funds tend to offer more opportunities to add or redeem capital throughout the fund lifecycle. Certain strategies may be better implemented via one fund structure over another.7

Funds may also be distinguished by their size, concentration in specific sectors or geographies, risk appetite, or investment horizon.8

What Are Some Risks or Other Considerations Related to Private Infrastructure Investment?

Private infrastructure may offer an opportunity for inflation protection or income generation distinct from traditional investments, but like other private markets investments, private investments in infrastructure assets generally come with risks,9 such as the ones listed below.

Lack of Liquidity

Investing in private market infrastructure can pose liquidity risk as underlying assets are illiquid and may not be easily sold when desired—limiting the investors’ ability to redeem their shares.

Blind Pool Risk

Private market infrastructure investing often demands that investors commit to “blind pools." In other words, they must commit to a fund without any knowledge of its prospective investments—or even before a manager has identified the fund's future investments. By giving managers this degree of discretion to build the portfolio, there's a risk that the manager may deviate from the marketed strategy.

Environmental Risk

Infrastructure investments, especially those related to conventional energy production, carry environmental risks, and neglecting these risks can lead to contamination, fines, and regulatory changes—which may negatively affect performance. Fund managers are responsible for managing these risks through sound maintenance and operational procedures, compliance reviews, and environmental assessments.

Regulatory Risk

Infrastructure assets are subject to numerous regulations, and compliance failures can result in fines or loss of licenses to operate the assets—which could significantly affect potential cash flows.

Operating and Technical Risk

Infrastructure investments are complex and can face operating and technical challenges. Mitigating these risks involves hiring qualified personnel, implementing sound business plans, conducting maintenance, and having appropriate insurance, especially in greenfield construction projects.