What You'll Learn

Secondary transaction volume was relatively muted in early 2023—largely due to valuation uncertainty—but there may be signs of pent-up supply.

Secondaries pricing has appeared to rebound, yet given recent fluctuations in asset valuations, potentially shrinking discounts don’t necessarily mean a missed opportunity.

Despite valuation corrections and a public equity rebound, LP-led secondary deal opportunities may continue as LPs may need to rebalance portfolios and could be challenged by declining distributions across private equity.

An unfavorable exit environment and fundraising challenges may continue to drive momentum in GP-led secondaries.

Nearly a year ago, we highlighted how the evolution of the private equity secondary market and a confluence of market factors appeared to be expanding the opportunity set for investors. Yet, private equity secondary transaction volume in the first half of 2023 was lower than anticipated.1 Why might that have been the case? And are the factors catalyzing secondary volume still likely to persist?

In this piece, we look under the hood to attempt to understand what may have driven the topline reported numbers on transaction volume, discount levels, and the balance of supply and demand. To reassess the opportunity set looking forward, we revisit whether market conditions continue to incentivize LPs and GPs to look to the secondary market and aim to better understand what may happen in the coming quarters.

Transaction Volume and Pricing in the PE Secondary Market

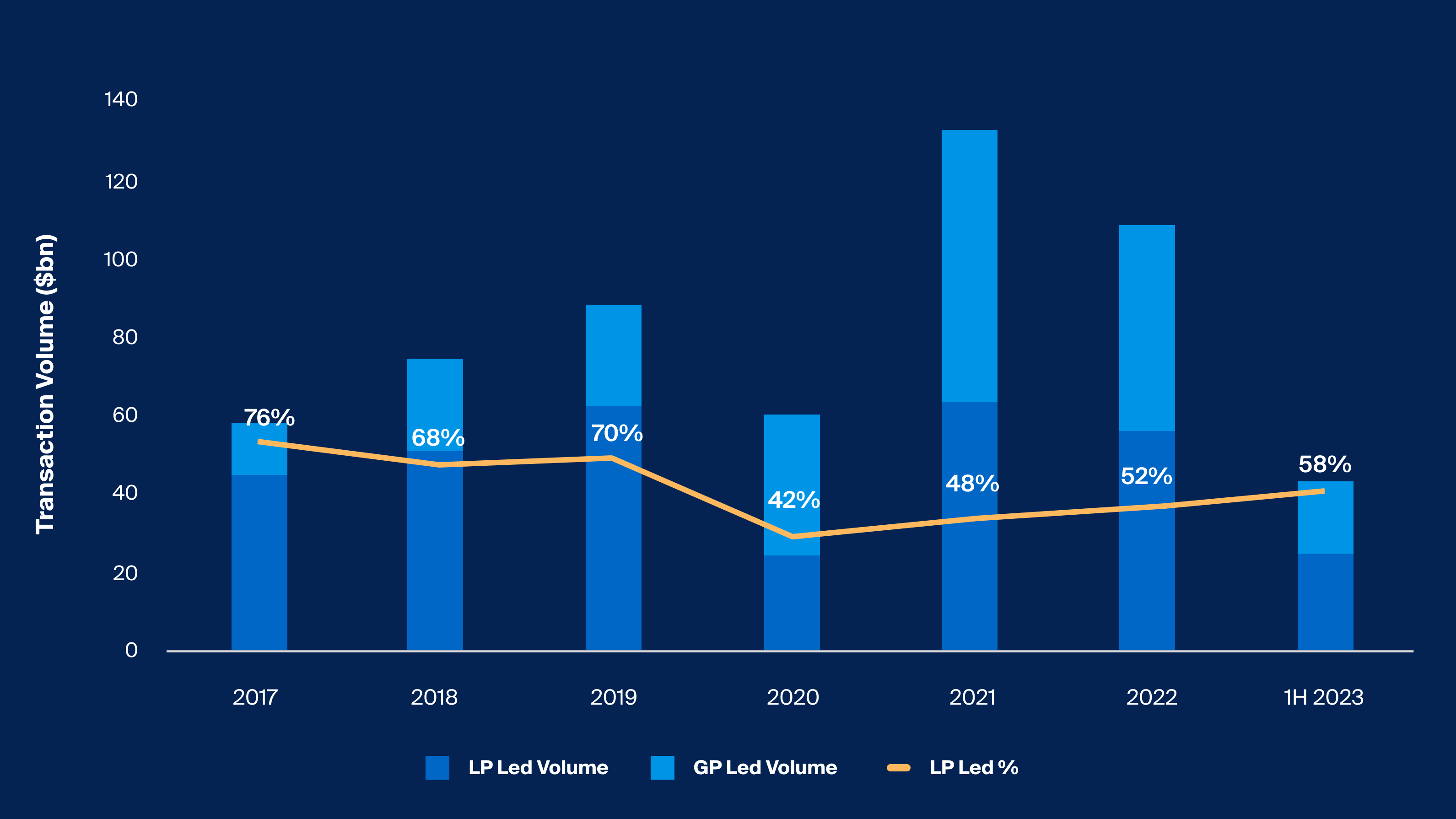

Total secondary transaction volume fell 18% in 2022 to $108 billion from a record $132 billion the prior year. In the first half of 2023, volume fell to $43 billion, down 25% compared to the same period in 2022 (Exhibit 1).

Buyers and sellers, it seems, could not agree on pricing, preventing many potential deals from transacting.2 If valuations correct and the economic situation becomes clearer, trading may increase in the coming months and years as buyers and sellers feel more confident about prices. When bid-ask spreads narrow, a greater proportion of sidelined transactions should begin to clear.3

Footnotes

Source: Jefferies, H1 2023 Global Secondaries Market Review, July 2023

Secondary transaction volume in the first half of 2023 was muted

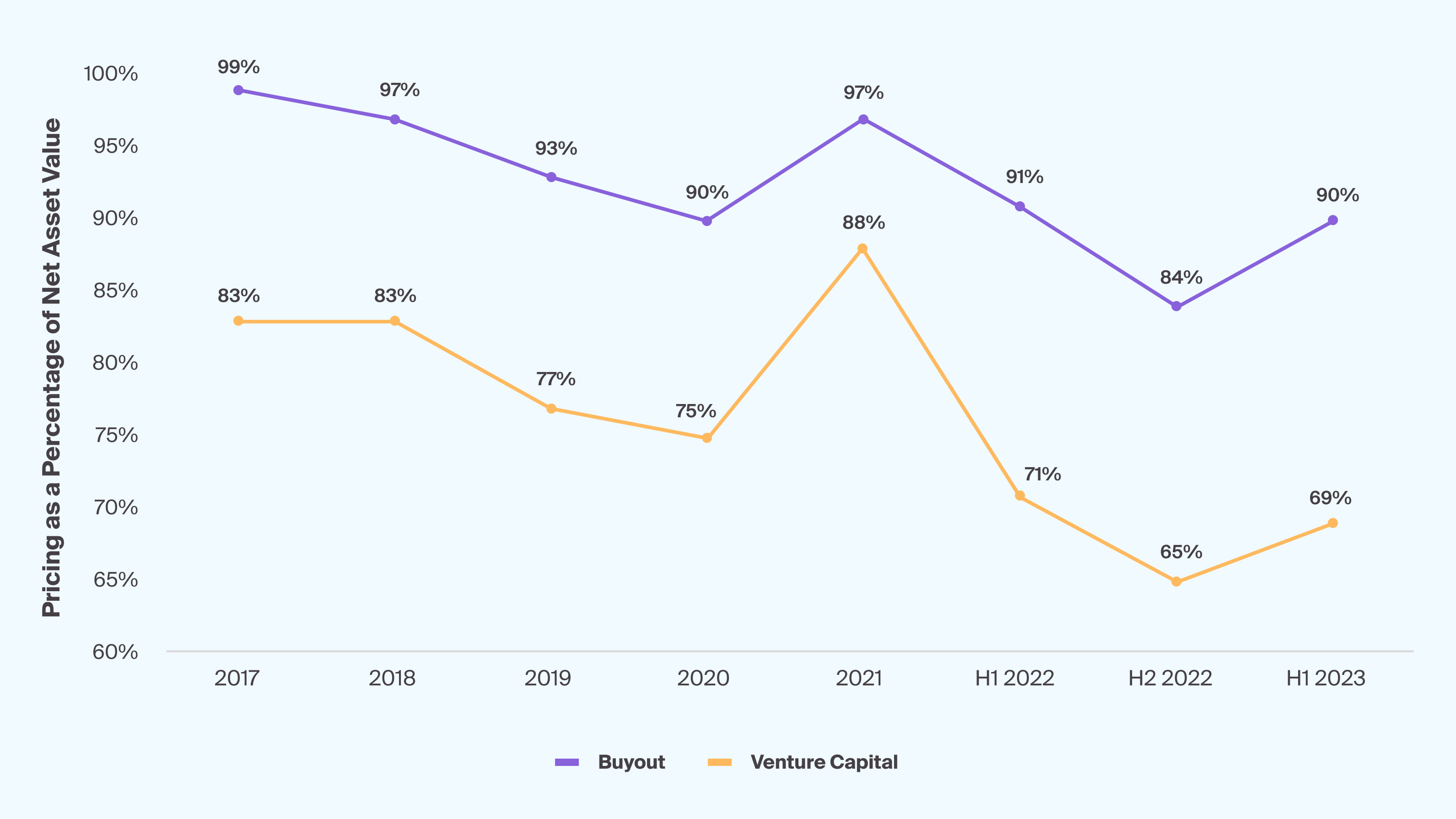

As for pricing and discounts available in the secondary market, have we seen an opportunity come and go? It seems that pricing may have found a bottom in the second half of 2022 before increasing earlier this year. LP portfolio pricing for buyout and venture capital increased by 600 and 400 basis points from H2 2022 prices, respectively, rebounding to 90% and 69% of reference NAV. This pricing is still on the lower end historically across the last five-plus years (Exhibit 2).

Footnotes

Source: Jefferies, H1 2023 Global Secondaries Market Review, July 2023

Discounts in LP-led secondary transactions have shown signs of narrowing from a multi-year high in the first half of 2023 but may not tell the whole story given corrections in valuations (Exhibit 2)

As valuations slowly adjust down to account for the new macroeconomic reality of higher rates, discounts are likely to shrink.4 Given the way these discounts are calculated, that may not necessarily translate into a disadvantage for would-be secondary buyers. It’s important to recognize that secondary market discounts are calculated relative to NAV and can thus be deceiving when valuations are in motion.

The discount to the intrinsic value of the assets within a fund—rather than just the headline discount to the last reported NAV—tends to be more important for a potential buyer’s ultimate returns from that fund.5 Acquiring secondary stakes at discounts to a fund’s listed NAV can be beneficial and may offer a margin of safety, particularly with valuations in flux. However, ultimate returns for successful secondary funds are often attributed more to capital appreciation than the markup as a result of discount-to-NAV pricing.6

Deal mechanics and discounts also may differ when making the distinction between GP-led and LP-led transactions. LP-led transactions often see greater discounts given the sale comes from the portfolio of an individual investor, who may be more willing to sell part of their portfolio at a meaningful discount.7

GP-led transaction pricing operates somewhat differently. These GP-led sales often require the consent of LPs or the rollover into a new vehicle, making substantial discounts difficult.8 As a result, pricing for the majority of transactions in GP-led transactions has been greater than 90% of NAV—and has even been at a premium historically.9

Supply and Demand: Revisiting the Impact of New Entrants

As the secondary market continues to attract new entrants and capital, investors may also question whether heightened competition has now eroded the market opportunity. The ratio of dry powder (demand for secondary deals) to transaction volume (supply of secondary deals) spiked in the first half of 2023 to 3.8, implying, by our calculation, that there were roughly $3.8 dollars competing for every dollar of transaction volume (Exhibit 3). While this spike in favor of sellers may suggest such an erosion, that logic could be misleading, given competing evidence that the secondary market remains undercapitalized.

Footnotes

Chart Source: Jefferies, H1 2023 Global Secondaries Market Review, July 2023, Preqin, Private Equity Secondaries Dry Powder, as of August 2023.

More dollars appear to be chasing fewer transactions, but the secondary market remains undercapitalized as deal supply far outweighs deals actually transacting in market (Exhibit 3)

Transaction volume, which only tracks completed transactions, represents a much smaller portion of the total amount of assets that are positioned for secondary sales.10 For example, the secondary market supply actually grew to over $200 billion in assets as of 2022, with only $100 billion of those assets having transacted.11 As we noted earlier, many deals were not completed in the first half of 2023 due to wide bid-ask spreads,12 and the percentage of deals to clear could rise as valuation certainty increases and those spreads narrow.

But are there compelling reasons to believe that “true” secondary market supply is still on the rise? In other words, are LPs and GPs still motivated to access the secondary market? In the following sections, we explore potential catalysts in the current market environment that could support such momentum.

LP-Led Catalysts

LPs Continue To Rebalance Their Portfolios

In 2022, we indicated that falling prices in the public markets would likely increase the gap between public market valuations and the private market valuations that lag them. As a result, investors might need to rebalance their portfolios that had more allocated to private markets. This gap in valuations peaked in September of 2022 and has since fallen to some degree.13

Year to date, the S&P 500 has regained roughly 15.9%, which has appeared to lessen the denominator effect for investors with public and private equity allocations.14 While the effect doesn’t seem to be as extreme as in the most recent public equity market bottom in October 2022, according to Bain, as of July, as many as one in three LPs still remain largely over allocated to private equity.15

LPs Seek Liquidity as Private Equity Distributions Underwhelm

In 2021, increased liquidity in the financial system led to considerable activity in both public and private markets, where we saw a high volume of exits in both M&A and the IPO market.16 During this time, private equity funds made distributions back to investors at record levels.17 Then, in 2022, as valuations fell and liquidity was drained from the market amid rising interest rates, the exit environment dried up—leaving many private equity sponsors unable or unwilling to find exit opportunities for the portfolio companies in their maturing funds. Distribution rates fell in turn.18

According to a recent survey by Capstone Partners, 72% of LPs reportedly received lower distributions this year.19 In the event that distributions slow substantially for an extended period, LPs may not be able to uphold liquidity mandates in their portfolios, make planned capital commitments, or meet capital calls for existing commitments they’ve made to other funds. As a result, they may take matters into their own hands, seeking liquidity directly from their private market portfolios.

Many LPs have already indicated they intend to use the secondary market to generate liquidity; in a survey conducted in Q1 2023, Coller Capital found that as many as 77% of LPs indicated they would turn to the secondary market over the next two years.20 Due to these pressures, LPs may continue to tap the secondary market as a means to free up capital needed elsewhere, increasing the supply of deals.

GP-Led Catalysts

GPs Seek Liquidity To Generate Distributions

GPs have lately become well acquainted with one of the most unfavorable kinds of exit environments—one in which falling valuations are matched with prolonged uncertainty around macroeconomic conditions. They have thus appeared to be increasingly hesitant to exit their investments through traditional avenues.

In Q2 2023, while exits rebounded slightly, the IPO market remained significantly shut off. Only 13 companies backed by PE firms completed an IPO in the first half of this year.21 IPO markets have been one of private equity’s major exit channels, providing needed liquidity to LPs.22 When the exit environment for private equity sponsors is as muted as it is now, the liquidity issue experienced by the LPs discussed prior may be a downstream effect of this GP liquidity issue.

In 2022, distributions from buyout funds reached their lowest level since the global financial crisis, and just 14% of invested NAV was returned to investors.23 Without the realizations required to make distributions to their LPs, many GPs are seeking liquidity elsewhere. Delays in distributions could impact both the relative performance of their fund and a GP’s ability to attract future capital.

As the GP-led secondary toolkit has evolved, GPs continue to seek secondary market liquidity, keeping volume elevated—especially when compared to pre-pandemic levels. This trend may persist as the bid-ask spread compresses.24

Valuations Lead to Unfavorable Pricing for Trophy Assets

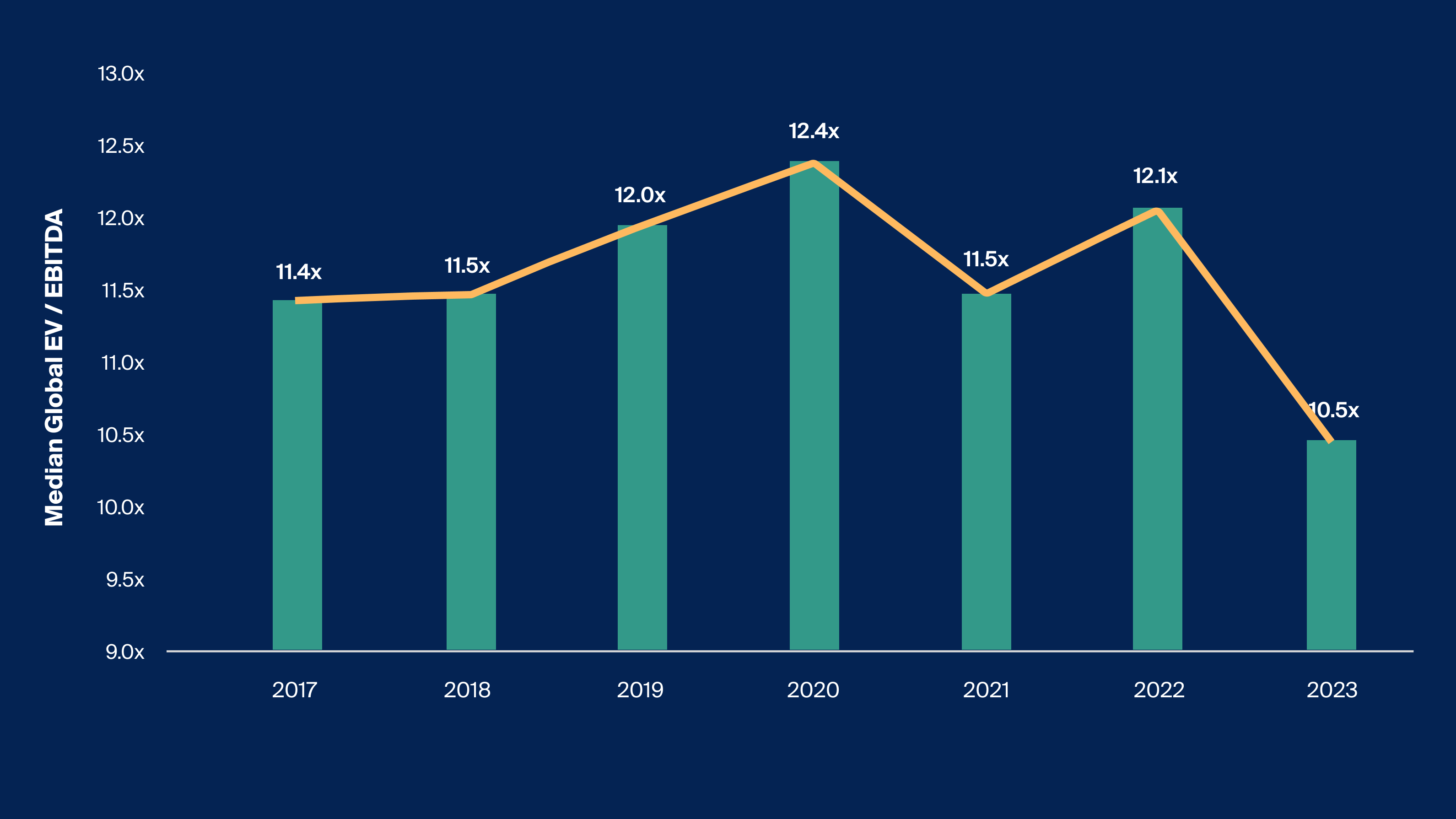

As many venture capital and private equity firms continue to lower the valuations of their portfolios,25 the median EV/EBITDA ratio globally lowered to 10.5x in the first half of 2023, dropping to its lowest level in many years (Exhibit 4). GPs with maturing finite-life funds are left at an impasse, faced with exiting their investments at relatively unattractive valuation multiples. As a result, they have looked to the secondary market to fund continuation vehicles that allow them to hold onto their highest conviction assets.26

Footnotes

Source: Pitchbook, Q2 2023 US PE Breakdown Summary, as of Q2 2023.

Median global EV/EBITDA fell to a recent low, forcing many GPs to consider alternative means of realization or continuation (Exhibit 5)

In fact, the differentiation in the strategies used by GP-led partners has increased the use of more strategies like single and multi-asset continuation vehicles broadly. Single-asset continuation vehicles accounted for around 40% of all GP-led transaction volume in the first half of 2023.27 LPs are also warming up to these transactions—between 50% and 66% of LPs surveyed this year by Capstone Partners said a lower distribution environment would make them more inclined to a GP-led transaction.28

Fundraising Challenges Drive GPs to the Secondary Market

Another potential driver of GP-led secondary volume may actually have little to do with maturing funds or portfolio management and more to do with this year’s difficult fundraising environment for new funds.

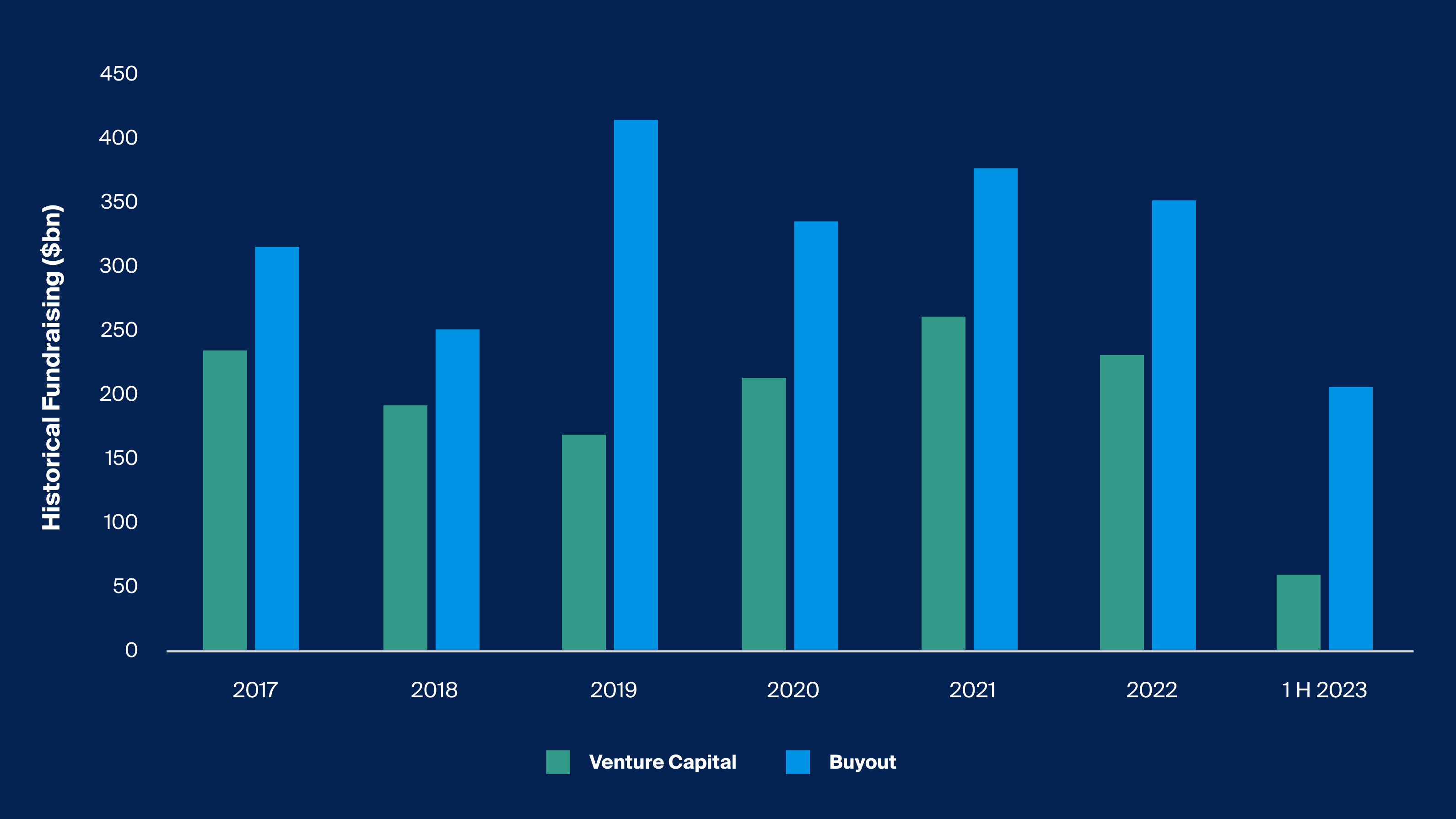

These challenges have been especially present for venture capital firms, which remained below $60 billion in fundraising through the first half of the year—a far cry from fundraising in years prior (Exhibit 5).

Footnotes

Source: Preqin, Aggregate Fundraising for Venture Capital and Buyout, as of Q2 2023.

Fundraising so far in 2023 has appeared to lag previous years, particularly in venture capital (Exhibit 6)

To compensate for the lack of fundraising momentum, some private equity GPs have utilized alternative strategies to bring investors on board.29 Stapled transactions are designed to help GPs raise capital for a new fund while simultaneously offering liquidity to LPs of an existing fund. The GPs either through a tender offer or fund recapitalization address existing LP liquidity needs while simultaneously requiring the secondary buyers of these deals to commit to their subsequent fund in a stapled transaction.30 Such strategies are designed to provide fundraising support for GPs and may provide additional incentives for GPs to turn to the secondary market.

Risks Related to Private Equity Secondaries

While the opportunity set for private equity secondaries may remain compelling, investors should understand that private equity secondaries also have their own set of risks. Like many private market strategies, private equity secondaries funds tend to acquire illiquid interests in private companies; consequently, these funds may offer less liquidity when compared to public markets.

In addition, the ongoing return potential of fund’s underlying portfolio companies is not guaranteed, and investors may still lose all or some of the capital they invest. Though investment durations tend to be shorter, secondaries investments may still be relatively illiquid, especially if demand for certain managers or their funds declines. Investors in fund-of-funds or specialized secondary funds also face two tiers of GPs and potentially additional fees and expenses as a result.