When the Consumer Price Index of inflation for March came in this month at 8.5%, it not only hit another four-decade high, but it again exceeded the markets expectation for the rate of year-over-year price increases according to a Bloomberg survey. Interestingly, and despite the ongoing higher than expected pressures, after the release we heard calls across the market that we had reached ‘peak inflation’.1 Regardless of this view, the U.S. Federal Reserve (the Fed) doubled down on their commitment to raise interest rates to aggressively fight inflation2, while restarting the runoff of its more than $8.9 trillion dollar balance sheet.3

Interestingly however, both equity and bond markets appear to have set divergent expectations for the ongoing impact on inflation, which sees them now seemingly hold opposing views on the prospect of forward returns. While there can only be one future state of the market, this creates the potential for future volatility and dispersion in risk assets and could have very real implications for the future risk and return potential for both stock and bond markets.

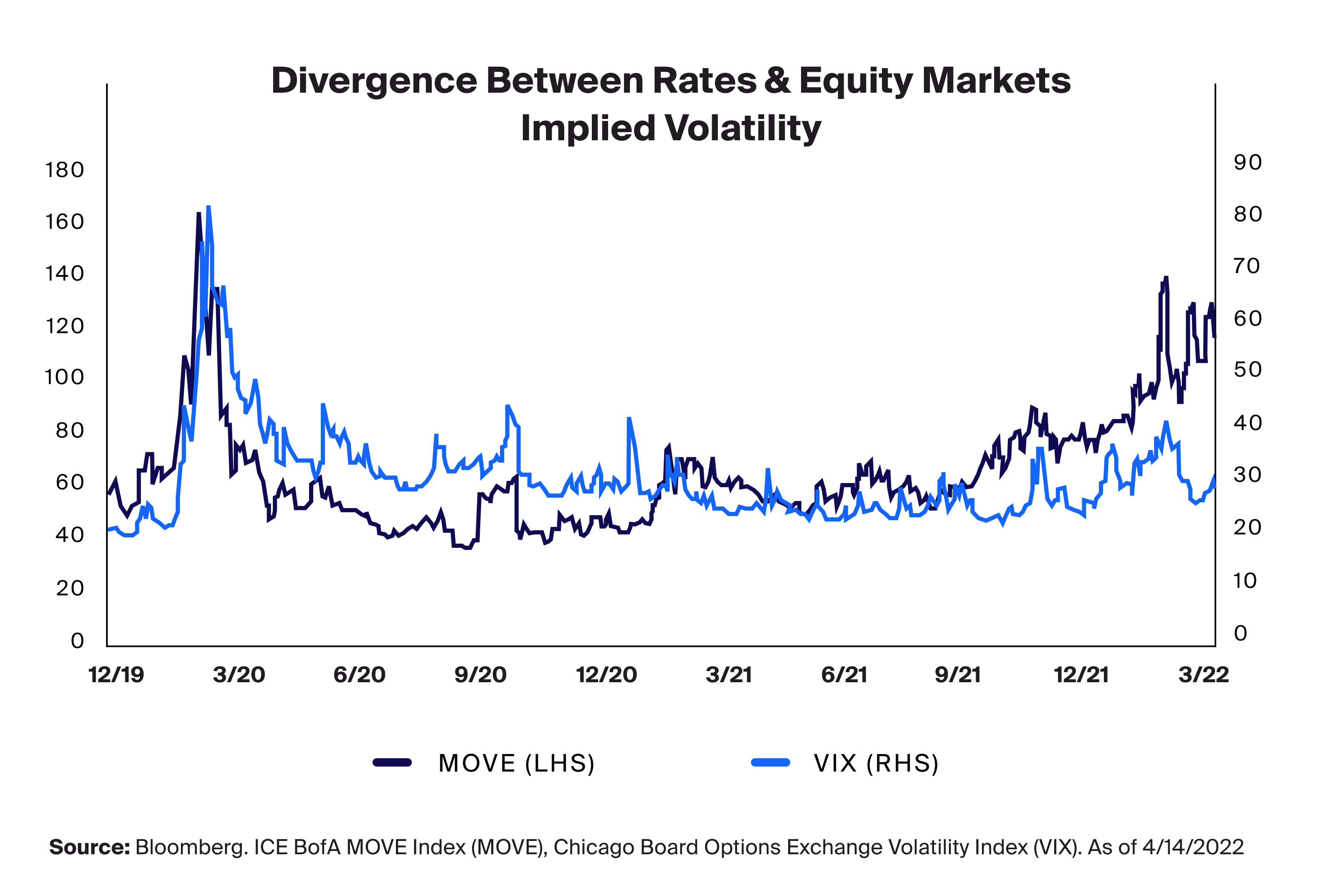

Divergence in Implied Volatility

By looking at the expected implied volatility of an asset class, we may be able get a sense of what investors general expectations are for the dispersion of returns – the higher the dispersion, the higher the potential range of future returns, with the reverse also being true.4 Both the U.S. stock and bond markets have measures of short-term implied volatility. Stocks have the VIX, or the Chicago Board Options Exchange Volatility Index, and bonds have the MOVE, or the ICE BofA MOVE Index.

Currently, we see that the MOVE Index is trending higher and is approaching the level it was in March 2020, when the index hit a high of more than 160.5 The bond market appears to be taking its cue from the Fed’s hawkish stance on interest rates to stamp out high inflation and appears to be factoring in a volatile future state for bond markets. Conversely, we see that the VIX is trending lower and is currently below its 24.5 average since the end of 2019.6 The stock market appears to be expecting future returns to be less volatile, which could reflect the general view that we have reached ‘peak inflation’ and forward returns are unlikely to be greatly impacted by it.

This divergence, which started in October 2021, occurred after the Fed made it clear that it would begin to tighten monetary policy and remove liquidity from markets via its balance sheet roll-off,7 setting bond and stock markets on divergent paths for expected volatility.

The Implication of Implied Volatility

What the VIX may be telling us is that equity investors believe they expect the divergence of returns in the future to be low, and that equity returns are more than likely to be positive, though this does not imply any magnitude in returns. Conversely, the MOVE may be telling us that bond investors expect returns to exhibit high divergence, and therefore volatility, and that there could be a high dispersion of returns. Essentially, stock and bond markets appear to have have very different views of what the short-term volatility and return trajectory for each asset class may potentially be.

The practical implication of this difference could be that investors who hold both stocks and bonds may experience two potential future outcomes.

Bond investors may currently be accurate and persistent inflation may drive volatility in interest rates and prices may fall as rates increase on continued Fed tightening. In this future state, stocks may reprice given a worse than expected outcome for inflation, and company earnings may also decline.

Inflation may have already peaked. This peak could mean the impact on stocks and their earnings will be short-lived and markets may continue higher as we exit the recent high inflationary environment. In this future state, bond yields may move lower to reflect less aggressive Fed tightening and bond prices may gain.

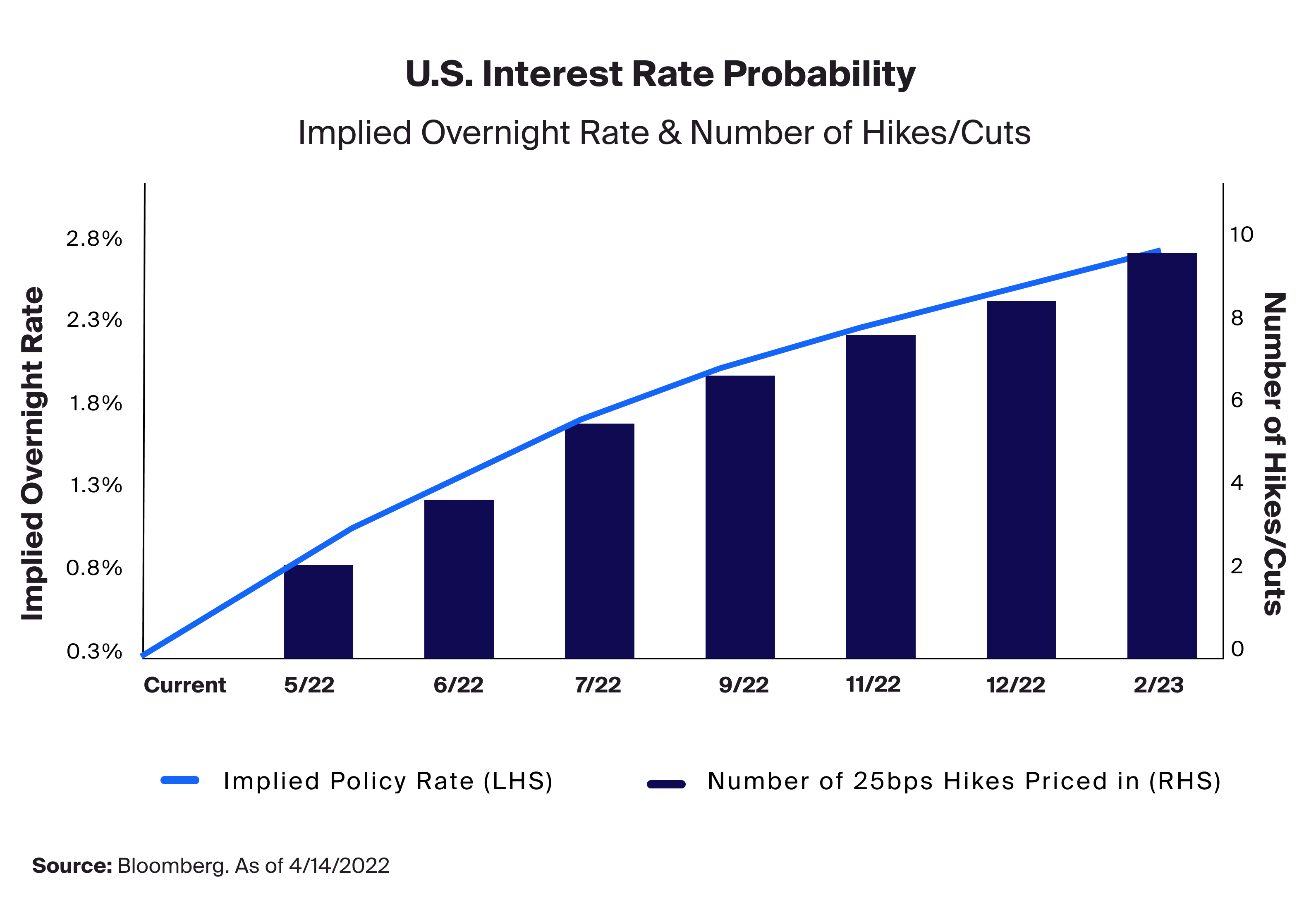

Given that the market is pricing in more than eight 25 basis point rate hikes before the end of the year, taking the implied overnight policy rate from 0.33% today to more than 2.47%, investors may be pricing a persistence in inflation that appears at odds with the stock markets overall assessment.

Irrespective of the path of future inflation, and the resulting response by the Fed, the divergence in the outlook for volatility of stocks and bonds may necessitate investors to consider hedging this uncertainty. A few possible solutions for this could be to leverage hedge funds. Hedge fund categories that could be used include:

fixed income focused hedge funds, such as relative value strategies,

hedge funds driven by macroeconomic and inflation sensitive assets like global macro, equity market neutral and long/short equity hedge funds that may provide a dampened exposure to equity market beta and its directionality.