Today’s Inflationary Climate

As 2021 came to a close, we saw inflation, as represented by the Consumer Price Index (CPI), top 7%, after rising 0.5% in December. This annual move was the most rapid change in inflation since June 1982 causing investors to consider strategies to hedge its potential impact on real returns.1 When investors discuss hedges to rising inflation, many bring up gold due to its historic return in the 1970s. Gold is generally considered a hard asset due to its ability to hold value over time. Most recently however, gold has underperformed as a hedge in periods of rising CPI2, leaving some investors to search for new strategies to offset inflation. CAIS has been observing sentiment toward Bitcoin as a potential inflation hedge and explores this strategy using a few comparative data points seen below.

In an article from CNBC3, the author points out gold’s viability as a hedge to inflation wains, as commodities and REITs begin to outperform, provide higher returns and a more effective hedge during inflationary periods following 1980. While commodities and REITs returned positive through the periods of 1980-1984 and 1988-1991, gold averaged a total return of negative 8-10%.

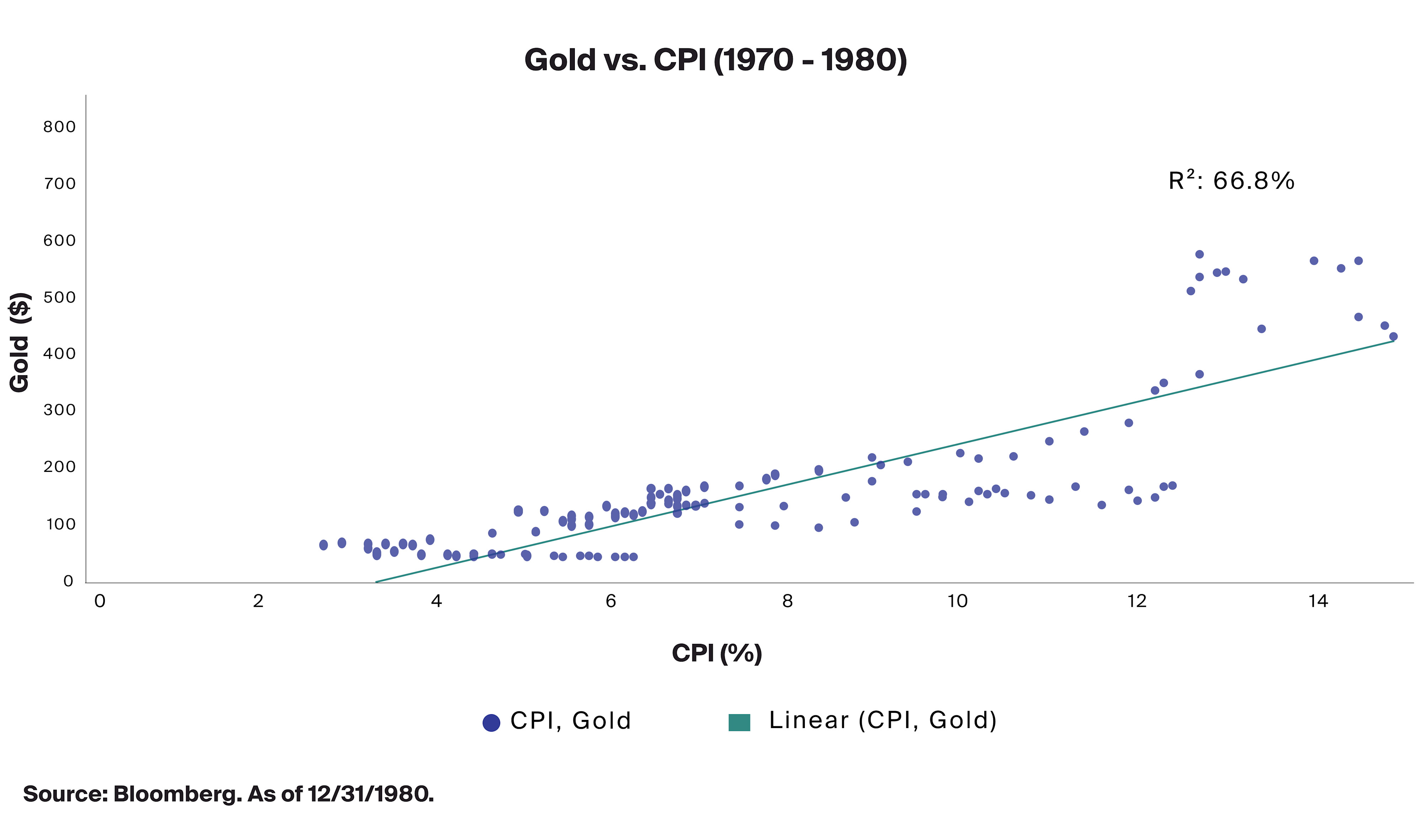

Looking at gold’s relationship to CPI, we compared gold’s historical performance over its most successful inflation hedging period, the 1970s. During this decade, CPI reached more than 12% at its peak, before dropping to 5%. By 1979, inflation again climbed to over 13% before eventually falling back to single digits in the early 80s. Over this phase of fluctuation in CPI we have enough data to form a regression that works to capture the overall relationship of the CPI to the performance of gold.

R-Squared can help us understand the correlation between CPI and gold as it represents the overall strength of the relationship between two series of variables. Essentially, this formula tells us that 66.8% of the variation in the data may be explained using a linear model. At 66.8% there may be a strong enough correlation to conclude that gold and CPI over this duration had a distinct and significant statistical relationship. In addition to statistical hedging performance, gold has generally been considered a strong diversifier because it is considered a hard asset. Hard assets are a category of investments that are frequently used to hedge against inflation because they retain consistent value. Gold may be considered a hard asset because it generally satisfies several properties:4

Scarcity: A limited supply means that greater demand will likely push prices up.

Accessibility: The market will value and accept the asset.

Durability: The asset will continue to garner demand over time.

Bitcoin as a Hard Asset

The case for Bitcoin acting as an effective hedge against inflation may derive from investors noting its technology as closely embodying the properties of hard assets, like gold. Below we walk through how Bitcoin may be described as a hard asset using these same properties.

Scarcity: The supply of Bitcoin is capped at 21 million, where programmatically the difficulty to mine each Bitcoin becomes increasingly more complex, slowly decreasing the frequency at which new coins are mined until this fixed quantity is reached.

Accessibility: We have seen significant growth in the cryptocurrency and blockchain industries, where acquiring Bitcoin has become available to retail consumers on numerous public exchanges.5

Durability: An asset is generally as valuable as the demand for it grows. Bitcoin is projected to become legal tender in several developing nations following El Salvador, that find its deflationary issuance schedule, ledger transparency and accessibility valuable to fight hyperinflation, corruption and poverty.6 As more countries may begin to utilize Bitcoin within their central monetary policy, Bitcoin’s value should grow.

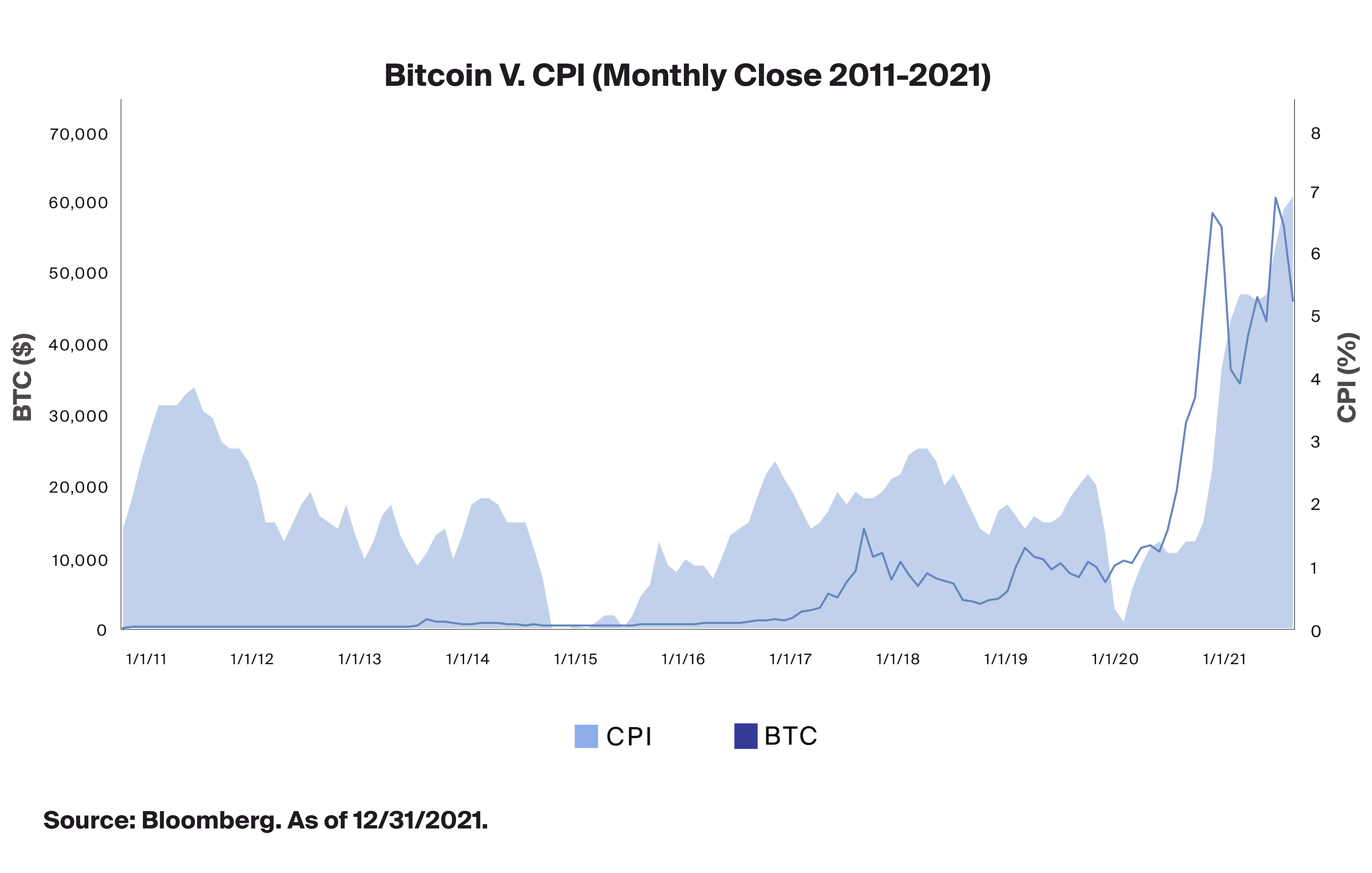

Whether or not Bitcoin is a hard asset does not alone answer the question of whether the cryptocurrency can be used to hedge against rising prices in all scenarios. To look more closely at the relationship of Bitcoin and CPI we can compare the recent crypto bull run to recent inflation numbers.

At first glance, Bitcoin and CPI appear to rise consistently with one another which may lead us to assume that the two are correlated as a possible hedging strategy. Looking below, we can analyze the linear relationship to quantify the correlation between CPI and Bitcoin over this period.

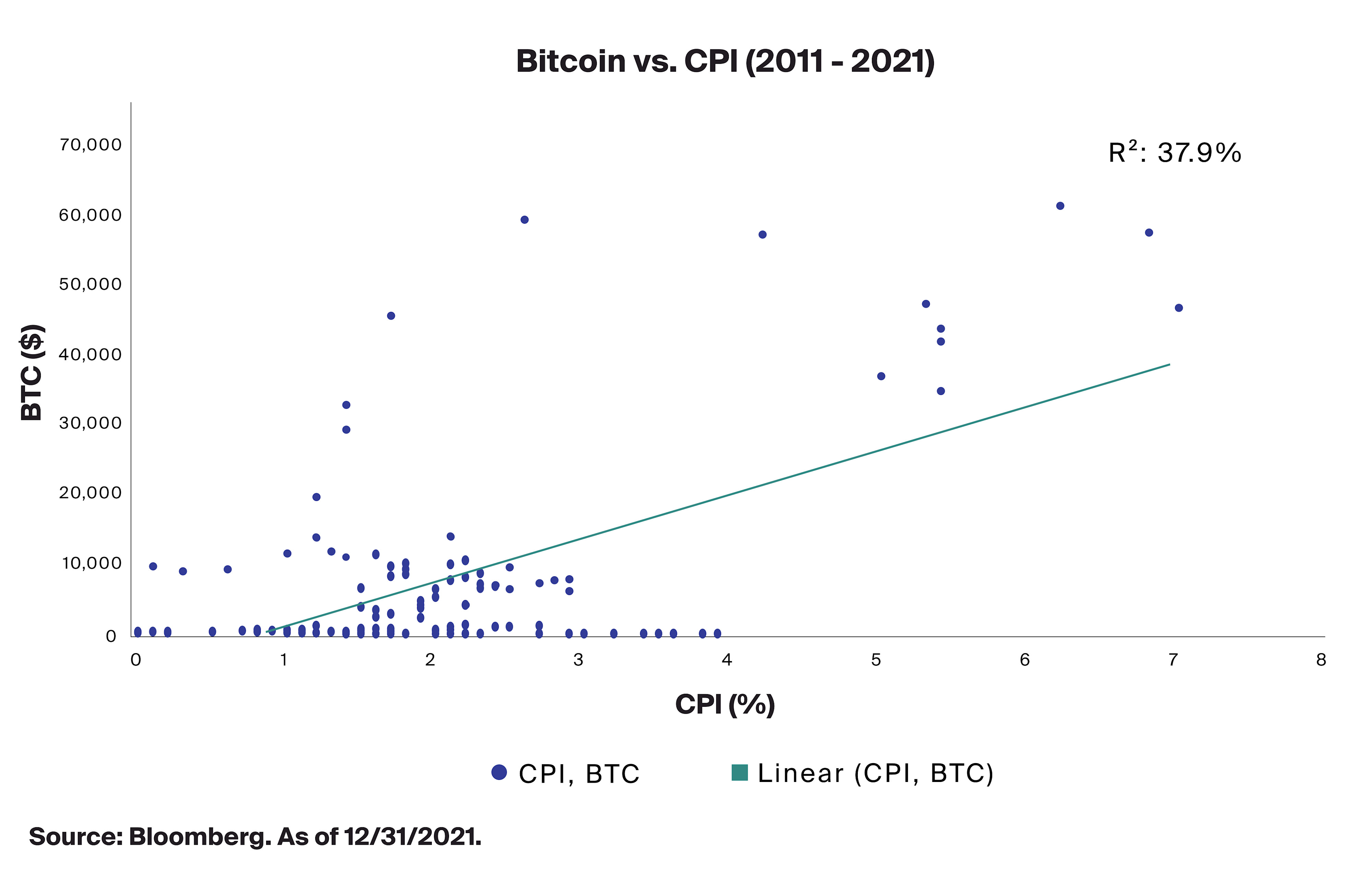

Given the limited ten year trend, there is very little performance data from Bitcoin during periods where the CPI is consistently above 5%. Consequently, the linear model skews towards periods when Bitcoin was below $10,000, which does not provide a clear enough relationship between the two trends. An R-Squared of 37.9% depicts a relatively low correlation when compared to gold’s performance over the separate 10-year period of rising rates. Looking at the above performance comparison of Bitcoin and CPI, we are led to conclude that there is simply not enough of a track record to make a concrete assessment on its inflation hedging capabilities. To confidently claim that Bitcoin may hedge against inflation with respect to correlation alone, we would need more performance data in scenarios where the CPI is both falling and rising. Currently, we are left with half of the inflation picture. If inflation stays consistent at these elevated levels, we will increase this sample size.

Outlook

There were many factors outside of inflation that may have caused the rise in Bitcoin’s price. While it is true that Bitcoin has seen its all-time highs in the very same period CPI has also ascended, there are many external factors at play. Bitcoin has seen considerable adoption over the past few years as growth in speculative retail investing along with increase in the money supply added volume to both tech and crypto markets.7 Bitcoin was also widely adopted by institutional firms like Block (formerly Square) and Microstrategy.

Bitcoin as a hedge to inflation should not be the only consideration for use. Bitcoin functions as a decentralized, trustless P2P monetary network. Supply will presumably gradually tighten as demand for the technology rises, which may drive the price per Bitcoin higher. Bitcoin may continue to yield high returns as a growth asset over the coming years, however, the efficacy of Bitcoin as an inflation hedge may or may not materialize. It is too soon to tell.

In the meantime, as data shows, other Commodities and REITs may be able to provide greater returns through inflationary periods. At this point in its lifecycle, Bitcoin may be considered a growth asset, that exhibits properties of hard assets, and that may prove an effective hedge to rising inflation in the future. Both institutional and retail investors remain optimistic on the continued utility and demand for Bitcoin. In the global economy we may see Bitcoin continue to outperform public markets as its adoption and use cases expand.8 Given the correlation data presented above, there is simply not enough of a case to claim that Bitcoin can be trusted to hedge inflation perfectly in the near term, only time will tell.