As the risk to traditional fixed income markets generally increases with a rise in rates, some alternative sources of income from products like Collateralized Loan Obligations (CLOs) have the potential to provide investors with greater yields and a hedge against inflation through their floating rate structures. Historically, CLOs have provided investors with higher yields and lower default rates than those of corporate loans.1 In fact, no AAA rated CLO tranche has ever defaulted.2

What Is a CLO?

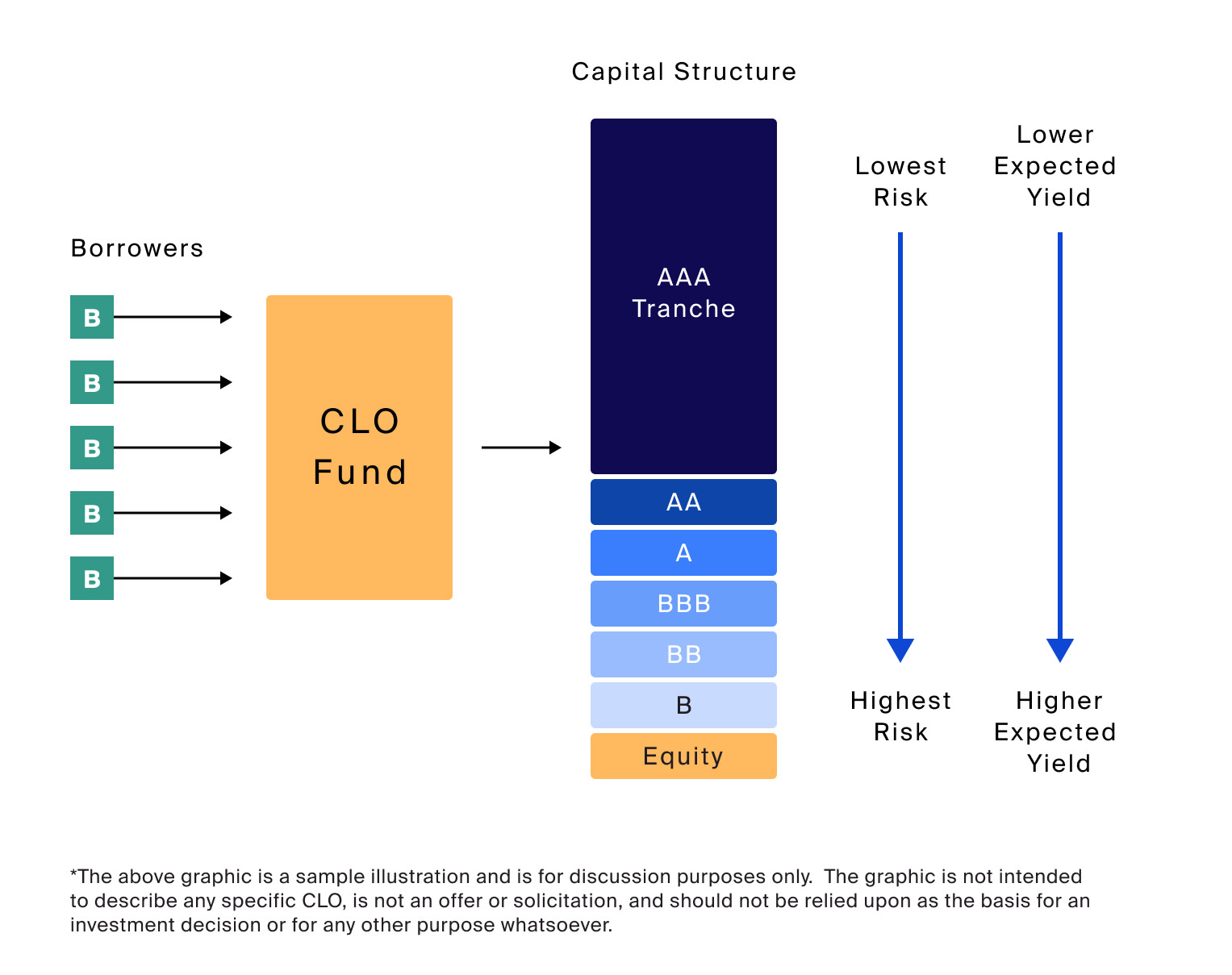

A CLO is a structured security generally backed by a pool of senior secured loans and is generally managed as a CLO fund. Dating back to the 1980’s, CLOs were first created to package leveraged loans to provide investors with customizable risk/returns streams3. Potential cash flows from the underlying collateral form the backbone of the CLO structure. Distributions would generally be paid sequentially and follow a waterfall process. Tranches are typically engineered by the fund, organizing the risk from lowest to highest, and inversely, lowest to highest yield or total return. The equity tranche is generally the lowest level in the capital structure and generally has the potential to generate the highest nominal return to investors in comparison to debt tranches.

In the graphic above, we can see that within the CLO capital structure, the AAA tranche is of the lowest risk, as this tier will experience the last loss of principal and highest priority of cash flows along with a lower expected yield. B rated debt and the equity tranche are of the highest risk, subject to the first loss of principal and offer the lowest claim on cash flows yet may provide the highest expected yield. While investment in higher tranches earn the first claim on debt repayments, many investors look for an allocation in lower tiers which have historically produced an attractive risk/return premium.4 Investors generally have discretion over tranches they would like to invest in depending on their risk and return profile.

CLO Versus CDO

To first clear up some confusion, many investors are familiar with the debt structure of a CDO, which stands for Collateralized Debt Obligation, often combining collateral such as mortgages, bonds, and consumer credit. A significant difference between a CDO and a CLO is specific to the underlying collateral. While a CDO would generally consist of exposure to a single industry, such as the housing market, a CLO in comparison, can create a more diversified capital structure as their underlying debt instruments often combine corporate loans from numerous industries.5 This may decrease risk exposure, as cash flows are spread over the market rather than tied to a specific and potentially uncertain sector outcome.6 In addition, many CLOs are required to comply with certain built-in risk protections like coverage tests, which require the underlying pool of loans be greater than the interest due on outstanding debt. Other potential protections may include collateral concentration limits, borrower diversification and borrower size requirements focused on default protection, industry diversification and borrower size respectively.7

The Potential Benefits of CLOs

A CLO allocation can come with several benefits including, higher relative performance, low interest rate sensitivity and potential for diversification compared to that of traditional fixed income. In comparison to other corporate debt instruments, CLO tranches have performed well, as per research from Pinebridge. CLO spreads are generally greatest at lower debt ratings and higher risk levels, according to PineBridge as of August 2021. Pinebridge believes this premium is driven by complexity, liquidity, and regulatory requirements.8 These spreads and subsequent total returns may translate to a considerable risk/return premium over comparable corporate bonds typically held by many investors.

Another important factor of debt securities that should be considered is a borrower’s ability to continue paying off their issued loans, a failure to do so is known as default, and is measured by the impairment rate. According to Bloomberg, “out of more than 1,300 U.S. CLO transactions rated by the firm from 2010 through the third quarter of 2021 -- including about 11,400 securities across the rating spectrum -- only five portions have defaulted as of Jan. 1, 2022.”9 Lower impairment rates may allow investors to retain yield performance regardless of market conditions and can once again provide portfolio diversification and a consistent source of return. With the prospect of interest rate hikes on the horizon, many investors are looking to CLO debt to seek to minimize duration risk as CLOs have proven to provide very low sensitivity to changes in rates.10 CLO tranches are floating rate yield instruments often earning interest at a premium to benchmark rates such as LIBOR and SOFR. As rates fluctuate, CLO yields may change periodically based on the movement of the benchmarks they are designed to track. Fixed rate instruments in comparison are generally subject to duration risk as their yield is determined prior to any changes in market conditions and benchmark lending rates. All this considered, many investors have used the CLO capital structure to provide a potential diversification benefit as well as a potential inflation hedge, due to lower correlation to typical fixed income instruments and the inherent versatility of floating rate yields.11 According to PineBridge, the average correlation of CLOs relative to other fixed income classes – US Treasury Bonds, US Aggregate, US IG Credit, Securitized Products, High Yield, EM Debt -- is just .298 adding the diversification benefit that many yield focused investors may seek.12

The Potential Risks of CLOs

Lastly, CLOs are composed of intricate capital structures, and investors should consider the risks associated with investment. Due to credit exposure, CLOs are subject to borrower credit strength and thus the strength of the underlying companies.13 The continued economic performance of borrowers indirectly factors into the strength of credit and return an investor may experience through fluctuating yield and in some cases tiers of the capital structure may be excluded from principal repayment. Another risk to consider is the timing of issuance which describes the periodic market conditions when a CLO is issued. In some cases, a CLO may be issued when market conditions are healthy and lending rates are desirable, however during reinvestment periods, market conditions can be subject to change and so may the conditions of yield and subsequent return for investors. In addition, although CLOs are composed of floating rate yield instruments, reinvestment periods may fall short of spread durations which may make lower tiers of the capital structure susceptible to spread duration due to sequential redemption.14

In closing, CLOs have seen considerable allocation in recent years as investors look for alternative yield outside of traditional fixed income markets.15 Consequently, CLOs historic performance shows the potential to both provide a hedge to uncertain economic environments and a potential source to alternative uncorrelated yield.