What Are Qualified Opportunity Zones (QOZs)?

In 2017, the Tax Cuts and Jobs Act was introduced, which led to the creation of over 8,700 Qualified Opportunity Zones (QOZs) across the United States.1 These zones were designated by Congress and state Governors to stimulate economic development and job creation by encouraging long-term investments in economically distressed communities.

The primary objectives of these zones is to stimulate economic growth and to offer tax incentives to investors who are willing to contribute and invest their capital gains into these areas. These incentives include the deferral of capital gains taxes and, in some cases, the complete elimination of taxes on new gains from investments held for at least ten years.

Here's how it works: investors can defer tax on any prior capital gains, within 180 days of sale, if invested in a Qualified Opportunity Fund (QOF) until the date they sell their QOF investment or December 31, 2026, whichever comes first. In addition, when an investor holds a QOF investment for at least ten years; under this scenario, the investor pays no taxes on any gains from that investment.

The Role of the Qualified Opportunity Fund (QOF)

The method in which an investor can contribute to QOZs is through the structure of a Qualified Opportunity Fund (QOF) which seeks to raise investor capital and identify opportunities in the listed zones for development of numerous types of properties and businesses.

A QOF is a vehicle structured either as a corporation or a partnership that invests at least 90% of its assets in QOZ property.2 This includes a variety of developments such as, but not limited to, commercial real estate, multi-family residential buildings, and infrastructure projects. The QOF manages these projects, overseeing their development, construction, and operation.

The Social Benefits of Investing in QOZs

Investing in QOZs is not only tax-advantaged, but may also be socially responsible. These investments aim to bring about significant improvements in underserved areas, which can lead to enhanced community development and economic growth. This can include new housing, improved infrastructure, and the creation of jobs.

The Tax Incentives of QOZs

The Opportunity Zone program allows for the reinvestment of gains from a variety of assets into QOFs. This includes gains from stocks, bonds, real estate, and more. A capital gain is eligible for deferral if it is from the sale or exchange of property with an unrelated party (not more than 20 percent common ownership) and the gain is treated as a capital gain (short-term or long term) for federal income tax purposes.

Once a capital gain is executed, the taxpayer will have 180 days following the date of the sale to invest the now realized gain into a Qualified Opportunity Fund. From this stage, the initial capital gains tax the investor is subject to pay may be deferred until 2026, and any gains earned on the QOZ will be exempt from tax responsibility if held for 10 years or more.3

Key tax incentives in summary4:

Deferral: Investors can defer taxes on eligible capital gains until the end of 2026 by investing those gains into a QOF.

Exclusion: If held for 10 years, investors pay will pay no taxes on any capital gains from their QOF investments.

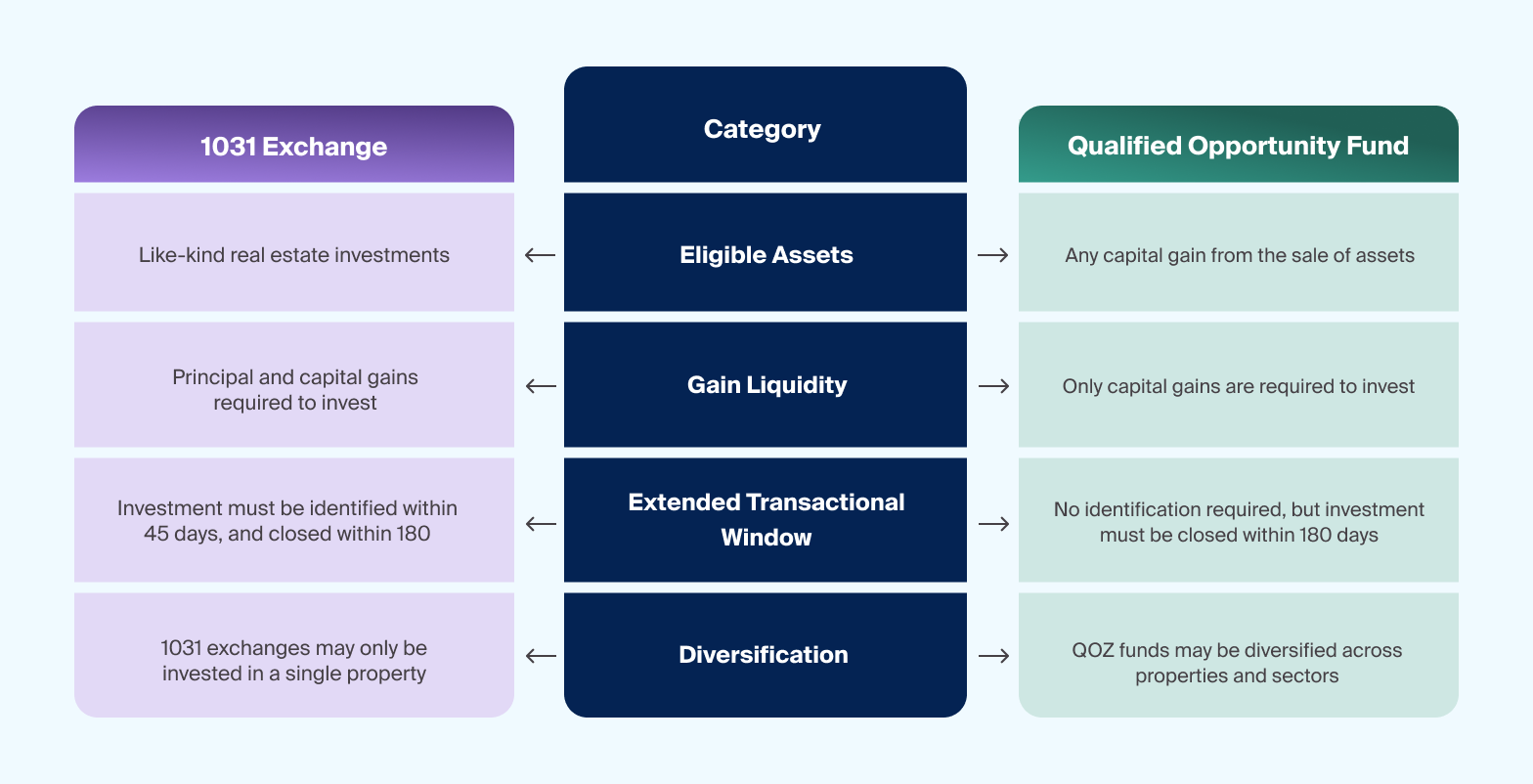

Comparison to Other Tax Advantaged Strategies

Investors may be curious how the QOZ strategy compares to other tax incentivized real estate strategies like 1031s. Unlike a 1031 Exchange, which requires investing in like-kind property to defer gains, QOZ funds allow investors to invest in a more diverse set of assets. Here are some potential advantages of QOZ funds compared to 1031 exchanges5:

Exhibit 1: Comparison to Other Tax Advantaged Strategies

Eligible Assets: In a QOZ, any capital gainfrom the sale of assets for federal income purposes may be used for deferral, whereas in a 1031, these assets must be like-kind real estate investments.

Gain Liquidity: QOZ investors can, if they choose, to reinvest only the capital gains from a previous asset sale, andare not subject to invest the entire principal, which is required when investing in a 1031. But it must be noted that only the capital gain portion of the investment will be eligible for the exemption from tax.

Extended Transactional Window: QOZ investors have 180 days to identify an investment, compared to just 45 days for identification and 180 days for investment in a 1031 exchange.

Diversification: QOZ funds are more diversified and invest in any number of properties and property types, reducing the risk compared to single-asset 1031 exchanges, which must invest in like-kind properties.

Secular Tailwinds

Since QOZs are composed of real estate assets, they are no more isolated from the secular tailwinds that impact the rest of the real estate market. Various opportunities in real estate may specifically support the types of assets that QOFs deploy toward.

Industrial

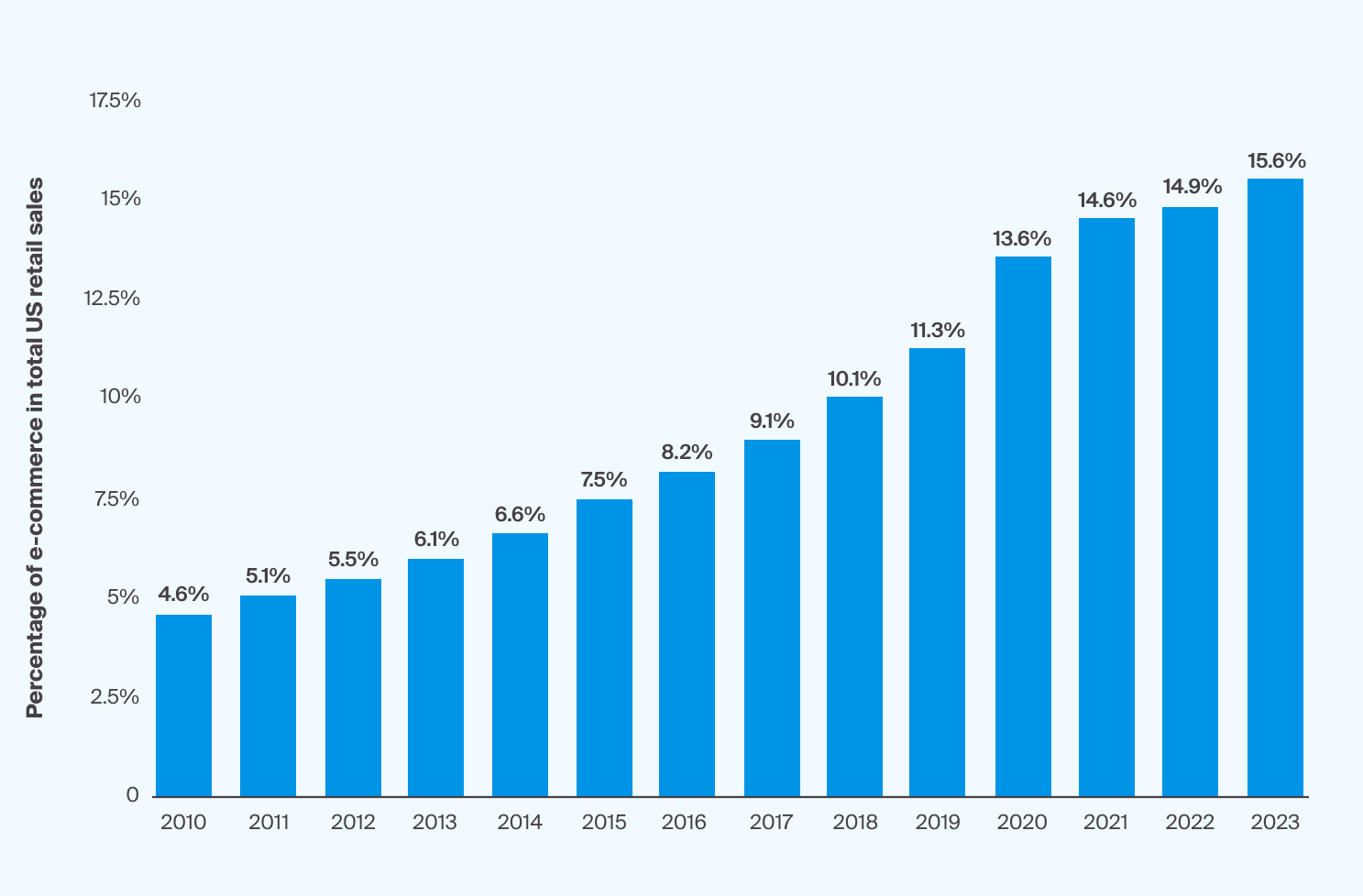

The industrial sector is experiencing a surge due to increased onshoring and nearshoring operations. The reshoring of manufacturing jobs and the growth of e-commerce are driving demand for modern logistics facilities. E-commerce companies accounted for 28.2% of all industrial absorption from 2016 through 2019, and since Covid-19, that number rose to approximately 40% as consumers shifted their shopping patterns to more frequent online purchasing. For instance, every $1 billion in new e-commerce sales requires an additional million square feet of warehouse space6.

There may be a growing premium for modern warehouses and its expected that properties that facilitate quicker movement of goods through automation and other technological enhancements will both be in greater demand and perform better than traditional and outdated industrial assets.7

Source: Statista, Percentage of e-commerce in total retail sales in the United States in 4th quarter from 2010 to 2023, as of 2024

Rise in business inventories and exponential growth ration of e-commerce to retail sales

Multi-Family

The multi-family housing market is facing a supply-demand imbalance. Despite slowing construction, the demand for rental units is rising, particularly in high-growth areas. This mismatch is pushing up housing prices, indicating a need for more residential construction in these zones8.

QOZ Considerations

Legislative Updates

Since QOZ investments are subject to a number of timelines, one of these being the termination of the program in 2026, many investors may be curious on updates to legislation and continuation of the program. With the program having now been in effect for a number of years, a new bipartisan bill, the Opportunity Zones Transparency, Extension, and Improvement Act, was introduced in 2023 and aimed to extend the QOZ program through December 2028. If passed, the legislative update would provide investors additional time to benefit from the tax incentives QOZs enable, and for more communities to benefit from the capital deployed into these zones.

Risks of QOZs

While the tax benefits can be attractive, advisors must consider various risks. These include, but are not limited to, the stringent requirements for investments in QOZ property and the potential illiquidity due to long holding periods. Advisors should be prepared for lock-up periods and management fees, which can affect overall returns.

Investments in QOZs seek to provide a unique combination of tax benefits and the potential for meaningful social impact. However, like all investments, careful consideration and professional advice are essential to navigating the opportunities and risks involved.

One also must note, that the information provided is not constituted as tax advice and any investor interested in this strategy or any other tax advantaged strategy is strongly urged to consult their tax professionals.

The Bottom Line

Qualified Opportunity Zones (QOZs) may present a blend of social responsibility and financial incentives. By channeling investments into economically distressed communities, these zones aim to foster long-term economic growth and revitalization. For investors, QOZs may provide certain tax benefits, which have the potential to positively affect the after-tax return on their investments.

With legislative efforts like the Opportunity Zones Transparency, Extension, and Improvement Act of 2023, there is an indication that QOZs may continue to be a part of the economic landscape.