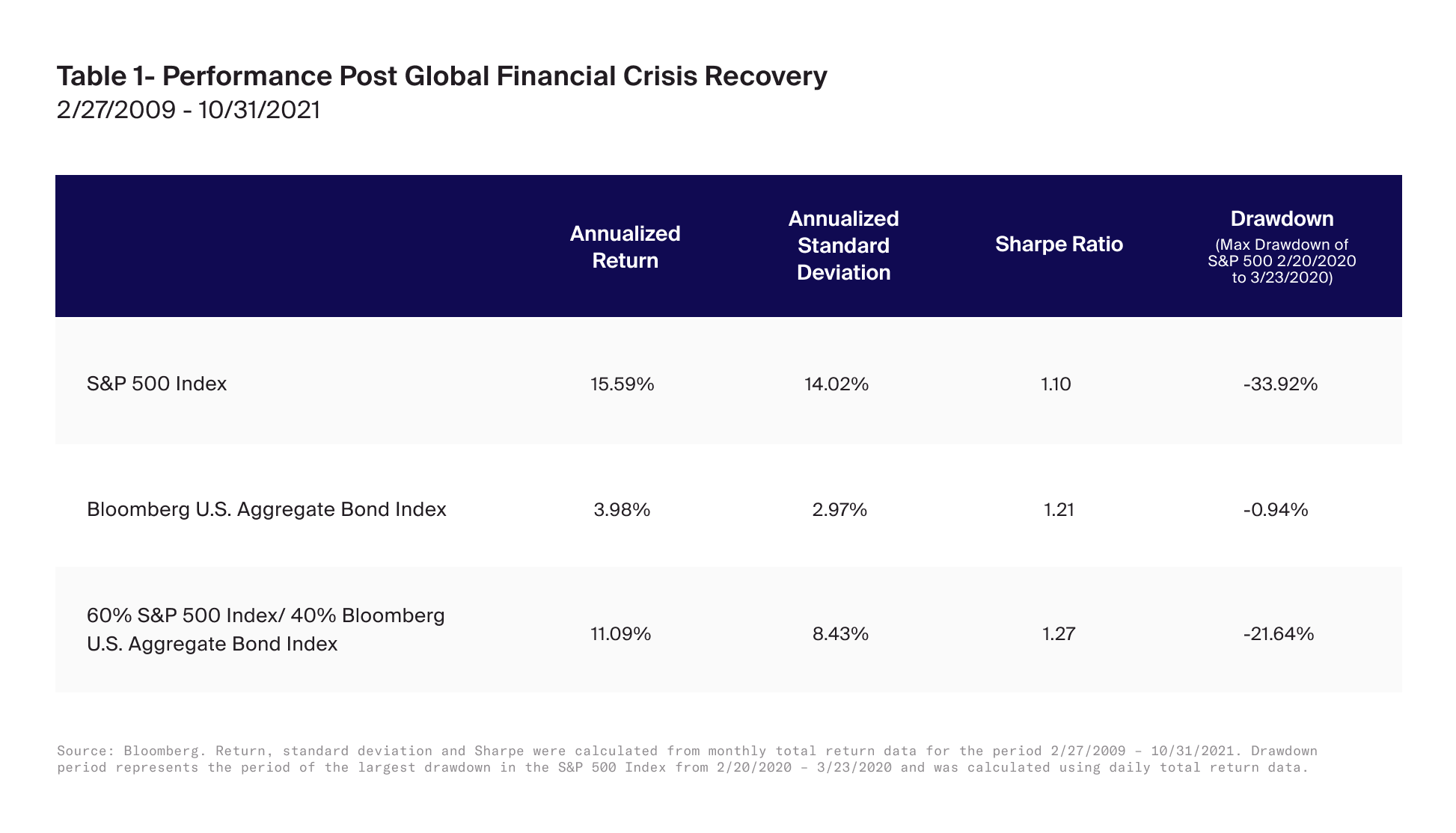

The recovery and subsequent rally from last year’s pandemic induced market lows has helped traditional 60/40 stock/bond portfolio investors realize continued gains from the balanced portfolio that they have enjoyed for most of the recovery from the global financial crisis (GFC), more than a decade ago. As shown in Table 1 below, since the GFC market recovery began in March 2009, a 60/40 portfolio has returned an annualized return of 11.09% with volatility as measured by standard deviation of 8.43%, delivering investors a Sharpe ratio of 1.27. On a risk-adjusted basis, this compares favorably to equities, with the S&P 500 realizing an annualized return of 15.59% with a higher standard deviation of 14.02%, and Sharpe ratio of 1.10. The attractive absolute and relative returns of the 60/40 portfolio, as well as its relative simplicity have helped endear it to investors across the globe.

Additionally, over this period, bond yields have declined meaning that bond prices have advanced, adding not only to the overall return of a balanced 60/40 portfolio, but have helped reduce overall portfolio volatility as well. In such an attractive risk and return environment, many investors have questioned the need for diversification, as well as the role of alternative sources of return. A potential problem is that this assumes that both stocks and bonds will continue to move higher together – an assumption that given high historical stock valuations and low bond yields and tight spreads, may be unlikely to persist. This is confirmed by the low long-term capital market assumptions issued by banks and asset managers alike over the past 12 months12.

Given the aforementioned low future expected return environment, coupled with the potential for the diminishing diversification benefit from bonds in a rising rate environment, we believe today may present an excellent opportunity for investors to reimagine the 60/40 portfolio.

The Correlation of Bonds, Friend or Foe

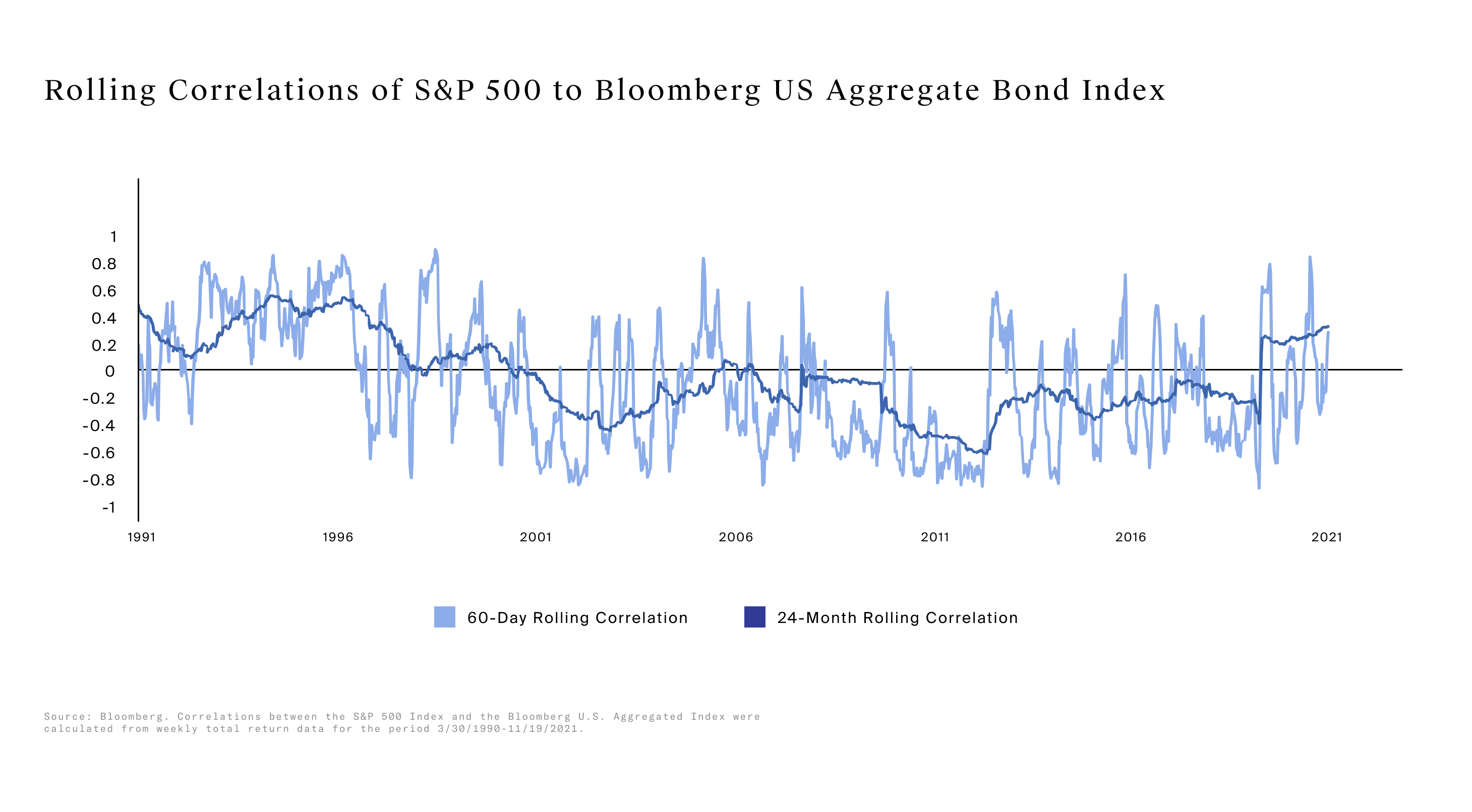

Many investors point to the declining correlation between stocks and bonds over the past 30 years to highlight their potential diversification benefit for a 60/40 portfolio. In Exhibit 1, we can see that this is certainly the case when looking at the 24-month rolling correlation of stocks and bonds. If we look however at shorter-term measures of correlation such as the 60-day rolling, there are frequent spikes where correlation rapidly spikes to over +0.5 reducing the effectiveness of bonds to dampen overall volatility.

Exhibit 1

During the height of the pandemic induced sell-off between 20 February 2020 and 23 March 2020 date, we saw that a 60/40 portfolio lost -21.64%, while stocks declined by -33.92%.3 While this may be deemed a good result for a 60/40 portfolio, there are reasons to believe that this may be unlikely to occur in the future.

In a low expected return environment for both stocks and bonds, as well as the potential for bonds to offer a diminished diversification benefit as part of a broader portfolio, investors may need to look more broadly to a wider opportunity set to enhance returns, dampen volatility, and diversify risk. It is through the varied characteristics of alternative investments and private markets that we believe investors may find these opportunities.

The Case for Alternative Investments

The four main categories of alternative investments – hedge funds, private equity, private debt and real estate – can potentially offer unique and varied yet complementary characteristics to more traditional investments such as stocks and bonds.

Private Equity

It may come as a surprise to some that in the first year of the pandemic, more applications for business formations were made than at any other time on record.4 Meanwhile, the number of public companies has shrunk to multi-decade lows.5. In addition, companies are raising more capital rounds in the private markets6, with more of the high growth phase of business formation going to those investors who invest in venture and growth equity segments of the private equity asset class7. Given this, it may be increasingly important that investors allocate to private equity to seek to enhance the return of a traditional portfolio.

The potential for long-term value creation, active management, and proprietary deal sourcing are among some of the reasons why private equity funds have delivered between 1-5% in excess annualized returns (net of all fees) over the S&P 500 since the GFC8.

Private Debt

Today, investors can access several benefits relative to traditional bonds by accessing private debt markets. Firstly, investors may receive up to 8.8% yield on direct lending, the largest strategy within the private debt universe, compared to just 3.8% in U.S. High Yield.9 Additionally, since 2008, direct lending has had a correlation of 0.0 to global bond markets, providing a diversification benefit relative to bonds and highlighting a potential source of funding for a move into private debt. Finally, and perhaps most importantly given the outlook for higher interest rates that many market participants are expecting, is the floating rate structure typically associated with private debt. To partially compensate for a higher risk of default, private lenders issue credit at spreads above a reference benchmark, which allows the contractual coupon to adjust over time as the benchmark adjusts10. This typically leads to lower duration11, or interest rate sensitivity relative to traditional bonds, a potential benefit for investors in a rising rate environment.

Private Real Estate

The tangible nature of real estate makes it a very familiar investment for many investors, though its composition expands beyond single and multi-family homes to include commercial and industrial real estate to name a few. In addition to this, the focus on cash flows in the form of rents, as well as the potential for landlords to pass through rental increases, also make it a potential hedge against inflation. Year-over-year correlation between core U.S. real estate and headline inflation is just 0.46.12 Additionally, real estate has the potential to provide the diversification they are seeking in their traditional portfolios, as evidenced by the fact that US Core Real Estate has 0.1 correlation to stocks, and -0.1 correlation to bonds, all while providing income with a 3.9% yield.13

Hedge Funds

Hedge funds have the potential to provide effective diversification given their general focus on generating attractive risk adjusted returns regardless of market directionality. Investor enthusiasm for hedge funds spiked last year and into this year given their relative and absolute performance through the pandemic, generating the strongest absolute return since 2009.14 Positive relative performance has continued into this year with hedge funds outperforming the S&P 500 Index in the third quarter, weathering September’s extreme volatility and protecting investors against the month’s significant drawdown.15 This, coupled with the events of the pandemic have placed the importance of risk management squarely in focus for investors who are increasingly looking to hedge funds to offset broader market risks.

Looking Forward, Seeking to Balance Portfolio Risk and Return With Alternatives

Given the low forward return and capital market expectations previously mentioned, as well as the low current yield environment for bonds and the increasingly correlation between the two, investors may have to reimagine the 60/40 portfolio to maintain expected return and to diversify the risk of the overall portfolio. We believe that alternatives such as hedge funds and private markets exposure may be key to achieving this balance between risk and return, while potentially unlocking access to the uncorrelated and enhanced returns these strategies offer.