Private Equity Piques Interest

Past and present.

In CAIS’s view based on interactions with its client base, private equity has become an increasingly important asset class to investors as a way to seek access to a broader set of growth opportunities, especially as the global economic outlook slows and future return expectations are revised lower. Widely known as a return enhancement strategy, private equity has consistently delivered superior risk-adjusted returns over that of public equities [1]. Having grown to over $4.7 trillion as a market [2], private equity is likely to continue to grow as an asset class due to:

Access to attractive opportunities across each stage of the business growth cycle [3]

Companies staying private for longer [4]

Opportunities Across the Business Growth Cycle

From start-up to maturity.

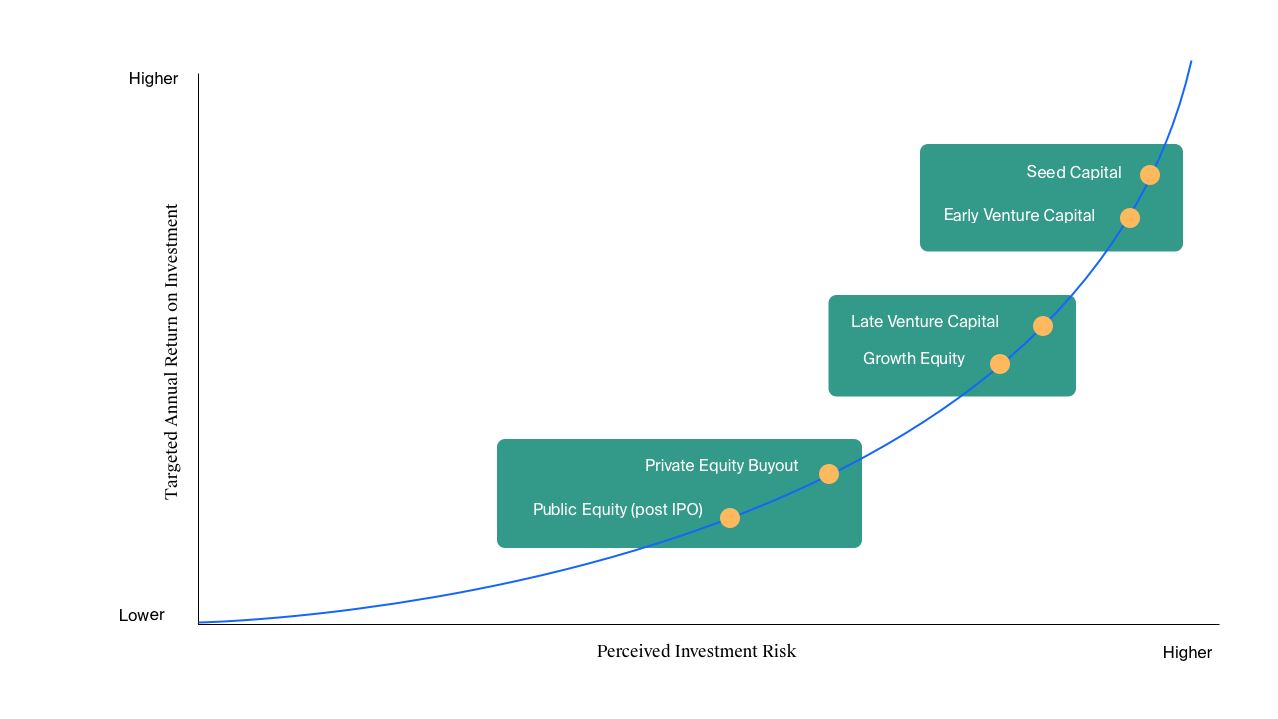

Generally, a significant amount of the value created within a company occurs between start-up and when it matures. It is at this point of maturity that management can choose to remain private, sell to a larger company or go public through the IPO process. Each stage has very different risk and return profiles and therefore may be best accessed with different types of private equity strategies.

The Start-Up Stage

Every company starts with an idea or product that the founders think can achieve commercial success. Typically, they are financed with seed capital that is provided by friends or family, angel investors or early stage venture capital. It is estimated that over 90% of start-ups fail and as such the risk of investing in a start-up through an early venture capital fund is high, but the potential reward can be significant. Risk at this stage is highest and centers around market and product risk [6].

The Fast Growing Stage

At this stage a company’s idea or product is showing early signs of success and may be experiencing adoption by its target market. The stage can be further broken into pre- and post-revenue. Within a pre-revenue business, some of the business risk has been alleviated with the business having overcome early obstacles. Late stage venture capital may look to acquire a minority equity stake in the business to help the business get their product to market, help them start scaling and provide expertise. A post-revenue company has generally established its product within the market and is looking to expand its product offering or operations. Growth equity may provide capital in exchange for either a minority or majority stake in the company. It is anticipated that risk within this stage begins to decline as operational uncertainty is overcome, however return potential declines relative to early stage venture capital. The risk has shifted to execution and management risk [7].

The business growth cycle provides varying risk and return dynamics for private equity strategies that may enhance the return of a traditional portfolio.

The Mature Stage

The mature company generally has a long track-record of revenue generation and as such should have access to a broader range of funding sources, including cash flow from their existing business and the use of debt. Private equity buyout may seek a majority or controlling stake in the company and will likely use both debt and equity to finance the transaction. The private equity firm will seek to use their skills in reducing operational costs, upgrading talent and management teams, and financial engineering to create value within the company [8]. Due to the use of leverage, some risk shifts to default risk while execution risk remains, however, the overall risk profile is generally less than the previous three aforementioned private equity strategies.

The business growth cycle provides varying risk and return dynamics for private equity strategies that may enhance the return of a traditional portfolio.

Private for Longer

Over the past 20 years, the number of public companies in the U.S. has dropped from a peak in the 1990’s of around 8,000 companies listed on the NYSE and NASDAQ to between 5,000 and 6,000 today [9]. This is because companies are choosing to stay private for longer. The reasons that are typically given for this include the burdensome regulatory disclosures and reporting requirements of public companies, a more efficient capital raising process in the private markets [10], and a desire of entrepreneurs to retain control of their companies and to focus on long-term growth [11]. As a result, the number of companies that choose to file for their IPO has fallen dramatically from its peak in 1996 of almost 700, to 165 in 2020 [12]. Investors in public markets not only have less companies to choose from, but they also suffer a skew to more mature, higher market capitalization companies that for the most part have already experienced their high growth phase.

The ability for private equity to access a diverse range of opportunities within the ever-growing private markets, as well as across the business growth cycle, helps explain the asset class’s growing popularity amongst investors.

For more information about investment opportunities available on the CAIS Platform, contact a CAIS representative.