What Are Real Assets?

Real assets are generally defined as physical assets that include infrastructure and natural resources and can also include real estate.

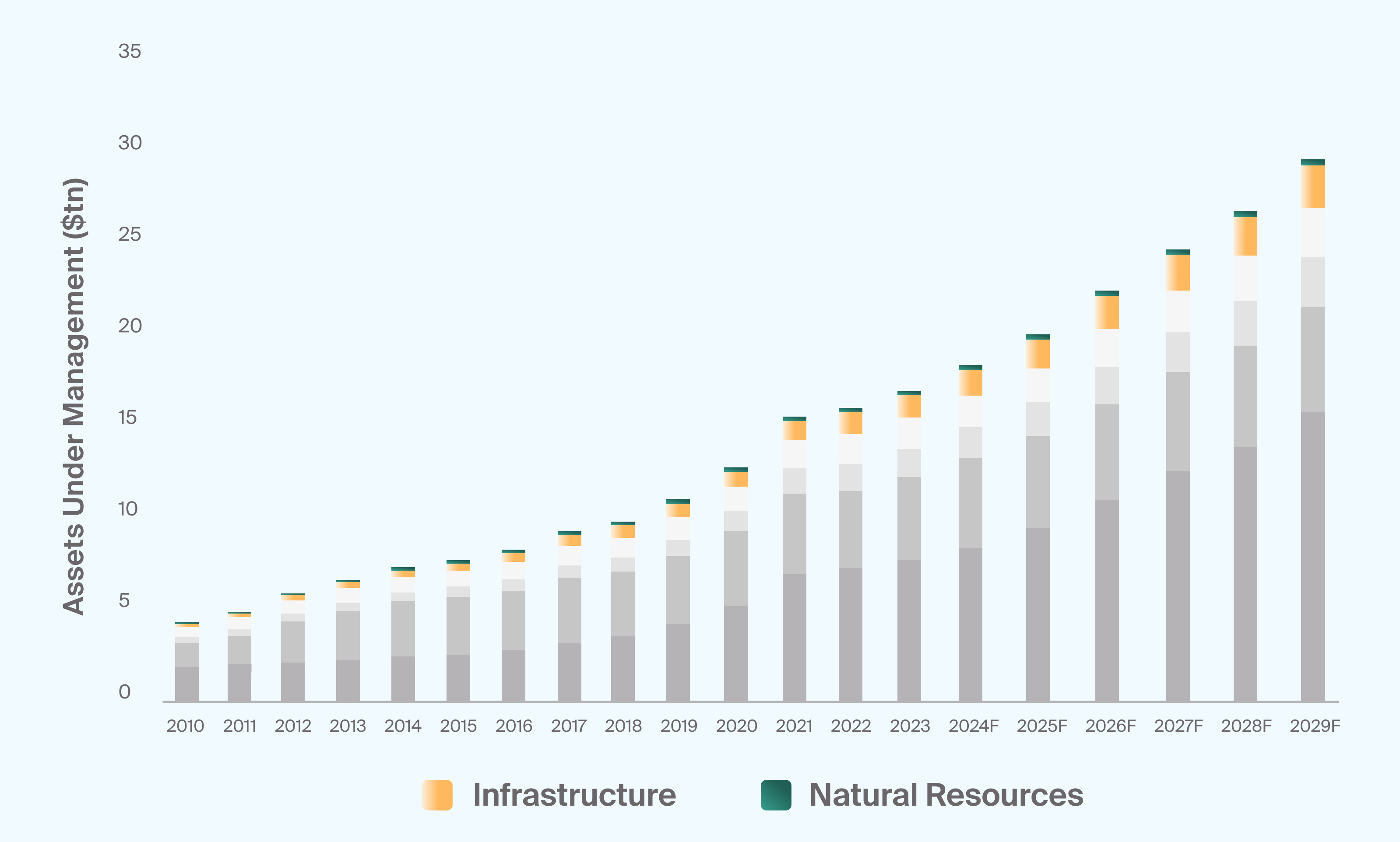

Real assets are a smaller private markets landscape, but they continue to grow in prominence. Infrastructure and natural resources—the two underlying asset classes within real assets—are expected to reach a combined $2.6 trillion in assets under management (AUM) by 2029, representing just over 11% of total alternative assets globally (Exhibit 1).

Source: Preqin, Future of Alternatives 2029; AUM values for 2024 to 2029 forecasted by Preqin.

Real assets are a small but growing alternative asset class including infrastructure and natural resources (Exhibit 1)

Real asset investments can be made through a direct transaction or through a private commingled structure.

Depending on the type and mix of real assets, these investments may offer the potential for portfolio diversification with relatively low correlations to traditional asset classes, such as stocks and bonds. Real asset investments often generate income, and some may protect against inflation, their value can be positively correlated with real economic factors like rising commodity prices. However, these benefits are also accompanied by risks, such as reduced liquidity, commodity price volatility, and exposure to regulatory changes.

What Are Some Examples of Real Assets and Strategies?

There are a variety of investments within infrastructure and natural resources, some of which share common themes and investment strategies.

Infrastructure

Infrastructure assets can be related to a wide variety of physical assets that tend to play roles in helping economies operate efficiently. Some examples include:

Traditional Energy: Oil rigs and natural gas pipelines

Renewable Energy & Cleantech: Wind turbines, solar energy equipment, on-shore and off-shore wind farms, and battery storage

Logistics: Warehouses and data centers

Telecommunications: Mobile phone towers

Transportation: Airports, ports, toll roads and ships

Utilities: Power utilities, water utilities and waste management services

Infrastructure investments can be made at various stages in an asset’s lifecycle.

Greenfield assets generally refer to projects that are being designed and built. This also means they do not typically generate revenues at the early stages of the investment. This combination of characteristics means these assets tend to have a higher risk profile.

Brownfield assets broadly describe existing structures that require some level of improvement or repair. Because they may be partially operational and generating some income, these investments may have a slightly lower risk profile than greenfield investments.

Secondary stage assets tend to be fully operational and already generating income, without needing any significant improvements. This is typically the lowest-risk infrastructure investment.

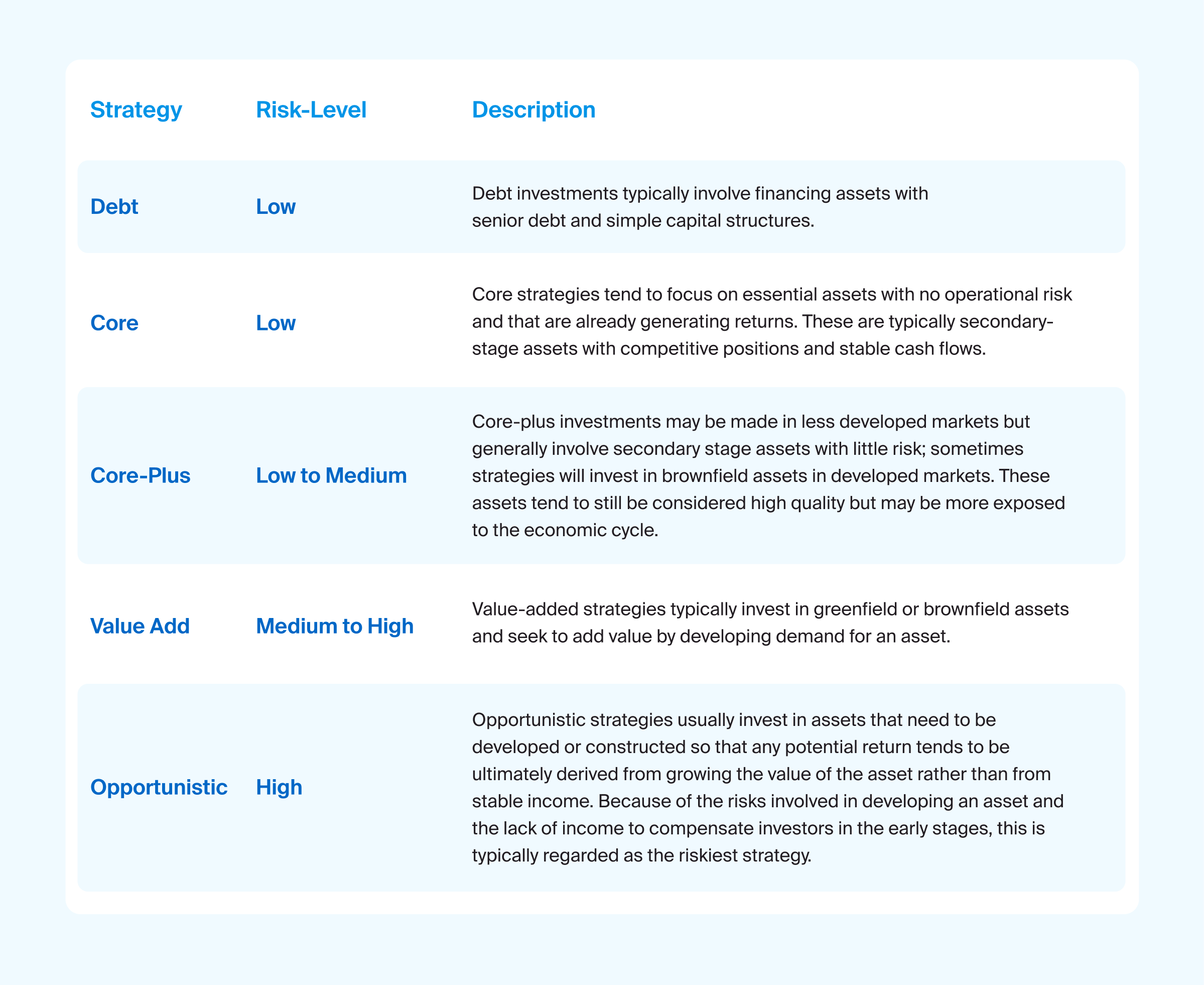

The categories of infrastructure strategies are like real estate and display a wide variety of risk and return profiles.

The categories of infrastructure strategies are like real estate and display a wide variety of risk and return profiles.

Natural Resources

Investing in natural resources can involve investments in the infrastructure related to the natural resources and the commodities themselves. These investments feature a range of risk and return profiles Some broad categories include:

Agriculture & Farmland: Agriculture technology, landowners or operators, livestock and commodities, such as coffee, cotton and grains

Energy: Oil, natural gas, coal and renewables and investment in related processes and infrastructure

Metals & Mining: Base, precious and ferrous metals and non-metallic minerals and investing in the exploration and refining processes

Timber: Forests, tree farms and cut wood

Considerations When Investing in Real Assets

J-Curve

Some real asset investments, such as certain types of infrastructure investments, will follow the J-curve pattern, where they will produce negative cash flows in the early years, due to capital calls and management fees paid before there is a chance for the investment to generate returns. More mature infrastructure investments and some types of natural resource investments may have more potential to offset any expenses with income at an earlier stage.

Liquidity

The liquidity of a real asset investment can vary at both the asset level and the fund level. Leverage used by a manager can also impact the liquidity of a property. Assets with current income can help improve liquidity as cash is returned to investors while the asset is held.

Manager Selection and Access

Manager selection and due diligence can be an important part of real asset investing, given the wide level of manager abilities, track records and access to investment opportunities. Additionally, some real asset funds may be diversified while others may be highly specialized in one type of investment.

Diversification

Investors can diversify their real asset allocation in many ways including by manager, geography, strategy and asset type.

Access to investment opportunities in the physical assets that often play an important role in the global economy is likely to improve as the asset class grows and develops.