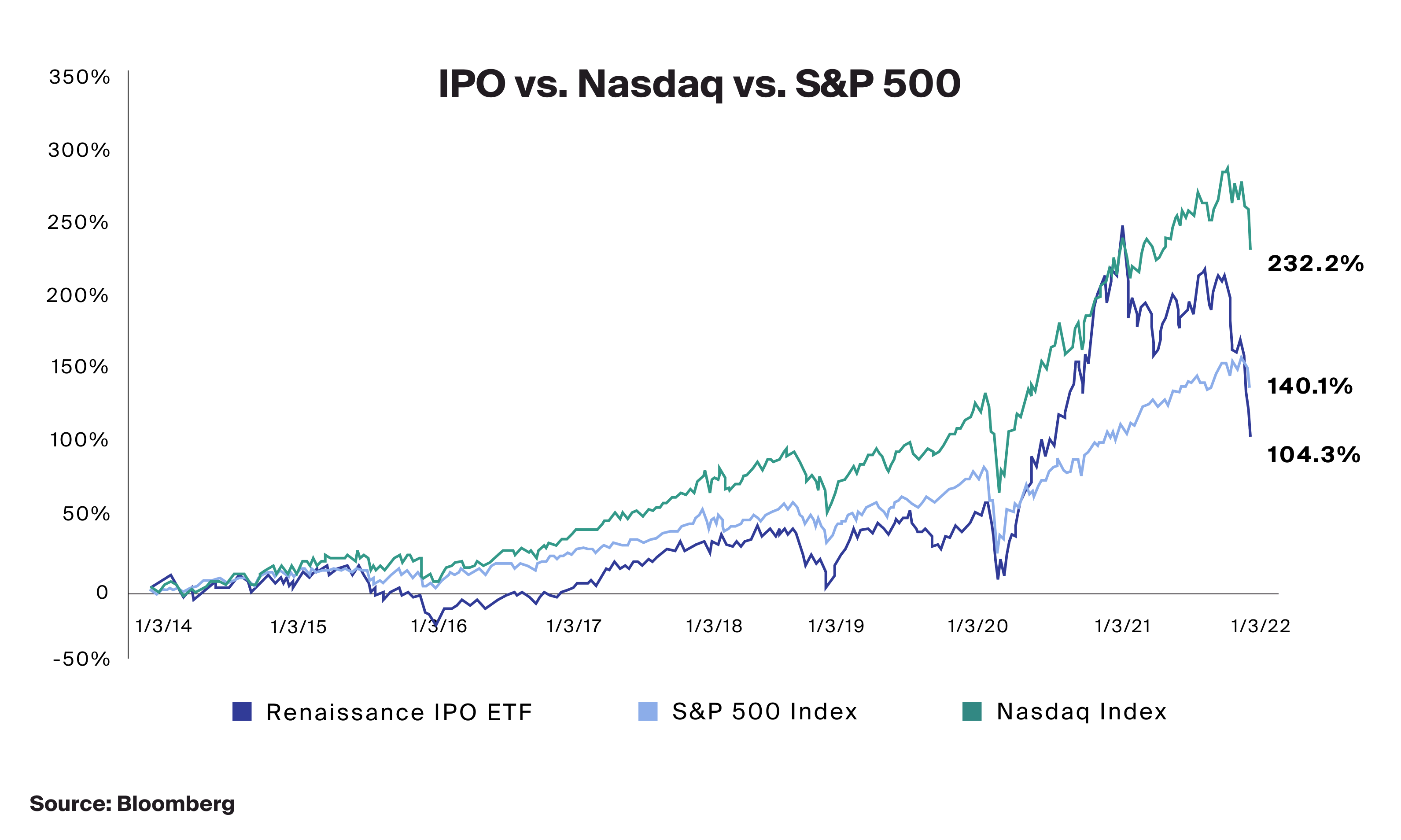

Initial public offerings (IPOs) have been highly sought after in recent years by investors and issuers alike – the former seeking to access higher relative returns, the latter seeking to capitalize on the strength in public equity valuations to raise capital.1 In 2020, IPOs as represented by the Renaissance IPO ETF was up 107.3%, outperforming both the NASDAQ’s return of 43.6% and the S&P 500’s return of 16.3%. Since then, however, returns have declined on both an absolute and relative basis with IPOs declining 10.3%, underperforming broader U.S. equity indices. This occurred given the dimming prospects for growth and growth-oriented investments under a higher interest rate regime. To maintain enhanced returns, some investors have started to look to private markets, and specifically to venture capital and private equity.

Riding the IPO Wave

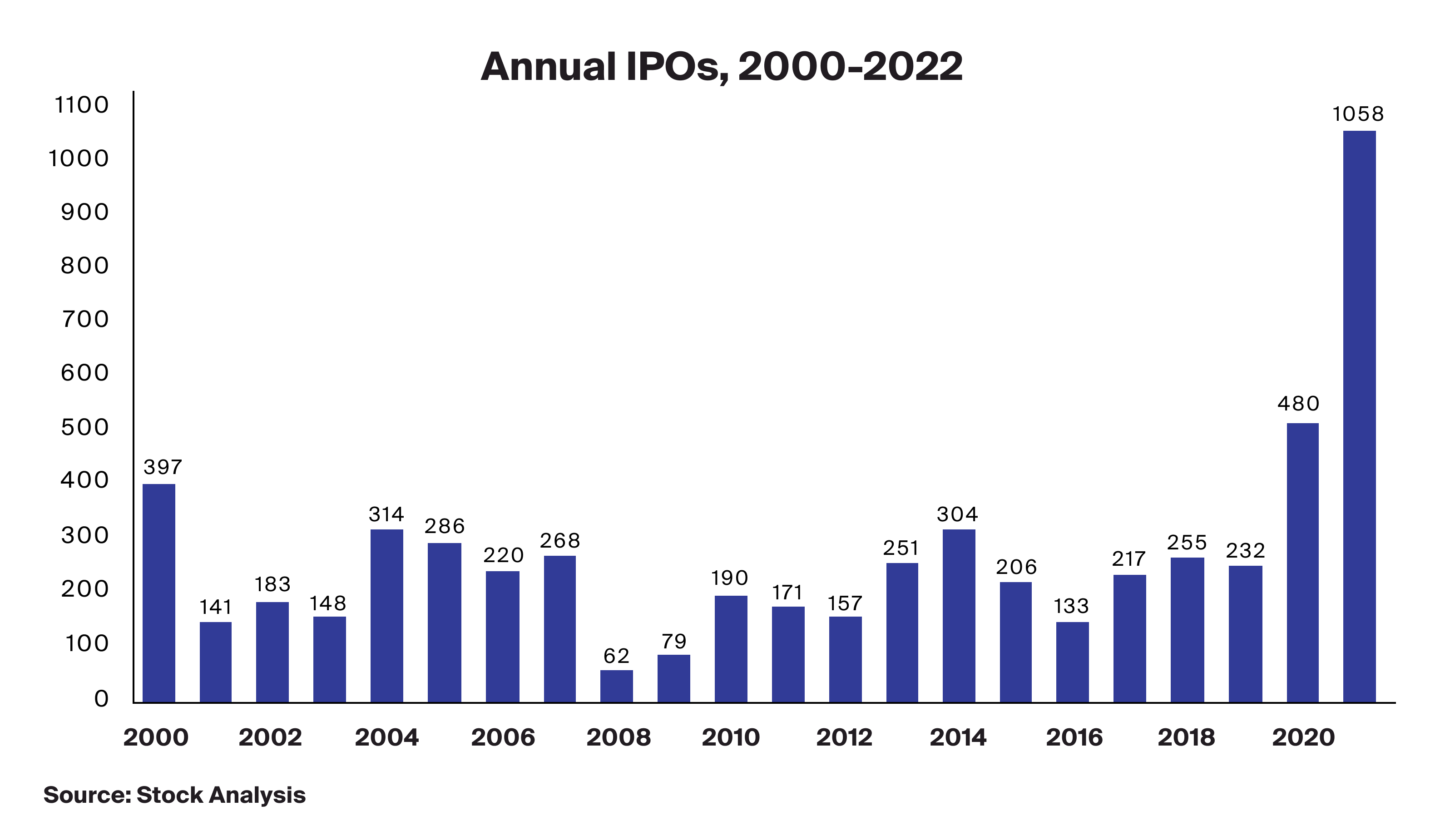

As mentioned earlier, 2020 was a bumpier year for the performance of IPOs with 480 coming to market, the highest since 2014.2 During this year, first day performance averaged almost 42%, the best average one-day performance since 2000. Names such as Airbnb (ABNB) and DoorDash (DASH) saw average returns of 113% and 86% respectively.3 The record number of IPOs coming to market continued into 2021 as issuers sought to take advantage of the higher valuations in public equity markets, reaching 1,058: an all-time record that represented 120% more than the prior year.4 Research from Bank of America showed that while it was a record year for IPOs, performance was relatively lackluster. The 6-month post-IPO performance of this cohort fell by -14% on average, versus their historical gain of +14%.5 Over the course of the year, two-thirds ended below their IPO price.6 The outlook for higher rates coupled with an elevation in overall market volatility, which we have addressed here, and the general rotation away from high risk, growth orientated companies, such as those recently listed on exchanges, appear to have hurt overall performance of IPOs in 2021.

The poor relative performance of IPOs may reduce the opportunity set for investors in traditional markets like those for stocks and bonds as they are generally considered to be an instrument that allows for investment in new, growth orientated companies.7 Given the continued lackluster outlook for these types of companies trading in public markets, we are increasingly seeing advisors that utilize the CAIS Platform seek investments in private markets, and more specifically, in venture capital and private equity.

Going Public (to Private)

Generally, a significant amount of the value created within a company occurs between its inception and when it matures. It is at the point of maturity that management can choose to remain private, sell to a larger company, or go private through the IPO process itself. The below chart provides a general sketch of the relationship between the potential annual return on investment for various private equity and venture opportunities, as well as the perceived investment risk. It must be emphasized that while venture may have more return potential, it does come at the potential for more risk.

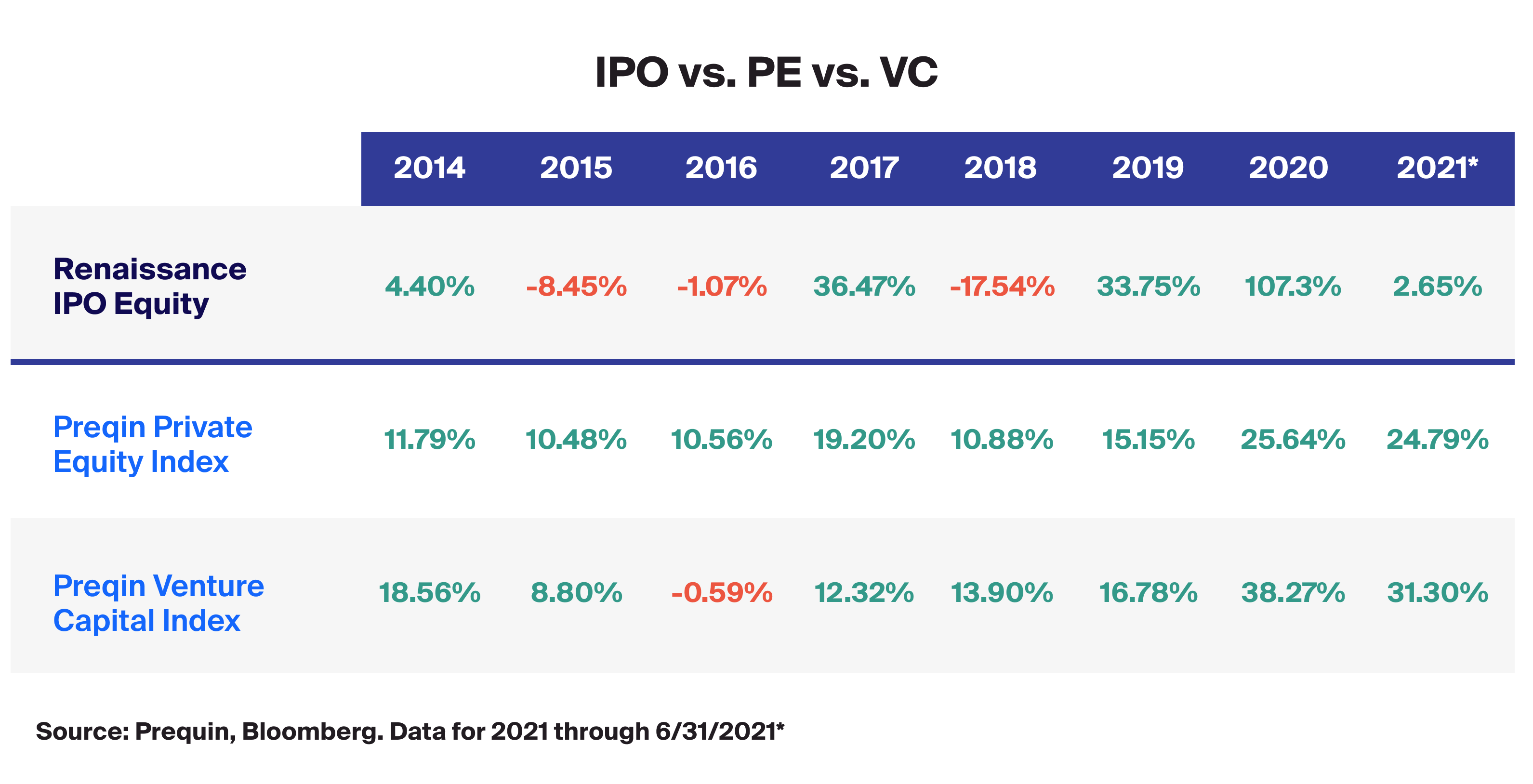

If we look at the actual returns realized from both private equity and venture capital relative to IPO markets over the past several years, we can see there is a greater persistence in both absolute and relative returns as shown in the below table of returns. This doesn’t consider the illiquid nature of private market investments, which typically have lock-up periods greater than 10 years, but it highlights that these private market investments may potentially unlock access to the high growth phases that a business may go through. Both private equity and venture capital present another avenue for investors to access new, growth orientated investments that they may have previously sought to get via IPOs.

In summary, we believe we will see more investors researching ways with which they can access private market instruments to replace the once valued and coveted IPO marketplace.