What Is Private Real Estate?

Real estate is generally defined as tangible property consisting of land, buildings, and related structures. Private real estate is a private markets asset class focused on pooling ownership of property assets in a fund.

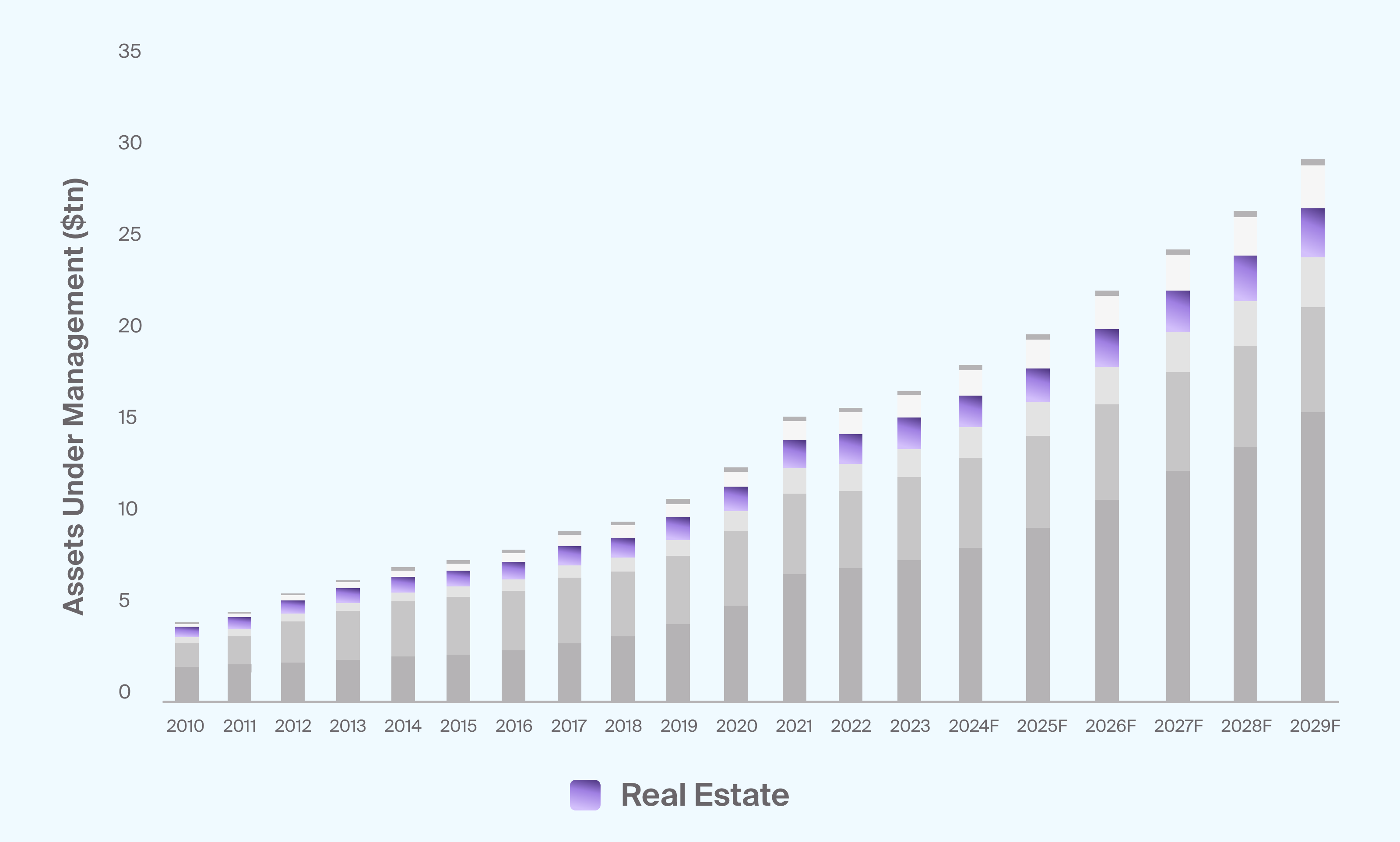

Assets under management (AUM) in private real estate strategies grew to an estimated $1.7 trillion in 2024 and could rise to nearly $2.7 trillion by the end of 2029 (Exhibit 1).

Source: Preqin Future of Alternatives 2029; 2024-2029 are Preqin's forecasted figures.

Real estate is generally defined as tangible property consisting of land, buildings and related structures. Assets under management (AUM) grew to roughly $1.3 trillion at the end of 2021 and could rise to $1.8 trillion by the end of 2026.

Private real estate investments can be made through a direct transaction for a single property, direct acquisition of a portfolio of assets or through a diversified commingled fund. Generally, private real estate investments are less liquid than public real estate options, such as real estate investment trusts (REITs), which can be traded on equity exchanges. As a result, private real estate is typically a higher-risk investment.

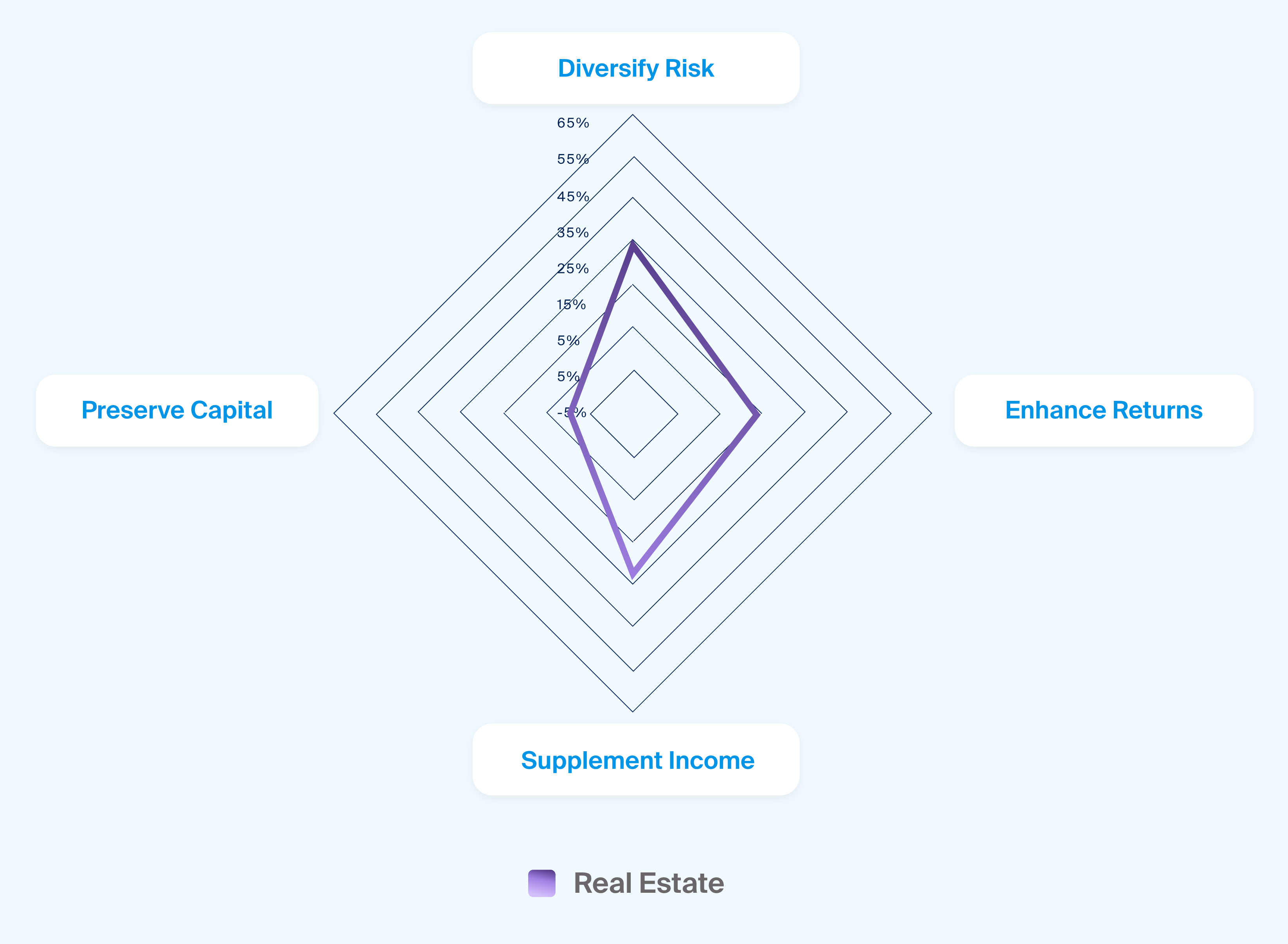

As advisors look to diversify portfolios and find new sources of returns, private real estate may complement exposure to traditional and other alternative asset classes (Exhibit 2).1

Source: CAIS and Mercer, “The State of Alternative Investments in Wealth Management 2023,” December 2023.

Private real estate investments can be made through a direct transaction for a single property, direct acquisition of a portfolio of assets or through a diversified commingled fund. Generally, private real estate investments are less liquid than public real estate options, such as real estate investment trusts (REITs), which can be traded on equity exchanges. As a result, private real estate is typically a higher-risk investment. Importantly, as investors look to diversify portfolios and find new sources of returns, private real estate may complement exposure to traditional and other alternative asset classes.

Limited partnerships, where the investment manager (typically the general partner or GP) oversees the investment of the fund assets and manages the day-to-day operations of the fund, is generally used for commingled real estate assets. In these partnerships, limited partners (LPs) supply capital but otherwise have a passive role.

Private real estate funds can be structured as:

Open-ended funds, which can typically be entered and exited at any time but are sometimes subject to contribution and redemption queues. Open-ended funds, also known as evergreen or perpetual funds, are often used for core or core-plus strategies.

Closed-ended funds, which tend to have a pre-defined fundraising period and lock-up period. Closed-ended funds are typically used for value-add and opportunistic strategies.

What Are the Potential Benefits of Real Estate Investments?

Financial advisors may choose to allocate to private real estate funds to target some of the following potential benefits.

Inflation Hedge: Because they are generally tied to rents, which can go up contractually alongside inflation rates, real estate investments may offer a hedge against inflation.

Low Correlation to Other Asset Classes: Real estate investments have historically had a relatively low correlation with traditional asset classes like stocks and bonds, potentially serving as portfolio diversifiers.2

Income Generation: Though past performance doesn’t guarantee outcomes, private real estate assets generally have predictable income streams, especially in sectors where longer-term leases are more common.

What Are Some Types of Private Real Estate Strategies?

Four common types of private real estate strategies span a range of risk and return profiles (Exhibit 3). Each of these may invest across particular sectors and types of markets.

Core Real Estate

Core strategies tend to invest in high-quality assets with high levels of occupancy, often in prime locations. Typically, these assets do not require meaningful development or improvements, and much of the return is derived from current income or rent. Core assets tend to own less-levered properties and are held for longer periods of time. These characteristics can give core assets a generally lower risk/return profile.

Core-Plus Real Estate

Core-plus strategies are similar to core strategies in that they also tend to invest in high-quality assets in strong markets. However, the properties may require minor upgrades to increase cash flows and managers may add more leverage to the assets. Returns tend to be generated equally from current income and capital appreciation, which can increase the risk over core funds.

Value-Add Real Estate

Value-added investments typically require repositioning or re-development but generally have existing tenants and current rental income. Although there is a current income component, the majority of returns tend to come from capital appreciation. These assets tend to have a moderate level of leverage and are typically held for shorter periods of time. Value-add real estate generally has higher risk and reward characteristics than core and core plus strategies.

Opportunistic Real Estate

Opportunistic real estate fund managers often invest in special situations or distressed properties, such as halted construction, bankruptcy, ground-up development or heavy redevelopment, generally with the goal of stabilizing the asset and then selling it to a core real estate buyer. As such, the asset is typically held for a relatively short period of time compared to other real estate assets, and the majority of the return is expected to come from capital appreciation. These investments also tend to utilize more leverage to cover higher costs and to increase returns. Opportunistic real estate strategies can have higher risk/reward profiles due to the risks associated with turning around a property, the need to sell it at a profit and limited, if any, current income.

There are also four common classifications of property, as well as a number of niche sectors, which sometimes overlap with infrastructure investments.

Industrial properties are used for warehouses, e-commerce distribution centers, logistics, production and manufacturing.

Retail buildings are where consumers buy goods or services.

Multi-family residential assets house multiple families, such as apartments or condominium buildings, but may also include hotels and other more niche categories.

Office buildings are used to conduct commercial and professional work. These assets typically have long leases from tenants.

Additional niche categories include storage, medical offices, senior housing, student housing and data centers.

The potential attractiveness and resilience of local markets, which can affect the value of the real estate asset, is typically ranked as primary, secondary or tertiary.

Which Sectors Do Private Real Estate Funds Invest In?

Real estate strategies may focus on one sector or category of commercial real estate property, or they may include a mix of them. The potential attractiveness and resilience of local markets, which can affect the value of the real estate asset, is typically ranked as primary, secondary, or tertiary.

It’s worth noting that as more private infrastructure strategies come to market, there may be overlap in the assets included in each asset class.

Industrial Property

Industrial properties are used for warehouses, e-commerce distribution centers, logistics, production, and manufacturing.

Retail Property

Retail buildings are where consumers buy goods or services. These can include hotels and resorts, professional sports complexes, shopping centers, strip malls, restaurants, and healthcare facilities.

Residential Property

Residential real estate investing can include a mix of multi-family or single-family properties. Multi-family residential assets house multiple families, such as apartments or condominium buildings, but may also include hotels and other more niche categories. Single-family residential developments, focused on lower-density rental housing, may also be part of these strategies.

Office

Office buildings are used to conduct commercial and professional work. These assets typically have long leases from tenants. They may be classified Class A through Class C, depending on their age, quality, aesthetics, and location.

Data Centers

Data centers and other technology-focused property assets may be considered within real estate or infrastructure asset classes. These properties have become one of the more sought-after investments among real estate managers hoping to capitalize on the growth in cloud-computing, big data analytics, and artificial intelligence.3

Niche Real Estate Opportunities

Additional niche categories may include storage, medical offices, senior housing, and student housing. Certain funds may focus on these strategies to capture demographic shifts or geographic trends, for example.

What Are Some Risks or Considerations for Advisors When Investing in Private Real Estate?

Manager Selection and Access

Value creation in private real estate can be dependent on access to attractive deals followed by efficient management and improvement of properties. This makes manager due diligence an important part of the private real estate investment process. Advisors should look for managers with experience and resources, good industry relationships, operational stability, strong risk management practices, and a proven track record in terms of performance and assets under management.

Diversification

Advisors can aim to diversify their real estate allocation in many ways including by manager, geography, vintage year, type of strategy, property sector, and type of market.

J-Curve

Private real estate investments tend to follow a pattern called the J-curve, where they will produce negative cash flows in the early years, due to capital calls and management fees paid before there is a chance for the investment to generate returns. It may take several years until underlying investments are marked up to their current value or gains realized through exit transactions.

Liquidity

The liquidity of a real estate investment can vary at both the property level and the fund level. Leverage used by a manager can also impact the liquidity of a property. While both of these factors can increase the risk of the investment, assets with current income can help lower risk and improve liquidity as cash is returned to investors while the asset is held.

Real estate is a well-established asset class. As advisors increasingly look to diversify their portfolios and gain access to a wider range of investments, real estate may continue to play a role in portfolios in the coming years.