The U.S. Federal Reserve (the Fed) announced recently that they remain patient on raising rates but will begin reducing the pandemic era bond purchases starting this month. Under the current program, the Fed has been purchasing $80bn in Treasurys and $40bn in Mortgage-Backed Securities (MBS) since March of 2020 to support the domestic economy by injecting liquidity into the market.1 It now plans to reduce this at an initial rate of $15bn per month – $10bn in Treasurys and $5bn in MBS.2 Given this trajectory, it appears the Fed should finish the taper by June 2022, which has many market participants anchoring on this period as the time they will increase interest rates for the first time.3 That is of course, if inflation doesn’t move from ‘transitory’ to stubbornly persistent, in which case, the Fed says it stands ready to use rate hikes to keep inflation in check.4

Take Off Conditions and Timing

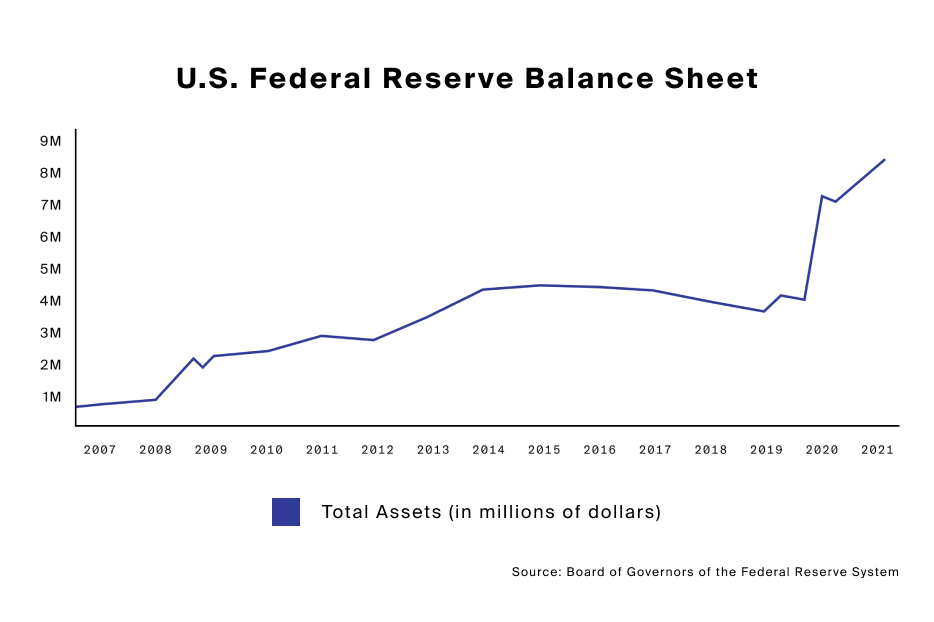

Firstly, tapering is not tightening. While reducing the bond purchase program will likely remove liquidity from the system, it must be remembered that since the program started in March 2020, the Fed has doubled the size of its balance sheet to over $8 trillion.5 As we can see in Figure 1 from the example from the Global Financial Crisis (GFC), it took several years until they started selling these assets, and when they did, they did so in an orderly fashion so as not to put downward pressure on prices. From this example, it can be assumed that even if they stop their bond purchases midway through next year, we are potentially years away from a balance sheet unwind. Additionally, Fed Chair Jerome Powell this week said they will also be reducing the amount of debt issuance going forward which will act as a counterweight and offset the demand lost when they no longer buying these bonds6 – likely reducing supply and demand at the same time.

Figure 1 - Fed Balance Sheet

Secondly, just because the Fed is tapering, doesn’t necessarily mean the automatic next step is tightening and we should listen to what they are telling us. Said differently, we should listen to their non-conventional monetary policy tool of ‘forward guidance’. Powell literally said this week that the central bank will be patient on raising rates, and that completing the taper doesn’t imply rate hikes.7

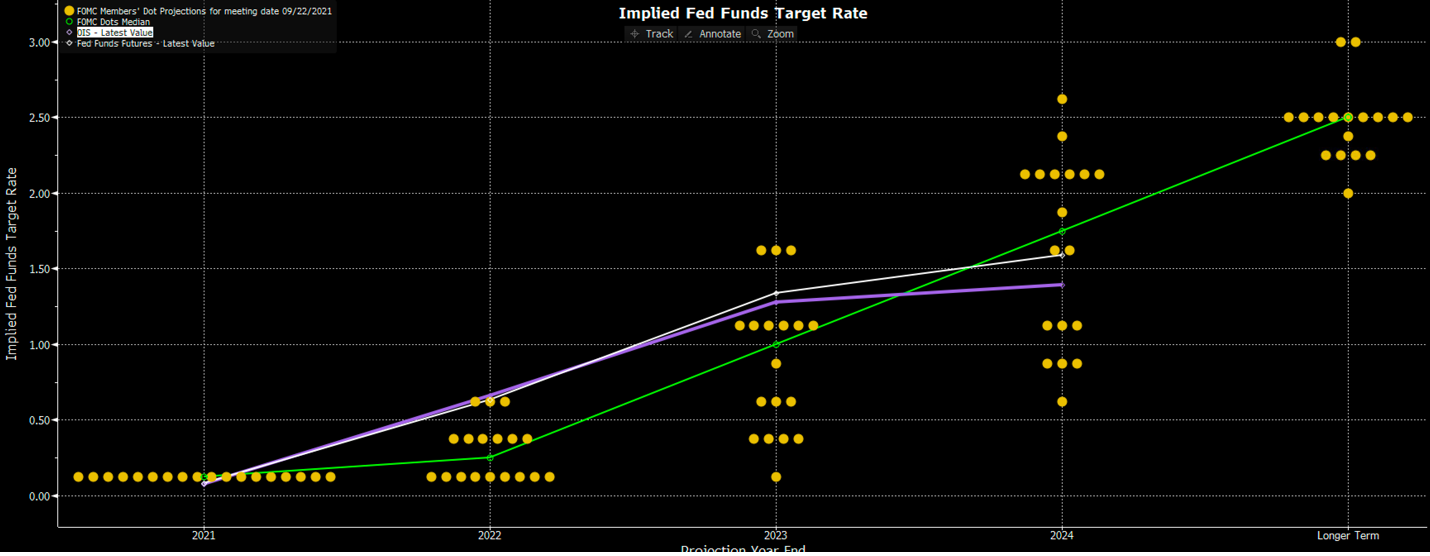

Not convinced? When the Fed provided a summary of economic projections in September, only 9 of the Fed’s 18 officials expected a move in 20228 and stated that rates will remain at zero until maximum employment is reached.9 We’ll unfortunately have to wait until December’s meeting to get the updated Fed projections.

Figure 2 – Fed’s September Summary of Economic Projections

Source: Bloomberg

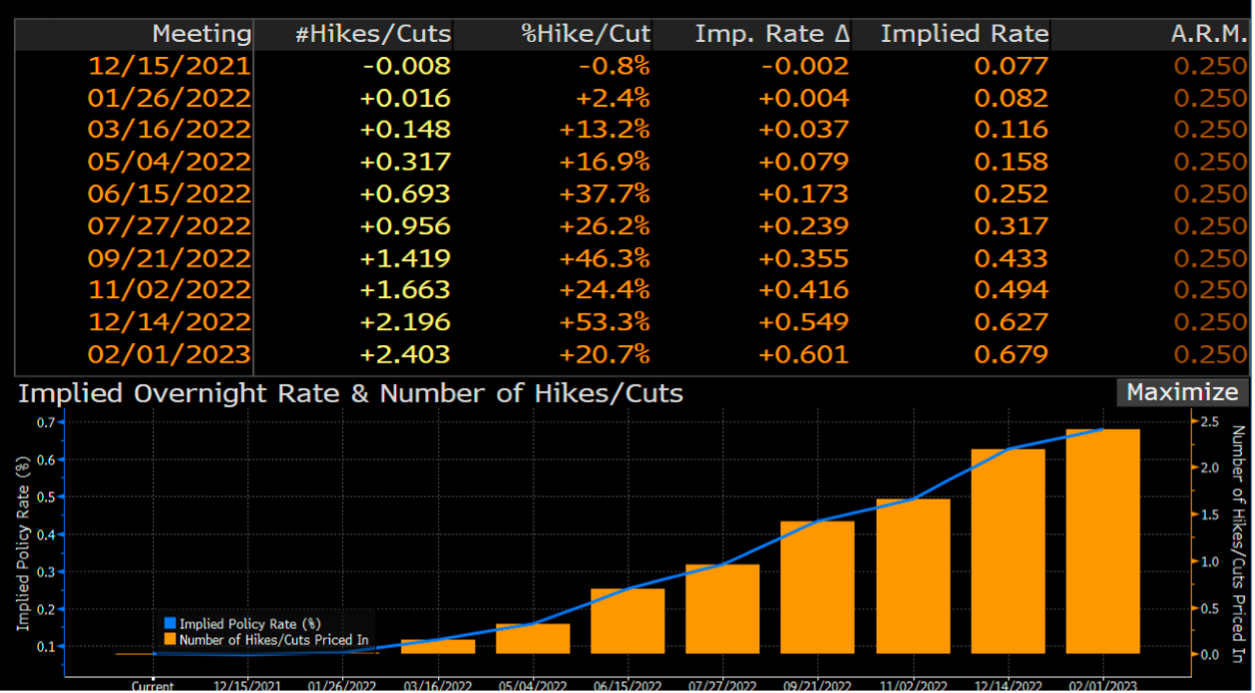

However, the market doesn’t seem to be getting the message. The below Bloomberg interest rate probability model shows that by July 2022, the model implies a 96% chance of an almost 25bps rate hike, a figure that jumps to 1.4 hikes of 25bps in September 2022 and to 2.2 25bps hikes by December 2022. That’s not only more than zero, but it’s also more than even the most hawkish Fed official is pricing in.

Figure 3 - Interest Rate Probabilities

Source: Bloomberg

But what about the yield curve, and specifically, what about the recent volatility in short rates? Short term rates are especially sensitive to monetary policy,10 and monetary policy is especially sensitive to the outlook for inflation.11 It is likely the current volatility in inflation that is causing the most uncertain inflation outlook the modern-day Fed has seen. It is quite possible that it is inflation volatility that is driving short rate volatility because inflation expectations are becoming unanchored – a colloquial term for when consumers and businesses expect higher prices to continue rising, essentially causing a negative feedback loop that makes this indeed happen.12

Volatility in short rates may also be due to the disparity between the take-off point and trajectory that the market is pricing in, and that of the Fed itself. Such a dispersion likely portends that one party or the other is right, or that neither is and there will be a convergence of opinion. Either way, to navigate through the volatility and to get to the eventual lift-off may take an active approach to managing both interest rate sensitivity and duration.

Flatter for Longer?

So, why has the yield curve flattened? Just as short rates are impacted by policy, long rates may be impacted by the outlook for growth in the real economy.13 As we just discussed, the volatility in inflation may have caused short rates to rise, while it’s just as likely that expectations for a slowdown in future economic growth has weighed on longer term rates. That could be because it is perceived that a high inflation will stifle longer term growth. This flattening of the yield curve is highlighted below, where the curve 6 months ago (yellow) is lower on the short end, and higher on the long end than the current yield curve (green).14

Figure 4 – The Treasury Yield Curve Flattening

From Taper to Tighten, the Path Ahead

The recent volatility in interest rates has been a shot across the bow for investors. We have lived with a relatively accommodative monetary policy for more than a decade and it looks like we have moved into a global tightening cycle judging by moves from other central banks like Australia and Canada this week, as well as the broadly held expectations for other developed nations to follow suit.15 This is a time to reassess an investment program’s exposures to both interest rates and duration, while considering how to immunize against the interim interest rate volatility and the potential for an interest rate increase at some in the next several years.

In the words of Wall Street legend Martin Zweig, “Don’t fight the tape, don’t fight the Fed”. In times of uncertainty such as this, we’d be wise to heed this warning.