The beginning of 2022 has delivered investors an experience quite different from the bull market that followed the pandemic. Increased volatility, rate hikes, and a growing lack of confidence in the forward-looking growth of the public market continue to place pressure on returns.

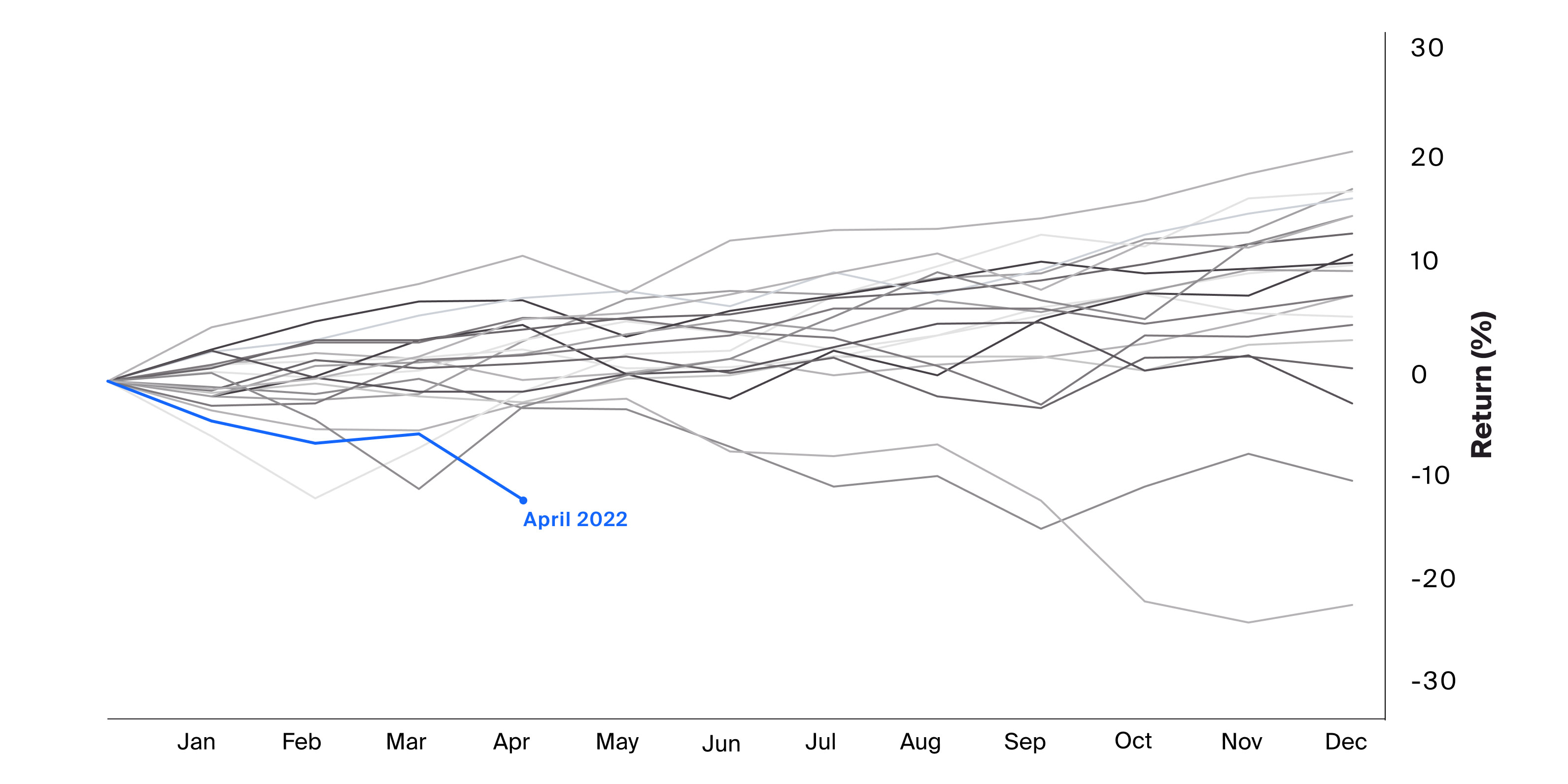

These factors, among many others, have contributed to one of the larger deteriorations in the return of the 60/40 stock/bond portfolio in the last 20 years, as outlined in the graph below. This allocation strategy was once regarded as a formidable hedge against market volatility and aimed to provide returns across numerous periods of economic uncertainty.1 Recently, with the combination of rate hikes and the recent equity market downturn, the 60/40 portfolio has declined.

Source: Bloomberg, Venn as of April 2022, 60/40 Portfolio represented by S&P 500 Index and the Bloomberg Barclays Aggregate Bond Gross Index.

Twenty year performance chart for the 60/40 Portfolio.

Looking at the chart above, we can see that within the last 20 years, the performance of the 60/40 portfolio has remained generally positive, apart from the occasional downturn. In 2022, the 60/40 portfolio has experienced one of its lowest year-to-date results out of the entire 20-year period, and some investors are beginning to look for alternative allocations to protect against the possibility of continued volatility.

Low Beta Strategies

In such an environment, there may be a need for portfolios capable of both minimizing risk and alleviating downside exposure, driving investors to seek out the type of risk-adjusted return once provided by the 60/40 portfolio. One possible solution is to look at low beta hedge fund strategies, specifically Event-Driven, Relative Value, and Macro. Based on their historical performance, we can start to piece together the potential benefits these strategies may provide in a portfolio looking to enhance risk-adjusted return. Historical statistics and past performance are not necessarily indicative of future returns.

For simplified edification, Event-Driven hedge funds actively manage allocation toward companies involved in corporate transactions including mergers, restructurings, buybacks, etc.2 Relative Value strategies focus on valuation discrepancy between various securities using fundamental and quantitative techniques.3 Lastly, Macro strategies focus on movements across underlying economic variables and their impacts on different types of asset classes such as equities, rates, and commodities, amongst others.4 Macro strategies are typically associated with asymmetric return, meaning that these strategies may perform better during periods of market downturn.

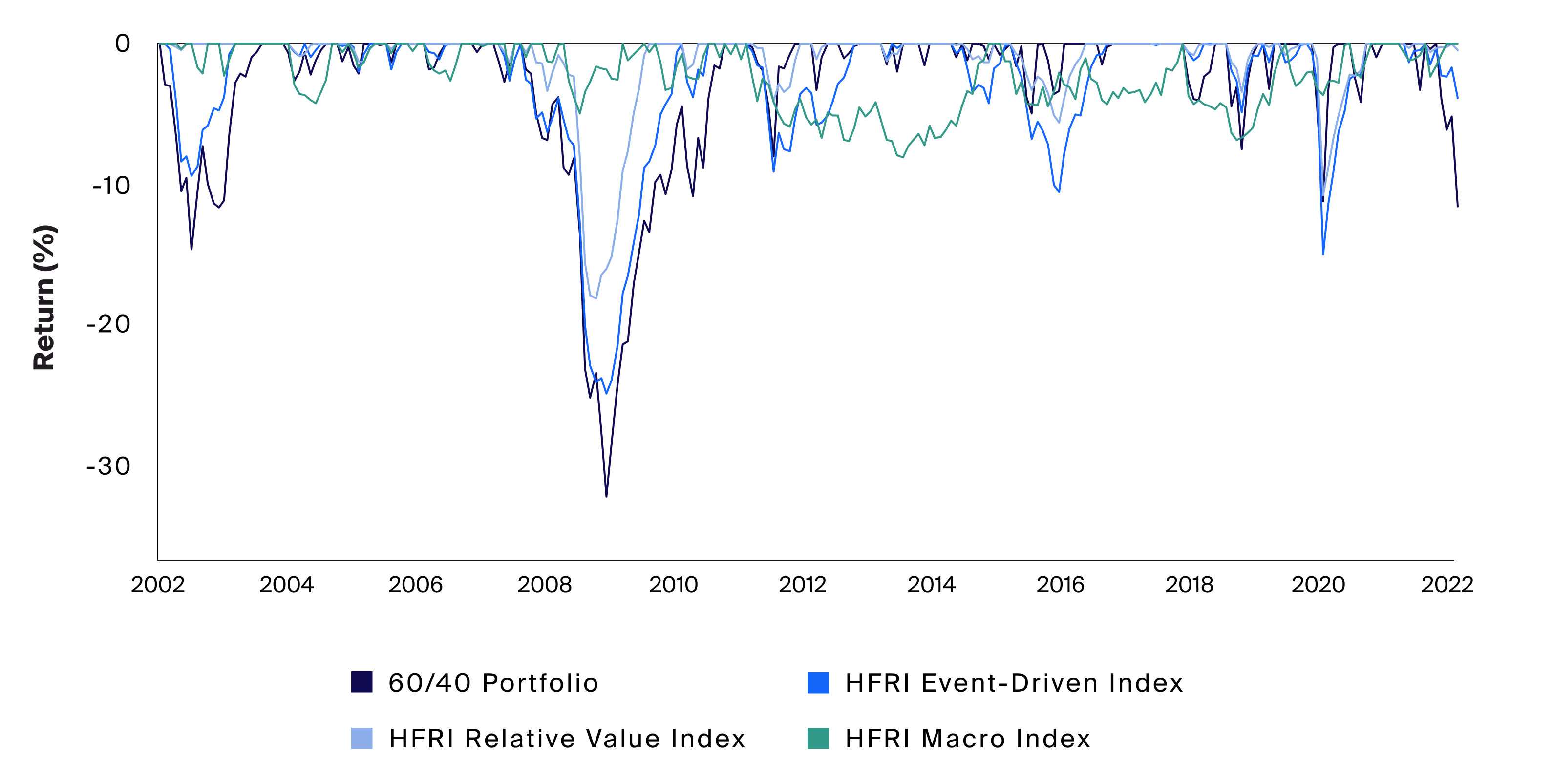

Below we can compare the historical drawdowns of these strategies relative to the 60/40 portfolio to visualize the periodic potential downside protection that allocating to these investments may complement within a well-diversified portfolio.

Source: Bloomberg, Venn as of April 2022, 60/40 Portfolio represented by S&P 500 Index and the Bloomberg Barclays Aggregate Bond Gross Index

Twenty year historical drawdown of the 60/40 Portfolio vs Hedge Fund Indices.

The downturn experienced in the 60/40 portfolio is often substantial compared to the hedge fund strategies, whose focus is to provide a consistent return across the entire economic cycle. There are also situations where the hedge fund indices experience downturns greater than the 60/40 portfolio which may indicate the low correlation of these strategies to the broader market and the benefit that diversification may provide. Therefore, minimizing downside pressure may reduce volatility via diversification, contributing to the overall risk-adjusted return indicated by the Sharpe ratio.

Quantifying Risk

In addition to historical performance and Sharpe, we look to additional risk statistics so that we may analyze these strategies in terms of the goals and preferences of an investor’s appetite for said risk. We can observe the statistical attributes of risk that these investments may contribute to performance within a portfolio.

| 60/40 Portfolio | HFRI Event-Driven Index | HFRI Relative Value Index | HFRI Macro Index | |

|---|---|---|---|---|

| Max Drawdown | -32.10% | -24.80% | -18.00% | -8.00% |

| Sharpe | 0.69 | 0.74 | 0.95 | 0.77 |

| Beta to Benchmark | 1.00 | 0.58 | 0.34 | 0.13 |

| VaR (95%) | 4.10% | 2.40% | 1.30% | 1.80% |

Source: HFR, Venn as of April 2022, 60/40 Portfolio represented by S&P 500 Index and the Bloomberg Barclays Aggregate Bond Gross Index.

Maximum drawdown describes the maximum observed loss in the value of an investment from peak to trough before a new peak value forms.5 The maximum drawdown may represent a historical indication of the maximal downside risk an investment may carry. Beta is a coefficient that tells us the price sensitivity an individual asset experiences on average in terms of benchmark performance, in this case, the 60/40 portfolio.6 Thus, the Beta is a measure of variability. A value greater than 1.0 indicates a strong directional correlation and may represent risk exposure to the benchmark. Looking above we can see that Beta is lower as we move across strategies to the right, meaning Macro strategies have the lowest average directional relationship with the 60/40 portfolio. VaR (Value at Risk) is the amount an investment might lose over a 1 month period with 95% confidence. The higher the confidence interval, the broader the dispersion of return.7 A higher VaR indicates a greater potential for short-term loss, so the 60/40 is statistically at risk of losing 4.10% each month based on past returns with a 95% confidence. The hedge fund strategies above have lower VaR, consistent with their beta profiles, given the potential for drawdowns with lesser depth.

Based on these results and the historical performance of the indices we have analyzed; we can start to develop an impression of the value that low beta hedge funds may be able to provide in portfolios from the perspective of risk-adjusted return. In a market laden with uncertainty and the potential for continued volatility, it may be vital to consider the risk metrics associated with portfolio allocation that may protect from drawdown and hedge volatility with strategies that access alternative sources of return. Lower beta hedge fund strategies are designed to target these alternative sources of return through active management, meaning that these opportunities are not only engineered to maximize investor return, but they may be able to adapt across broader market conditions.