What Are Growth Notes?

Growth-focused structured investments are complex hybrid investment products, typically issued by banks, that are designed to target the growth, or upside participation, of an underlying index, asset, or security.

Structured investments, generally, provide indirect exposure to the performance of public equities—such as indices, ETFs, single stocks—as well as other assets classes, like commodities or currencies. These strategies are often built by pairing a derivative linked to an underlying asset with a zero-coupon bond equivalent. This pairing, for example, may offer partial downside protection while allowing for participation in positive market performance; though, terms vary by issuer and structure.

Structured investments are not a standalone asset class, but rather an implementation tool that can be customized to reflect specific market perspectives or support targeted investment outcomes. While they often draw from public market exposures, they may also share characteristics with portfolios allocated to alternative investments, such as differentiated return profiles or risk management features.

How Do Growth-Focused Structured Notes Work?

The appeal of growth notes among advisors lies in their versatility and adaptability to market views or investment objectives.

Structural components may potentially include:

Underlying Assets: Growth notes typically reference public equities or equity indices, offering indirect exposure to well-known market benchmarks or individual securities.

Tenor: These products often have terms ranging from one to five years, helping them to align with various investment horizons.

Upside Terms: Investors may receive enhanced returns when the underlying asset performs positively, depending on the note’s levered participation rate, payout formula, or whether returns are capped or uncapped. For example, a note might be designed to deliver 1.5x or 150% of an underlier’s returns during the note’s duration.

Downside Terms: Many growth notes include built-in protection features, such as buffers or barriers, that help mitigate downside risk up to a certain level.

What Are Common Features of Growth-Focused Structured Notes?

Growth notes can take a variety of forms. Understanding the nuances of each structure and its potential terms and features is essential to aligning these products with a client’s investment goals and risk tolerance.

Barrier vs. Buffer

Both structures are designed to limit loss of principal, but they function differently. A buffer provides partial downside protection by absorbing losses up to a certain percentage—allowing the investor to participate in moderate declines without loss of principal.

A barrier, on the other hand, offers protection only if the underlying asset does not breach a specific threshold. If the barrier is crossed, the investor may be exposed to the full downside risk, making barriers more “all-or-nothing” compared to the gradual protection offered by buffers.

Note that regardless of the inclusion of barriers or buffers, loss of principal is a fundamental risk associated with investing in structured notes of any kind.

Capped vs. Uncapped

A capped growth note limits the maximum return an investor can earn, regardless of how well the underlying asset performs. This cap is often paired with enhanced participation rates to offer value within a defined range.

An uncapped structure allows for full upside participation, subject to other risks or product constraints, but may come with more modest participation terms or reduced downside protection. The trade-off is often between defined upside potential and greater exposure to market returns.

Digital vs. Dual Directional

A digital note pays a fixed return if the underlying asset meets specific conditions—typically remaining above a set level at maturity—offering a binary outcome: either the defined return or a potential loss.

A dual directional note, in contrast, can provide returns whether the asset increases or decreases in value, as long as the movement remains within a predetermined range. While digital notes focus on a single performance trigger, dual directional notes are structured to reward movement in either direction, adding flexibility in uncertain or range-bound markets.

Auto-Callable

These products may be redeemed automatically by the issuer before maturity if the underlying asset reaches a specified level, potentially limiting the upside while introducing reinvestment timing challenges. Auto-callability can be beneficial in low-volatility or steadily rising markets, but it may limit the opportunity to fully realize long-term market gains.

What Are Some Examples of Growth-Focused Structured Notes?

Many growth notes offer a combination of these structures. Some examples are included below. Note the graphs are provided for illustrative purposes only; please refer to the prospectus of each structured investment to better understand each feature.

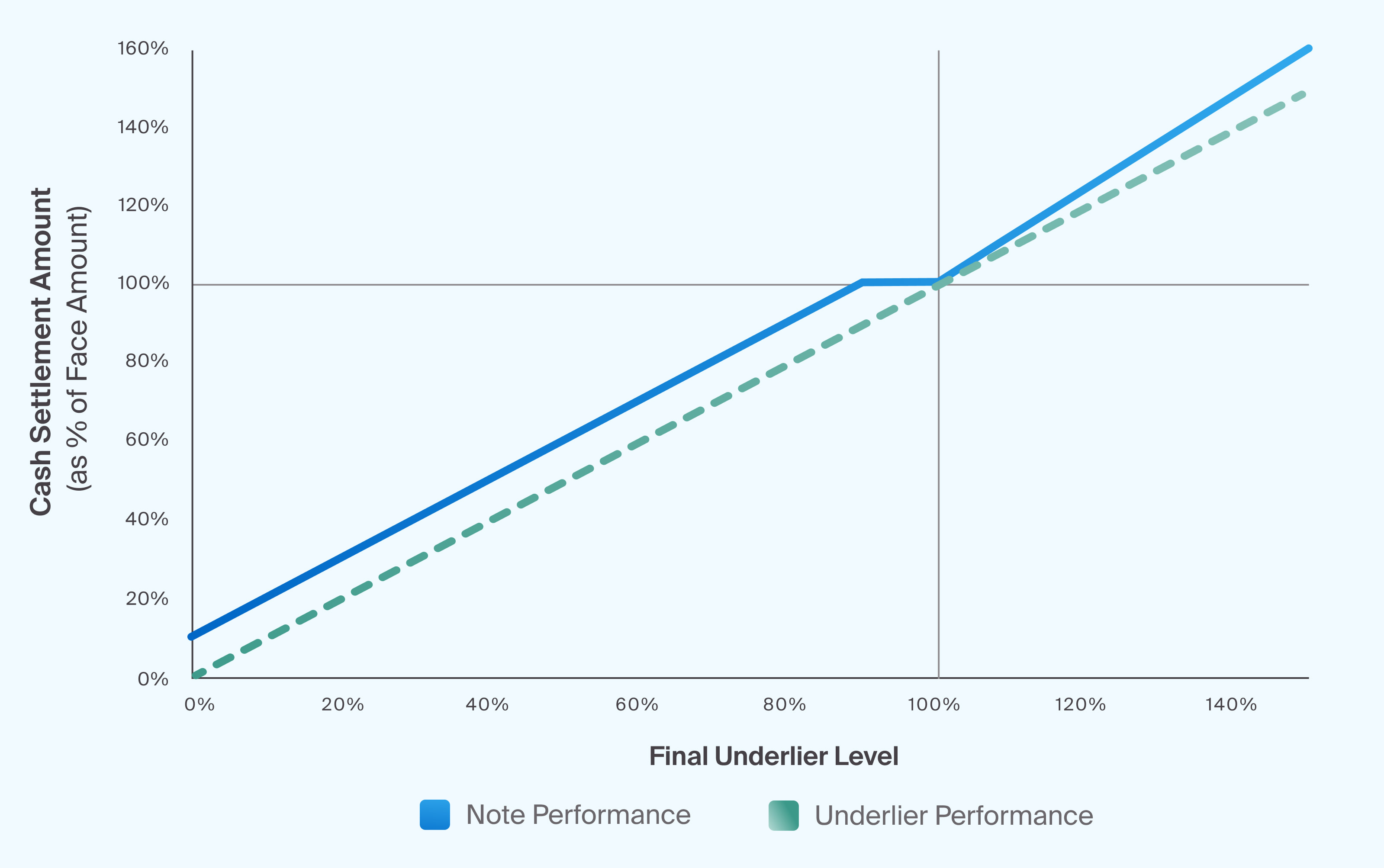

Buffer Uncapped Growth Note (Exhibit 1)

A Buffer Uncapped Growth Note (Exhibit 1) has the potential to capture unlimited upside returns, with a layer of fixed downside participation, beyond which, the investor participates in 1:1 downside of the underlier.

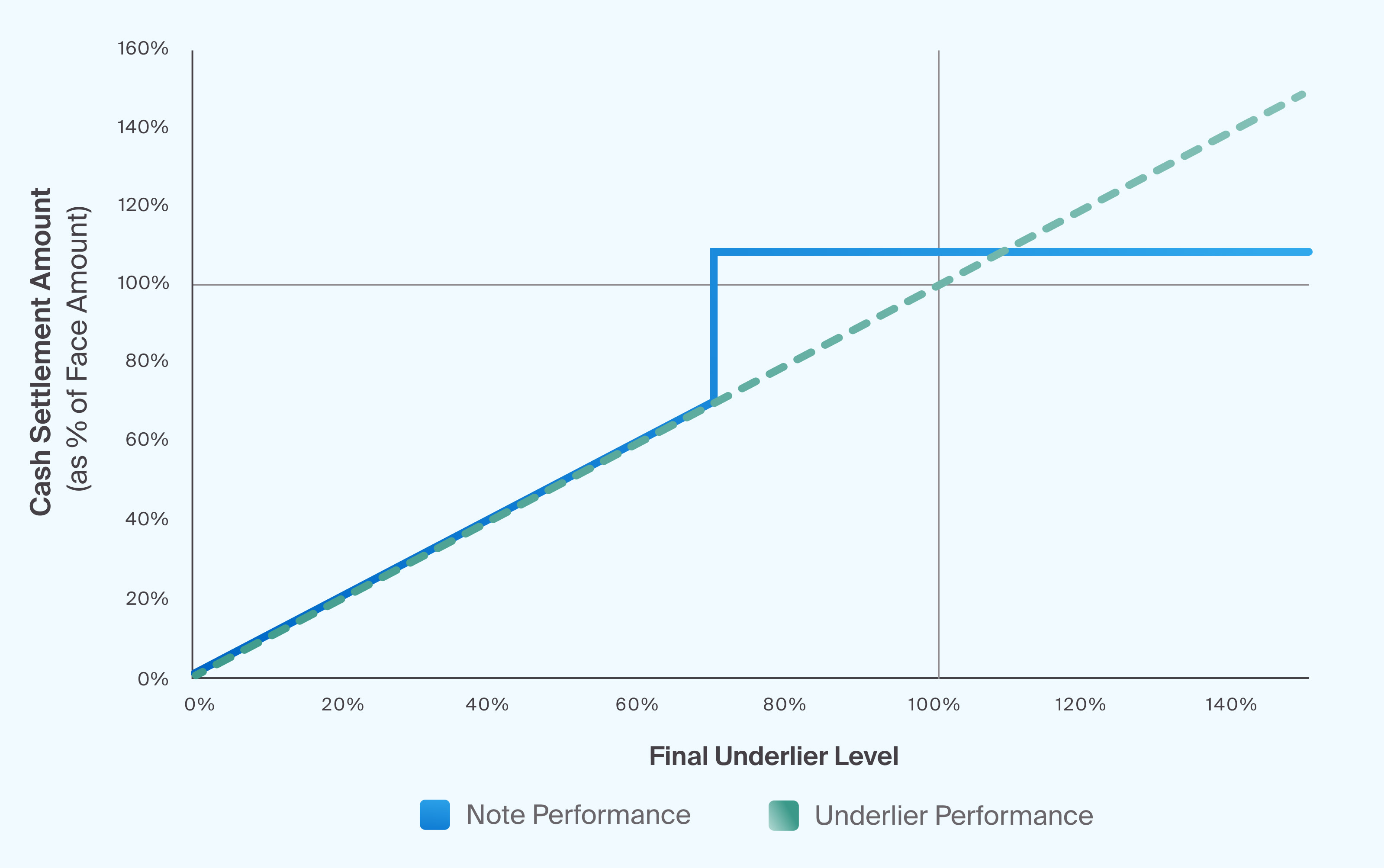

Barrier Digital Growth Note (Exhibit 2)

A Barrier Digital Growth Note (Exhibit 2) could offer a fixed return if the underlying asset remains above a specified level at maturity, with different outcomes if the barrier is breached.

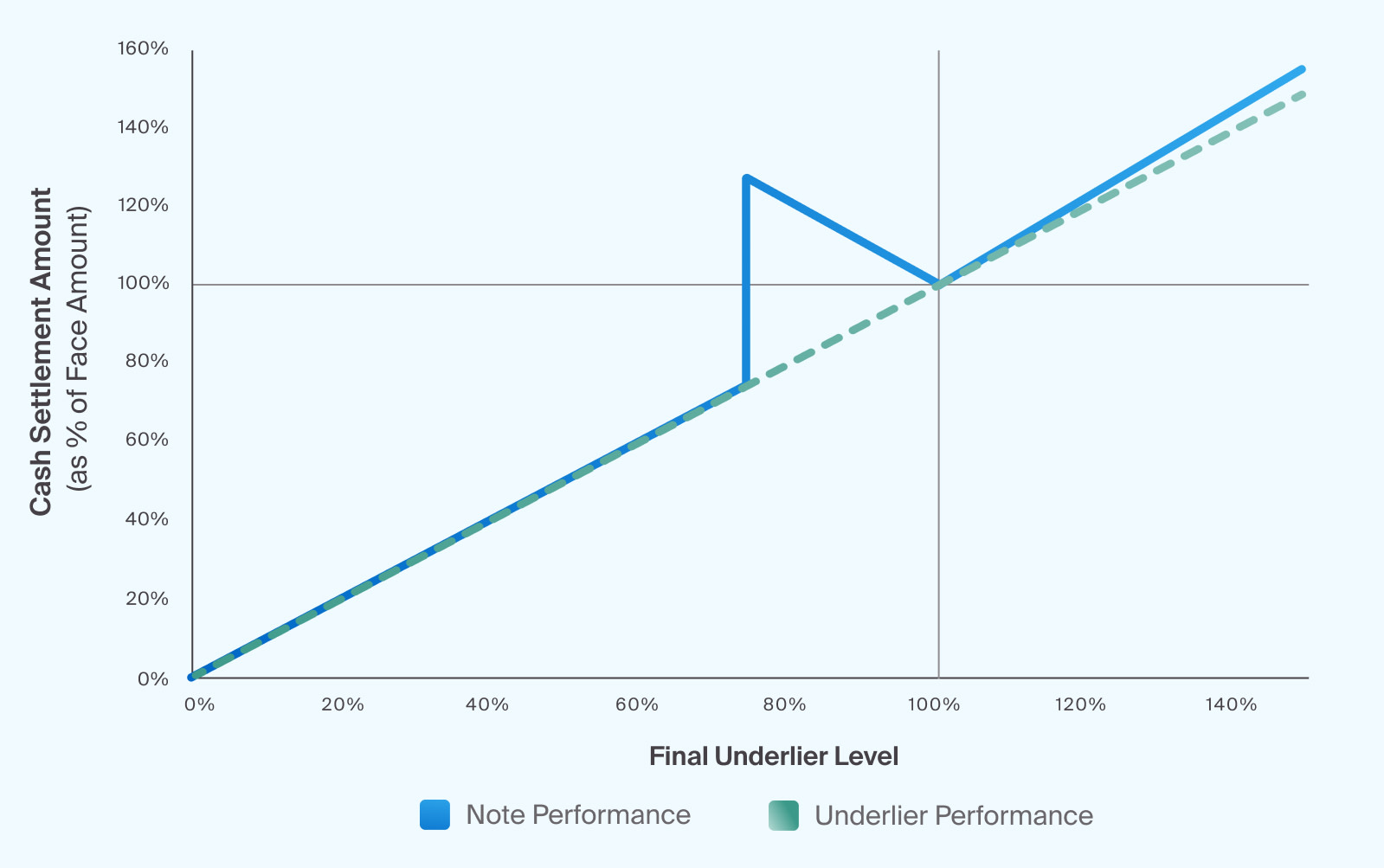

Barrier Dual Directional Uncapped Growth Note (Exhibit 3)

A Barrier Dual Directional Uncapped Growth Note (Exhibit 3) provides protection down to a barrier level—below which the investor participates 1:1 in losses—while offering uncapped upside potential and the ability to generate positive returns whether the underlier(s) rise or fall within a predefined range.

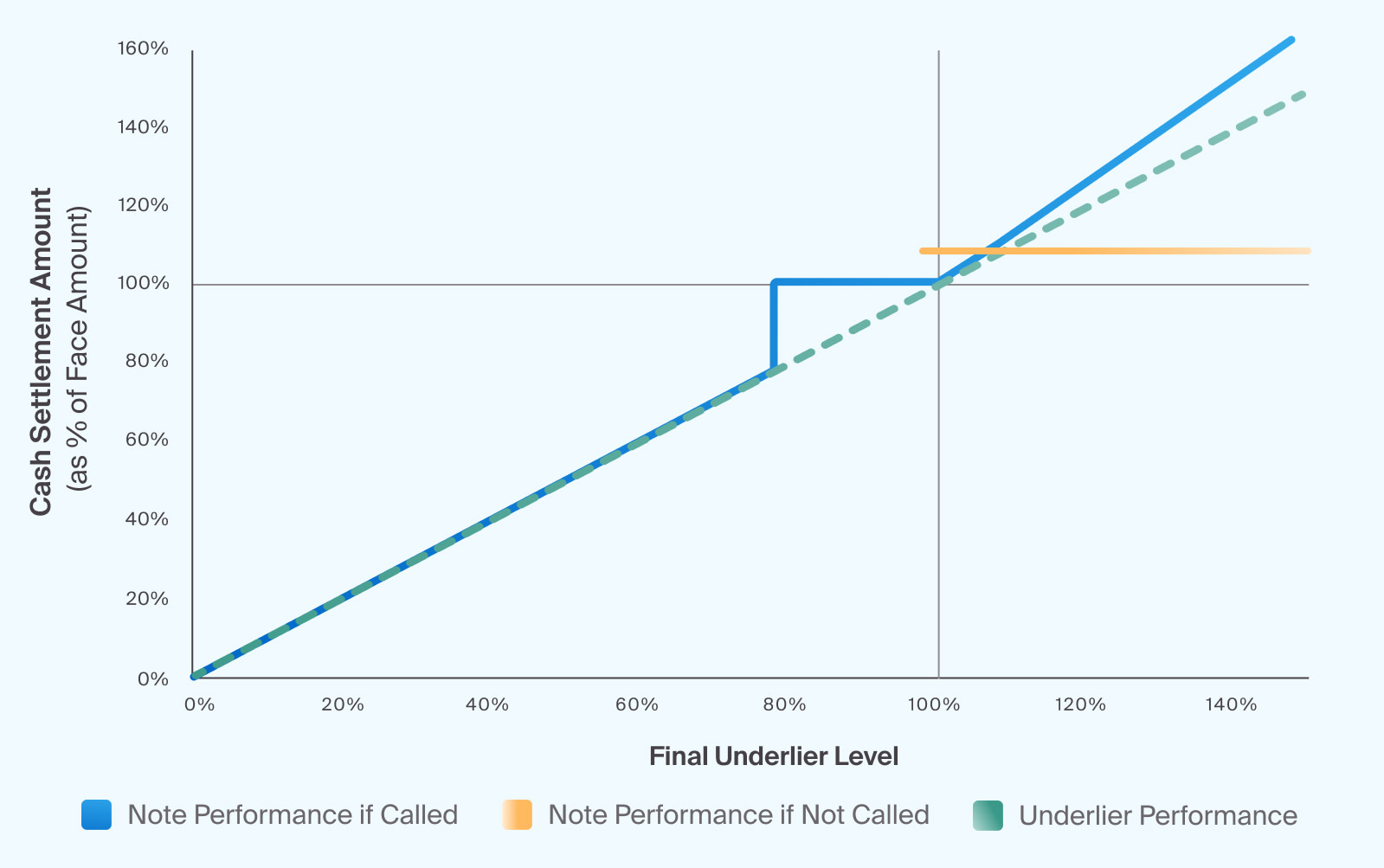

Buffer Auto-Callable Capped Growth Note (Exhibit 4)

A Barrier Auto-Callable Uncapped Growth Note (Exhibit 4) provides downside protection to a barrier level—beyond which losses are realized 1:1. The auto-callable feature allows for possibility of early redemption by the issuer at 100% plus a call premium if the underlier(s) is positive at a call observation date, allowing for an uncapped maximum return if not called.

What Are the Risks of Growth-Focused Structured Investments?

While growth-focused structured notes can offer strategic benefits, they also carry important risks. Advisors should review offering documents carefully and educate clients on the following:

Market Risk: The value of a structured note may fluctuate due to changes in the underlying asset, which can be influenced by volatility, interest rates, economic data, and geopolitical events.

Credit Risk: Structured notes are unsecured debt obligations of the issuing bank. Investors are subject to the creditworthiness of the issuer, as the issuer is responsible for any payments due.

Liquidity Risk: These investments are designed to be held to maturity, and while limited liquidity may be available, issuers are not obligated to repurchase the notes before maturity.

Capped Return: Many growth notes include a maximum return, which may cause them to underperform compared to direct equity investments during strong market rallies.

No Direct Ownership or Dividends: Investors do not own the underlying asset and typically will not receive dividends or other distributions associated with it.

Contingency: With certain notes, such as a digital note designed to pay a one-time coupon, the coupon payment(s) may be contingent on the level or value of the underlier at a given maturity date.

Callability: If a growth note has an auto-callable feature, it can be redeemed prior to maturity, which may limit the investor’s ability to receive coupon payments or participate in long-term gains.

Reinvestment Risk: If a note is called early, there is no guarantee that the investor will be able to reinvest the proceeds on similar terms or achieve comparable outcomes.

Tax Considerations: The tax treatment of structured notes depends on the product's structure and the type of account in which it is held. Advisors should recommend that clients consult with a tax professional.

Origination Costs: Structured notes may include embedded fees that are not always transparent but can reduce the investment’s overall return.

Principal Risk: These investments may result in the loss of some or all of the investor’s original principal, depending on market conditions and product terms.

What Is the Potential Role of Growth-Focused Structured Investments in a Portfolio?

Growth-focused structured notes may offer a versatile solution for advisors seeking to express specific market views or deliver above-market targeted outcomes. They can complement broader portfolio strategies—especially when looking to manage risk while still seeking upside exposure. However, as with all complex investment vehicles, transparency, education, and due diligence are important prior to implementation.