Risk and Return

Putting capital to work.

Risk and return are inherently linked – the more risk we take, the more return we can expect to receive to compensate us for the more uncertain outcome [1]. Thought of another way, the return that you can expect to receive is generally a function of the amount of risk you are willing to take. It is because of this relationship that we see many investors put capital to work, delaying spending today and investing for the future.

What is Volatility?

The uncertainty of value.

At this stage it might be helpful to define the risk that we are talking about. In the financial markets, we talk about volatility. Volatility is the potential for an investor to experience a loss or a gain from an investment. Essentially it is the uncertainty of value [2]. This is important for investors because the risk that the value of their investment does not match their expected outcome can put their financial goals in jeopardy.

Stock and Bonds

Balancing portfolios.

Extending this concept further, it is generally accepted that stocks are more risky than bonds [3] and because of this, stocks can be expected to return more than bonds over a full market cycle (typically 4-5 years) [4]. This also makes stocks the predominant source of risk within many portfolios. Traditional balanced portfolios will generally utilize both stocks and bonds, with the risk and return being reflective of the resulting combination of these assets. The higher the allocation to stocks, the higher the expected return, but the higher the portfolio risk.

Understanding Correlation

Zigs and zags.

This is where things get interesting.

When two or more assets either move in opposite directions, by differing magnitudes, or a combination of both, they are said to be lowly correlated – one zigs while the other zags. A portfolio constructed with lowly correlated assets can achieve the benefit of diversification thereby reducing its exposure to a concentrated source of risk. Since stocks are generally the predominant risk in a portfolio, it is the risk that investors typically seek to diversify. Going back to our example, adding bonds to a portfolio of stocks can reduce overall risk. This may occur in part because of diversification, but also because bonds are simply less risky investments. The investor has diversified and derisked the portfolio. While this can be a valuable benefit, it comes at a cost. That cost is a decrease in the overall expected return, lost because relative to stocks, bonds generally have a lower expected return.

The Power of Diversification

A broadened opportunity set.

What if an investor wants to diversify risk, but doesn’t want to give up expected return? This is where things can get really interesting.

Ideally an investor would be able to use the power of diversification to decrease risk while maintaining expected return, or keep risk constant and increase expected return. This may be possible to achieve but also may require an investor to look beyond traditional stocks and bonds. Broadening the opportunity set to include alternative asset classes can help as they have very different risk and return profiles, in addition to being lowly correlated to stocks and bonds [5].

The predominant source of risk within many portfolios comes from the stock exposure, so we can look at those alternative investments that diversify this exposure in order to have the greatest impact on the portfolio.

Within a variety of the main alternative asset classes – Hedge Funds, Private Equity, Private Credit, Real Estate and Real Assets – there are strategies that have the potential to diversify a traditional balanced portfolio based on their historical correlation. For example and relative to global stocks, the 10 year correlation of U.S. core real estate is negative (-0.2), as is global core infrastructure (-0.1) and direct lending (-0.1). While positively correlated, global macro hedge funds (+0.4) and bitcoin (+0.1) may also diversify a portfolio. Finally, venture capital is completely uncorrelated to global stocks (0.0) [6]. An added benefit of these asset classes is that they are all lowly correlated with each other [7].

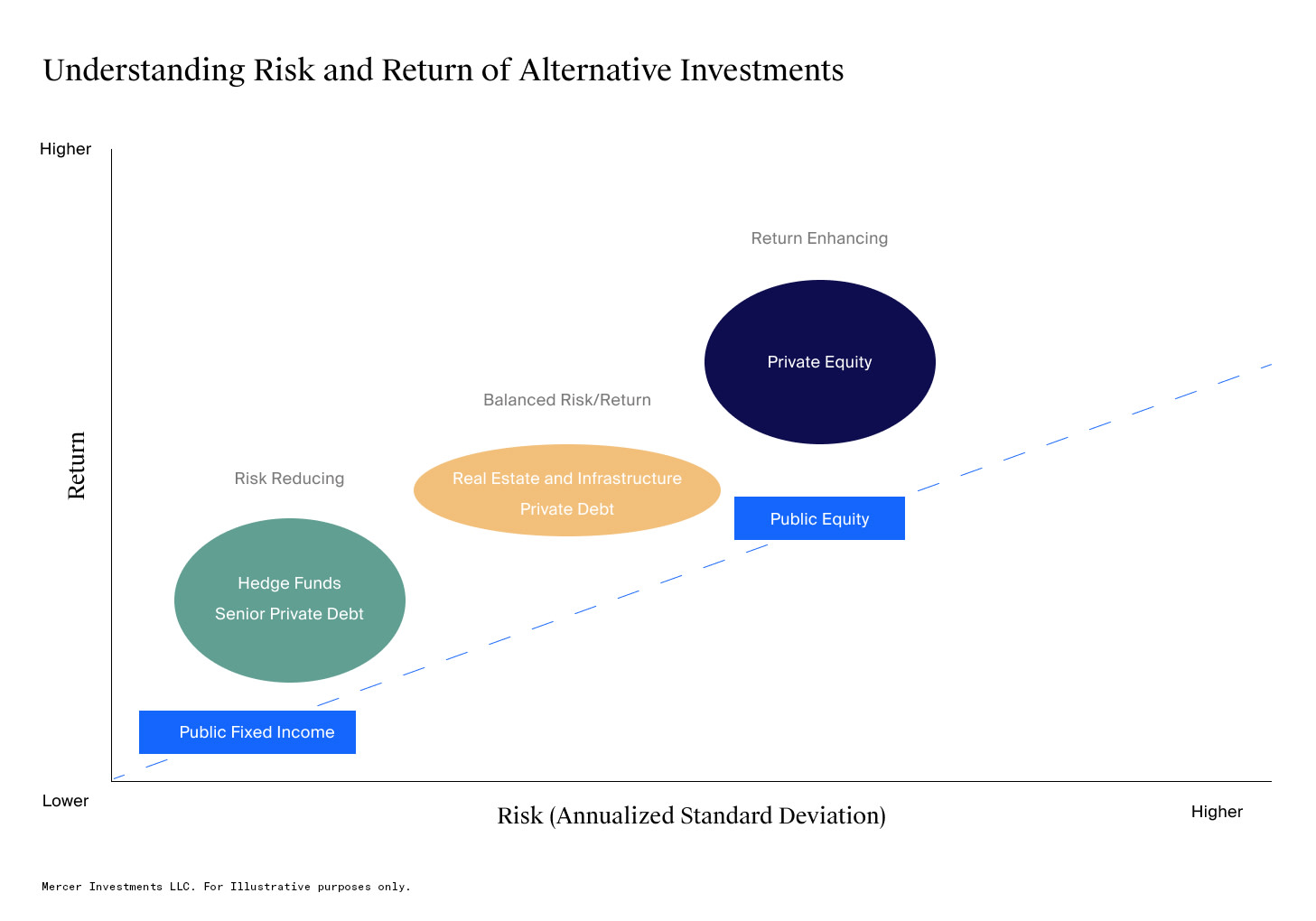

The chart below establishes the general relationship between risk and return of traditional assets, such as stocks and bonds, and alternative investments, such as private equity and hedge funds. In addition to the potential diversification benefits of these alternative asset classes, this chart shows that they all have expected returns that are similar to those of stocks. Using this and the correlations presented above, we can start to look at how we may be able to diversify the risk of a balanced portfolio while maintaining return.

Maintaining Expected Return

Lowering risk.

As the above chart shows, the expected return of real estate and infrastructure are generally the same as that of stocks, however they may have a lower level of volatility. As discussed, they are also generally lowly correlated to stocks [7] so an investor who uses this asset class to diversify a balanced portfolio may realize a similar expected return, however they have diversified and potentially lowered portfolio risk.

Increasing Expected Return

Maintaining risk.

As the above chart shows, the expected return of private equity, and more specifically, venture capital is greater than that of stocks for a similar level of risk. This asset class is also lowly correlated with stocks [8]. An investor who uses this asset class to diversify a balanced portfolio may enhance return, while diversifying risk and keeping its absolute level the same.

From these examples we can see that alternative investments may potentially be a powerful tool to diversify the risk of a balanced portfolio while maintaining expected return. It must be noted, that just as it is unwise to concentrate the risk of a portfolio to a single source, an investor may not want to rely on a single diversifying return stream. Multiple sources of diversification and return can be prudent and the broader opportunity set provided by alternative investments can help investors access these attractive benefits.