Venture capital is a form of private equity that involves investing money in early-stage companies that may have long-term growth potential.1 Traditionally, venture capital has been reserved for accredited investors—or those with a net worth of more than $1 million or an income of over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, with reasonable expectation of the same for the current year.2

What Is Venture Capital and Who Is Involved?

The venture capital ecosystem consists of four distinct players:3

Entrepreneurs who need funding for their companies

Venture capitalists (VCs), also referred to as general partners (GPs), who are looking to partner with companies and provide funding by pooling investor capital and creating a market to support the growth and transactions of early-stage businesses

Private investors or institutions, also referred to as limited partners (LPs), who are looking to invest in venture capital funds

Investment bankers who are looking to bring these earlier-stage companies to the market

For the purposes of this article, we will focus mainly on the role of VCs. A VC's primary goal is to raise money from LPs and use that capital to invest in promising startups. In some cases, a VC fund might also act as an LP itself by investing in other, typically larger, venture capital funds.

Companies may be in any of the following growth phases when seeking venture capital:4

Pre-Seed Stage: This is when a company is still in its infancy. Often, they are little more than an idea. Investors who invest at this stage are often considered “angel investors.” In exchange for capital, investors at this stage may be awarded convertible notes, equity, or preferred stock options.

Seed Stage: This phase takes place when a company has built a viable product or service and has begun expansion. Companies at this stage often turn to venture capital because their small size typically prevents them from accessing large loans or the capital markets. These investments are also referred to in a series, starting with Series A funding, followed by future rounds like Series B and so on. Early-stage funding may support different needs of the organization such as hiring, marketing, or operations.

Late Stage: This is when a company has proven its ability to generate revenue and no longer requires venture capital to scale. Late-stage companies have generally reached a point of positive cash flow generation, with the chance of profit, and thus begin to experiment with expanding into different markets.

Exit Stage: Once a company has achieved a certain level of growth and future scalability, VC investors may seek to “exit” the investment and recoup their return on invested capital. At this point, additional players enter the deal, including private equity investors and investment bankers, in search of high-growth deals to bring to market. These exits are typically achieved through an Initial Public Offering (IPO) or an acquisition from a larger company or another private equity fund, which generates liquidity for the VC, with the chance of significant returns.5

What Does Venture Capital Investing Involve?

Venture capital firms are vital for the success of younger companies and work alongside management teams to support the growth and development of these startups across numerous verticals. The investment process for venture capital firms involves a few critical steps which seek to ensure thorough evaluation of potential deals, strategic decision-making, and ongoing support for the selected companies.

This process involves:6

Sourcing deals

Conducting due diligence

Developing and presenting term sheets

Negotiating investment terms and documentation

Providing support and guidance

Advising on additional series funding or exit strategies

Venture capitalists will handle the active management of the fund, which includes sourcing new deals, helping new companies grow, and working alongside investment banks and private equity firms to exit profitable investments. In the early stages of a fund, LPs can contribute capital, with the potential to earn a return based on their contribution at the fund’s maturity.

Understanding Valuation in Venture Capital

One of the trickiest parts of venture capital is assigning value to a young company. With larger, established companies, investors can use metrics like cash flow and revenue to determine how much a company is worth. But many young companies have very little revenue, if any. There are a variety of methods available for assigning value to a young, growing company and determining the potential profitability of a VC investment.

One common approach, the venture capital method, was developed in 1987 by Bill Sahlman and is still employed by many VCs today.7 This method consists of six steps:

Estimate the size of the investment that is needed

Forecast the financials of the company

Determine the approximate timing of an exit

Calculate an expected multiple at exit

Discount to present value at the desired rate of return

Determine the valuation and desired ownership stake required

VCs may choose other methods, such as the Berkus method, scorecard valuation, or discounted cash flow, or a combination, depending on the data available to them and the stage of the company they’re assessing.8

Challenges and Opportunities in Venture Capital

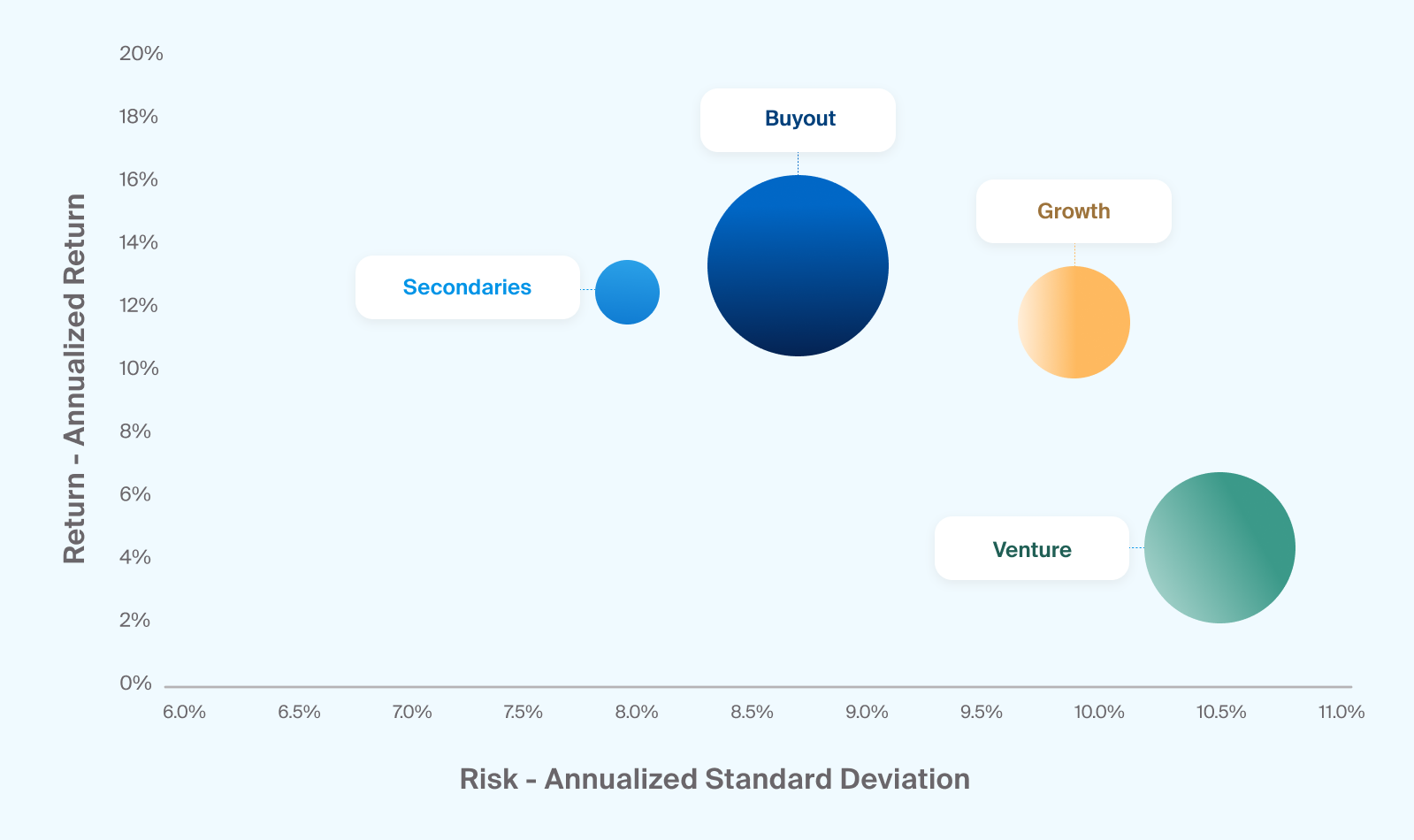

Venture capital firms work in a high-risk, and potentially high-reward asset class (Exhibit 1). This often means VCs will invest in several companies, knowing that many of them will likely fail. For example, a VC might invest in 10 companies knowing that nine of them will fail. But the one company that succeeds could generate a return that makes up for and offsets the loss of investing in the nine other companies.

Source: Preqin, return represented by annualized return, risk represented by annualized risk, calculated between 12-2000 and 9-2024, the size of each circle represents the assets under management (AUM) for funds in each category, as of 6-2024

Venture strategies often target high risk investments, reinforcing the need for strong due diligence when selecting managers (Exhibit 1)

Let’s examine the pros and cons of investing in venture capital.

Potential Benefits of Venture Capital Investing

High Return Potential

Investing in early-stage companies leaves high potential for returns, with many funds aiming to return an expected 25% to 35% per year through the life of the investment.9 It’s worth noting that average returns for the asset class have been lackluster over the last few decades (Exhibit 1), and only some managers have achieved targeted returns in this range.

Funding Innovation

Venture capital investments often go to innovative and cutting-edge companies. Investing in this asset class can help contribute to technological advancements and economic growth.

Diversification

As an alternative asset, investing in VC funds can allow for diversification away from more traditional asset classes like public equity and fixed income.

Risks of Venture Capital Investing

High Risk of Failure

Many early-stage companies fail completely. If this happens, it means that investors will likely lose the entirety of their investment.

Lack of Liquidity

Venture capital investments are typically illiquid, meaning they are difficult to redeem at short notice, if at all. In some cases, investments may be tied up for several years.

Long Investment Horizon

Venture capital investments often have a long time horizon, with returns potentially taking many years to materialize. This can be a drawback for investors looking for more immediate returns.

Limited Control

Investors in VC funds often have limited control over the operations and decision-making of the startups in which they invest. This lack of control can be challenging for those who prefer a more hands-on approach

Higher Fees

Some VC funds charge higher management or performance-based fees that can lower overall returns for investors.

High Performance Dispersion

Historically, VC funds have higher performance dispersion across managers than any other asset class. Though past performance is no guarantee, choosing an experienced VC can be critical when aiming to achieve higher VC fund returns.