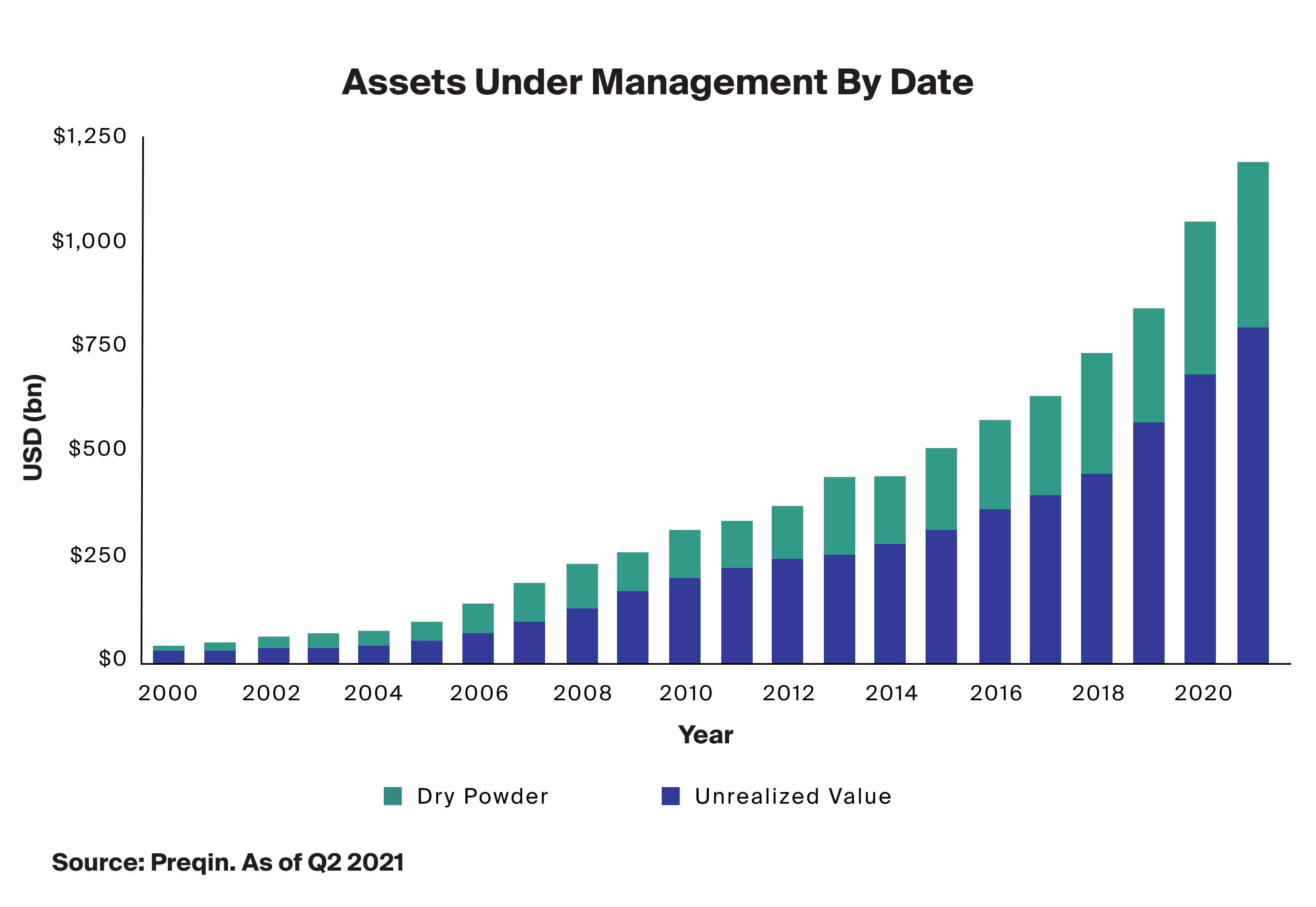

In last week’s blog post, Alternative Options for a Rising Rate World, we looked at the performance of both public and private market strategies, as well as hedge funds over the most recent six periods when the interest rate of the U.S. 10-Year Treasury climbed by more than 100 basis points (bps). Our analysis found that alternative investments may be a powerful tool in managing portfolios’ impact and exposure to rising rates. In this week’s blog post, we look at private debt, specifically, direct lending, a strategy that makes up over 40% of the $1.2 trillion private debt market, and how this asset class may also be a powerful tool to manage portfolios during inflationary times.

Directing Performance

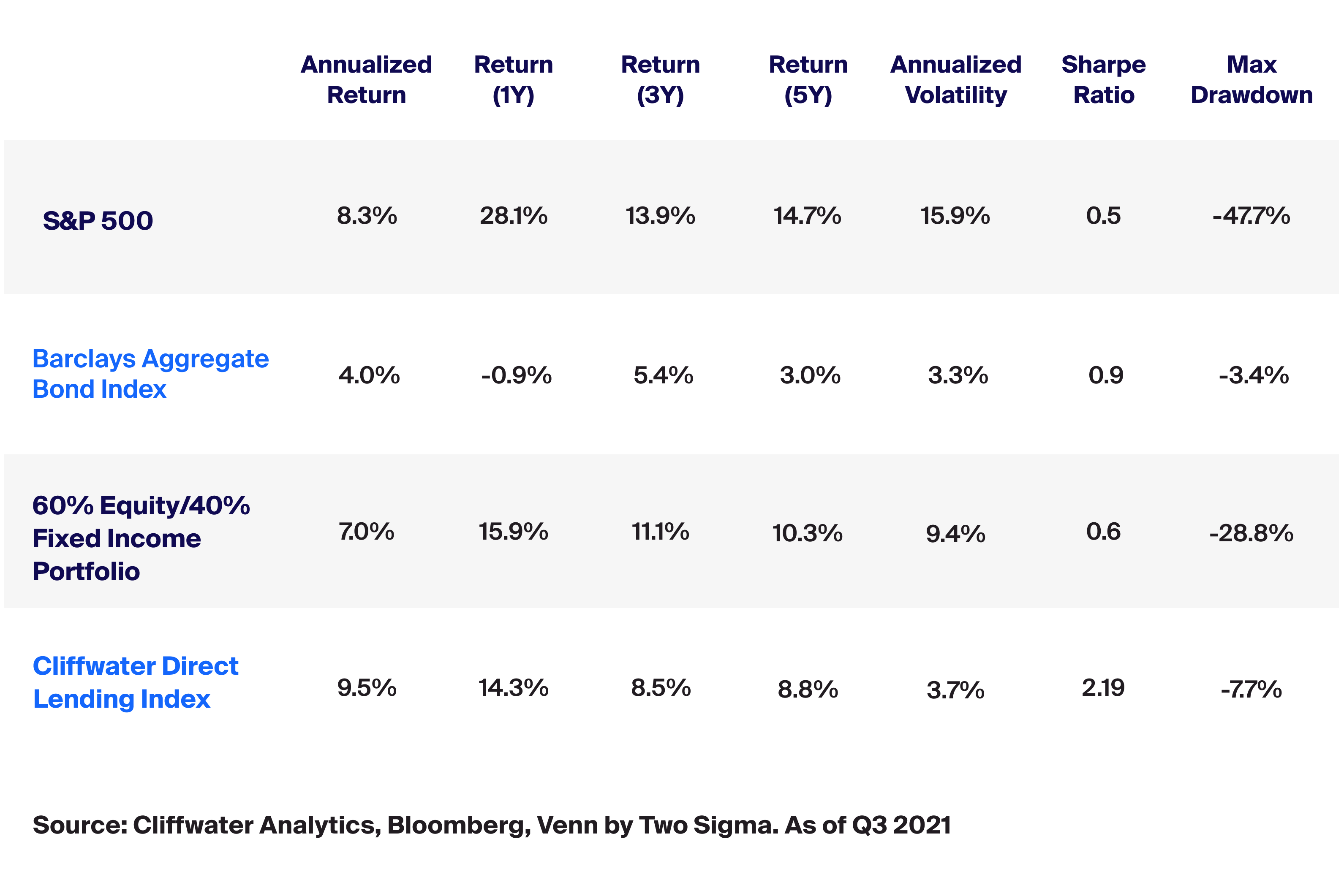

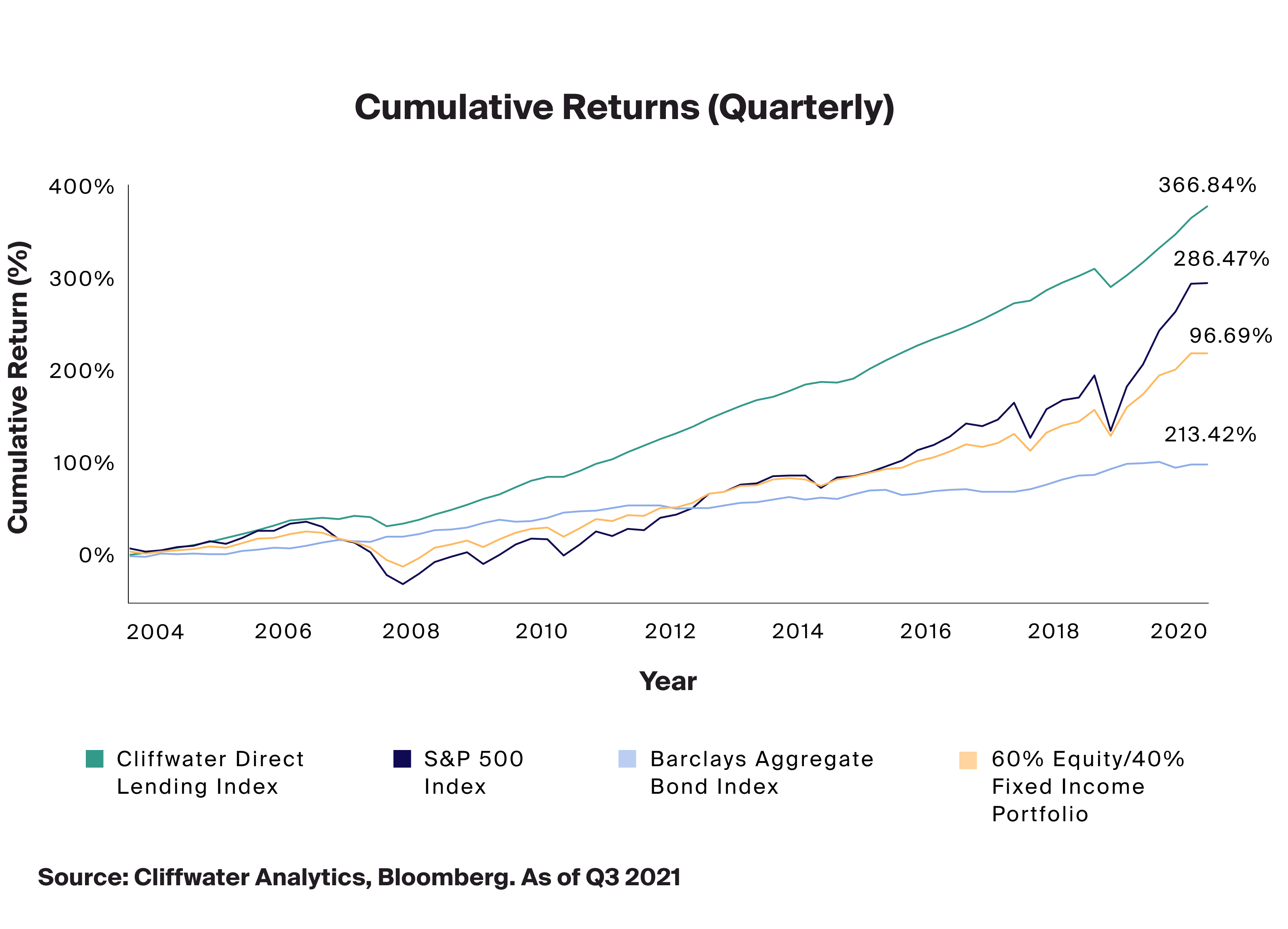

Throughout the last decade we have seen several periods of rising interest rates that have come with drawdowns as well as intervals of continued growth. To explore this further, we are looking at the long-term performance of direct lending relative to traditional investments by using the Cliffwater Direct Lending Index. Below we compare this index’s performance relative to public market indices, the 60/40 stock/bond portfolio comprised of the S&P 500 Index, and the Barclays Aggregate Bond Index quarterly, from December 2004 until September 2021.

The above data shows that over this specified time, depicting the most recent quarterly performance of the Cliffwater Direct Lending Index, we see a Sharpe ratio of 2.19. If we break down the components of this table, we uncover an interesting relationship between this asset class relative to stocks and bonds. Direct lending generated an annualized return of 9.5% over the time period explored, which compared favorably with stocks, which returned 8.3%. From a risk perspective, we also see that direct lending generated this return with just 30 bps more volatility than bonds at 3.7%, leading us to believe that direct lending generated equity like returns with bond like risk.

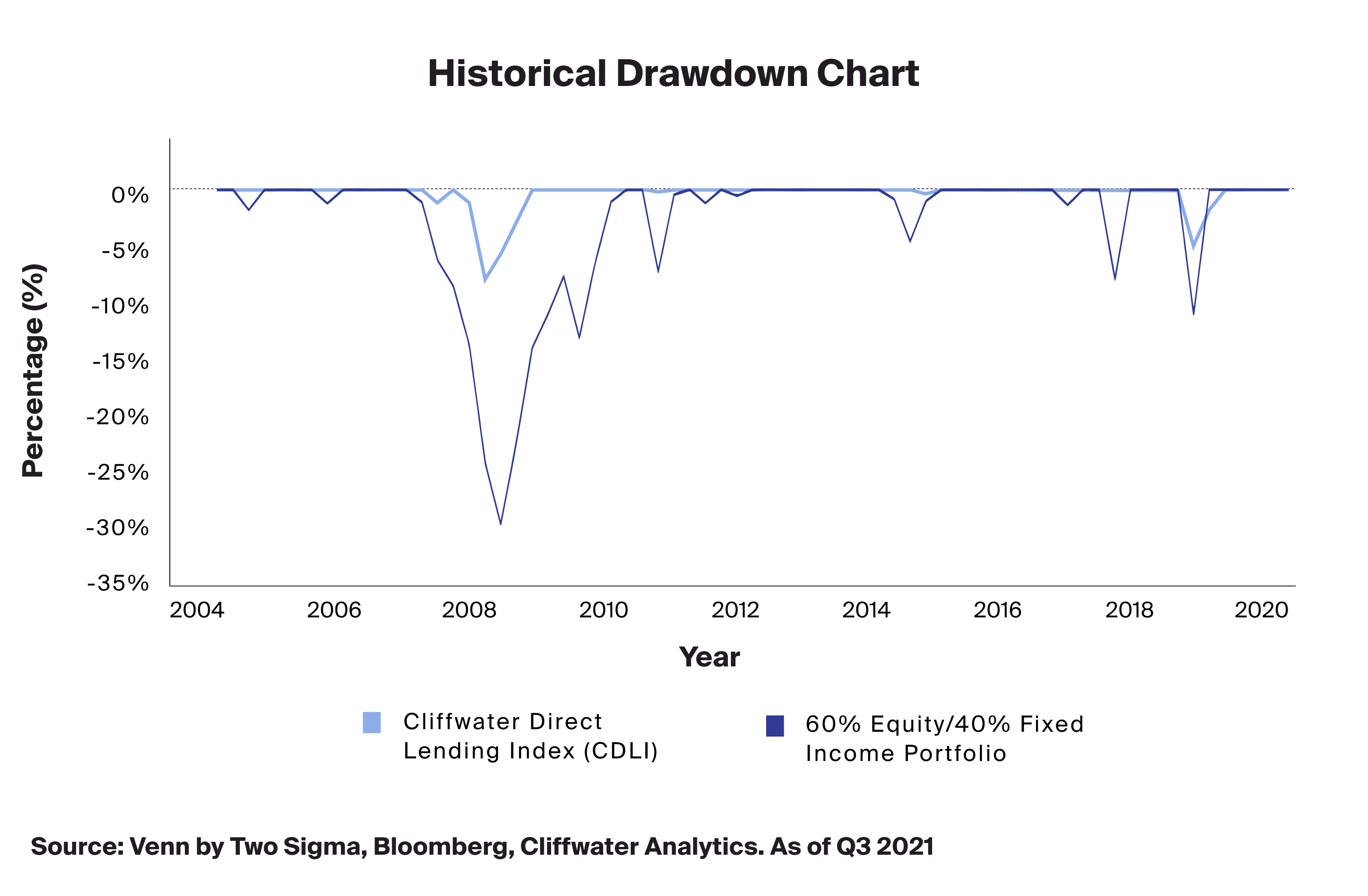

The above favorable risk adjusted performance may be due to direct lending’s ability to hedge against broader market downturns. Over the observation period, we saw four significant drawdowns of the 60/40 stock/bond portfolio. It is generally accepted that the 60/40 stock/bond portfolio experiences shallower drawdowns relative to stocks due to its considerable bond allocation. The max drawdown during this time for the 60/40 stock/bond portfolio compared to the direct lending index were -28.8% and -7.7% respectively. This suggests that in times of stress, direct lending may be a further hedge to stocks as part of a well-diversified portfolio.

Delving further into drawdowns and subsequent recoveries, at the depths of the global financial crisis (GFC) in December 2008 the S&P 500 fell nearly 50%, necessitating the 60/40 stock/bond portfolio to recover 35% [in order to get back to even], which eventually took more than two years. Over the same period, direct lending lost just 7.7% and managed to recover this amount in less than a year.

Elements That May Be Driving Return and Interest Rate Sensitivity

Direct lending strategies include loans that typically offer a spread over and above what may be realized on broadly syndicated leveraged loans issued by more traditional lenders like banks. This spread generally includes an illiquidity premium given these loans are typically buy-and-hold investments, as well as a “smaller company” risk premium because they are usually issued to smaller companies.1 Most commonly, direct lending funds utilize a floating rate coupon on loans which reduces their interest rate sensitivity, or duration.2 This feature can allow the coupon to reset higher when rates rise, potentially overcoming the negative contribution to total returns from higher rates – bond prices fall as interest rates rise. BlackRock also notes that direct lending has additional features that may make it an attractive alternative to traditional fixed income, namely, security, structural seniority, contractual yield and amortization, financial covenant protections and management access.

These features can make direct lending’s return profile different from traditional fixed income, potentially providing portfolio diversification benefits when added to a well-diversified portfolio.

Double Duty

In conclusion, during times of rising interest rates, when bonds may not be expected to provide the ballast to a portfolio as they have done historically, the above analysis displays that direct lending may not only help immunize a portfolio against rising interest rates, given its floating rate and lower duration, but it may also hedge against stock market volatility and soften the impact of drawdowns within a portfolio and the broader market.