What You'll Learn

Direct lending remains the largest strategy by AUM in North American private debt, but it may introduce concentration risk tied to sponsor-backed, middle-market companies.

Asset-based lending is gaining momentum as traditional banks retreat, providing income potential through exposure to real-world assets with shorter duration.

Real estate and infrastructure debt strategies may offer income and inflation-sensitive exposure, particularly via triple net lease or sector-focused investments.

Advisors have turned to private debt as a source of income and diversification within their portfolios,1 and in the last decade, the asset class as a whole has largely fulfilled these objectives, delivering relatively steady income2 and low correlation to traditional fixed income investments.3 As private debt matures as an asset class, it continues to encompass a range of strategies designed to offer differentiated exposure across the global economy and throughout market cycles. Advisors considering private debt have an opportunity to seek further diversification within what they may already look to as a diversifier for broader portfolios.

In this article, we highlight some dimensions of diversification that advisors can consider when allocating to this wide-ranging asset class.

Private Debt Is Not Just Direct Lending

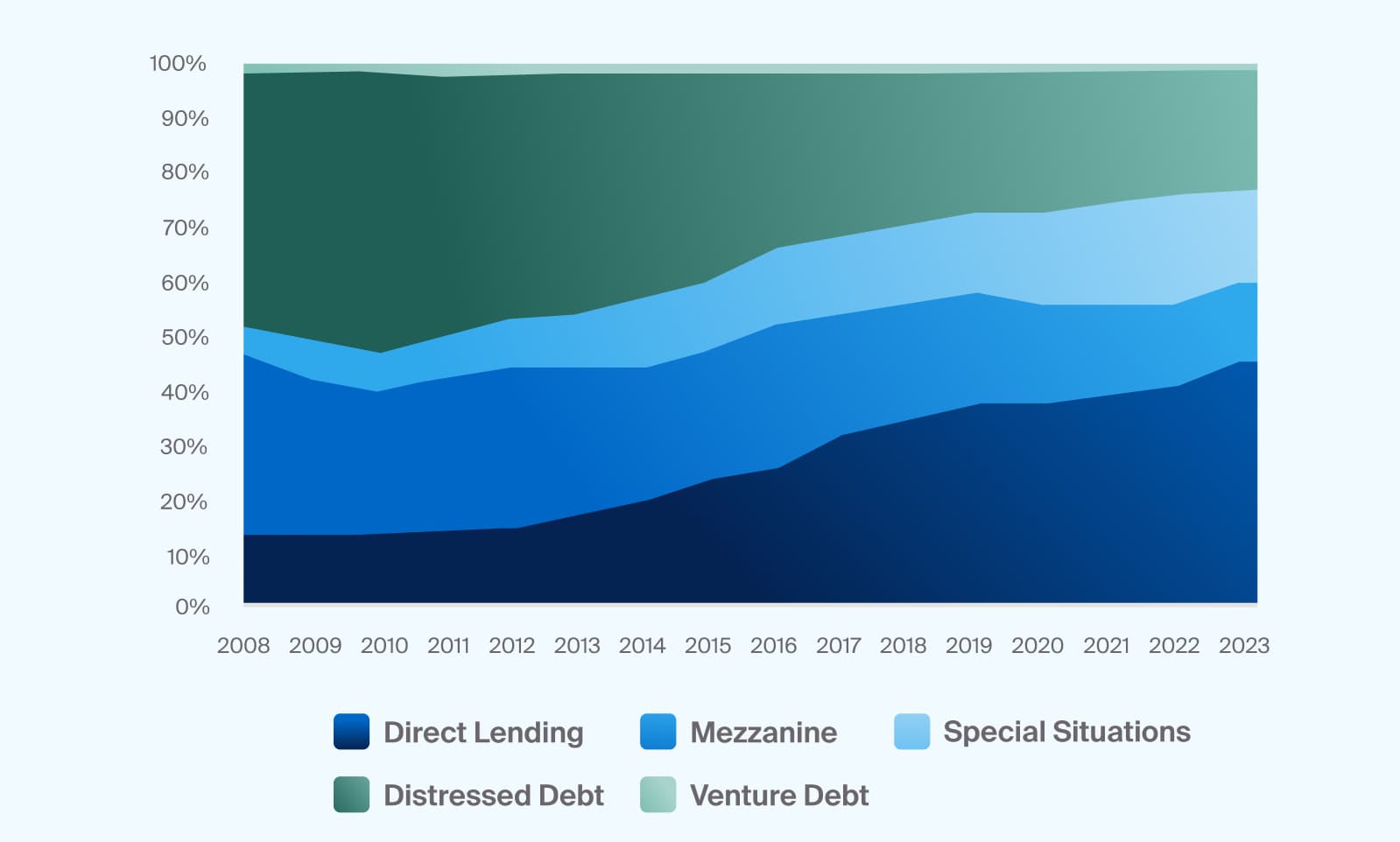

Direct lending strategies now comprise more than 45% of North American private debt AUM,4 but the broader asset class has grown to include a diverse range of strategies with distinct characteristics and use cases.

Source: Preqin, Global Report: Private Debt 2025

Direct lending strategies continue to make up the largest share of the private debt asset class in North America (Exhibit 2)

Direct lending strategies typically focus on senior debt, which sits highest in a company’s capital stack. With priority claims in the case of defaults and negotiated covenants that allow for more risk mitigation for lenders, direct lending strategies—as captured by the Cliffwater Direct Lending Index—delivered relatively consistent income that ranged from 9% to 12% annually between 2016 and 2024.5

Despite these potential benefits, one possible drawback of exclusively allocating to direct lending within a private debt portfolio is the concentration in sponsor-backed transactions. While private equity sponsorship often provides advantages, it can also expose direct lending strategies to correlated default risks. These correlated risks may arise from commonly shared characteristics of PE-backed companies, such as higher use of leverage or overlaps in sector focus or growth strategies that may be similarly vulnerable to certain market cycles.

Closing the Gap in Asset-Based Lending Demand

While banks have long participated in asset-based lending, these strategies have more recently gained momentum within private markets. For financial advisors, asset-based lending may represent an additional way to pursue diversified yield opportunities that are less dependent upon a company’s performance.

Also called asset-based finance, these strategies lend against a range of underlying assets—from hard assets like manufacturing or aviation equipment to softer assets like credit cards or short-term consumer loans. Asset-based loans tend to be shorter in duration than corporate loans and are often self-amortizing, meaning that principal is generally returned over time alongside interest payments rather than at an uncertain exit point.

Blue Owl estimates that the addressable market opportunity in asset-based finance could be as big as $11 trillion and that private markets have only penetrated roughly 4% of that, leaving ample opportunity for more alternative asset managers to step in where banks fall back.6

Rising Opportunities in Infrastructure and Real Estate Debt

Real estate and infrastructure are generally considered their own asset classes within private markets, yet debt-related strategies in these areas may also be a means for diversifying income alongside other private debt strategies.

Triple net lease, for example, may be one area of potential interest for income-seeking financial advisors also looking to hedge against inflation. These strategies, which tend to depend on long-term lease contracts, generally focus on single-tenant properties, where the tenant bears more of the property-related costs, including taxes, insurance, and operating expenses, thus insulating the lender from fluctuations in these costs.

Other real estate or infrastructure debt strategies may focus on specific geographies or sectors, aiming to take advantage of certain ongoing trends, such as the rise of artificial intelligence, the ongoing energy transition, or the demand for multi-family or single-family residential real estate.

Diversifying Income Sources in Private Credit Markets

Investing in private debt strategies may require similar considerations as investing in traditional fixed income, particularly regarding the dimensions along which advisors and fund managers may choose to concentrate or diversify.

For instance, in traditional fixed income, an advisor may choose to pursue similar bonds with a mix of duration, to try to insulate against interest rate risk, or she may decide to create a core allocation to historically safer government bonds with secondary allocations to riskier high-yield bonds. While private markets remain far less liquid than traditional debt investments, increases in access to private markets products may provide advisors with more ways to diversify than ever before.

Below we cover some of the dimensions of diversification that an advisor might consider when building a private debt allocation.

Capital Stack

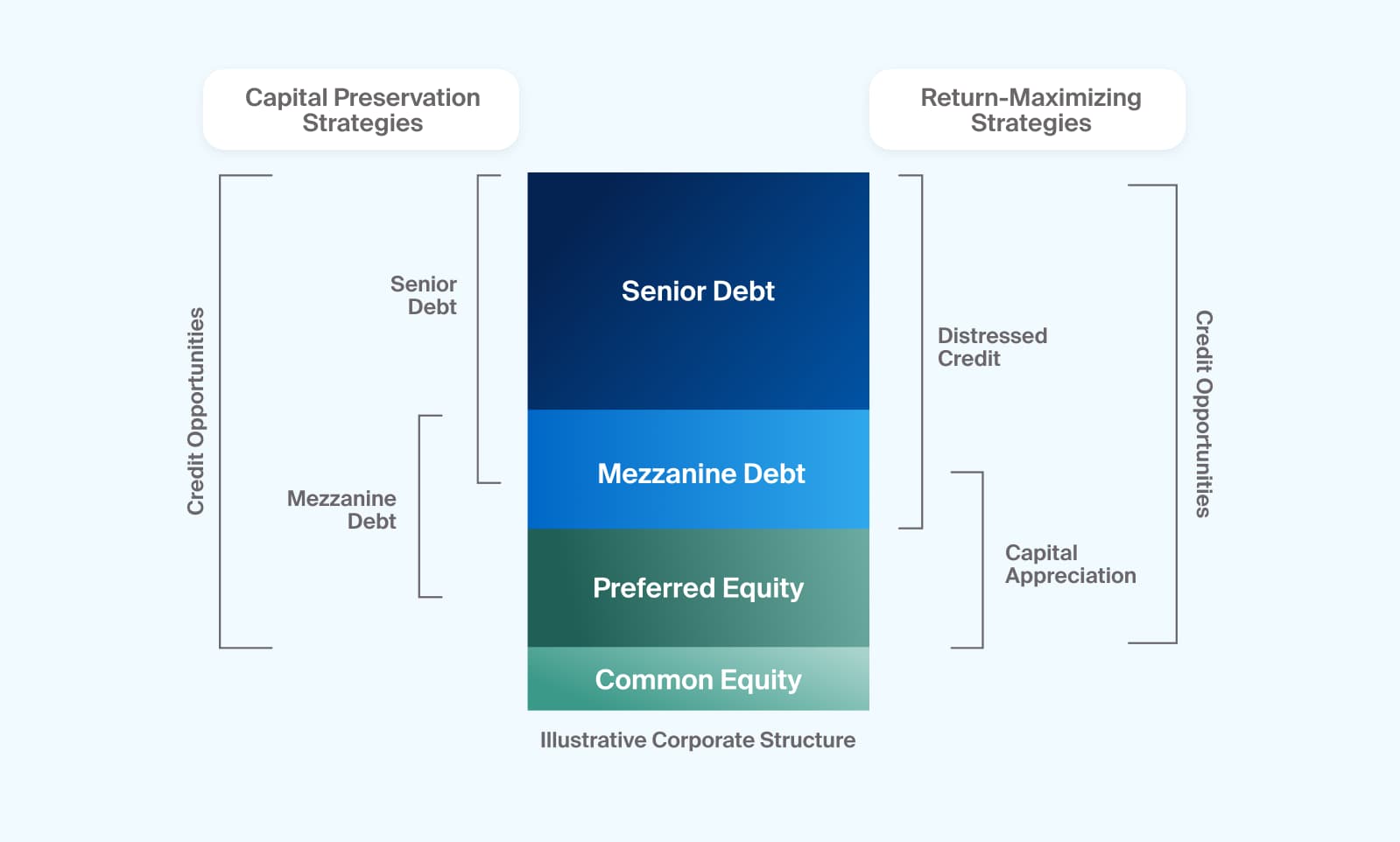

Allocating across the capital stack, such as senior debt, mezzanine debt, and subordinated debt, can help balance potential income with varying levels of risk exposure. Each tranche reflects a distinct claim on the underlying borrower’s assets in the case of a default and may therefore behave differently in market downturns depending on the solvency of each borrower.

Source: Cambridge Associates LLC. For illustrative purposes only.

Private debt strategies can vary in focus, with some concentrated higher or lower along the capital stack (Exhibit 3)

Borrower Size

Exposure to both middle-market and large-cap borrowers can introduce differentiated return profiles and access to a broader range of financing opportunities. Smaller, more niche borrowers in the lower middle market with fewer financing opportunities may offer attractive yield and diversification potential, while larger borrowers with established cash flows may contribute to stability and scale.

Increasingly in the United States, direct lenders are moving out of the middle market and serving the financing needs of large cap companies, with EBITDAs over $75 million.7 Some of these companies, because of their size and cash flows, may be more insulated from shorter-term market movements triggered by geopolitics and policy changes.

Credit Quality

Although credit ratings are less established within private markets, managers and advisors alike may choose to allocate across varying private credit tiers, targeting more of a balance between potential yield and credit risk. Advisors may choose to adjust credit quality exposure based on client goals and market outlook. Within private debt, some managers are now marketing their strategies as “investment-grade,” which may include a mix of corporate and asset-based lending to relatively well-performing companies,8 differentiating from distressed debt strategies that have historically delivered higher yields while taking on more risk.

The use of payment-in-kind (PIK) loans historically has been an indicator of lower credit quality. These PIK loans are designed to help borrowers with limited cash flows defer their interest payments, which runs the risk of hiding potential problems in these borrowers’ ability to repay their loans over time. As competition in lending to higher-quality borrowers has increased, PIK loans are becoming more standard in direct lending negotiations and thus may now be less associated with poor credit quality.9 PIK arrangements still put the lender at more risk, since they may not receive regular cash interest payments and are more dependent on a borrower’s ability to pay back more of the interest later.

It’s worth noting that if market volatility continues to put stress on credit markets overall, distressed debt strategies may be well positioned. Indeed, in four out of the last five major equity market downturns, distressed credit has outperformed both the S&P 500 and high-yield bonds.10 Because of the nature of distressed strategies, advisors would need to allocate capital before any signs of credit cycle stress emerge, as the chance for managers to buy assets below par may be significant but fleeting.

Geography

Diversifying by geography—whether across regions, states, or global markets—can help mitigate local economic or policy risks, as well as susceptibility to potential pressures on international supply chains. Regional debt markets may respond differently to interest rate moves, geopolitical shifts, or sector-specific demand.

In 2024, according to Preqin, 63% of the private debt deals they observed globally were in North America, where the bulk of fundraising is focused.11

Sector

Allocating to private debt opportunities across multiple industries can help manage sector-specific credit cycles. A strategy’s sector focus can also be a good indicator of its resilience amid market volatility and its susceptibility to inflationary pressures. For instance, domestic, service-based sectors, such as technology or healthcare, that do not rely on global supply chains may be less vulnerable to tariff swings or supply chain issues.

In 2024, according to Preqin, industrials was the largest sector by deal count, followed closely by consumer discretionary. Business services, information technology, and healthcare are other sectors where more private debt deals took place in recent years.12

Sponsored vs. Non-Sponsored Deals

Combining sponsor-backed and non-sponsored lending strategies may also create a broader opportunity set. Because borrowers are already owned fully or partially by a PE firm, sponsored deals can benefit from enhanced diligence and often may incorporate an equity cushion that can add protection for the lender in case of a default. However, PE-owned companies tend to be more highly levered, potentially introducing greater risk, and often competition for these deals is high, potentially forcing lenders to make rate concessions. As mentioned before, there's a potential concentration risk also given the similarities among PE-owned companies.

Non-sponsored deals, by contrast, may be more difficult to originate and underwrite and tend to require more experience and a more robust and/or specialized sourcing network. However, because there may be less competition, lenders may have the ability to negotiate more favorable rates and covenants, like constraints on a borrower’s use of leverage.

Many direct lending strategies tend to be concentrated in sponsor-backed deals;13 however, certain alternative asset managers have developed teams and processes that help them proactively originate loans independent of any private equity relationships.

Duration

Similar to common traditional fixed income investing approaches, blending short- and long-duration private debt instruments can help manage interest rate sensitivity and liquidity needs. Shorter duration products or semi-liquid evergreen funds may offer faster capital recycling and compounding. Longer durations may lock in contractual income over extended periods, potentially capturing the illiquidity premium that has differentiated private markets investing.

Asset Manager

Working with a mix of private debt managers—each with their own sourcing networks, underwriting standards, and sector focus—can enhance portfolio diversification. Manager selection also can play a role in operational processes and transparency.

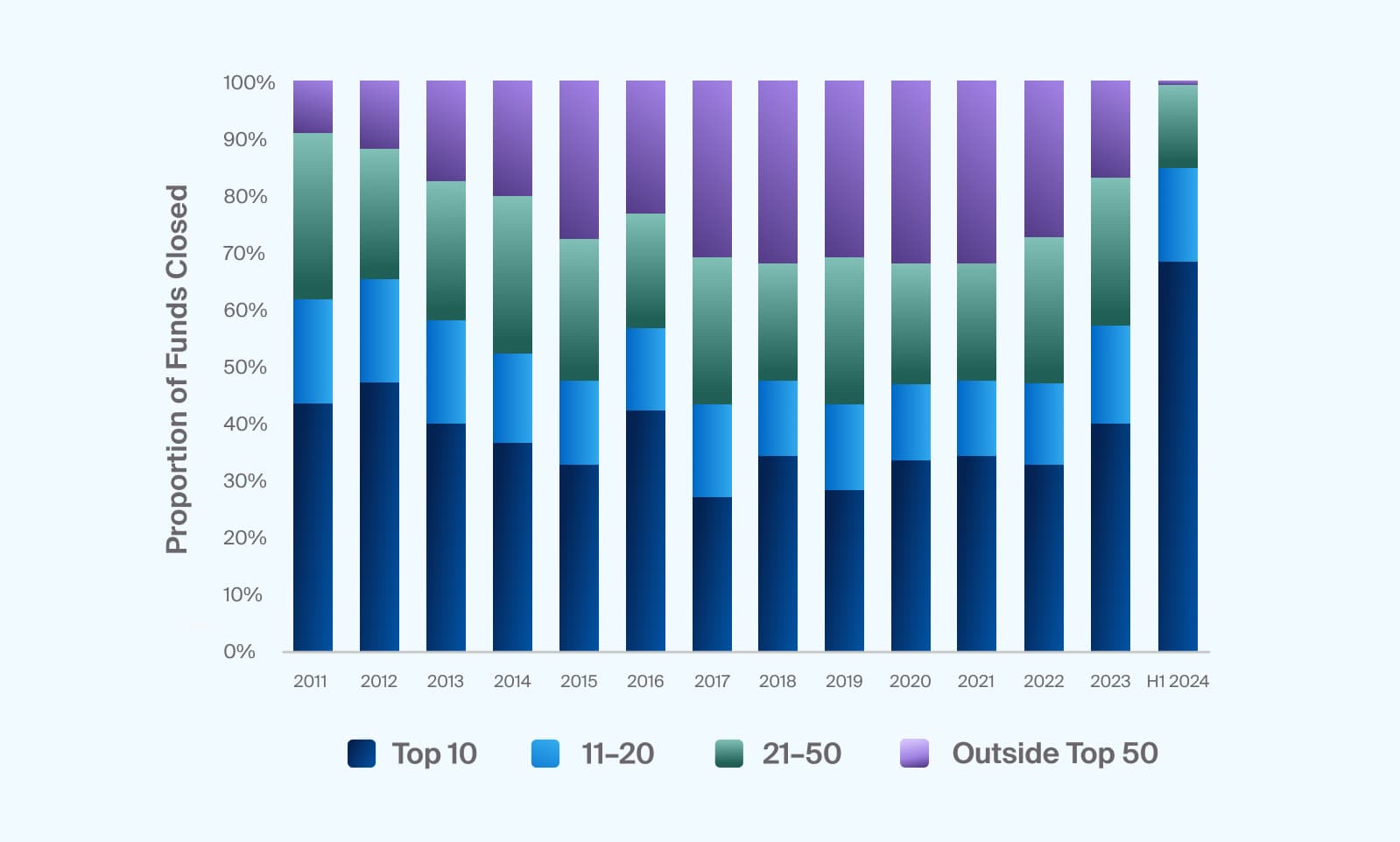

Manager size has been a notable determinant in fundraising in recent years, with larger funds and more experienced managers raising the most capital within the space.14 These managers are also increasingly offering a wider selection of vehicles, especially business development companies (BDCs).

Source: Preqin, Global Report: Private Debt 2025; Graph focuses on private debt funds closed within each year.

Capital raising in private debt has become more concentrated into larger funds (Exhibit 4)

Vehicle Type

Another way advisors can consider diversifying within private debt is by allocating via different fund structures, from drawdown, finite-life private funds to registered, fully funded, evergreen vehicles. These structures themselves may inherently capture some of the dimensions already covered above, like duration, and often involve trade-offs related to liquidity.

Non-traded and private BDCs in particular have proliferated exponentially in recent years to accommodate demand from the wealth channel, which includes retail or high-net-worth individuals and the financial advisors who invest on their behalf. Though these vehicles have been available since the 1980s, the number of private debt BDCs more than tripled in the decade leading up to 2023.15 However, BDCs are also concentrated among some of the largest managers, possibly reducing options for manager diversification.

Accessing Diversified Income Sources in Private Debt

There are a number of ways to aim to implement diversification in private debt, some more reliant on the skills and experience of alternative asset managers or third-party strategists and others that allow an advisor to maintain more control. For example, an advisor may simply seek a single investment in a more diversified private debt fund that considers multiple dimensions or incorporates different lending approaches.

Improving alternative investment trade technology, along with model portfolios, can also make it easier operationally to invest in a mix of funds within a single asset class where each fund has distinct characteristics or focus areas.

Evaluating Risks Within Private Debt

Although diversification across some of the dimensions above may help to mitigate risk when investing in private debt, risks remain. Manager selection and deal access can significantly influence outcomes in the asset class, especially if managers have specialized skills in assessing credit default risks or unique access to exclusive deals.

Private loans also often have less transparency regarding historical defaults, potentially increasing uncertainty compared to traditional fixed-income instruments. Additionally, liquidity constraints and infrequent market pricing can mask underlying volatility, creating valuation challenges. Though, private debt typically offers current income streams, reducing some of the initial cash-flow impact or J-curve seen in other private markets investments.