What You'll Learn

Since 2001, portfolios that incorporated various allocation amounts to private debt at the index level may have historically outperformed a 60/40 portfolio comprising global public equities and fixed income alone, on a cumulative basis.

A portfolio that included a 10% allocation to private debt, broadly defined and net of fees, would have marginally outperformed with lower volatility if that allocation came from global public equities yet volatility would have increased slightly if the private debt allocation replaced traditional fixed income with greater outperformance of the traditional portfolio.

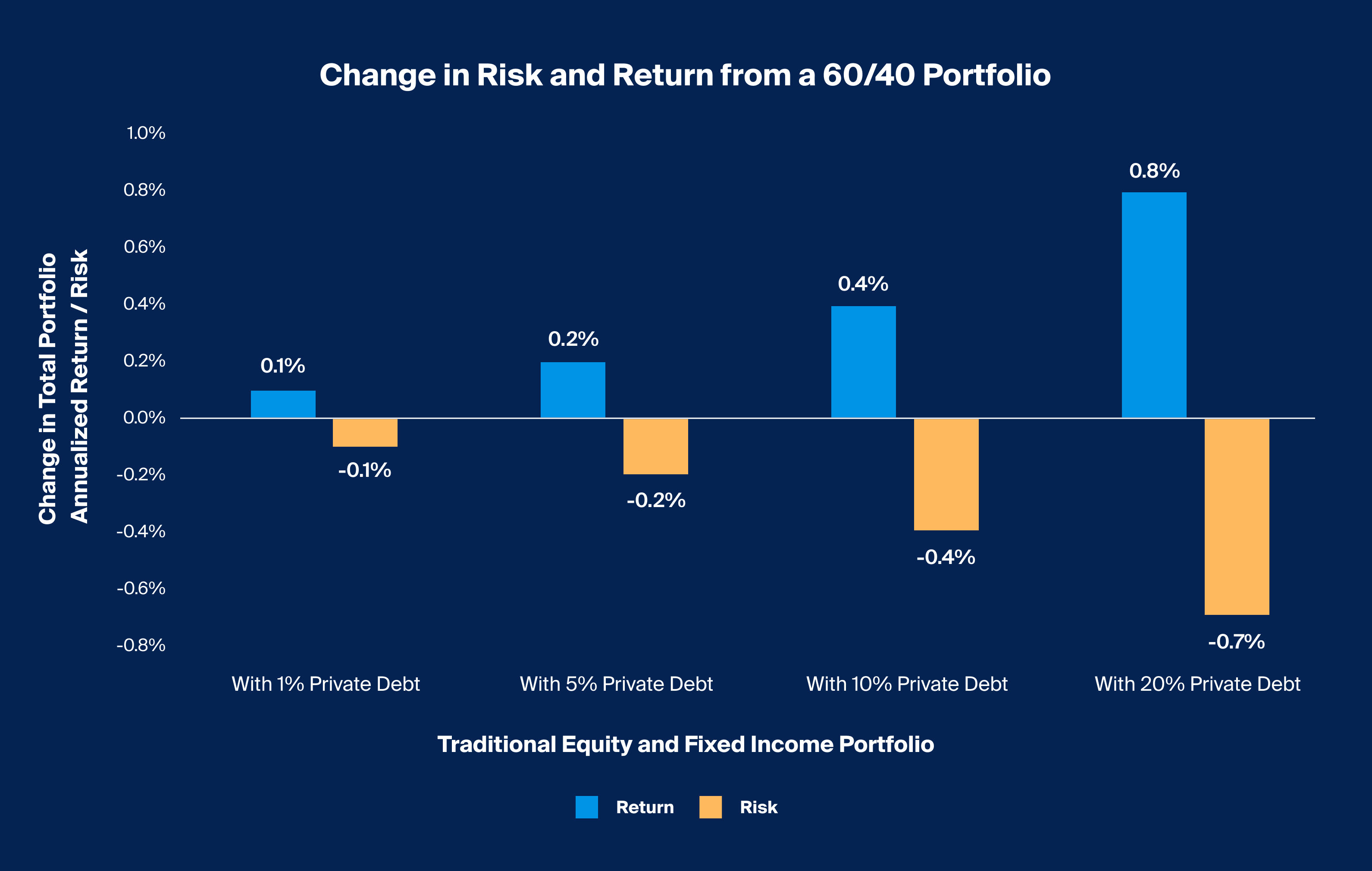

Historically, between 2001 and 2023, the greater an allocation to private debt in aggregate, the lower the risk and higher the return would have been compared with a more traditional baseline portfolio comprising global public equities and fixed income across the spectrum of risk profiles.

As traditional banks continue their decade-plus retreat from middle-market lending, midsize companies strapped for capital seem to keep tapping into private debt.1 This ongoing trend has not only expanded the opportunity set for private lenders but has also given investors access to diversified yield.2

For advisors, there’s much to consider when accessing potential private debt (also known as private credit) opportunities. Even before eventually identifying a specific product or manager, the advisor may consider where to source capital to fund any new commitment. Simultaneously, the allocation must be sized appropriately, considering the risk and return objectives of a portfolio. Just as importantly, private market vehicles are generally less liquid than their traditional counterparts like public equity and fixed income, so allocations of any size will require elevated attention to a portfolio’s liquidity constraints.

In this article, we aim to assess the historical impacts of different funding strategies for private debt commitments and the effect of allocation sizing on a total portfolio’s risk and return.

Funding an Allocation to Private Debt

To start our analysis, we created a historical base case portfolio, composed of 60% global public equities (represented by the MSCI ACWI Net Total Return Index) and 40% fixed income (represented by the Bloomberg Barclays US Aggregate Bond Index). Since the launch of the Preqin Private Debt Index in Q4 2001 to Q2 2023, this more traditional portfolio would have delivered an annualized return of 6.0% with a standard deviation of 10.7% (Exhibit 1). Note that the private markets indices used below are composed of individual funds and calculated net of fees, and it is not possible to invest in an index.

Footnotes

Source: Bloomberg, Preqin, 60/40 Portfolio represented by 60% allocation to the MSCI ACWI Net Total Return Index, and 40% allocation to the Bloomberg Barclays US Aggregate Bond Index, 55/35/10 represented by 55% allocation to the MSCI ACWI Net Total Return Index, 35% allocation to the Bloomberg Barclays US Aggregate Bond Index, and 10% allocation to the Preqin Private Debt Index, analysis conducted between Q4 2001 and Q2 2023. Past performance is no guarantee of future results. This graphic does not predict or project performance or imply that past performance will recur.

Based on the defined variables and time period, a portfolio with a private debt allocation of 10% funded equally from global public equities and fixed income appears to have outperformed the 60/40 portfolio cumulatively since 2001 (Exhibit 1)

We found that when private debt at the index level (represented by the Preqin Private Debt Index) was incorporated at 10% of the portfolio, the overall portfolio would have historically outperformed a portfolio comprising global public equities and fixed income alone, on a cumulative basis, since 2001 (Exhibit 1). During this time period, private debt has remained generally uncorrelated to fixed income, potentially building the case for private debt as a diversifier rather than simply a supplement to traditional yield (Exhibit 2).

Footnotes

Source: Bloomberg, Preqin, Venn, Equity represented by MSCI ACWI Net Total Return Index, Fixed Income represented by the Bloomberg Barclays US Aggregate Bond Index, Private Debt represented by the Preqin Private Debt Index, analysis conducted through Venn between Q1 2002 and Q2 2023. Past performance is no guarantee of future results. This graphic does not predict or project performance or imply that past performance will recur.

Private debt in aggregate has historically had a low correlation to traditional fixed income and a moderate correlation with global public equities (Exhibit 2)

If that base-case 60/40 portfolio reallocated 10% of total assets from global public equities to private debt—starting the same time period with a 50% allocation to global public equities, 40% allocation to fixed income, and 10% allocation to private debt—the annualized return would have been 0.3 percentage points higher than the base case (Exhibit 3). Risk, represented by annualized standard deviation, meanwhile, would have been 1.2 percentage points lower. In this scenario, because global public equities were historically more volatile than private debt, it makes sense that a decreased allocation would have also lowered volatility. Likewise, replacing a portion of the global public equities allocation with private debt—the better performer of the two during the observation period—increased portfolio return.

In contrast, a 10% allocation to private debt funded entirely from the fixed income “bucket” would have increased return by 0.6 percentage points at the cost of increasing volatility by 0.5 percentage points (Exhibit 3). In this case, the equity allocation remained untouched, meaning that the full return and risk profile of the asset class was maintained, increasing portfolio volatility due to the higher volatility of private debt relative to fixed income.

Now what happens if we had drawn capital from both equity and fixed income and achieved an allocation of 10% to private debt? A 10% allocation to private debt, funded (5% each) from both global public equities and fixed income, would have resulted in an increase in return of 0.4 percentage points and a decline in risk of 0.4 percentage points (Exhibit 3).

Footnotes

Source: Bloomberg, Preqin, Venn, Bars measure the change in return and risk starting at 60/40 and moving to the other listed allocations, 60/40 Portfolio represented by 60% allocation to the MSCI ACWI Net Total Return Index, and 40% allocation to the Bloomberg Barclays US Aggregate Bond Index, 50/40/10 represented by 50% allocation to the MSCI ACWI Net Total Return Index, 40% allocation to the Bloomberg Barclays US Aggregate Bond Index, and 10% allocation to the Preqin Private Debt Index, 60/30/10 represented by 60% allocation to the MSCI ACWI Net Total Return Index, 30% allocation to the Bloomberg Barclays US Aggregate Bond Index, and 10% allocation to the Preqin Private Debt Index 55/35/10 represented by 55% allocation to the MSCI ACWI Net Total Return Index, 35% allocation to the Bloomberg Barclays US Aggregate Bond Index, and 10% allocation to the Preqin Private Debt Index, analysis conducted between Q4 2001 and Q2 2023. Return is the annualized return and risk is the annualized standard deviation. Past performance is no guarantee of future results. This graphic does not predict or project performance or imply that past performance will recur.

Funding an allocation to private debt from global public equities, fixed income, or both, compared with a 60/40 portfolio has historically resulted in different portfolio-level implications (Exhibit 3)

Notwithstanding our analysis, it is important to stress that there are no clear-cut options for allocating to private debt. If enhancing return was a key objective, funding an allocation from fixed income may have been more attractive despite an increase in volatility. If the objective was risk mitigation or downside protection, funding from equity may be more preferred. Funding from both equities and fixed income, meanwhile, would appear to have achieved more of a balance between return enhancement and risk mitigation.

Sizing an Allocation to Private Debt

Next, we explore how different sizing decisions for a private debt allocation may have historically affected risk and return in a portfolio. Above, we demonstrated how the origin of capital can impact performance, but in the prior examples, we assumed an allocation of 10%, a percentage that may not be aligned with the liquidity constraints of a particular investor or portfolio.

Below we analyze the addition of private debt to a traditional 60/40 portfolio at different sizes over the same period, funded equally between equity and fixed income. While it is important to emphasize that past performance is no guarantee of future results, it appears that annualized risk and return during the identified period had an inverse relationship as private debt is marginally added in greater quantity to the base portfolio. Historically, these scenarios suggest that the greater an allocation to private debt in aggregate, the lower the risk and higher the return would have been for these portfolios (Exhibit 4).

Footnotes

Source: Bloomberg, Preqin, Venn, 60/40 Portfolio represented by 60% allocation to the MSCI ACWI Net Total Return Index, and 40% allocation to the Bloomberg Barclays US Aggregate Bond Index, each allocation to Private Debt, represented by the Preqin Private Debt Index is funded equally between Equity and Fixed Income, analysis conducted through Venn between Q1 2002 and Q2 2023. Return is the annualized return and risk is the annualized standard deviation. Past performance is no guarantee of future results. This graphic does not predict or project performance or imply that past performance will recur.

Based on the defined variables and time period, Incrementally higher allocations to private debt in aggregate appears to have increased annualized return and reduced annualized risk (Exhibit 4)

Increasing an allocation to private debt to 20% would have increased risk-adjusted return by 0.8 percentage points; however, it’s worth noting that an allocation of that size could sacrifice the overall liquidity of a portfolio. On the other hand, a 1% allocation to private debt may not have achieved a meaningful improvement to risk and return, particularly if liquidity constraints may have permitted a greater allocation.

In Exhibit 5 below, we compare a selection of historical portfolios using these indices. The darkest blue line represents the portfolios exclusively comprising global public equities and fixed income. Every step, or dot, on that line depicts a different starting allocation. The bottom leftmost dot on that line, for example, depicts an allocation of 90% fixed income and 10% equity; the top rightmost dot consists of the opposite, 90% equity and 10% fixed income. At every point in between, we modeled in a 10% shift from the starting allocation (Exhibit 5).

Footnotes

Source: Bloomberg, Preqin, Venn, 60/40 Portfolio represented by 60% allocation to the MSCI ACWI Net Total Return Index, and 40% allocation to the Bloomberg Barclays US Aggregate Bond Index, each allocation to Private Debt, represented by the Preqin Private Debt Index is funded equally between Equity and Fixed Income. Return is the annualized return and risk is the annualized standard deviation. Analysis conducted through Venn between Q1 2002 and Q2 2023. Past performance is no guarantee of future results. This graphic does not predict or project performance or imply that past performance will recur.

Based on the defined variables and time period, a gradual allocation to private debt appears to have improved risk-adjusted return across the risk spectrum (Exhibit 5)

According to this historical analysis, the gradual addition of private debt—funded equally from global public equities and fixed income—moved portfolios at these varying allocations across the risk spectrum up and to the left (Exhibit 5). Smaller allocations, as intuition would suggest, appear to have a smaller impact on the “shift” in the risk and return. Any advisor considering private debt should also bear in mind that this analysis focused on private debt in aggregate, and the historical volatility and performance of any individual fund within the Preqin Private Debt Index likely would have varied the results we found here. Private debt also comes with risks and considerations that differ in nature from the risks associated with traditional fixed income, including credit default risk, lack of transparency, J-curves, and limited liquidity.