In their search for income, many investors are turning to mezzanine financing — an asset class which has historically paid a 12-20% total return, and furthermore, comes with the added upside potential of equity ownership.1

What Is Mezzanine Financing and How Does It Work?

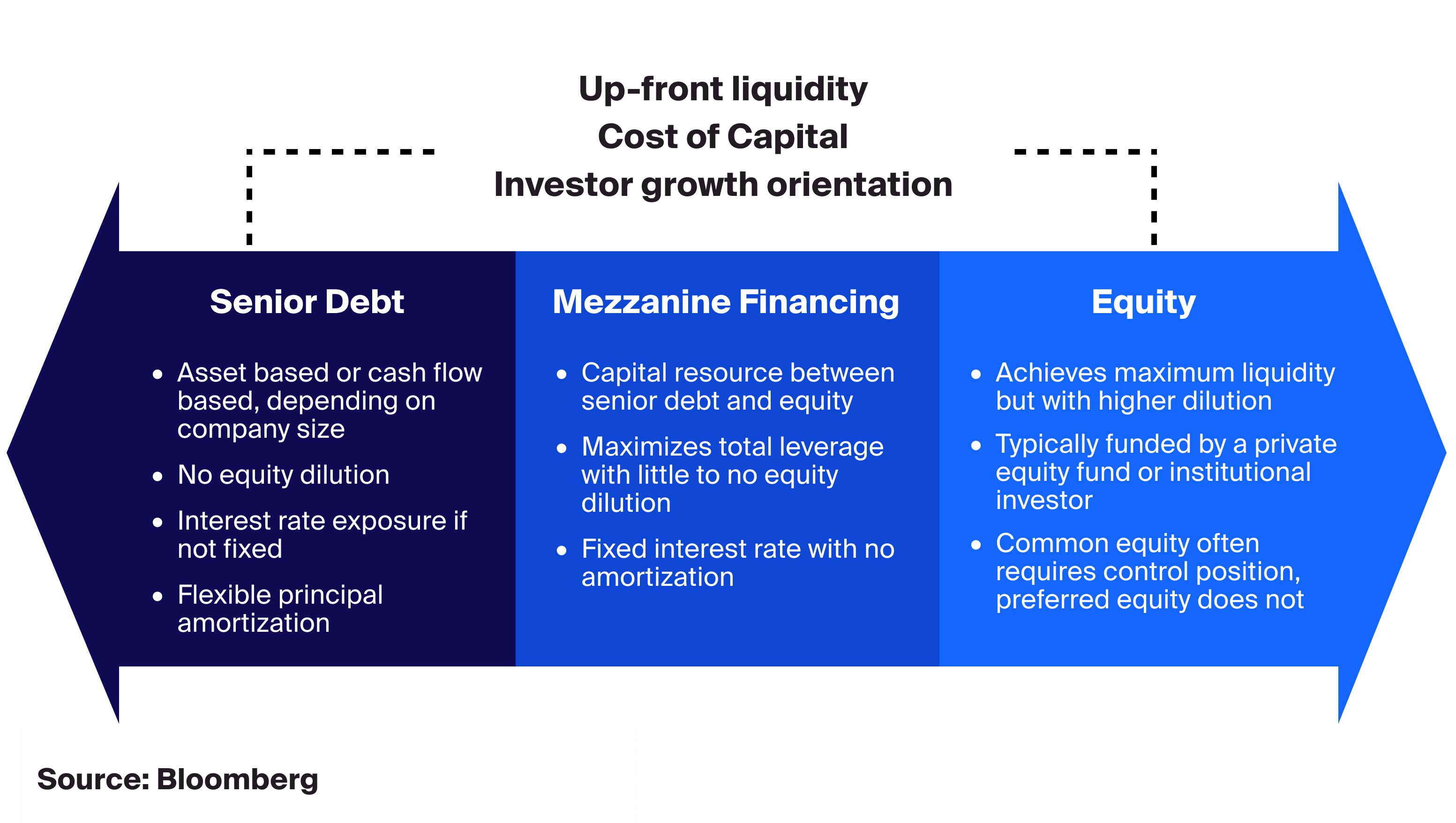

Mezzanine, as its name implies, sits in between senior debt and equity in the capital structure.

As aptly put by Prudential, “mezzanine financing can be viewed as either expensive (higher coupon) debt or cheap (less dilutive) equity.” 2 This is generally because the company pays a higher interest rate on mezzanine financing than it does for senior debt obtained from their banks. – Still, even with this in mind, its overall cost of capital can remain significantly less expensive for the company than if it were to secure this needed financing through equity issuances.2

Why Do Companies Issue Mezzanine Financing?

When a company is in need of capital to fund its growth, it will generally first turn to its traditional lenders —the banks— for senior debt. Yet regardless of the merits of the company itself, post-Global Financial Crisis regulations have made it difficult for the banks to lend above certain thresholds.3

The next thought might be to seek financing from external investors, by giving up a piece of the company (equity) – an option which many owners are not willing to pursue, as they generally wish to retain control, especially in the business’ growth phase.

Mezzanine can potentially allow them to seek this financing – without the bank, and without the threat of external ownership. The company can either pursue mezzanine through directly negotiated transactions, or through a pooled private-fund structure that specifically targets these types of investments.4

Who Uses Mezzanine Debt Financing?

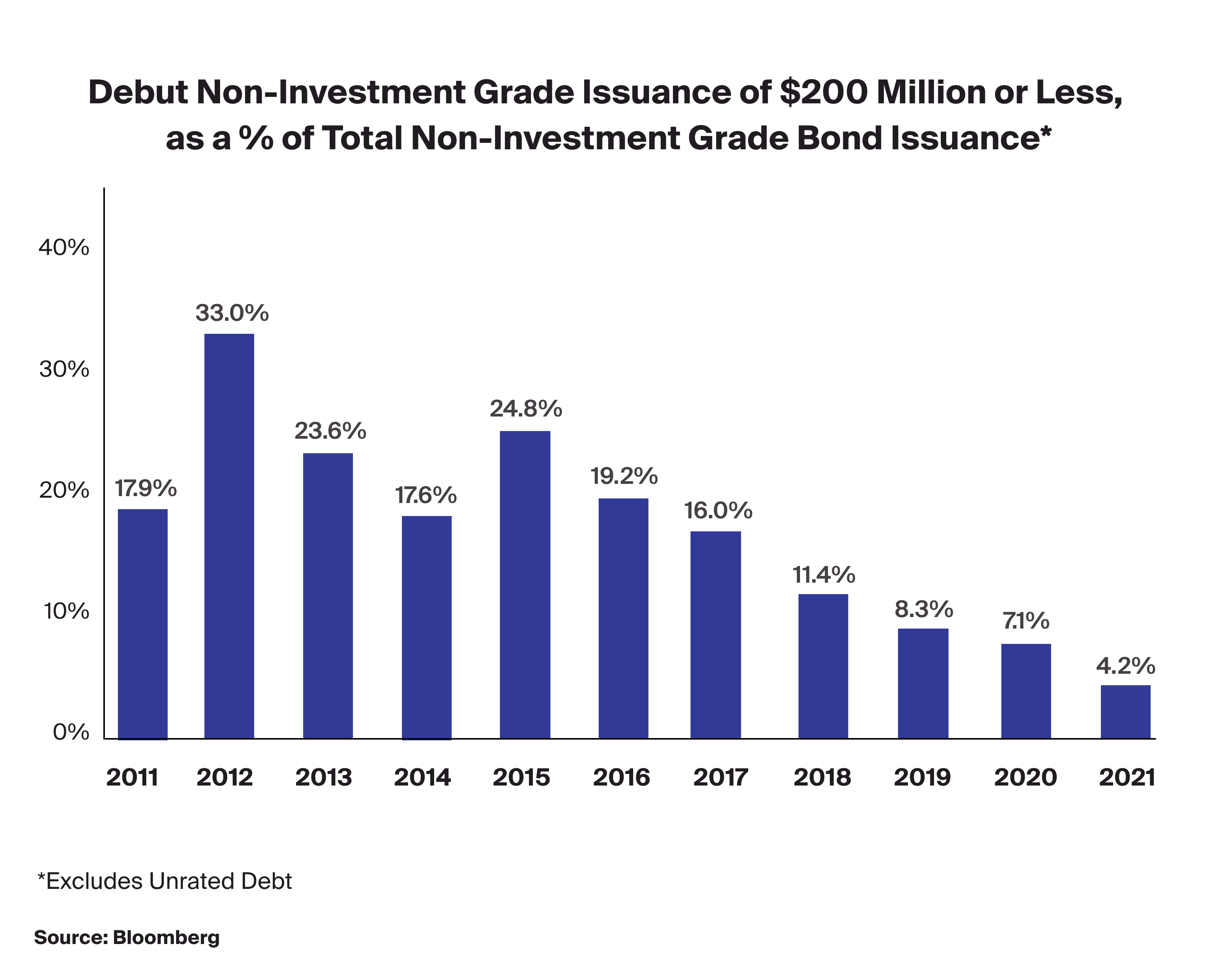

Private equity firms typically target the middle-market, characterized by companies with revenues between $50 million to $1 billion.5 It can offer a more optimal, size-appropriate alternative to the high-yield bond markets commonly used by their larger counterparts. To understand why, we point to the fact that in 2021, 96% of all non-Investment Grade bond issuances debuted at $200 million or more.6 Many middle-market businesses simply do not have the financing need nor appetite to swallow up this large minimum. Mezzanine therefore offers a solution that is potentially right-sized to the profile of the middle-market – a segment which accounts for the vast majority of businesses in the United States, and on a standalone basis, would be the world’s fifth largest economy.7

Do You Need Collateral for Mezzanine Financing?

In many cases, collateral does not need to be offered up in a mezzanine transaction. From the company’s perspective, this is a welcome feature: it may have a substantial amount of intangible assets recorded on its balance sheets, or has already had its existing inventory / accounts receivables / fixed assets be discounted through the bank’s conservative underwriting.8 From the investor’s perspective, the absence of collateral allows them to command the above mentioned features: high coupons, and often times, warrants which are convertible into equity ownership at a given date or specific event, or in the event of a default.9

What Are the Potential Benefits of Mezzanine Financing, From the Investor’s Perspective?

The opportunity for an attractive total return, as the investor enjoys both the potential advantages of a debt investment (income, via coupons), and an equity investment (ownership, via convertible warrants).

Downside risk management through a privately negotiated transaction, which could include all the common risk-mitigating hallmarks of private credit transactions (eg. covenants).

The potential for less volatile long-term performance (via the coupon component).

Compared to broadly-syndicated loans, mezzanine financing investors are typically able to perform more extensive due diligence, and gain greater access to company management and information (eg. full look-through of historical financial statements, earnings and audit reports, and environmental or other expert analyses).10

What Are Some Risks of Mezzanine Financing, From the Investor’s Perspective?

As illustratived above, mezzanine is junior in the capital structure to senior debt, and would therefore be secondary priority in the event of a default. Investors should bear this risk in mind, alongside the fact that there is often no collateral either in a mezzanine transaction.

Because mezzanine financing is typically privately negotiated, and can carry a longer term (up to 8 years11), it is significantly less liquid than traditional, public market securities.

Mezzanine is commonly utilized by middle-market companies in their growth phase. This business profile presents its own potential risks, such as a less experienced management team, a greater net effect in instances of capital losses (eg. loss of a key customer), and the overall risk that the venture does not succeed.

Other Considerations About Mezzanine Financing

What’s an Example of Mezzanine Finance?

Mezzanine finance incorporates debt and equity financing that’s typically used by middle market companies. Here’s an example: A small business owner may be likely to seek mezzanine funding if their business needs growth capital, but has already reached its capacity to take on another bank loan.

In theory, the business could just issue common stock, but it could risk dilution. Thus, the owner may opt for mezzanine capital. This form of financing typically comes with higher interest rates, but it can also provide more flexibility.

For instance, a borrower could receive funding that combines interest payments and PIK (Payment in Kind) interest, which mayallow them to protect cash flow.

Mezzanine Finance vs. Equity Finance: What’s the Difference Between the Two?

When it comes to business owners, both mezzanine and equity finance are can be important tools, but they have different structures. Here’s a breakdown:

Mezzanine finance is the middle ground between senior debt and common equity, which is usually characterized by higher returns than traditional bank loans because they are higher risk.

Equity finance typically involves selling a part of the business (common stock or preferred stock) in order to raise capital.

Further, mezzanine financing usually comes with tax-deductible interest payments, allowing companies that leverage this type of financing to write off interest as a business expense.12 On the other hand, equity financing can dilute ownership, but it doesn’t call for amortization or short-term repayment, which may be beneficial, depending on the situation.

What Are Different Types of Mezzanine Financing?

Mezzanine financing is diverse, tailored to suit various needs in the commercial real estate and corporate sectors. Some common types include:

Mezzanine loans: A type of financing where the borrower defaults and lenders can convert their debt into an ownership or equity interest, usually after senior lenders are paid.

Preferred equity: Resembling common equity but with a higher claim on assets and earnings. It's above common stock but below debt in the capital stack.

Subordinated debt: A form of debt that ranks after senior lenders in case of default. It carries higher risk and thus often demands higher interest rates.

PIK (Payment In Kind) loans: Instead of cash interest payments, the interest compounds or is paid by issuing additional securities.

Management and leveraged buyouts: Mezzanine capital can support management buyouts, where management teams buy a significant stake, or leveraged buyouts, where external parties acquire companies using a significant amount of borrowed money.

Providers of mezzanine funding typically seek businesses with strong management teams, clear growth strategies, and stable cash flows, seeking a return on investment.