The private debt asset class, otherwise referred to as direct lending, has tripled in size since 2008—its growth helped by investors seeking alternative sources of income in a near-zero interest rate environment.1 However, the shift into a new, harsher rising-rate environment appears to be changing the potential risk and reward profile of the asset class.

Moving forward, advisors may benefit from a more rigorous approach when comparing performing credit strategies broadly or assessing whether and how to add more direct lending exposure to their client portfolios. In this piece, we explore how certain tradeoffs related to direct lending and other credit strategies appear to be playing out in today’s market environment.

We believe that while underwriting trends point towards better lender protection in new loan deals, performance across direct lending portfolios may begin to widen given the rising probability of a true credit downturn. If we continue to see a sustained pullback in liquidity, some companies that had fueled their growth through cheaper debt financing may potentially face unsustainable capital structures.

In this environment, we believe there will be winners and losers at the company level and a greater spread of outcomes among the funds that provide capital to those companies.

Now, more than at any time in the past decade, it may be important to seek out managers with the resources and experience to employ rigorous credit selection, negotiate lender-protective terms and maximize value in default scenarios. To further mitigate against growing risks, advisors may also consider diversifying across multiple high-quality managers to decrease loan-level concentration risk.

Comparing Alternative Income Sources

Advisors looking beyond a traditional 60/40 allocation have a variety of income-based investment options beyond investment-grade bonds, with varying degrees of potential risks. In this section, we compare direct lending with high-yield bonds and leveraged loans.

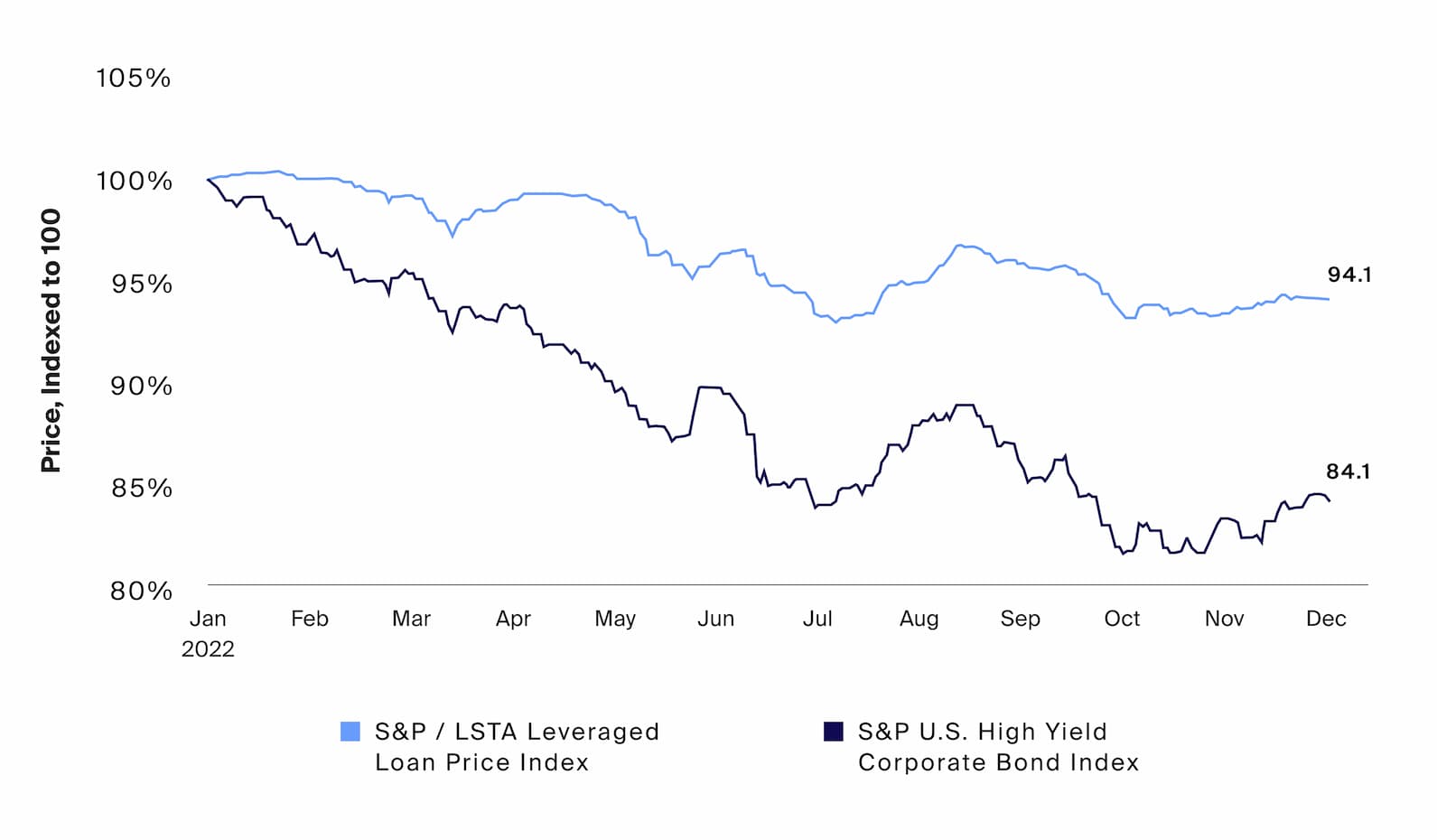

This year, both high-yield bonds and leveraged loans experienced price declines (Exhibit 1), and market participants, including hedge funds, have shown renewed interest in these asset classes given their higher yields.2 However, there are important considerations when assessing these publicly traded credit assets.

Source: Bloomberg, S&P U.S. High Yield Corporate Bond Index, S&P/LSTA Loan Price Index, as of 12/5/2022.

This year, both high-yield bonds and leveraged loans experienced price declines, and market participants, including hedge funds, have shown renewed interest in these asset classes given their higher yields. However, there are important considerations when assessing these publicly traded credit assets.

The Fed continues to hold fast in its hawkish positioning, re-emphasizing the risk of pausing or reversing rate hikes too soon.3 While rate hikes may slow, most economists surveyed by Bloomberg did not expect rates to peak until at least the end of Q1 2023.4 Meanwhile, they were split on whether a reversal may occur later in 2023. Some surveyed also held the view that the market rebound to the soft CPI (Consumer Price Index) print in October may have been a premature reaction.

Advisors seeking lower duration and lower volatility debt to mitigate against the potential for continued interest rate increases or heightened recession risks may prefer the characteristics offered by direct loans over high-yield bonds.5 High-yield bonds, while broadly shorter in duration than their investment-grade counterparts,6 are still more sensitive to potential interest-rate fluctuations compared to direct loans with floating rate structures, whose rates are reset every 30 to 90 days.7 As recession risks rise, secured loans may also provide greater downside protection, as historically the asset class has had lower default rates and higher recovery ratios than high-yield bonds.8

Direct loans, particularly of the first lien and senior secured variety that make up most of the direct lending market,9 may also mitigate against the risk of capital losses given these assets are positioned at the top of the capital structure. In contrast, high-yield bonds are often further down in the capital structure and unsecured, putting them at greater risk of principal loss in a restructuring, all else equal.10 Investors with higher risk appetites looking to take advantage of a credit downturn scenario may also prefer stressed and distressed credit securities.

This year, we have also seen differences within the broader loan market.11 For instance, the syndicated loan market experienced the same volatility felt by public equity markets, which appeared to lead to lower year-over-year issuance so far in 2022. By comparison, the private credit market appears to be just as active as last year, with many participants taking advantage of its differentiating features, such as the ability to customize deal terms, the absence of rating requirements, a greater likelihood of financing and the efficiency that comes with fewer involved parties.12

Direct lending may continue to be an attractive asset class for advisors seeking positive inflation-adjusted income, given its floating rate nature and higher priority in the capital structure. Even so, potential investments in direct lending funds still involve significant credit risk and demand greater scrutiny as we face the possibility of slower economic growth or recession.

Shifting Market Dynamics in Direct Lending

In the near term, demand for direct lending seems to be challenged by an M&A slowdown in private equity (PE), which may get worse before it gets better.13 As much as 75% of the demand within direct lending is driven by PE, so that decline in M&A may also mean less demand for PE-sponsored direct lending deals.14

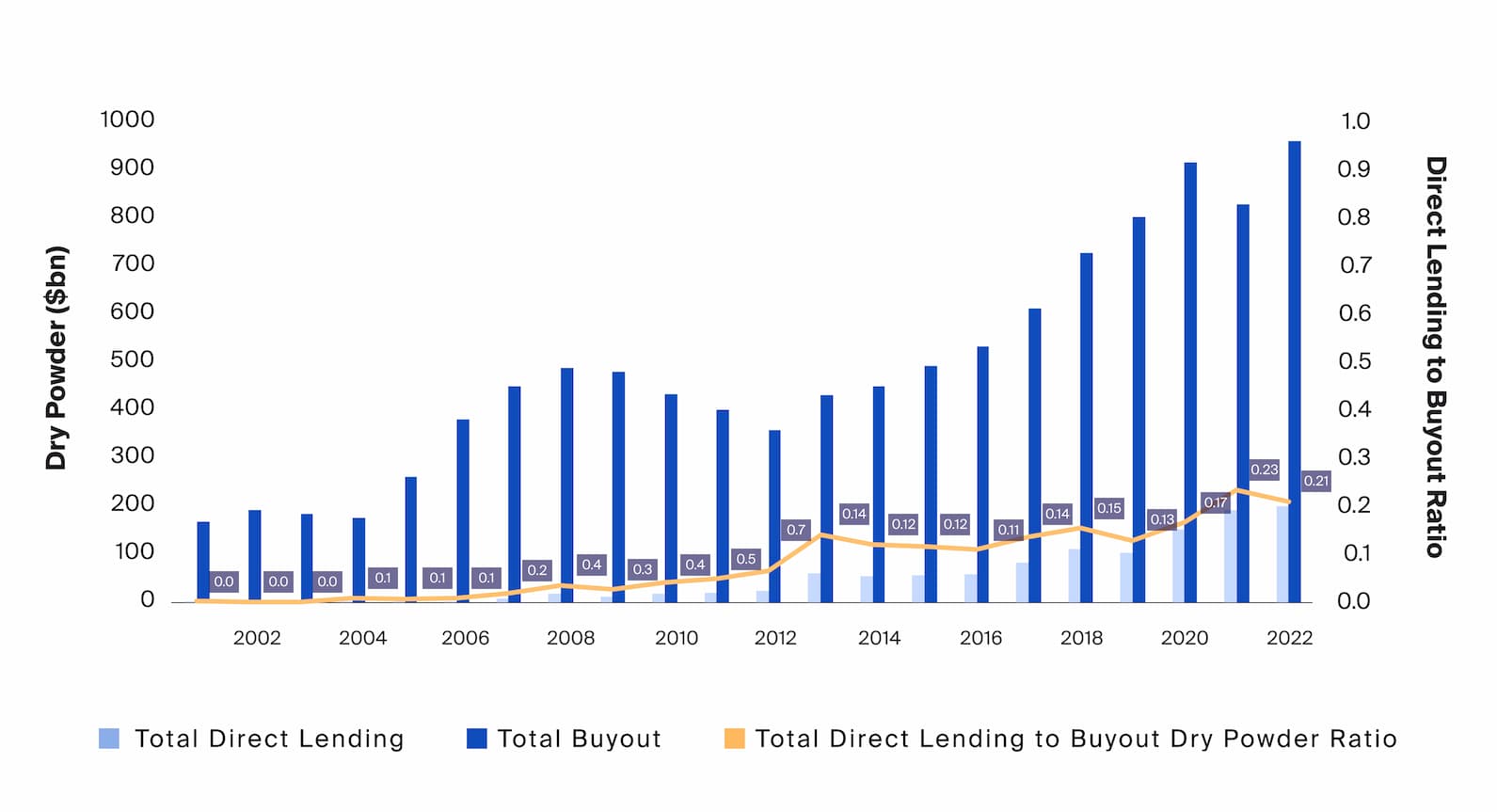

While we expect this slowdown in sponsored deal flow to continue in the near term, activity should eventually resume.15 We are seeing a significant gap between the amount of dry powder—i.e., committed but still unallocated capital—in private equity and direct lending (Exhibit 2). If PE activity picks up in the medium term, either because of an improved execution environment or as PE managers are incentivized to deploy within their limited investment windows, we believe that overhang in dry powder could potentially drive opportunity in direct lending.

Source: Preqin, Direct Lending Dry Powder Total, Buyout Dry Powder Total, as of 11/2022.

We are seeing a significant gap between the amount of dry powder—i.e., committed but still unallocated capital—in private equity and direct lending. If PE activity picks up in the medium term, either because of an improved execution environment or as PE managers are incentivized to deploy within their limited investment windows, we believe that overhang in dry powder could potentially drive opportunity in direct lending.

Indeed, despite the growth in direct lending over the last decade, private equity managers—specifically those focused on buyout opportunities—still have far more dry powder at their disposal than direct lenders. In other words, when activity resumes, we should still see more significant PE-sponsored demand for direct lending. The recent slowdown in deal activity has also not been uniform. Deal activity for lower middle market companies remained strong through Q3 2022.16

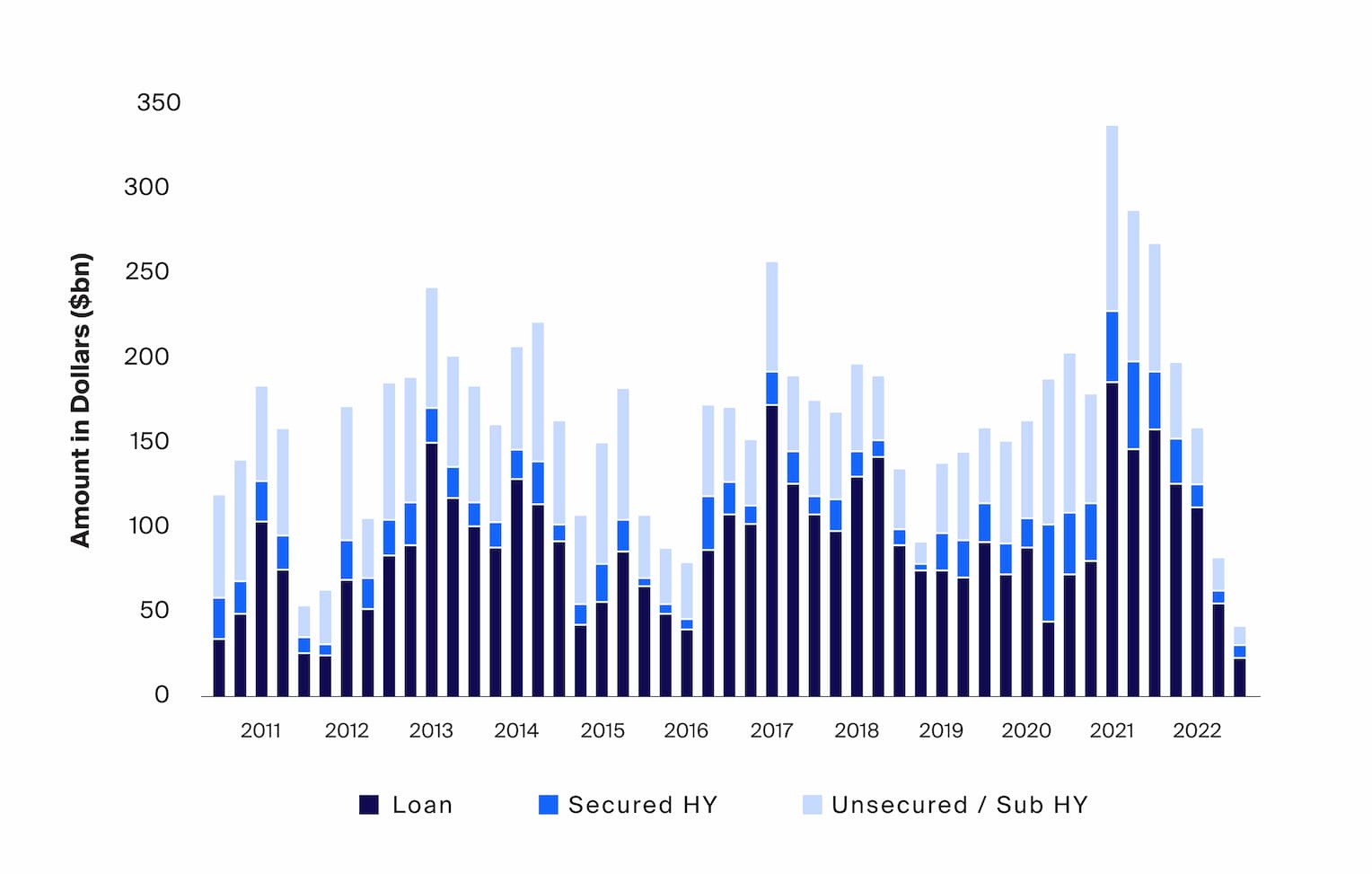

Source: Pitchbook, Leveraged Commentary & Data (LCD), as of 9/2022.

Despite the growth in direct lending over the last decade, private equity managers—specifically those focused on buyout opportunities—still have far more dry powder at their disposal than direct lenders. In other words, when activity resumes, we should still see more significant PE-sponsored demand for direct lending. The recent slowdown in deal activity has also not been uniform.

Challenged by higher costs and lack of access, larger private companies are experiencing a dearth of traditional, public market debt financing options.17 As a result, there has been an increase in “non-sponsor” deal flow for lenders who focus on the upper middle market.18 The decline of activity in public debt issuance has also been beneficial for direct lenders in pricing their deals. Previously, prices had generally been set by banks within the broadly syndicated market and then assumed by lenders in the private market; with less activity and competition from the public space, direct lenders can now set terms that are more in line with credit fundamentals.19

The net balance of these factors may indicate a mixed short-term outlook for private credit demand, but potentially strong tailwinds in the medium to longer term. Advisors may benefit from partnering with managers that have established sourcing capabilities in the non-sponsored space with the scale and available capital to provide debt financing solutions to larger companies, which typically raise debt capital in the public markets.

Potential Impending Credit Stress

Though we have yet to see significant price adjustments in private lending, moving forward, direct lenders may still be exposed to the same risks that have caused spreads to widen in high-yield and broadly syndicated loan markets.

Few, if any, companies that acquire debt are immune to the current market challenges—such as high inflation, tight labor market, potential recession, and rising interest rates. These factors may impact earnings and their ability to service their debt obligations over time. Companies financed with floating rate loans—rather than fixed-rate debt, like high-yield bonds—may experience even more immediate consequences of the rising interest rate environment. When the reference rate of those loans, typically LIBOR or SOFR, rises in lockstep with the Fed funds target rates, their interest expenses increase too.20

From the perspective of the capital provider, this scenario is a double-edged sword: on one side, the lender can benefit from the rising yield, while on the other side, the risk of default increases.21 Already, interest coverage ratios and debt-to-EBITDA ratios—commonly utilized measures of creditworthiness—are under pressure, particularly for loans underwritten prior to the Fed rate hikes.22 Default rates for U.S. loans have already begun to rise, increasing to 1.1% by the end of Q3 2022, but are still well below the historical average.23

Valuations in the private markets are expected to eventually catch up to more widely traded market credit spreads.24 This catch-up, however, will likely be on a company-by-company and loan-by-loan basis, as some will fare better than others based on each loan’s terms, the degree of leverage employed and the relative impact of a downturn on the company’s earnings.25

Direct lenders may have an advantage over their broadly syndicated counterparts on this front as well. Comparatively, private loans tend to have more simplified capital structures and involve fewer parties, making it easier to reorganize or “work out” their loans when needed.26 In addition, their focus on first-lien senior secured loans and unitranche strategies, as well as their efforts to include protective covenants, may lead to stronger recovery rates.

Advisors may consider closely scrutinizing their underlying sector exposure in private credit, with particular attention to industries that are more cyclical and consumer-facing. We believe deterioration in fundamentals in those types of companies may cut into their margins and earnings, thus potentially hindering their ability to service debt obligations.

Underwriting Trends in Direct Lending

Recent market challenges have seemingly driven private lenders to ramp up protective covenants in the new loans they originate. As we mentioned previously, lenders are generally facing less competition and are better positioned to command better terms.

Many seem to be using this influence to take a more conservative approach in anticipation of deteriorating economic conditions. For example, leverage, as measured by the debt-to-EBITDA ratio, in new deals has fallen by a full turn with companies easily underwriting to 6.5x last year down to below 5-5.25x.27 Additionally, we have seen a severe decline in covenant-lite loans. Lenders also seem to encourage lower levels of leverage in loan-to-value terms and more conservative EBITDA estimates—both potentially increasing interest coverage in a downside scenario.28

All considered, advisors who intend to increase exposure to private credit may prefer funds—either drawdown vehicles or newer BDCs—from qualified managers that are not yet fully invested. Newer loan terms are broadly more protective than those underwritten before the emergence of recent market deterioration.29 As such, a “newer” portfolio may include more protections than a legacy portfolio.

Assessing Asset Manager Experience

Dispersion of performance across direct lending managers had been relatively low during the rise of this asset class in the past decade, perhaps because many managers and funds in the space have only operated in a very benign environment with default rates well below historical averages. New firms that entered the business during this benign period may not have experienced a true, sustained credit downturn and default cycle. Such firms remain untested in their ability to assess credit risk. They also may not have the resources and experience to engage in what can be highly complex and time-intensive post-default workouts and recoveries.30 As such, we believe conducting thorough due diligence on manager capabilities and experience may become increasingly prudent in this new environment.

The proposition for private debt still holds and may be even more appealing—floating rates mean greater yields and less interest rate risk—in a continued rising rate and high inflationary environment. Still, advisors should be wary of potentially increasing credit risk in an economic downturn and an increased likelihood of dispersion in performance by different funds. They can attempt to mitigate these heightened risks by focusing their exposure into acyclical industries, partnering with managers that have proven expertise in rigorous credit selection and workouts, and limiting concentration to individual companies and managers by allocating to multiple high-quality funds that exhibit the characteristics described above.