About This Series

Private equity exposure varies by company size and deal type. This three-part series looks across the capital spectrum—large cap, upper middle market, and lower middle market—to show what each segment offers, where the risks may sit, and how managers are adapting.

What You'll Learn

Upper-middle-market private equity operates within broader middle-market trends that show resilient deal activity and consistent platform-building focus.

Add-on acquisitions now drive the majority of value creation through operational improvements rather than financial engineering.

This segment may offer advisors balanced exposure between large-cap operational sophistication and growth-oriented expansion potential.

What Is Upper-Middle-Market Private Equity? Understanding the Segment and Its Role

Think of the upper-middle-market (UMM) as the Goldilocks zone of private equity between scale and growth—companies valued between $250 million and $1 billion that have professional management and established business models but still have room to expand. Industry data typically aggregates middle-market activity, but managers often approach upper-middle-market deals with platform-building strategies, while lower-middle-market focuses more on founder transitions. Unlike large-cap deals that focus on optimizing mature enterprises, this space is often about platform building: taking strong regional players and helping them become national or even international leaders.

While large-cap managers have become increasingly selective about transactions, UMM funds have found ways to deploy capital through platform expansion. One reason? Market fragmentation in sectors like business services, industrial technology, and specialized manufacturing creates ongoing consolidation opportunities.

For advisors, this segment may offer a different equation than large-cap exposure: more growth potential through systematic expansion but with the operational sophistication and governance expected from established businesses rather than startup ventures.

Mid-Market Private Equity Trends: Steady Activity in an Unsteady Market

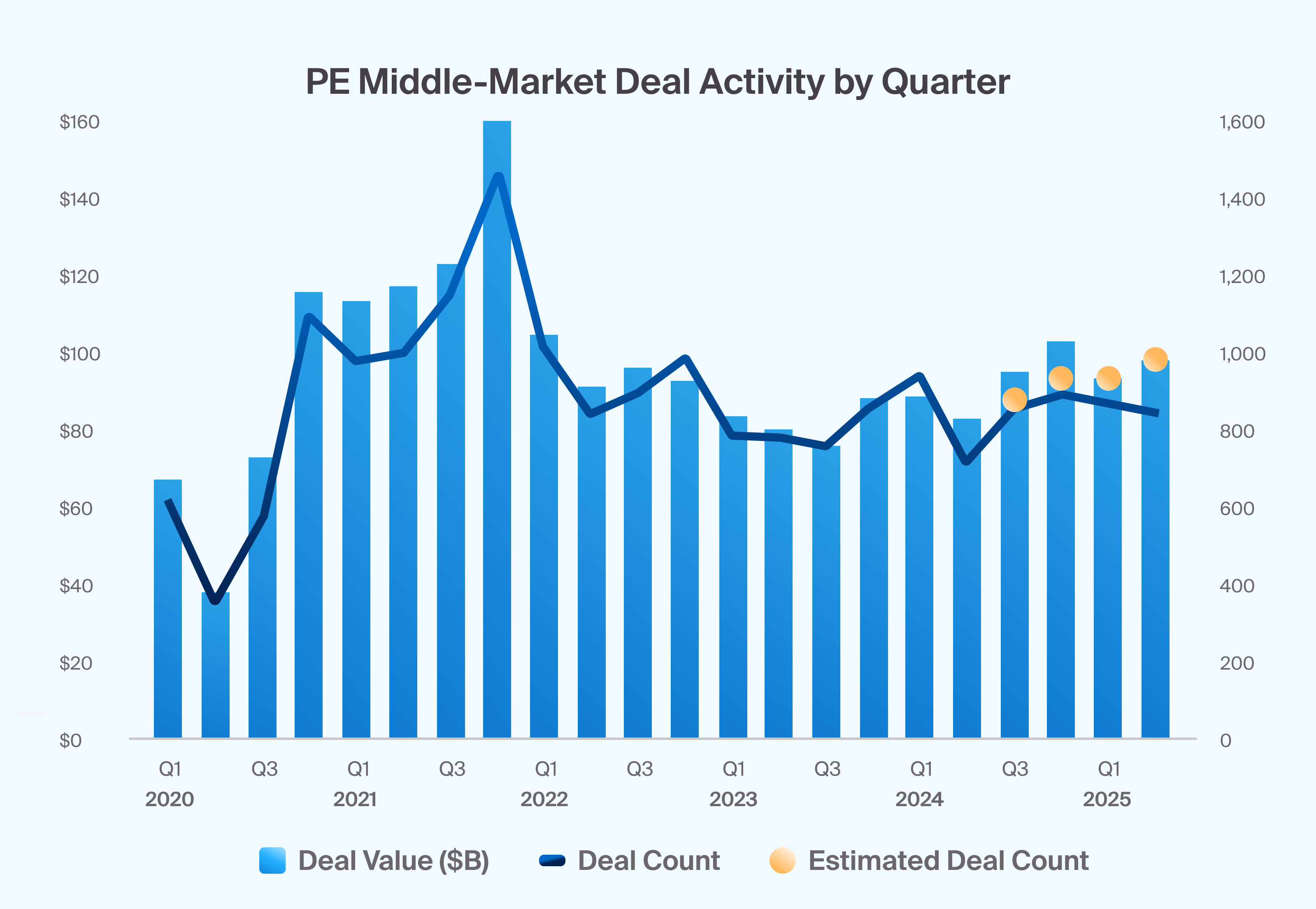

Upper-middle-market activity has shown resilience within broader middle-market trends. Middle-market deals reached $97.2 billion in value during Q2 2025, up 18.1% year-over-year, with 978 deals representing a 39.1% increase in transaction count (Exhibit 1).

Add-on acquisitions have emerged as a key performance driver. Instead of hunting for new platform companies in a competitive market, managers are using their existing portfolio companies as acquisition engines. They’re buying complementary businesses, expanding geographically, and adding service lines that create operational synergies.

Instead of paying premium prices for standalone deals, managers can acquire bolt-ons at more reasonable valuations while leveraging the infrastructure they’ve already built.

Source: Garrett Hinds et al., “US PE Middle Market Report,” Pitchbook, Sep. 12, 2025

Middle-market deal activity has grown in 2025 year-over-year (Exhibit 1)

Operational Value Creation in Upper-Middle-Market Private Equity

The shift away from leverage-driven returns has changed how upper-middle-market managers create value. Revenue growth and margin expansion now contribute the majority of value creation in all private equity, replacing financial engineering as the primary lever.1

What does this mean in practice? Managers are getting more involved with day-to-day business operations. Take industrial distribution as an example. A platform company might standardize inventory systems, negotiate better supplier terms through increased scale, or implement cross-selling programs.

Technology-enabled service businesses offer another model. A regional IT services firm can expand geographically through acquisitions while layering in new capabilities like cybersecurity or cloud migration services. Each add-on can benefit from shared sales teams, standardized service delivery, and combined vendor relationships.

Often, the managers who excel here maintain dedicated operating teams focused on post-acquisition integration, combining systems, aligning processes, and capturing synergies.

Sector Experience Can Create Sustainable Advantages

Deep industry knowledge has remained important for sustainable success. UMM managers often specialize in specific verticals where they understand competitive dynamics, regulatory environments, and operational improvement opportunities.

Consider business services. An experienced manager knows which subsectors are consolidating fastest, which types of companies may fit best in a platform, and how to identify add-on targets that focus on value creation rather than increased scale, for example.

Technology continued to represent the largest share of buyout deals by value in 2024 at 33%, but upper-middle-market strategies often focus on the intersection of technology and traditional industries, businesses that use software to deliver services but aren’t pure tech plays.2

Upper-Middle-Market Private Equity: What’s Working and What’s Getting Harder

Managers with established integration processes and sector experience continued finding attractive opportunities. The carveout market provided ongoing deal flow, representing 11.1% of middle-market deal value in Q2 2025.3

There are sectors that remain fragmented enough to support multiple years of consolidation activity. As such, there are a lot of potential targets, creating sustained opportunity for platform companies with compatible operational capabilities.

But execution has gotten more complex. Integration timelines have stretched as managers prioritize getting the fundamentals right—aligning systems, cultures, and processes takes longer but often creates more durable value. The companies that try to rush through integrations may find themselves with operational headaches that can hurt rather than help performance.

Competition for quality platforms remains. While add-on valuations remain reasonable, establishing new platforms means competing against strategic buyers and other sponsors for the same pool of high-quality leaders.

The Risks and Realities in Private Equity’s Upper Middle Market

Upper-middle-market strategies can demonstrate how different parts of the private equity spectrum adapt to changing conditions. These approaches may offer exposure to companies with institutional governance and professional management, positioned for meaningful expansion through systematic consolidation.

However, the same scale that supports consistent deal flow can also bring distinct risks. Integration may strain management teams when add-on pacing outpaces operational capacity, and competition for high-quality assets keeps valuations elevated. Financing remains available but selective, requiring careful underwriting and capital-structure discipline.

When managers own platforms in fragmented industries, acquisition opportunities often arise more regularly and may provide steady investment activity notwithstanding broader market timing.

For advisors, this segment seeks to bridge operational maturity with growth potential—established businesses early enough in their consolidation journey for value creation. As we’ll explore next, lower-middle-market strategies push the growth focus further, targeting founder-led transitions where entrepreneurial energy meets succession planning needs.