Learn about structured notes, including the three most common strategies advisors can utilize.

What Are Structured Notes?

Structured notes (commonly known as structured investments or structured products) generally refer to debt securities that, in many cases, feature an exposure to the performance of an underlying asset class, such as equities, currencies, or commodities. These investments typically seek to provide some combination of potential coupon payments, enhanced upside participation, and/or a measure of downside protection, all of which can vary greatly by strategy.

While structured notes may offer some features or performance similar to bonds or equities, these securities are typically notes issued by a bank and do not trade on an exchange. Structured notes US issuance volume increased more than 40% between 2023 and 2024, reaching $194 billion in 2024, according to SPi.

In this article we give an example of how structured notes may be structured, identify the three types of products that generally seek to achieve distinct potential outcomes, and outline the general risks and considerations when investing in structured products.

What Is the Composition of a Standard Structured Note?

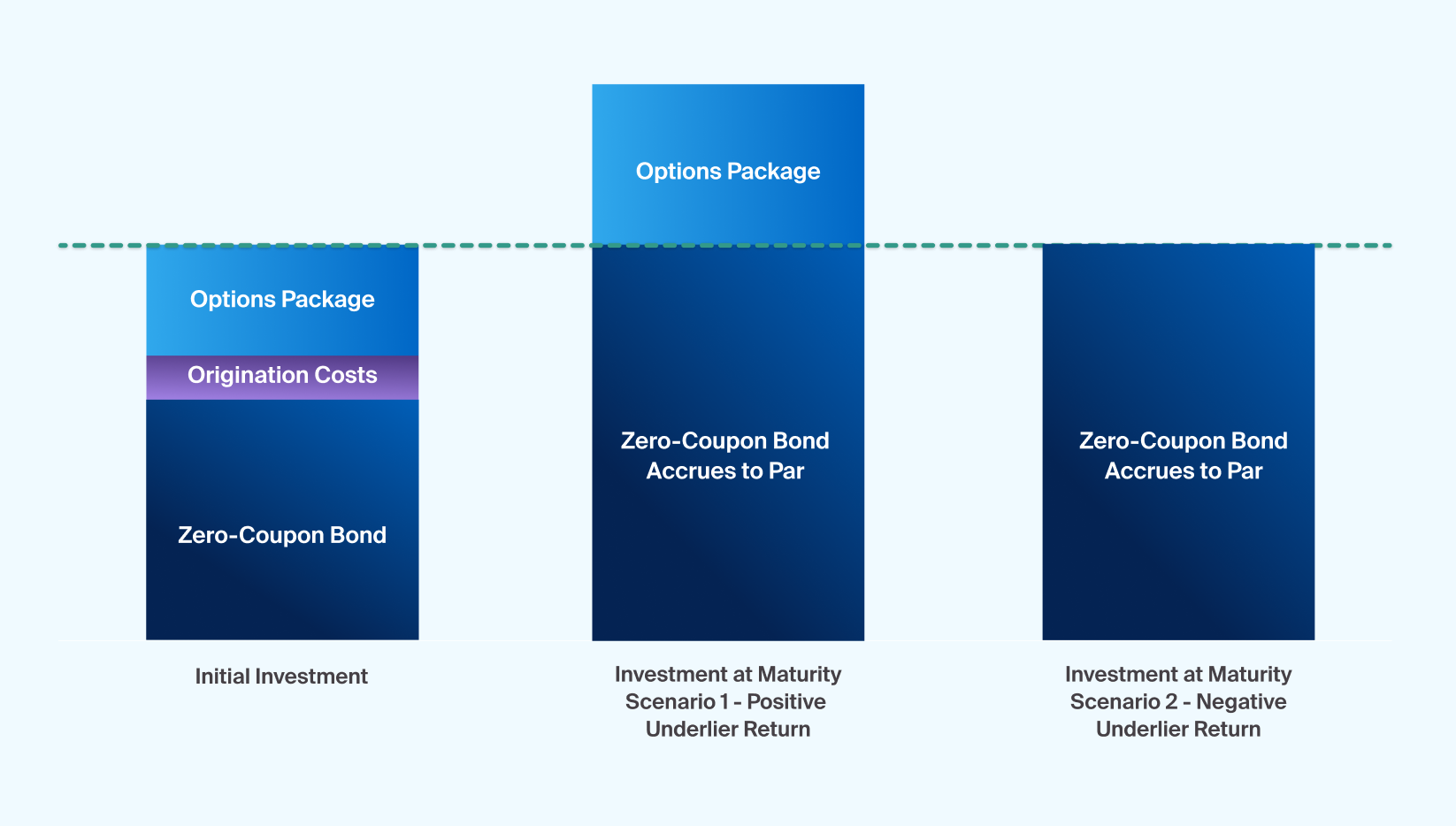

A structured note is often composed of a zero-coupon bond purchased at a discount, built-in origination costs, and a package of derivative components.

To illustrate, let’s use the common example of a growth strategy note. This security generally seeks to offer an advisor enhanced upside participation in the return of an underlier over a stated time horizon. In its standard construction, once the investor’s principal amount is allocated to the debt element of the investment, the remaining capital is used towards origination costs and to purchase call options on the underlier to potentially achieve a specified degree of levered participation relative to the return of the underlier. The return of the note may also be capped or uncapped depending on the terms of the notes.

At maturity, the investor may receive a certain percentage of the performance of the underlier. In the event the underlier declines over the time horizon of the note, the investor can expect to participate in the downside, dependent on the specific details of the growth strategy note purchased and whether downside protection was featured.

The below example illustrates the structure of a standard structured note with downside protection (Exhibit 1). There are many variations of structured notes, which can differ significantly in their complexity, terms, and components.

Footnotes

This illustration is intended solely for illustrative purposes and does not represent a current offering. See important risk considerations at the end of this document. Investors need to review offering documents for a specific offering for a detailed explanation of the potential risks.

This illustration is intended solely for illustrative purposes and does not represent a current offering. See important risk considerations at the end of this document. Investors need to review offering documents for a specific offering for a detailed explanation of the potential risks.

What Are Some Common Strategies of Structured Notes?

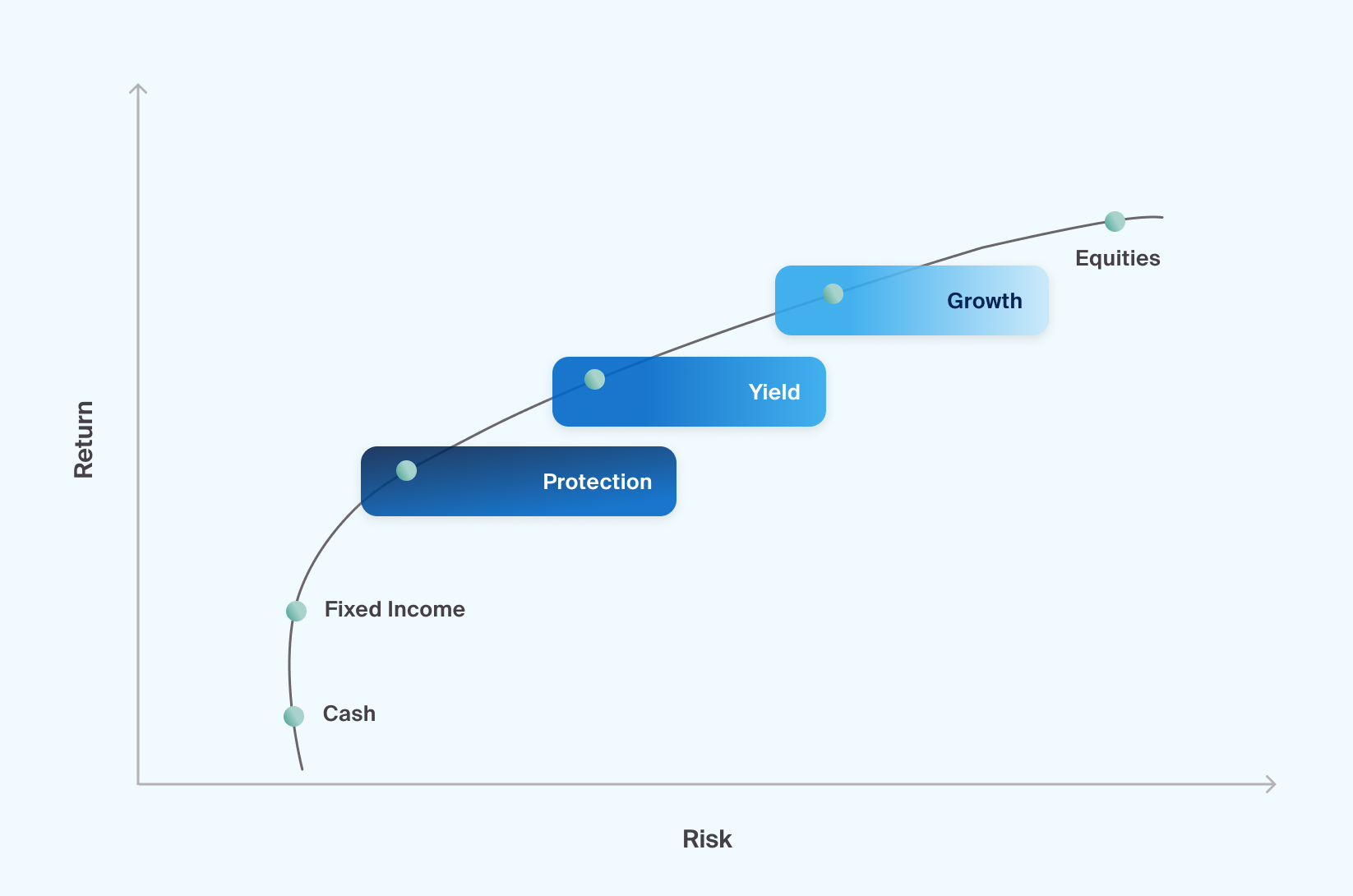

Structured notes can be designed to seek to meet a range of needs and come in a variety of strategies each with custom components and risk-return profiles. Three broad categories of structured notes that focus on distinct potential outcomes are yield, growth, and protection (Exhibit 2).

Yield: Yield notes are designed to seek an enhanced yield relative to comparable fixed income or credit investment strategies.

Growth: Growth notes are designed to seek enhanced upside participation to the return of an underlier, while seeking to provide a degree of downside risk mitigation. The maximum return may be capped or uncapped depending on the note.

Protection: Protection notes are designed to seek market exposure to an underlying asset class or market, while seeking to provide full or partial downside protection.

With a blend of return characteristics and a range of risk-return profiles, structured notes have the potential to serve a wide range of functions in portfolios.

For some advisors, the ability to access some of the performance of a more volatile asset class, through a structured note with features such as the opportunity for full principal repayment or downside protection, may be attractive. Other advisors may view structured notes as a way to potentially increase returns when traditional markets are trading in a narrow range.

Structured notes can be a way to fine-tune portfolio exposure. With a variety of customizable strategies, advisors may aim to work with a bank issuer to design an investment that meets a specific investment goal or serves a particular role in a portfolio.

Footnotes

Structured solutions can be designed to seek to meet a range of needs and come in a variety of strategies each with custom components and risk-return profiles. Three broad categories of structured solutions that focus on distinct potential outcomes are yield, growth and protection.

Some General Risks and Considerations When Investing in Structured Notes

Structured notes have the potential to help advisors meet particular needs in a portfolio. However, given the wide variety of strategies, terms, and components, advisors must take care to understand several key risks that differentiate these investments from traditional securities. The following is a non-exhaustive list of certain considerations. Investors are urged to consult their investment, legal, tax, accounting, and other advisors prior to investing in structured products.

Credit quality of the issuer can be particularly important because receipt of any payments, including any repayment of principal, is dependent on the ability of the issuer to repay it. Investors may diversify their credit risk by purchasing structured products from different issuers.

Pricing and fees may differ by issuer and should be considered when assessing structured notes.

Illiquidity is another important considerations as structured notes generally lack a secondary market, meaning they are relatively illiquid. Structured notes are generally expected to be held till maturity, which may be several or more years.

No direct ownership in underlying assets means that investors that hold structured products that are linked to certain underliers do not have the same rights as holders of the underlying asset. The investor is limited to the pre-specified return potential of the notes and thus will not partake in the same performance of the underlying assets. In addition, investors will not receive any dividends or other distributions from the underlying assets.

Risks to the strategy will vary by security but may include:

Investments may be limited to a cap on upside participation or exposure to the full downside participation of the underlier which may result in a significant portion or complete loss of the investment.

For some notes there will be no incremental returns if underlier(s) do not appreciate.

Other changes in financial markets that make the terms of the note less attractive, such as changes in interest rates.

Tax considerations of an investment in certain offerings of structured products are uncertain. Investors are urged to read the discussion in the applicable structured product supplements and discuss the tax consequences in light of their particular situation with their tax advisor prior to investing.

Structured notes may be an option for advisors to access particular exposures for their clients' portfolio or in a way that seeks to meet their unique needs.