Which Structured Investments Target Downside Principal Protection?

Structured notes (also referred to as structured products or structured investments) generally refer to senior debt securities that have a return potential that is linked to an underlying asset, such as broad-based equity indices, single stocks, currencies, or commodities. These investments typically seek to provide a potential coupon payment, enhanced upside participation, and/or a measure of downside protection to the underlying asset’s performance.

Two types of structures that are designed, but not guaranteed, to protect principal are market-linked certificates of deposit (CDs) and protection notes.

Market-Linked CDs

Market-linked CDs are a type of structure that provides investors with exposure to the performance of an underlier(s) while carrying characteristics associated with traditional CDs, such as full principal protection via FDIC insurance, up to applicable limits.

Protection Notes

Protection notes are another category of structured notes designed to protect from potential losses. These notes primarily aim to limit downside principal risk while still providing an opportunity for equity-like returns. Protection notes are backed by the creditworthiness of the issuer. Any payment or delivery to be made on a structured note, including any repayment of principal, depends on the creditworthiness and ability of the issuer to satisfy its obligations.

Beyond market-linked CDs and protection notes, structured notes may offer various types and degrees of protection to help mitigate principal risk

What Are the Different Types of Downside Protection in Structured Notes?

100% Floors

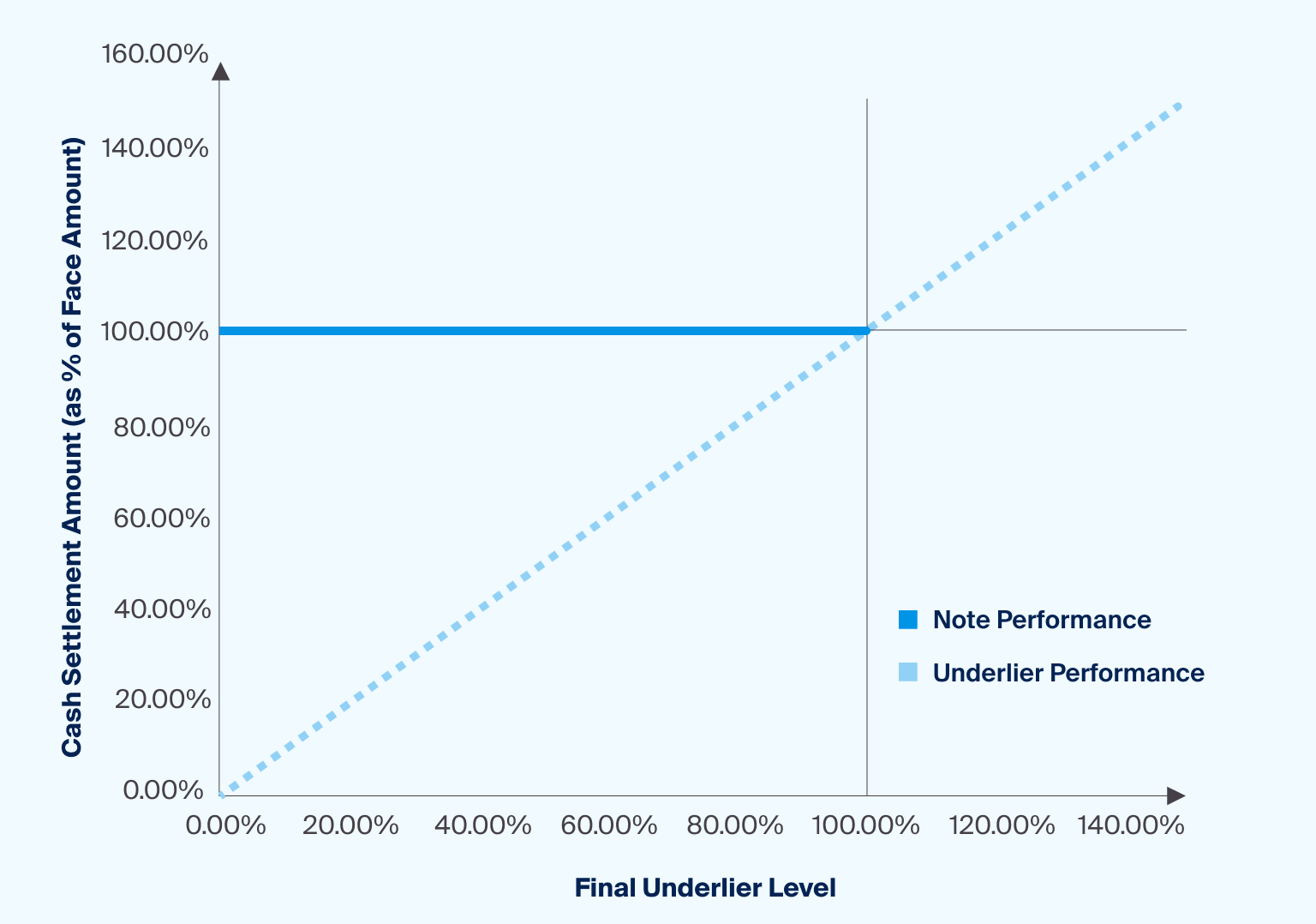

A 100% floor offered by an issuer creates the potential for protection against the downside market risk of the underlier whereby if the underlier remains the same or declines from the initial level to the final underlier level, the investor will receive their initial investment at maturity. These are available as a structured note or a market-linked CD.

Sample Illustration of a 100% Floor

Partial Floors

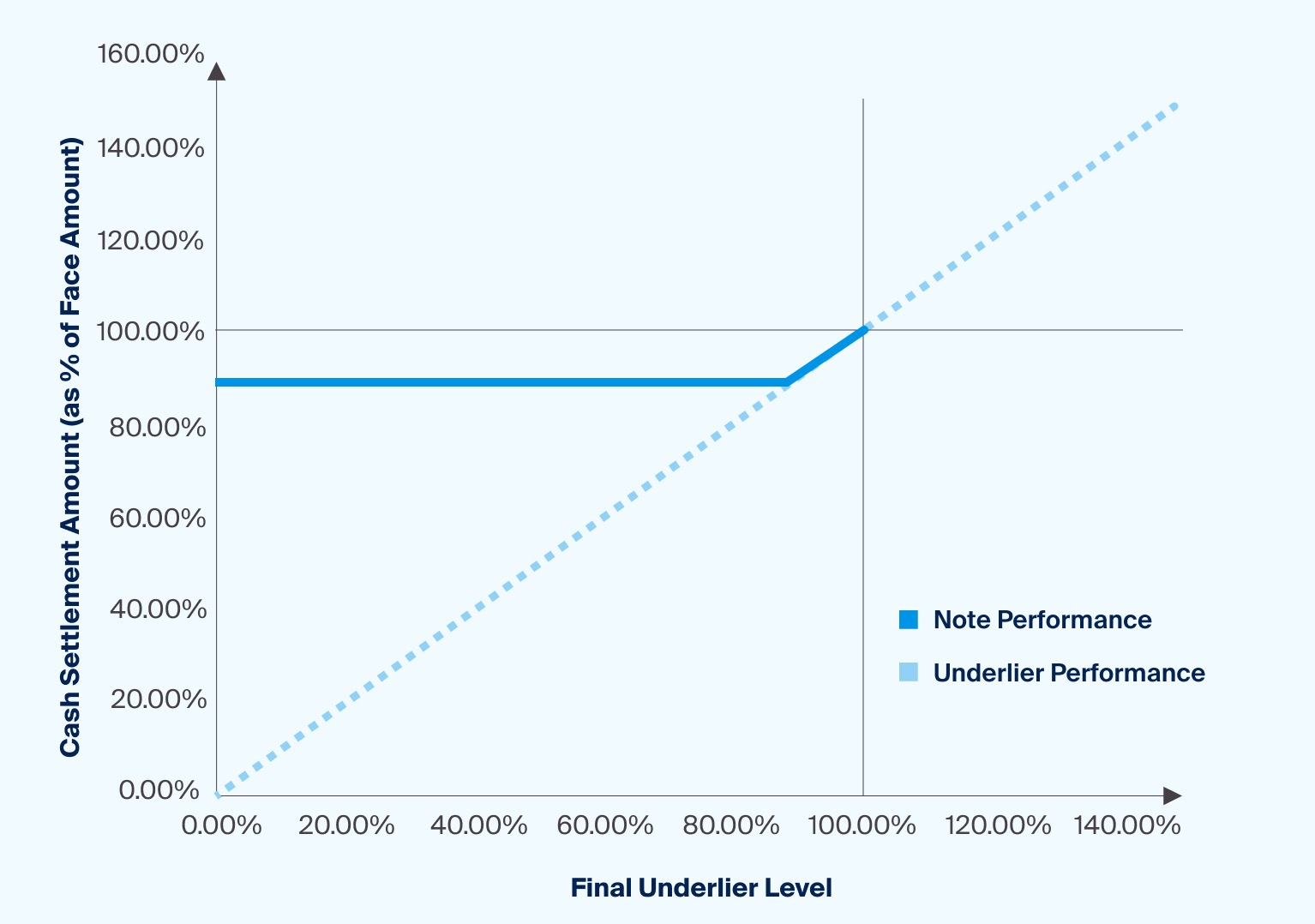

A partial floor offered by an issuer creates the potential for partial protection against the downside market risk of the underlier, whereby the investor will be exposed to any negative underlier performance down to the floor percentage at which the investor will receive a set percentage of their initial investment at maturity.

Sample Illustration of a Partial Floor (90%)

Buffers

Hard buffers, also known as hard protection, vanilla buffers, vanilla airbags, and static buffers, may protect a portion of principal investment from the downside market risk of the underliers, whereby if the underlier declines below the buffer level the investor will be exposed to the underlier return at maturity, lessened by the buffer amount. Depending upon market conditions and the underlier, there may be almost a full loss of principal investment at maturity despite the hard buffer.

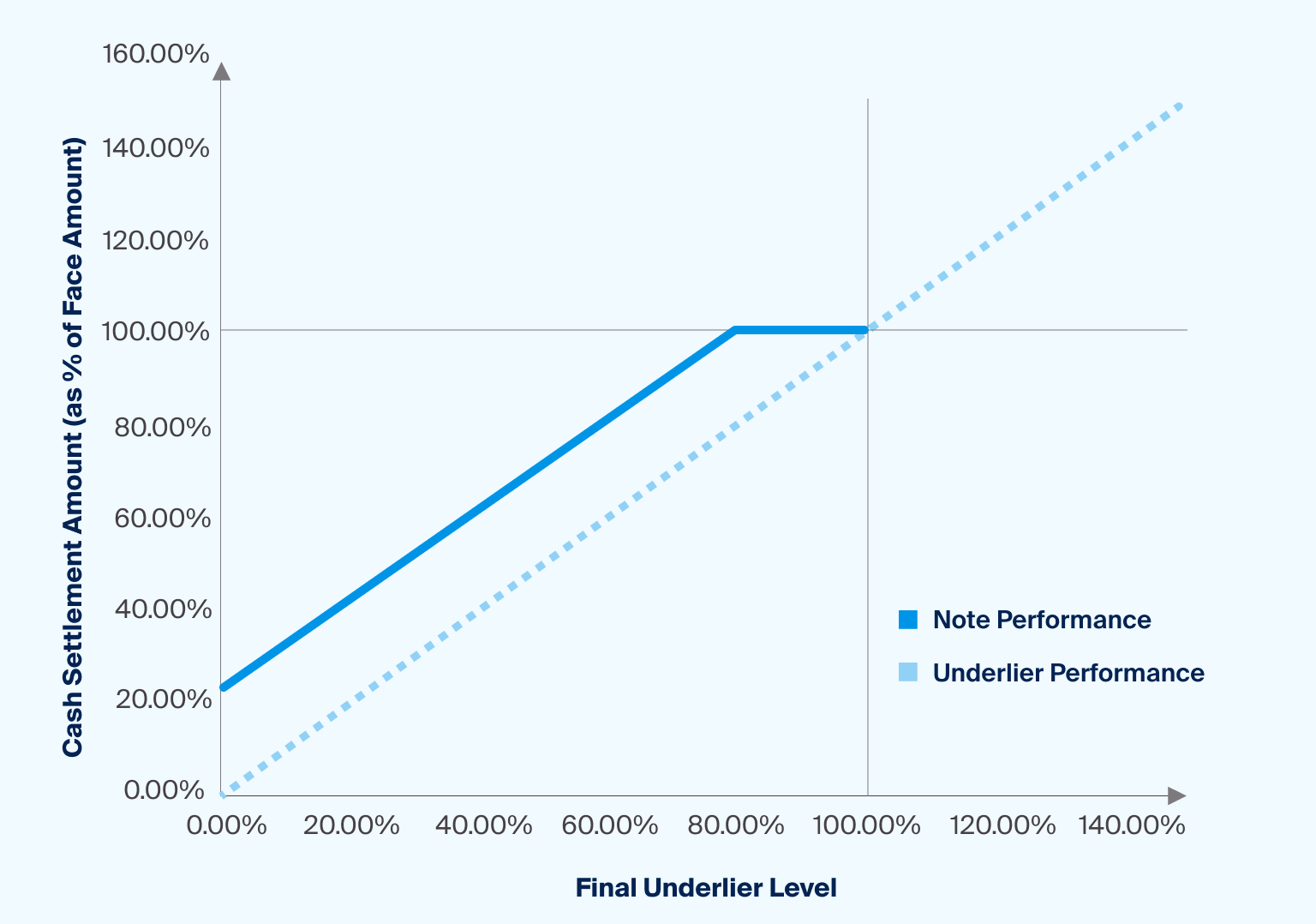

Sample Illustration of a Hard Buffer

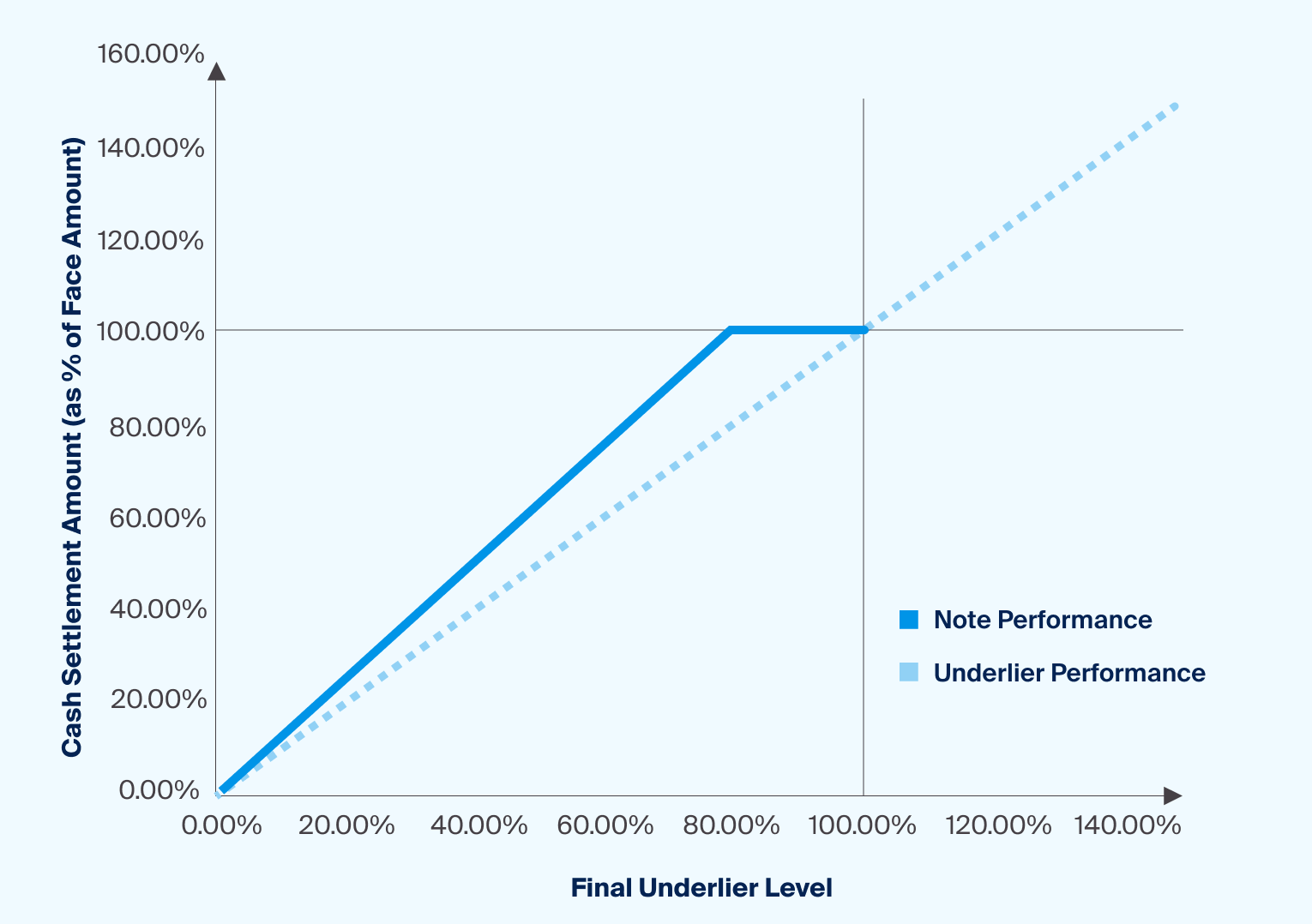

Geared buffers, also known as levered buffers, geared airbags, and fading buffers, may protect principal investment down to the buffer level. If the underlier declines below the buffer level the investor will lose at a rate greater than 1% of for each 1% that the underlier is less than the buffer level. Depending upon market conditions and the underlier, there may be full loss of principal investment at maturity despite the geared buffer.

Sample Illustration of a Geared Buffer | 75% Threshold (25% Geared Buffer)

Barriers

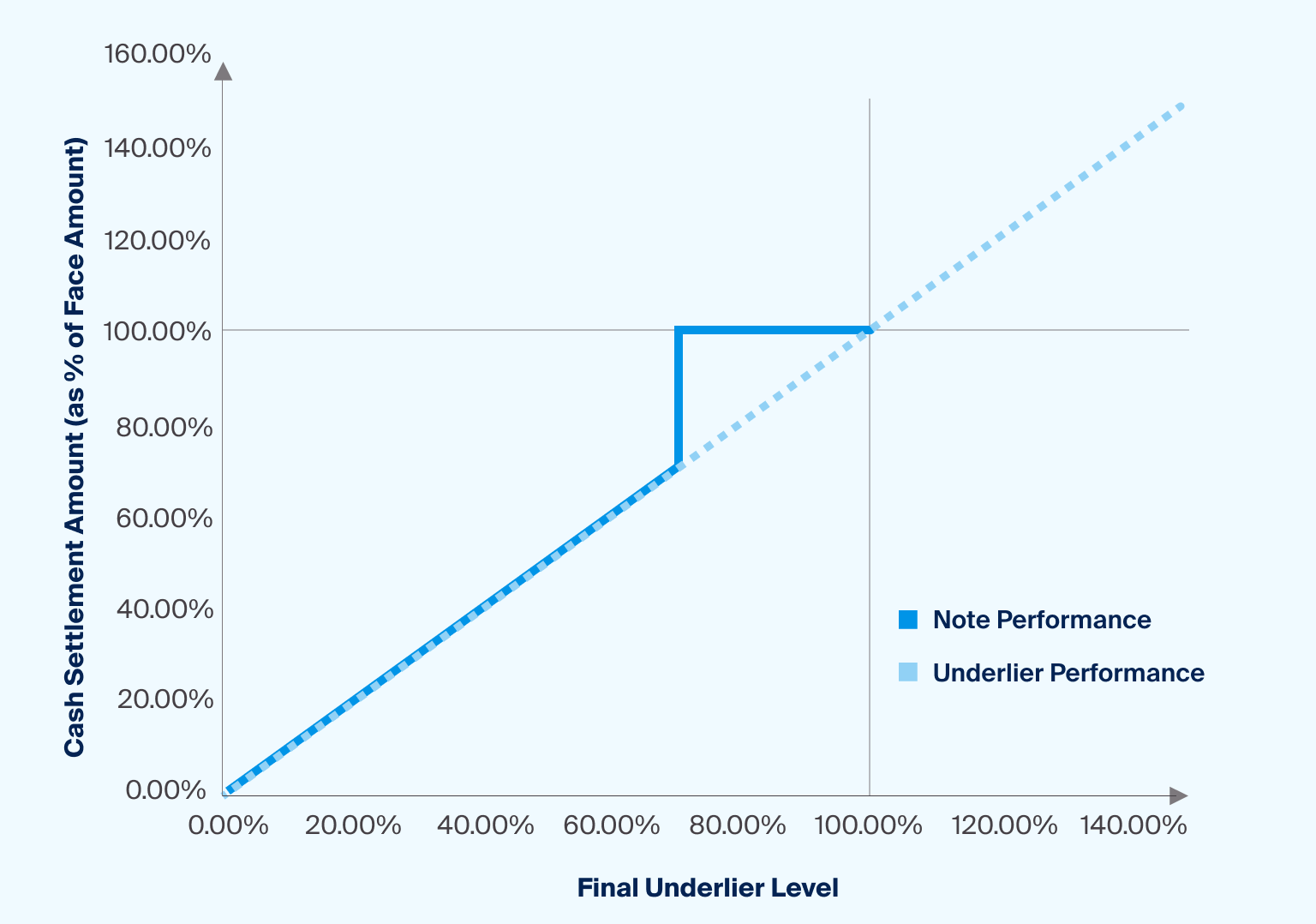

Barriers, also known as soft protection, cliff loss, trigger, and contingent buffers, may protect principal investment down to the barrier level. If the underlier drops below the barrier level, the investor will be exposed to the underlier return on a 1 to 1 basis. Depending upon market conditions and the underlier, there may be a full loss of principal investment at maturity despite the barrier. Barriers can be observed at different observation frequencies.

Sample Illustration of a Barrier | 70% Barrier

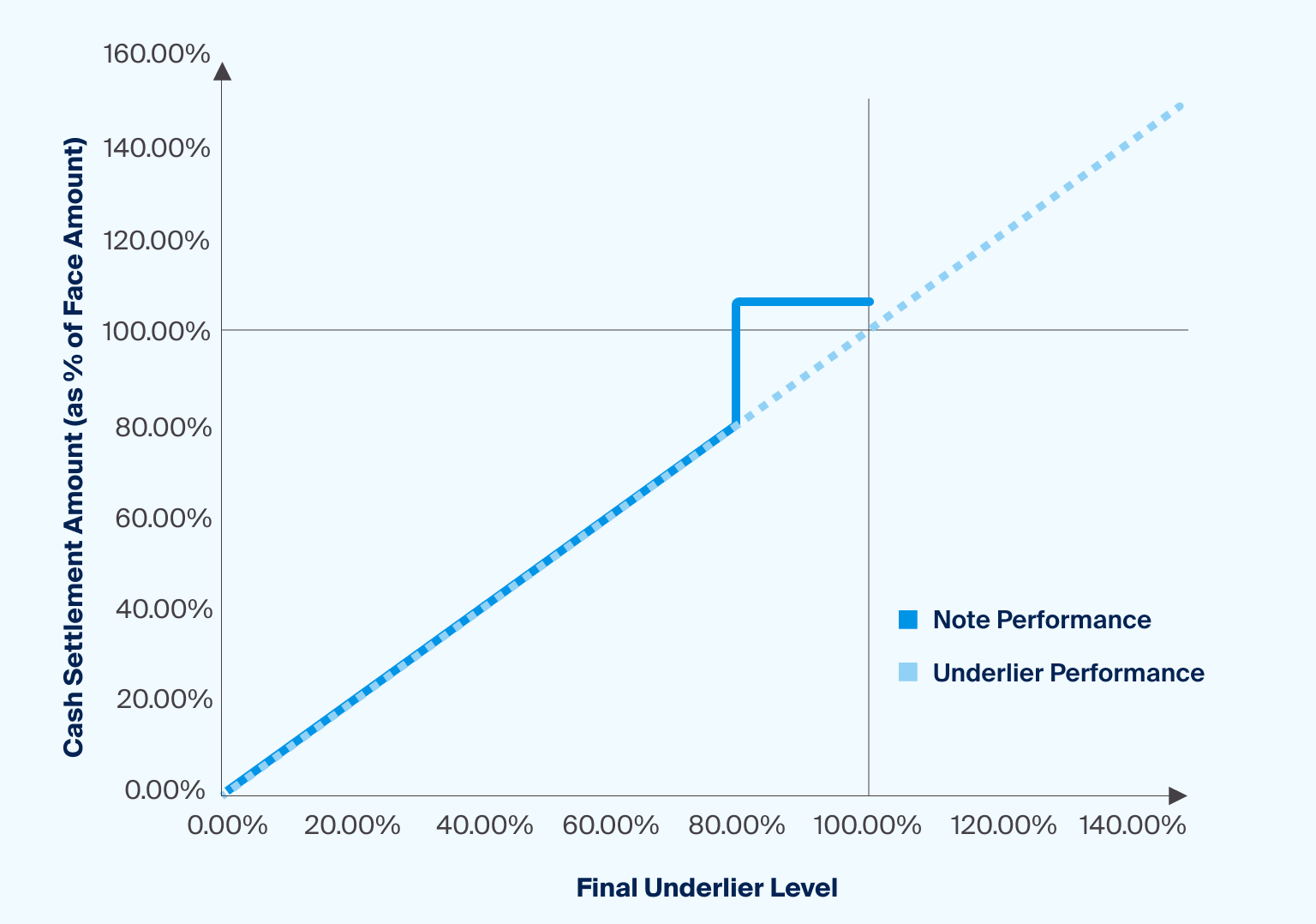

An in-the-money digital barrier may provide a specified digital return down to the barrier level. if the underlier drops below the barrier level, the investor will be exposed to the underlier return on a one-to-one basis.

Depending upon market conditions and the underlier, there may be a full loss of principal investment at maturity, despite the barrier. Barriers can be observed at different observation frequencies.

Sample Illustration of an In-The-Money Digital Barrier | 80% Barrier (4% Digital Return)

Dual Directional Buffer

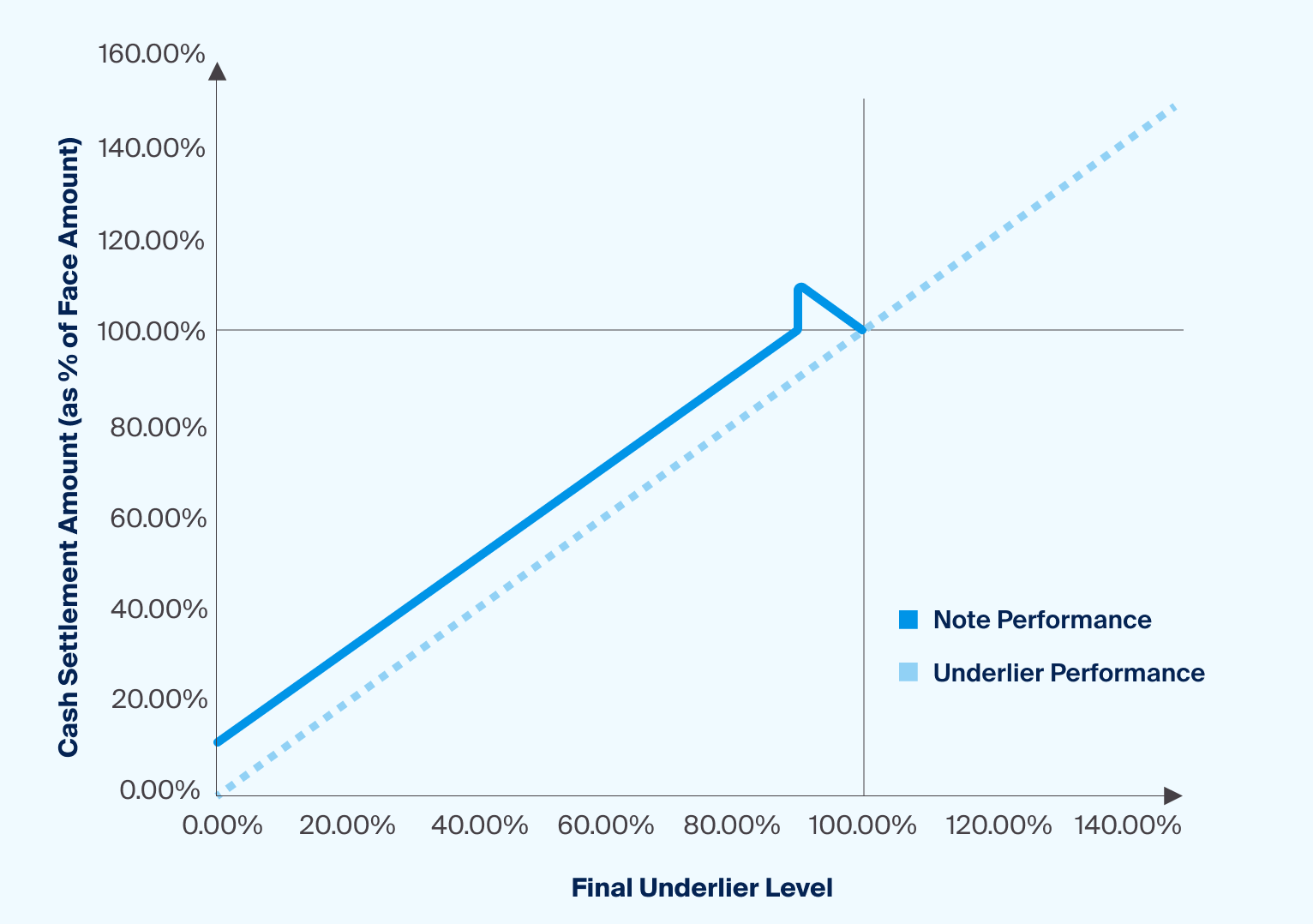

A dual directional buffer, also known as a bearish shark fin, twin-win, and absolute return, may provide an absolute return exposure relative to the underlier. If the underlier drops below the buffer level, the investor will be exposed to the underlier return at maturity, lessened by the buffer amount. Depending upon market conditions and the underlier, there may be almost a full loss of principal investment at maturity despite the buffer.

Sample Illustration of a Dual Directional (Buffer) | 90% Threshold (10% Absolute Return Buffer)

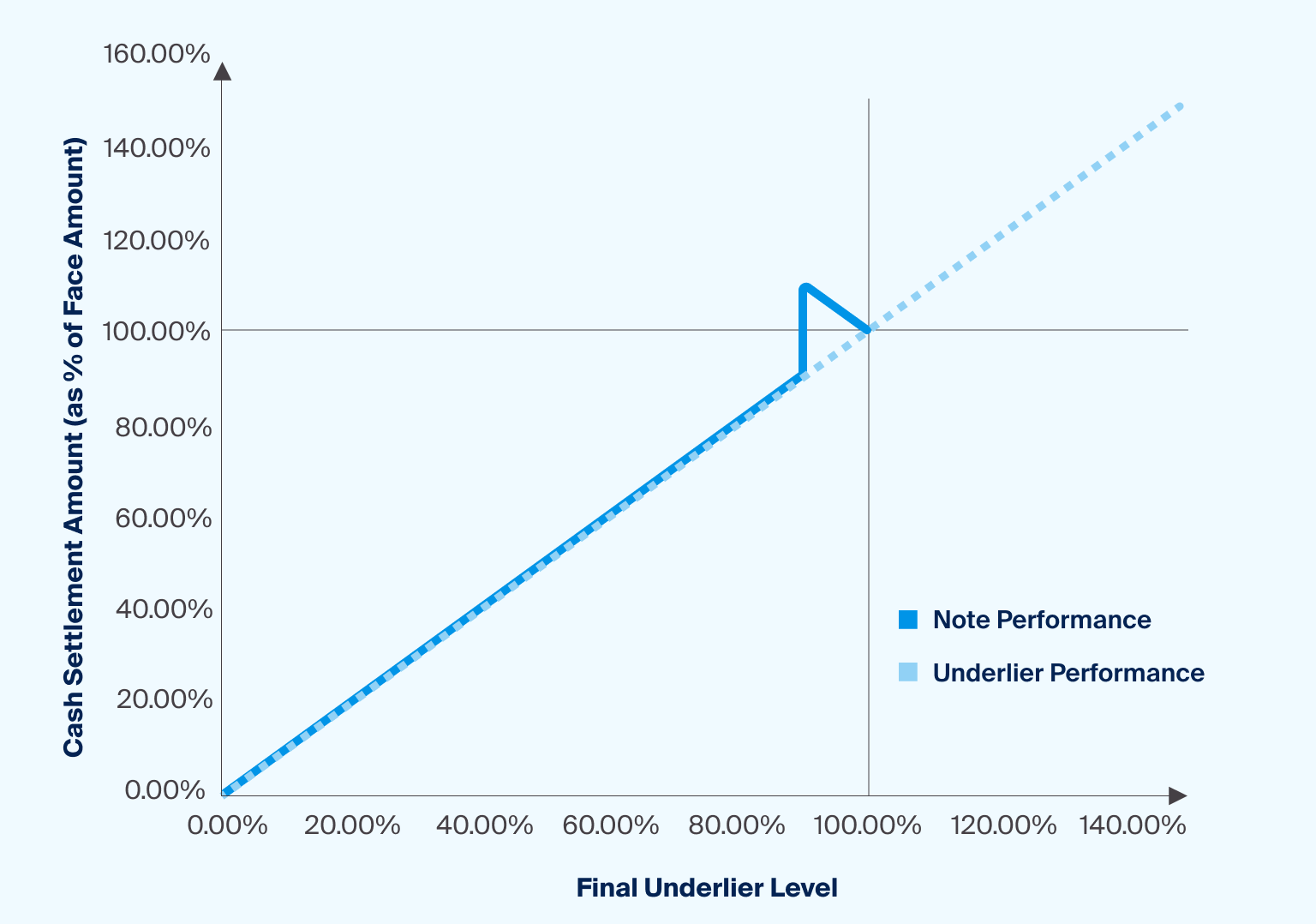

Dual Directional Barrier

A dual directional barrier may provide an absolute return exposure relative to the underlier. If the underlier drops below the barrier level, the principal investment will be exposed to the underlier return on a one-to-one basis. Depending upon market conditions and the underlier, there may be a full loss of principal investment at maturity despite the dual directional barrier.

Sample Illustration of a Dual Directional Barrier | 85% Absolute Return Barrier

What Are Some Risks of Investing in Market-Linked CDs and Protection Notes?

Market-linked CDs and protection notes may provide various features designed to balance risk and return. The various forms of downside protection, including floors, partial floors, buffers, barriers, and dual directionals, can cater to different risk appetites and investment objectives. As with any financial instrument, it is important to understand the specific terms of structured notes, review prospectuses, and consider the context of the overall investment strategy.

Prior to investing, please review notable investment risks associated with structured notes, such as:

Credit risk

Market risk

Liquidity risk

Reinvestment risk

Tax treatment

Dividends & distributions on underlying assets

Principal risk