What You’ll Learn

How private equity allocations may affect portfolio performance, depending on funding source and sizing

How thematic exposures like GP stakes, AI, and sports media may complement core allocations

Considerations for blending evergreen and drawdown fund structures

While private equity (PE) has long been associated with traditional buyouts, today’s opportunity set spans a wider range of strategies, company stages, geographies, and themes. For advisors, this presents both potential opportunity and complexity. Diversifying within private equity may help manage risk and capture its potential.

Understanding Private Equity’s Diverse Landscape

Like other segments of the alternatives market, private equity is not monolithic. It encompasses a broad spectrum of investment approaches, each with its own risk-return profile, time horizon, and implementation considerations. Advisors seeking to build diversified portfolios within private equity can explore several dimensions.

Stage of Investment

The lifecycle of a private company creates natural diversification opportunities across investment stages:

Venture capital focuses on early-stage companies with disruptive ideas but limited revenue. While risk of failure is high, successful investments can deliver outsized returns.1

Growth equity targets companies that are more established, often with proven business models and accelerating revenue, but still require capital to scale.

Buyouts involve acquiring mature companies, often with the goal of driving operational improvements or restructuring to increase value.

Each stage offers different levels of risk, return potential, and holding periods. Combining exposure across the lifecycle may help smooth performance across market cycles.

Sector Focus

Private equity managers often specialize in specific industries, such as healthcare, technology, consumer, or industrials. Sector-specific strategies can offer deep expertise and value creation opportunities but also introduce concentration risk. Allocating across sectors may allow advisors to balance cyclical and secular growth dynamics and potentially reduce correlation to public equity sectors.2

Geographic Scope

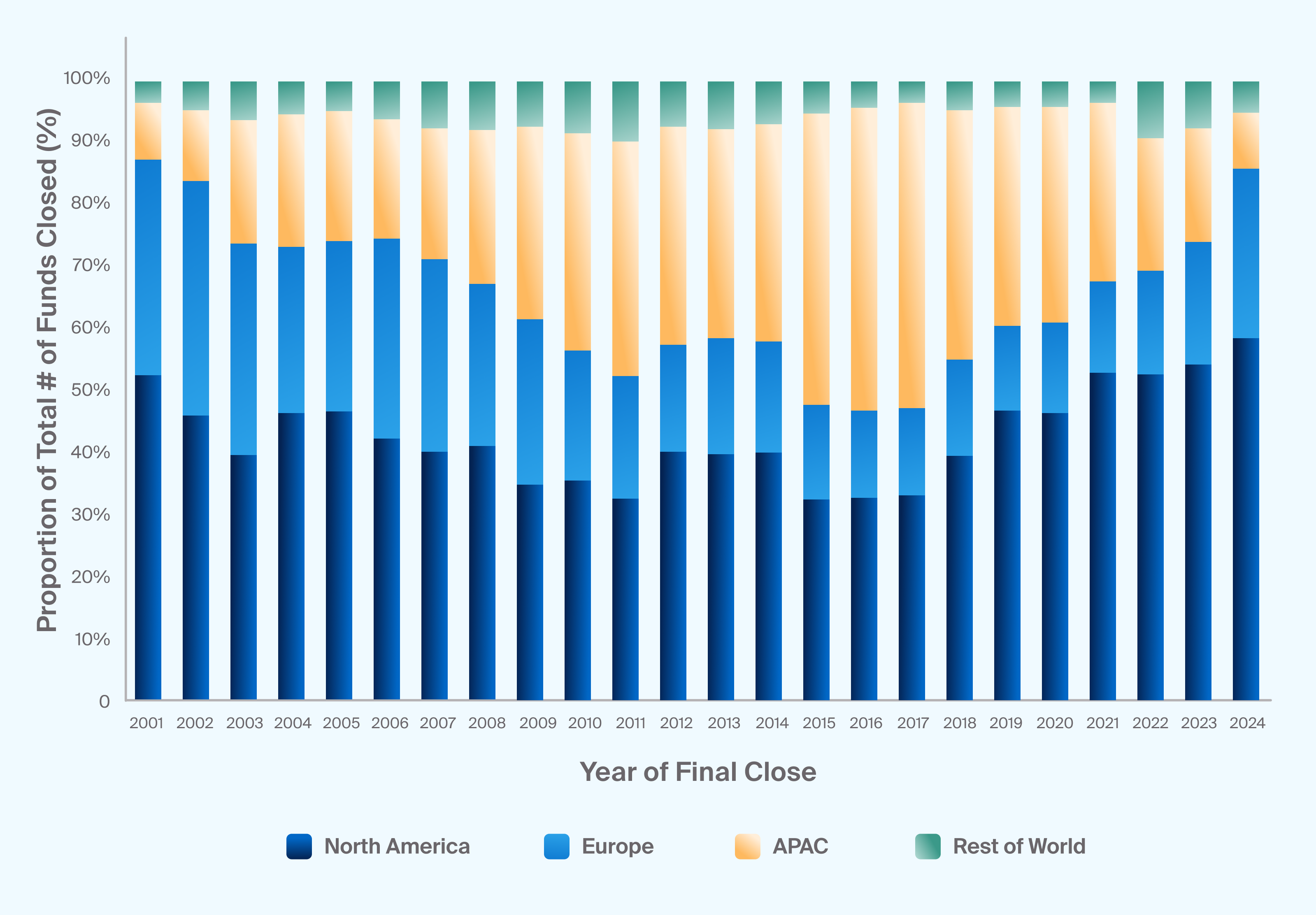

Global diversification can further enhance a private equity allocation. North American markets remain a dominant source of deal flow, but opportunities are expanding across Europe, Asia, and emerging markets (Exhibit 1). Regional exposures come with varying regulatory, economic, and exit environments, factors that may influence both risk and return. Blending geographies can help mitigate country-specific risk while capturing differentiated sources of growth.

Source: Preqin Pro YTD to end-Q3 2024

Europe expands private equity fundraising, taking a share from APAC (Exhibit 1)

Manager Strategy and Experience

Not all private equity managers approach value creation or deal origination the same way. Some focus on operational improvements, others on financial engineering, and some on strategic roll-ups or digital transformation. Diversifying by manager—especially across strategies and sourcing models—can reduce exposure to a single style or market cycle.3

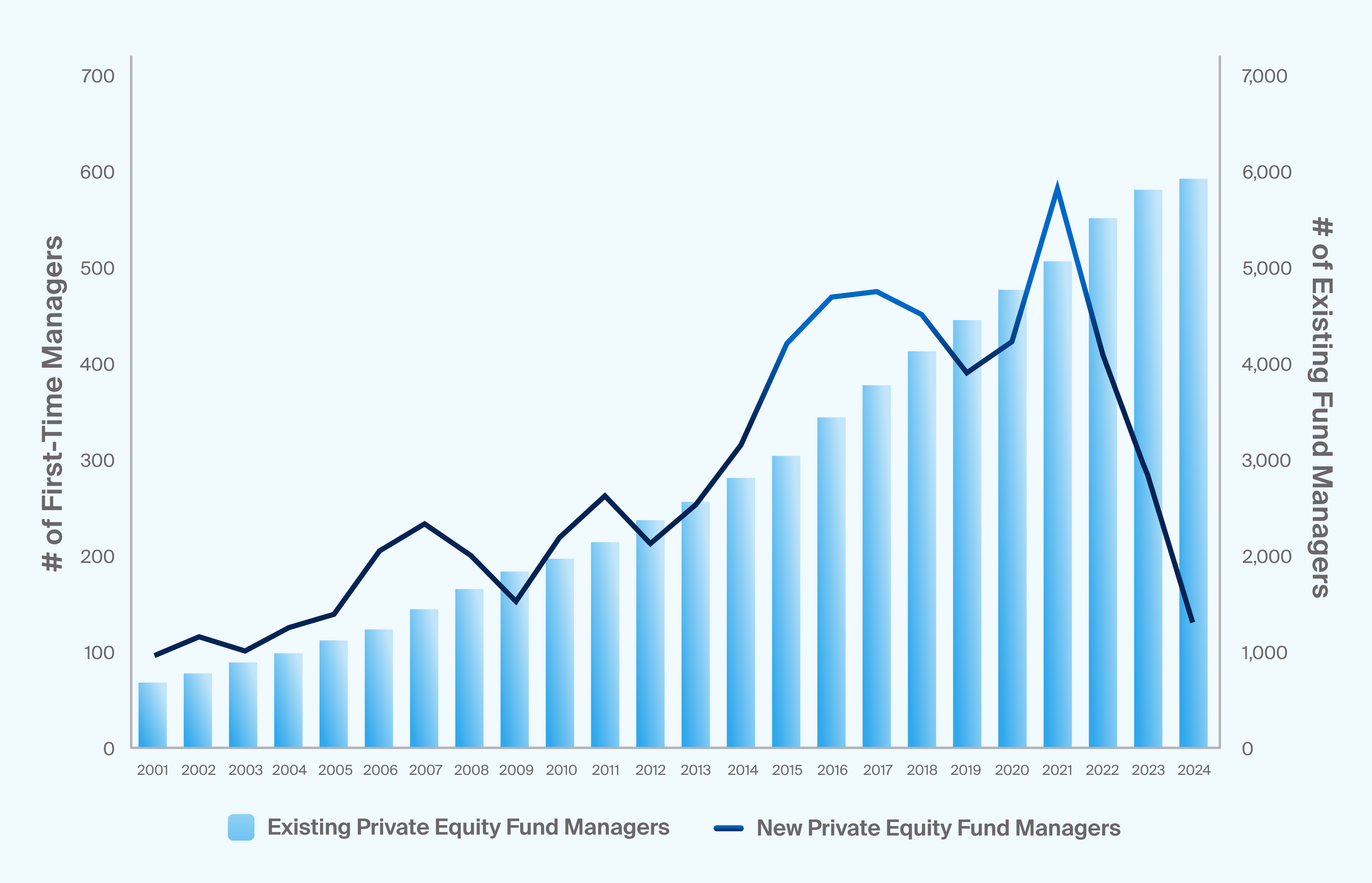

More recently, there's been a significant decline in proportion of first-time managers in the market, even despite the overall growth of managers in the asset class (Exhibit 2). This could be due to the high levels of performance dispersion across private equity managers, making experience more of a premium for those considering allocating to the space.

Source: Preqin Pro YTD to end-Q3 2024

The number of first-time private equity managers has declined even as the overall universe of managers has continued to grow (Exhibit 2)

Thematic Exposure: Opportunity and Concentration Risk

In addition to core diversification dimensions, with a proliferation of new products and greater access, advisors may have a fresh opportunity to explore more thematic strategies. These approaches seek to capitalize on long-term structural trends and emerging innovations. While thematic exposure can add conviction and alpha potential, it can also increase concentration risk if not managed carefully.

A few high-profile themes gaining traction include:

GP Stakes4: Investing in the management companies of private asset managers provides access to capital-light, cash-generative businesses with recurring revenue. These strategies offer indirect exposure to the growth of the alternative investment industry itself.

AI and Automation: Artificial intelligence is transforming industries from logistics to legal services. Funds focused on AI-related companies may benefit from rapid innovation but face intense competition and valuation sensitivity.5

Sports, Media, & Entertainment: As global audiences and streaming platforms proliferate, investments in sports franchises, production companies, and intellectual property have drawn attention from private equity. These assets can offer unique growth trajectories but may be less liquid and harder to value.6

While thematic allocations can complement a core PE portfolio, advisors should evaluate the tradeoffs between concentrated exposure and broader diversification. In many cases, themes may be considered as satellites within a larger, diversified allocation.

Implementation Considerations

Once a diversified strategy is defined, there are several implementation considerations. Advisors may consider a mix of:

Primaries (investments in new PE funds),

Secondaries (purchases of existing fund interests, often at a discount), and

Co-investments (direct investments alongside a GP in a single deal).

These approaches may vary in liquidity, capital call structure, fees, and access. For example, evergreen structures may offer more frequent subscription and liquidity windows, while drawdown funds often follow a traditional capital call model over a multi-year period.

Advisors may also consider risk tolerance, time horizon, and cash flow needs. A well-constructed portfolio often incorporates both the strategic intent of diversification and the practical realities of implementation.

Building Resilient Private Equity Allocations

Diversification within private equity can help advisors navigate the complexity of the asset class while seeking to align portfolios with long-term client objectives. By allocating across investment stages, sectors, geographies, manager styles, and themes, advisors can potentially reduce idiosyncratic risk and seek to improve performance.

As access to private equity expands, so too does the importance of portfolio design. A diversified approach—grounded in diligence and aligned to client objectives—can be one approach to private equity in today’s portfolios.