What You’ll Learn

How private equity allocations may affect portfolio performance, depending on funding source and sizing

How thematic exposures like GP stakes, AI, and sports media may complement core allocations

Considerations for blending evergreen and drawdown fund structures

While private equity (PE) has long been associated with traditional buyouts, today’s opportunity set spans a wider range of strategies, company stages, geographies, and themes. For advisors, this presents both potential opportunity and complexity. Diversifying within private equity may help manage risk and capture its potential.

Revisiting the Potential Role of Private Equity in a Portfolio

Before exploring different private equity strategies, it’s useful to step back and evaluate how the asset class has influenced overall portfolio performance—considering both allocation size and funding source.

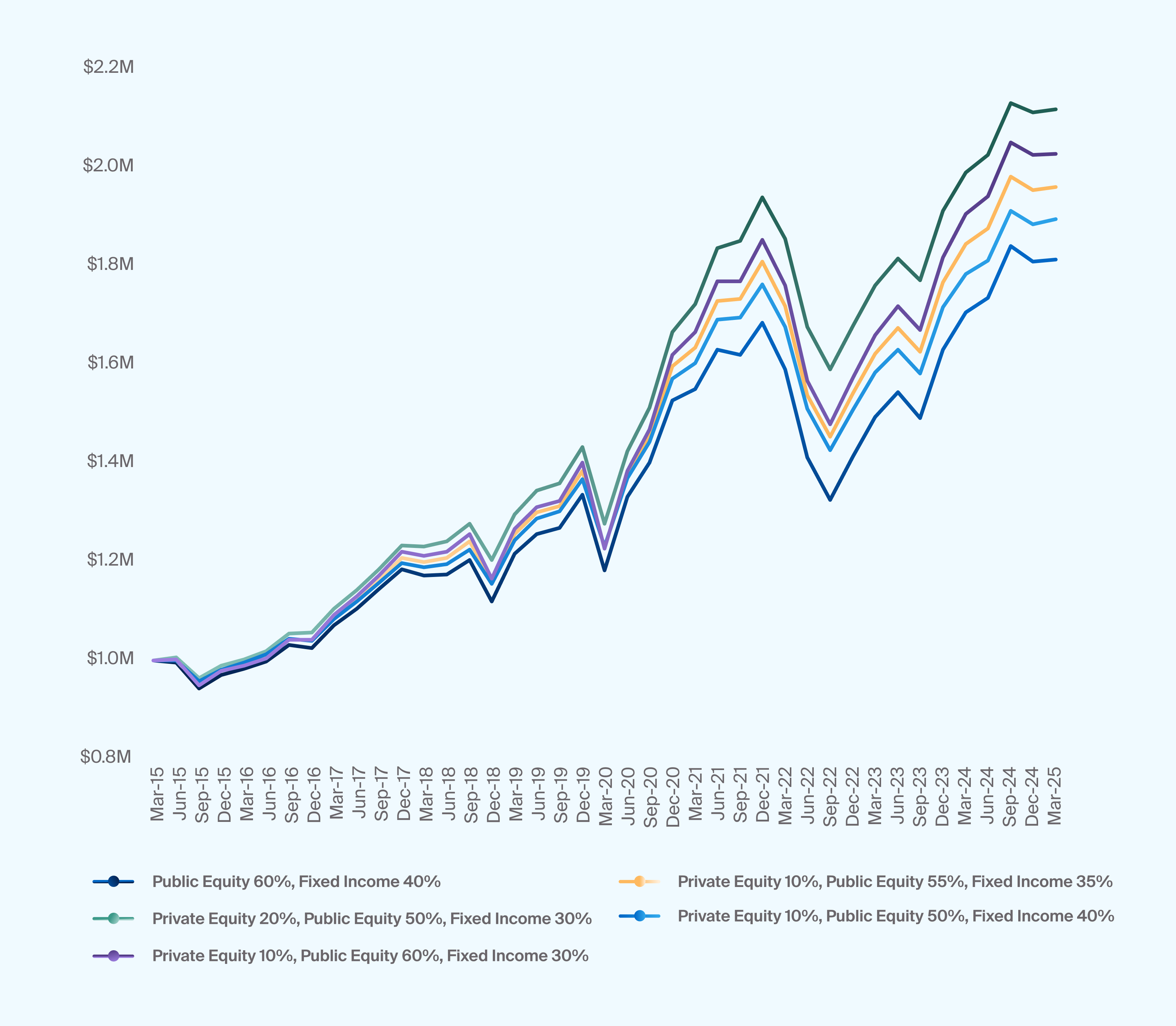

With the Preqin Quarterly Private Equity Index as a proxy, we compared a traditional 60/40 portfolio—composed of 60% global equities (MSCI ACWI Index) and 40% bonds (Bloomberg US Aggregate Bond Index)—with a portfolio that included a private equity allocation.

Using CAIS Compass, our platform’s portfolio construction tool, we analyzed performance between Q1 2015 and Q1 2025. The results: adding private equity to a 60/40 mix modestly improved performance, regardless of whether the capital came from equities or fixed income.

Illustrative portfolios that included private equity may have outperformed the traditional 60/40 on a cumulative basis in the last decade (Exhibit 1)

Notably, the portfolio with a 20% allocation to private equity delivered the strongest overall performance, ending the period with the highest cumulative value. This suggests that increasing exposure to private equity—within reasonable limits—may boost long-term returns. All three portfolios that sourced equally or primarily from public equity also exhibited lower volatility across the period than the traditional 60/40.

Interestingly, even among portfolios with a more modest 10% allocation to private equity, the source of that allocation appeared to make a difference. When private equity was funded by reducing fixed income exposure (rather than public equities), the portfolio produced better results. Replacing traditionally lower-yielding bonds with higher-returning private equity improved overall growth potential, without sacrificing much in the way of equity market exposure.

That said, it’s important to keep potential tradeoffs in mind. While private equity enhanced returns in this historical comparison, it also introduced greater complexity, less liquidity, and a longer investment horizon. While these factors aren't captured in the performance numbers, they are important considerations when building a balanced, durable allocation.

Still, portfolio construction requires more than a historical backtest (note that these are indices and not investable and past performance is not indicative of future results). Today’s private market environment includes fewer exits, more cautious underwriting, and higher dispersion across sectors.1,2 These are factors that may shape how private equity behaves moving forward, particularly in portfolios with less liquidity flexibility. At the same time, private equity has historically delivered positive results in market recoveries, and with public equity valuations elevated, some see the return outlook for private markets as relatively attractive.3

Understanding Private Equity’s Diverse Landscape

Like other segments of the alternatives market, private equity is not monolithic. It encompasses a broad spectrum of investment approaches, each with its own risk-return profile, time horizon, and implementation considerations. Advisors seeking to build diversified portfolios within private equity can explore several dimensions.

Stage of Investment

The lifecycle of a private company creates natural diversification opportunities across investment stages:

Venture capital focuses on early-stage companies with disruptive ideas but limited revenue. While risk of failure is high, successful investments can deliver outsized returns.4

Growth equity targets companies that are more established, often with proven business models and accelerating revenue, but still require capital to scale.

Buyouts involve acquiring mature companies, often with the goal of driving operational improvements or restructuring to increase value.

Each stage offers different levels of risk, return potential, and holding periods. Combining exposure across the lifecycle may help smooth performance across market cycles.

Sector Focus

Private equity managers often specialize in specific industries, such as healthcare, technology, consumer, or industrials. Sector-specific strategies can offer deep expertise and value creation opportunities but also introduce concentration risk. Allocating across sectors may allow advisors to balance cyclical and secular growth dynamics and potentially reduce correlation to public equity sectors.5

Geographic Scope

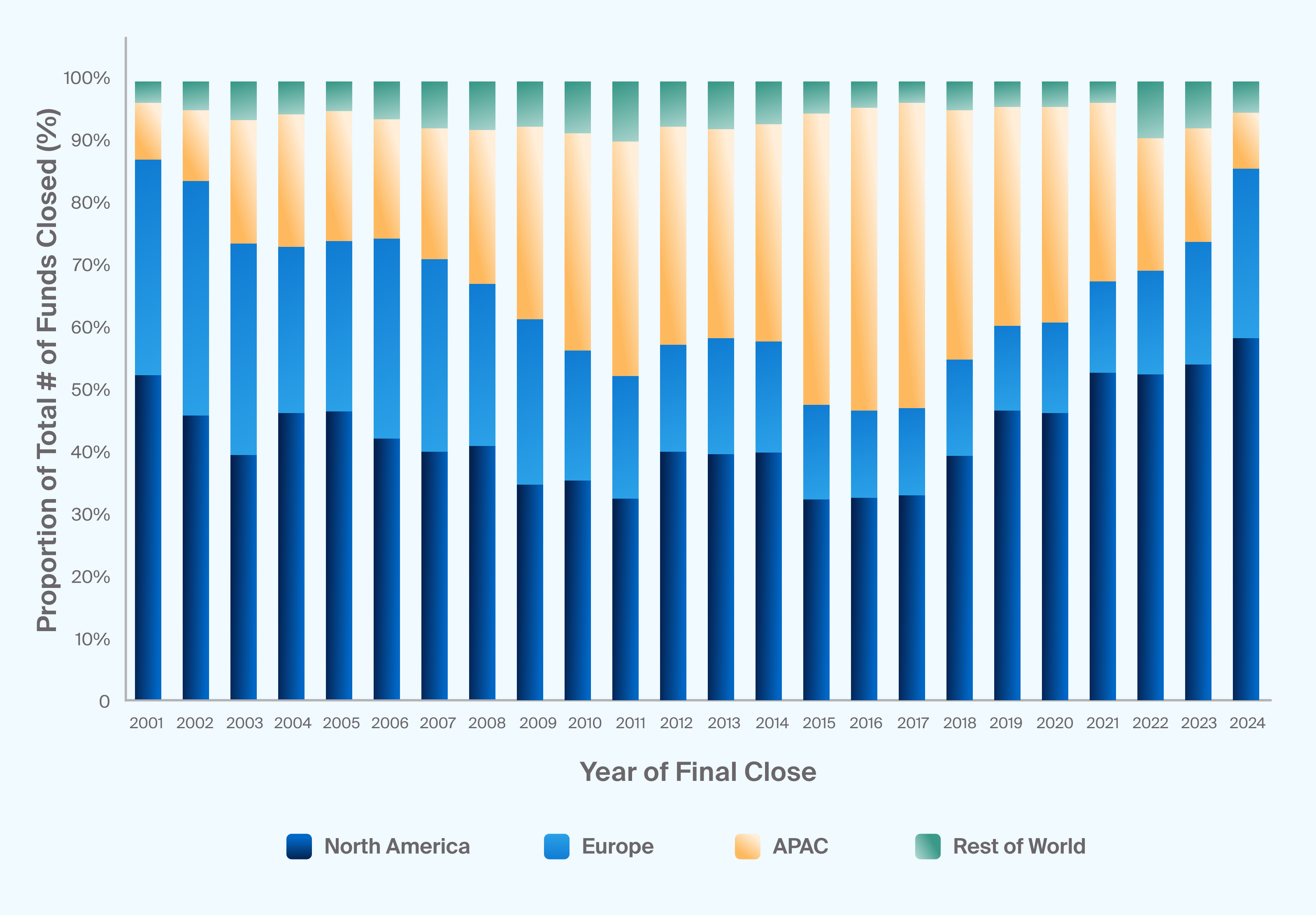

Global diversification can further enhance a private equity allocation. North American markets remain a dominant source of deal flow, but opportunities are expanding across Europe, Asia, and emerging markets (Exhibit 2). Regional exposures come with varying regulatory, economic, and exit environments, factors that may influence both risk and return. Blending geographies can help mitigate country-specific risk while capturing differentiated sources of growth.

Source: Preqin Pro YTD to end-Q3 2024

Europe expands private equity fundraising, taking a share from APAC (Exhibit 2)

Manager Strategy and Experience

Not all private equity managers approach value creation or deal origination the same way. Some focus on operational improvements, others on financial engineering, and some on strategic roll-ups or digital transformation. Diversifying by manager—especially across strategies and sourcing models—can reduce exposure to a single style or market cycle.6

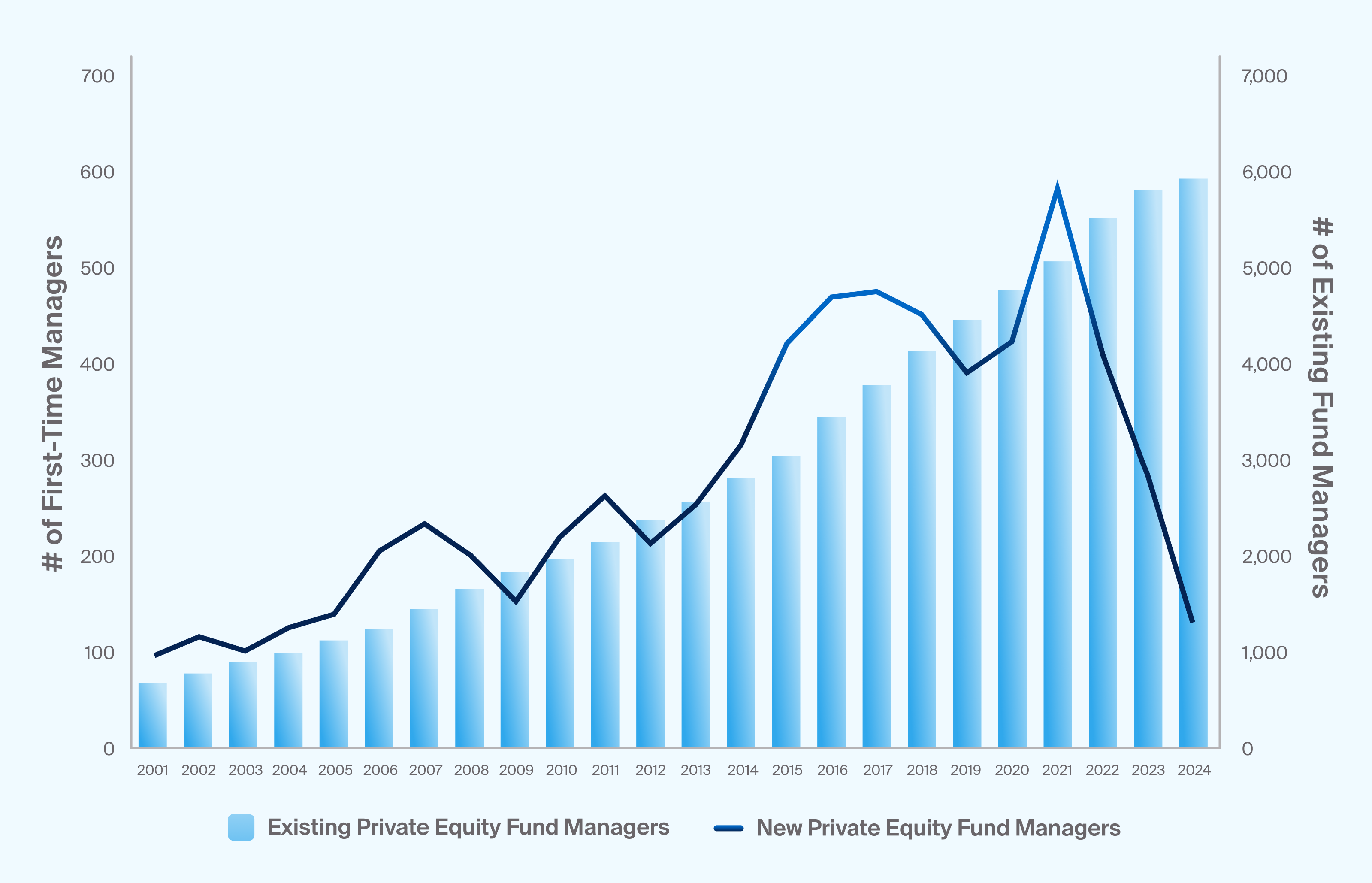

More recently, there's been a significant decline in proportion of first-time managers in the market, even despite the overall growth of managers in the asset class (Exhibit 3). This could be due to the high levels of performance dispersion across private equity managers, making experience more of a premium for those considering allocating to the space.

Source: Preqin Pro YTD to end-Q3 2024

The number of first-time private equity managers has declined even as the overall universe of managers has continued to grow (Exhibit 3)

Thematic Exposure: Opportunity and Concentration Risk

In addition to core diversification dimensions, with a proliferation of new products and greater access, advisors may have a fresh opportunity to explore more thematic strategies. These approaches seek to capitalize on long-term structural trends and emerging innovations. While thematic exposure can add conviction and alpha potential, it can also increase concentration risk if not managed carefully.

A few high-profile themes gaining traction include:

GP Stakes7: Investing in the management companies of private asset managers provides access to capital-light, cash-generative businesses with recurring revenue. These strategies offer indirect exposure to the growth of the alternative investment industry itself.

AI and Automation: Artificial intelligence is transforming industries from logistics to legal services. Funds focused on AI-related companies may benefit from rapid innovation but face intense competition and valuation sensitivity.8

Sports, Media, & Entertainment: As global audiences and streaming platforms proliferate, investments in sports franchises, production companies, and intellectual property have drawn attention from private equity. These assets can offer unique growth trajectories but may be less liquid and harder to value.9

While thematic allocations can complement a core PE portfolio, advisors should evaluate the tradeoffs between concentrated exposure and broader diversification. In many cases, themes may be considered as satellites within a larger, diversified allocation.

Implementation Considerations

Once a diversified strategy is defined, there are several implementation considerations. Advisors may consider a mix of:

Primaries (investments in new PE funds),

Secondaries (purchases of existing fund interests, often at a discount), and

Co-investments (direct investments alongside a GP in a single deal).

These approaches may vary in liquidity, capital call structure, fees, and access. For example, evergreen structures may offer more frequent subscription and liquidity windows, while drawdown funds often follow a traditional capital call model over a multi-year period.

Advisors may also consider risk tolerance, time horizon, and cash flow needs. A well-constructed portfolio often incorporates both the strategic intent of diversification and the practical realities of implementation.

Diversifying Private Equity Exposure: Blending Drawdown and Evergreen Fund Structures

Combining drawdown and evergreen fund structures may be another approach to diversification. For example, drawdown funds can be used to gradually reallocate from concentrated positions—such as individual stocks or index-linked funds. Rather than realizing gains all at once and potentially incurring a significant tax liability, an advisor may choose to allocate to a drawdown fund with a multiyear capital call schedule. This approach can help distribute the tax impact over time and may offer the potential to capture long-term capital gains where applicable.

This strategy can also support broader portfolio objectives. By slowly reallocating from public equities or fixed income, portfolios can gain exposure to private equity without disrupting their entire asset mix. And because drawdown funds call capital over time, they allow advisors to plan liquidity needs in advance.

For advisors already comfortable with evergreen structures, drawdown funds can serve as complementary building blocks—adding exposure to different segments of the private markets and further diversifying the return stream. Advisors might think of evergreen vehicles as core holdings that provide steady exposure, while drawdown funds act as satellite positions that may offer more targeted diversification or timing advantages.

As with all private market strategies, drawdown funds require oversight, including attention to capital call pacing and overall liquidity management. Advisors may want to evaluate their portfolios’ unique characteristics and risks in the context of their goals, time horizons, and broader asset allocation strategies.

Building Resilient Private Equity Allocations

Diversification within private equity can help advisors navigate the complexity of the asset class while seeking to align portfolios with long-term client objectives. By allocating across investment stages, sectors, geographies, manager styles, and themes, advisors can potentially reduce idiosyncratic risk and seek to improve performance.

As access to private equity expands, so too does the importance of portfolio design. A diversified approach—grounded in diligence and aligned to client objectives—can be one approach to private equity in today’s portfolios.