What you’ll learn

Private real estate has become much more accessible to advisors, but strategies typically available in wealth-centric structures may only provide a fraction of the entire risk-reward spectrum.

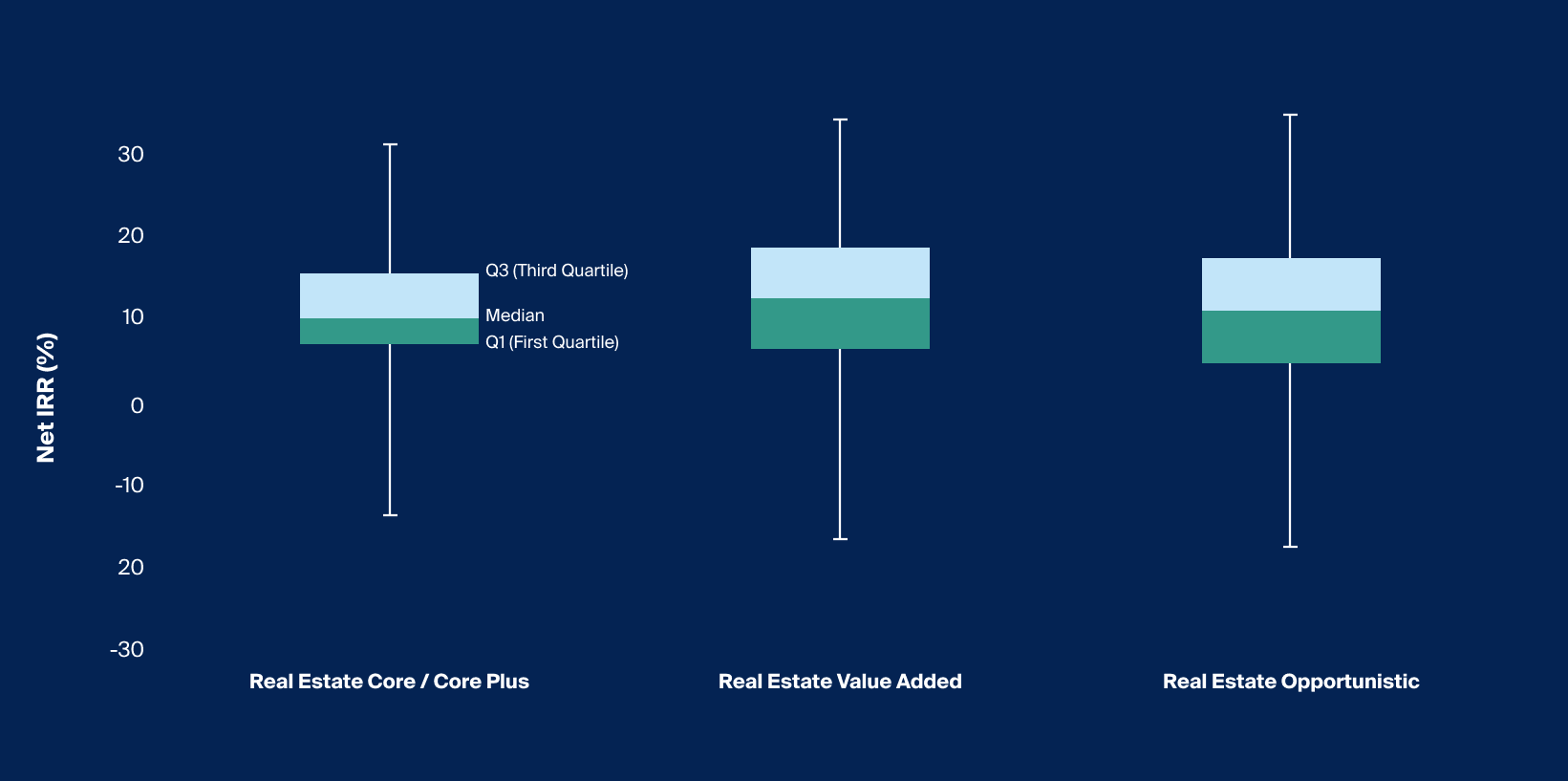

Comparing historical aggregate performance across funds, core / core plus funds exhibited the smallest dispersion of outcomes compared to value added and opportunistic which produced higher median net IRRs.

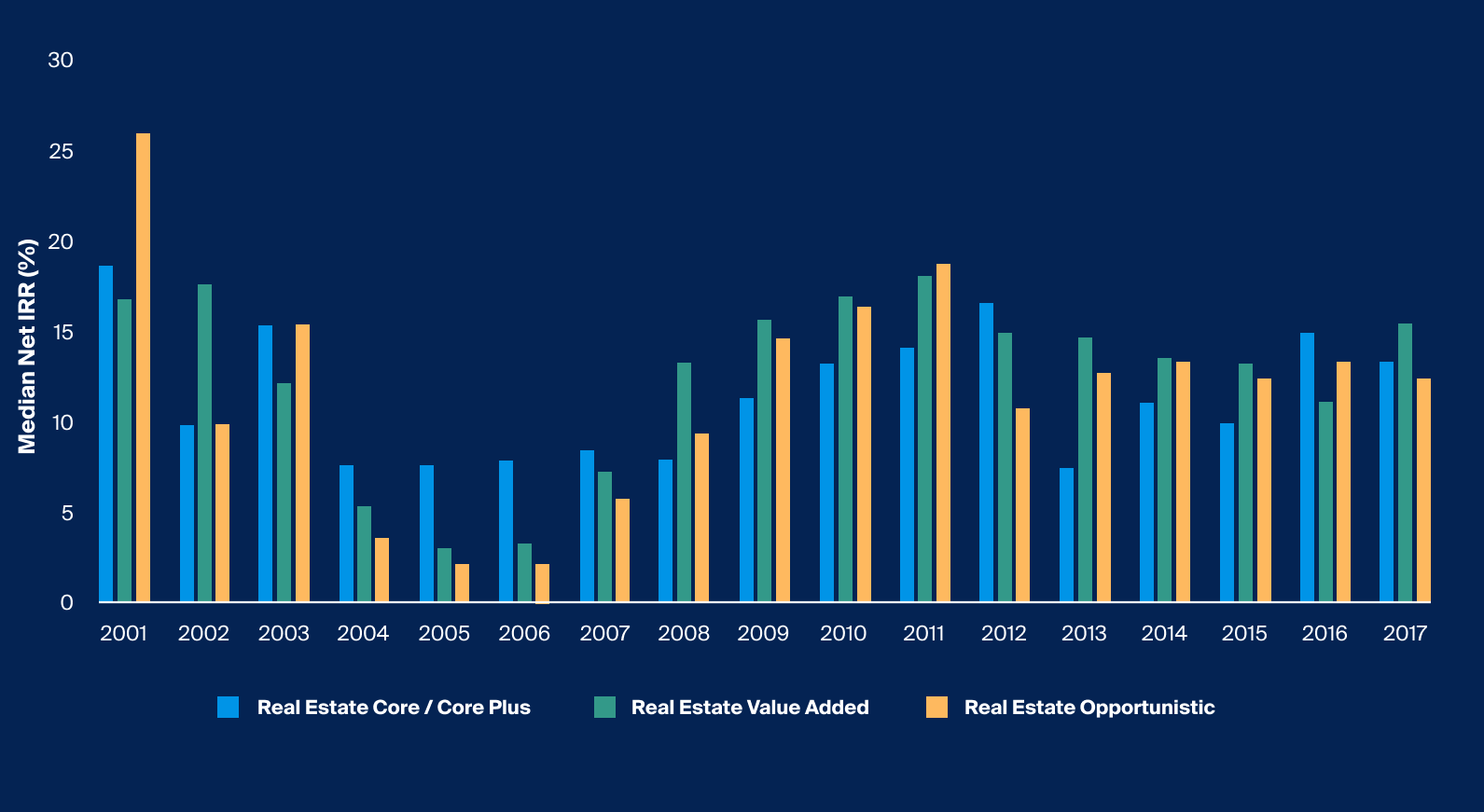

Returns for higher risk / return strategies had greater fluctuation across vintages than core / core plus, perhaps indicating to advisors that these strategies may present potential opportunities related to market dislocations.

Due to the differentiated opportunity sets that certain strategies may present related to market dislocations, Advisors may consider taking a more holistic approach to an asset allocation, considering strategy, structure and vintage diversification.

PERE’s most recent real estate survey found that institutional investors are looking towards these higher risk / return strategies as a means to capture various opportunities in the current macro environment.

As advisors assess the breadth of alternative investments, it may be helpful to analyze the variation in historical performance that different strategies have exhibited within each asset class. In private real estate, core and core plus strategies have become much more accessible through wealth-friendly structures like private or non-traded REITs, which provide potential liquidity, lower investment minimums with the opportunity to still generate income and total return.1 But core / core plus strategies are only a portion of the broader private real estate asset class. Value added and opportunistic strategies, which are positioned further up the risk / return spectrum, may offer differentiated benefits that core / core plus may not be designed to deliver.2

Managers of these strategies typically seek to generate a meaningful proportion of their returns through the improvement or additional investment into real estate assets, unlike core / core plus that are focused generally on maintaining and filling or slightly improving existing properties.3 Given a manager’s ability to do so consistently, this may offer a differentiated return driver that may be less sensitive to macroeconomic factors that impact real estate valuations.4 In periods of dislocation or more bespoke opportunity sets across sectors and geographic regions, it appears that that core / core plus strategies may not be as well equipped to capitalize on point in time differentiated opportunities the same way that opportunistic and value added funds can.5

PERE’s most recent real estate survey found institutional investors are looking towards these higher risk/return strategies to capture various opportunities in the current macro environment. When asked where fresh capital was planned to be deployed over the next 12 months, the greatest proportion of respondents indicated that value added would receive the most capital at nearly 30%, followed by opportunistic at 24%. Only 18% and 9% of investors indicated that they would be deploying fresh capital to core plus and core real estate, respectively.6

Does historical performance for these private real estate strategies provide support for these institutions’ intention to maintain or scale their real estate allocations towards strategies with greater risk and return? If so, what could this mean for those currently focused only on evergreen core and core plus real estate strategies?

Comparing Performance Dispersion Between Private Real Estate Funds by Strategy

How does the aggregated performance of higher risk / return strategies compare to core / core plus strategies in terms of their ultimate fund performance? To try and answer this broad question, we took the universe of funds tracked by Preqin between 2001 and 2017, with outliers removed, to seek to capture only funds that have closed or are later in their maturity in an attempt to standardize results for closer inspection. We’ll start by comparing strategies in like structures, using Preqin to represent finite-life drawdown, and, seek to measure the dispersion of ultimate fund performance in terms of net IRR.

Source: Preqin, Real Estate strategies represented by mature funds (minimum 6 years) and consists of Core/Core Plus, Value Added, and Opportunistic, outliers of fund data removed at 2.5% tails for each strategy, all returns measured by internal rate of return (IRR%) since inception of funds analyzed between 2001 and 2017, most up to date data, as of February 2024. Past performance is no guarantee of future results.

For the period of 2001-2017, Value-add and Opportunistic real estate funds appeared to generate a higher median net IRR with a greater dispersion of returns both to the upside and downside. (Exhibit 1)

Core / core plus funds exhibited the smallest dispersion of outcomes with the interquartile range between the first quartile and third quartile being 8.4% while value added and opportunistic exhibited a dispersion of 12.2% and 13.0%, respectively (Exhibit 1). The median net IRR of value added (12.4%) and opportunistic (11.0%) are higher than the median net IRR of core/core plus (10.0%) funds (Exhibit 1).

Assessing the Implications of Timing on Private Real Estate Strategies

The first analysis ignores the implication of timing. Using the very same dataset as before, we further dissect the ultimate fund performance of these strategies by their vintage year. Looking at vintage performance in combination with aggregate performance may help to understand the impact of the macro environment on fund performance and see if the historical data supports the claim that higher risk / return strategies can offer a differentiated source of return across market cycles.

Source: Preqin, Real Estate strategies represented by mature funds (minimum 6 years) and consists of Core / Core Plus, Value Added, and Opportunistic, outliers of fund data removed at 2.5% tails for each strategy, all returns measured by internal rate of return (IRR%) since inception of funds analyzed between 2001 and 2017, most up to date data, as of February 2024. Past performance is no guarantee of future results.

Value added and opportunistic fund performance appeared to exhibit greater variability across vintages, typically outperforming core / core plus following economic turmoil (Exhibit 2)

Depicting performance by vintage paints a more complete picture of the differences in performance characteristics between strategies.

As an example, for vintages established in the years immediately preceding the Global Financial Crisis ("GFC"), core / core-plus vintages delivered a higher median return than higher risk / return strategies from a median net IRR basis (Exhibit 2). However, for funds deploying in the GFC and its immediate aftermath between 2008-2011, higher risk / return strategies ultimately achieved returns above that of core / core plus (Exhibit 2). This relative performance pattern underlines the potential benefits of value added and opportunistic strategies to differentiate performance across market cycles.

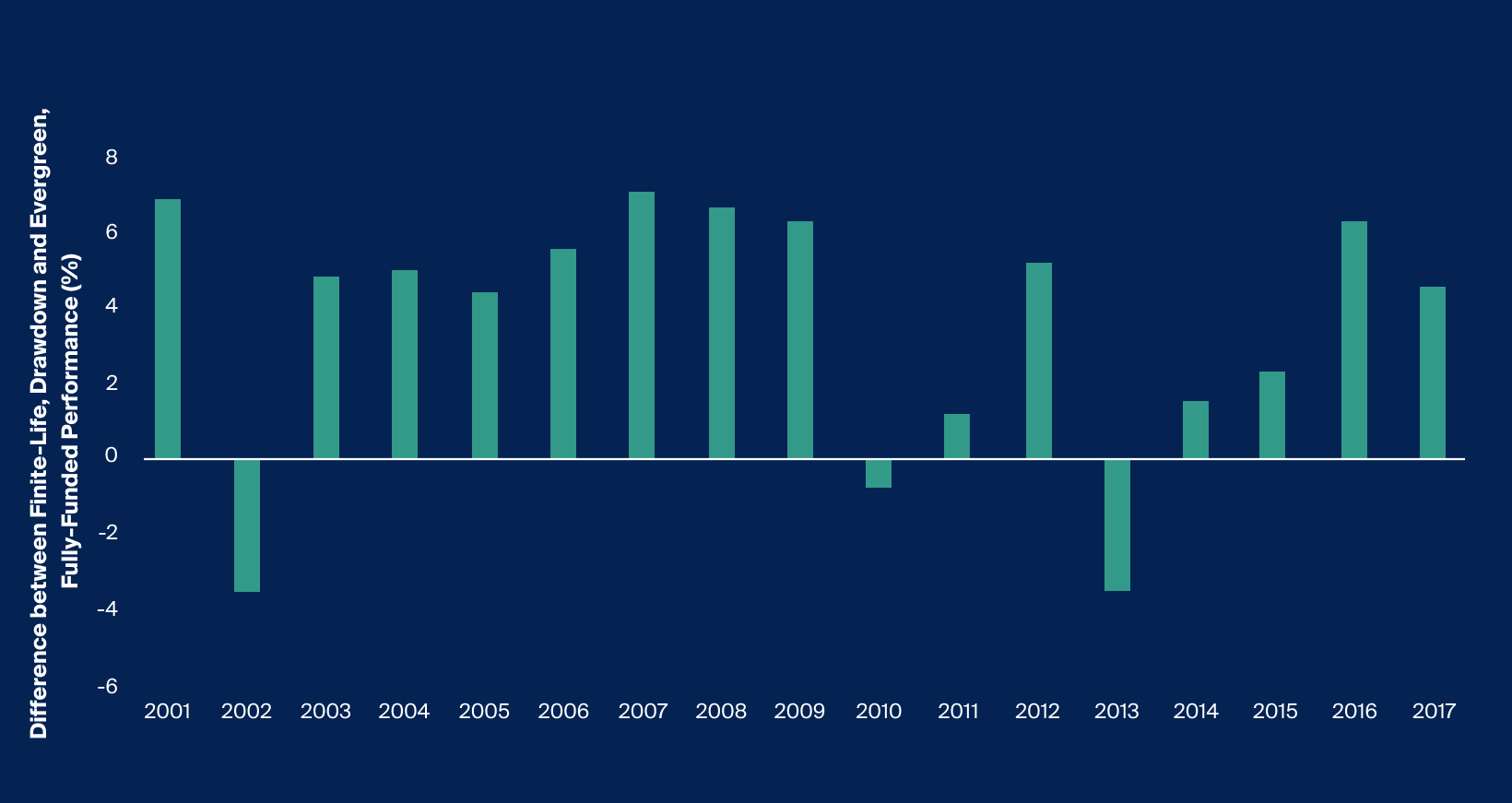

Considering Fund Structure

While our previous analyses have focused on finite-life, drawdown funds, the proliferation of access through evergreen, fully funded vehicles present an additional decision point for investors seeking to gain exposure to private real estate. To understand the potential tradeoffs between structures, we compared the returns for core / core plus between evergreen fully funded vehicles like non-traded REITs, depicted by the NCREIF ODCE Fund Index, with finite-life drawdown core / core plus strategies between 2001 and 2017, the data represented again by Preqin.

Given the impact of timing both at entry and exit on the ultimate performance for drawdown funds, we compare ultimate finite-life drawdown fund returns with the 5-year annualized return of evergreen fully funded funds assuming deployment in the same year to compare performance across these two different fund structures.

Source: Preqin, Real Estate strategies represented by mature funds (minimum 6 years) and consists of Core / Core Plus, outliers of fund data removed at 2.5% tails for each strategy, return measured by internal rate of return (IRR%) since inception of funds analyzed between 2001 and 2017; Bloomberg, NCREIF ODCE Fund Index TR, return measured by 5 year trailing annualized return, most up to date data, as of February 2024. Past performance is no guarantee of future results.

Traditional drawdown core / core-plus funds appeared to generate a greater annualized return than fully funded evergreen funds across market cycles (Exhibit 3)

What we can gather from this analysis is the variability of performance between the two structure types over time, and why allocating only to core / core plus in an evergreen structure may only award you a portion of the opportunity set that core / core plus funds may be able to capture. For the relevant period, it appears that the drawdown structure typically outperformed the evergreen equivalent for core / core-plus with an average median outperformance of finite-life, drawdown of 3.50% (Exhibit 3).

Considering a Holistic Approach to Private Real Estate Investing

Core / core plus strategies in evergreen fund structures may have an important place in portfolios given their greater accessibility, lower operational complexity, among other reasons. However, this analysis suggests that private real estate asset classes may offer an even broader set of opportunities. By understanding strategy, structure and vintage diversification, financial advisors may benefit from what the asset class could potentially provide exposure to. Of course, past performance is no guarantee of future results.

However, climbing the risk / return spectrum and utilizing drawdown fund structures may require additional scrutiny from financial advisors, given the additional investment and operational complexity.7 Manager selection in value-add and opportunistic strategies can be critical in achieving objectives given the greater dispersion of returns across funds than in core / core-plus historically (Exhibit 1). Finally, when considering building a total allocation to private real estate, financial advisors may also consider revisiting portfolio liquidity needs as funds with higher risk/return strategies may have relatively less liquidity that more accessible evergreen core/core plus funds may offer.