About This Series

Private equity exposure varies by company size and deal type. This three-part series looks across the capital spectrum—large cap, upper middle market, and lower middle market—to show what each segment offers, where the risks may sit, and how managers are adapting.

What You'll Learn

Lower-middle-market (LMM) targets founder-led businesses under $250 million, emphasizing operational development over platform consolidation.

Value creation centers on professionalization, management development, and growth acceleration rather than financial engineering.

These strategies often require different skill sets and face distinct execution challenges compared to larger deal segments.

Success often depends on identifying scalable business models and partnering with capable founders ready for institutional support.

What Is Lower-Middle-Market Private Equity?

LMM private equity sits at the entrepreneurial end of the spectrum: companies valued under $250 million, typically founder-led with solid business models but plenty of room to grow. These strategies often focus on helping businesses strengthen business fundamentals—e.g., formalizing financial reporting, governance, and operation processes—rather than building acquisition platforms.

Think about it this way: these are companies that have moved past startup risk but haven’t reached institutional maturity yet. A regional manufacturer may have solid relationships and margins but basic reporting and informal planning, the gap LMM investors aim to bridge.

While upper-middle-market (UMM) strategies may buy established platforms to systematically roll up competitors, LMM managers often partner with founders to professionalize operations, expand markets, and build management capabilities designed to unlock growth.

Founder Partnerships Define Lower-Middle-Market Approaches

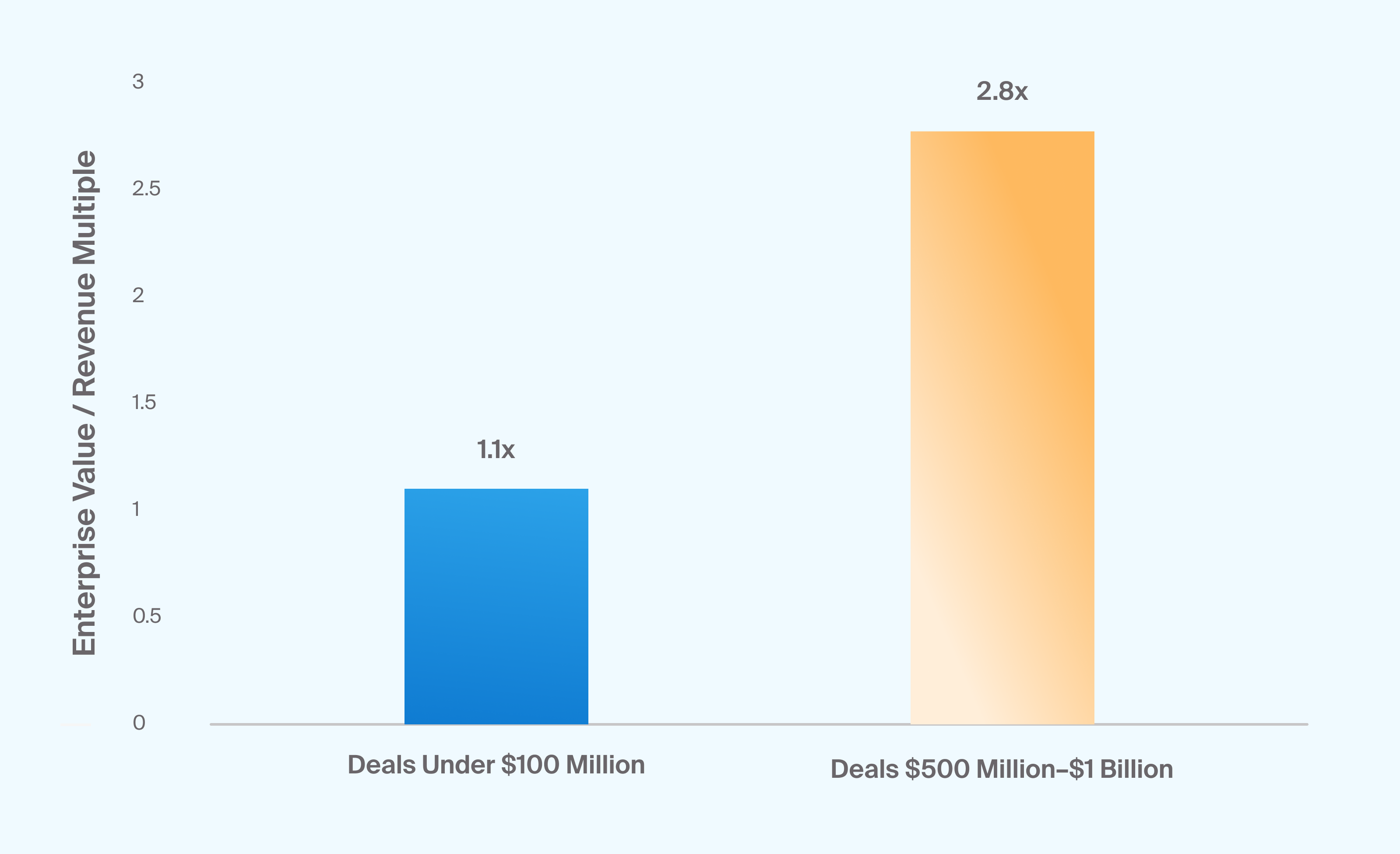

LMM activity sits within broader middle-market trends, and here’s where the data gets tricky: most industry reports combine middle-market activity across the entire spectrum rather than breaking out the lower segment specifically. What is clear, though, is that the smaller end of the market—typically non-sponsored, founder-owned companies—continues to offer attractive entry valuations for buyers, trading around 1.1x revenue versus 2.8x for larger deals (Exhibit 1).

Source: Garrett Hinds et al., “US PE Middle Market Report,” Pitchbook, Sep. 12, 2025

The lower end of the middle market continues to offer attractive entry valuations (Exhibit 1)

Lower multiples may reflect smaller scale, thinner liquidity, and the work required to institutionalize operations. For buyers, that discount can create room to drive value through operational improvement and growth.

The dynamic differs from larger deals. Many founders have built profitable, growing businesses but recognize they need capital and experience to get to the next level. Many want to stay involved and preserve the culture, making this a partnership rather than a hand-off.

Revenue growth and margin expansion drive value creation across PE segments, but in LMM deals, those improvements often come from building basic business infrastructure that just didn’t exist before rather than optimizing what’s already there.

Where Operational Expertise Drives Growth in the Lower-Middle-Market

LMM managers may add value by building the structures that larger companies already have: finance systems, leadership depth, and technology infrastructure, to name a few.

A regional business-services firm, for example, might rely on informal sales tracking and founder relationships; an LMM sponsor could install a CRM system, formalized processes, and introduce data-driven decision making. The same manager may help recruit professional leadership or design success plans to help the company scale beyond its original team. Technology upgrades—like e-commerce or automated delivery tools—often follow, giving traditional businesses new efficiency and reach. These are foundational, hands-on improvements that are designed to convert entrepreneurial operations into institutional platforms.

Industry Dynamics May Drive Lower-Middle-Market Success

Service businesses with strong customer relationships, niche manufacturers with specialized know-how, and technology-enabled services that can expand tend to attract manager attention.

Healthcare, business services, and industrial manufacturing appear across the middle market, but LMM managers often pursue earlier stage opportunities within these sectors: companies too small for UMM attention but poised to grow with professional support.

Lower-Middle-Market Private Equity: What’s Working and What’s Getting Harder

Managers with operational experience and deep sector knowledge continue to find opportunities, especially in fragmented industries.1 The carveout market provides some deal flow too: carveouts represented 11% of middle-market deal value in Q2 2025, and occasionally larger companies divest smaller units that fit in the LMM profile.2

Execution can be demanding: management development takes time, and managers have to upgrade systems while maintaining operations and founder alignment. Due diligence is complex when reporting is limited and growth strategies untested—managers are underwriting potential more than a track record.

The Risks and Realities in Private Equity’s Lower Middle Market

LMM private equity shows different characteristics than the other segments we’ve covered. These strategies target businesses with entrepreneurial energy and development potential, but success often requires patient capital and operational experience to guide the professionalization process.

The execution risk is different from UMM platform building or large-cap optimization. Success may depend on management development, operational transformation, and market expansion that can face unexpected challenges when managers are effectively teaching companies how to operate at scale.

Each segment reflects a different approach to value creation and distinct manager capabilities, showing how private equity adapts across the capital spectrum. For financial advisors, the segment behaves more like private small-cap exposure: greater variability and longer timelines, but tangible, company-building drivers of value.