Explore how CAIS’ latest platform improvements streamline advisor operations, strengthen connectivity, and expand access across the alts lifecycle.

At CAIS, product development begins with listening, both to the financial advisor community and the broader wealth ecosystem that shapes advisors’ day-to-day work. Guided by that feedback, each enhancement is designed to address where advisors need the most support, removing friction from their workflows and strengthening the overall alternative investment experience on the CAIS platform.

Like all of our feature enhancements, those introduced over the last quarter reflect that philosophy: deepening integrations with partners like Schwab, broadening pricing tool capabilities, and expanding multi-product to multi-account trade capabilities. Together, these updates make the CAIS platform a more unified, advisor-centered experience that connects every part of the alternative investment lifecycle.

New Trade and Profile Enhancements for Users Who Custody With Schwab Advisor Services™

CAIS has expanded its integration with Schwab Advisor Services, introducing new capabilities for users of Schwab on the CAIS platform. These enhancements streamline two key parts of the advisor workflow.

Submit Ticker-Traded Fund Orders Through CAIS

Advisors can now submit orders across CAIS Marketplace ticker-traded and subscription-based funds using a single, consistent workflow. Using CAIS’ centralized Order Pipeline, advisors can allocate CAIS Marketplace ticker-traded strategies within model portfolios and monitor orders in the Orders tab, regardless of the investment vehicle.

A look at ticker-traded fund orders through CAIS

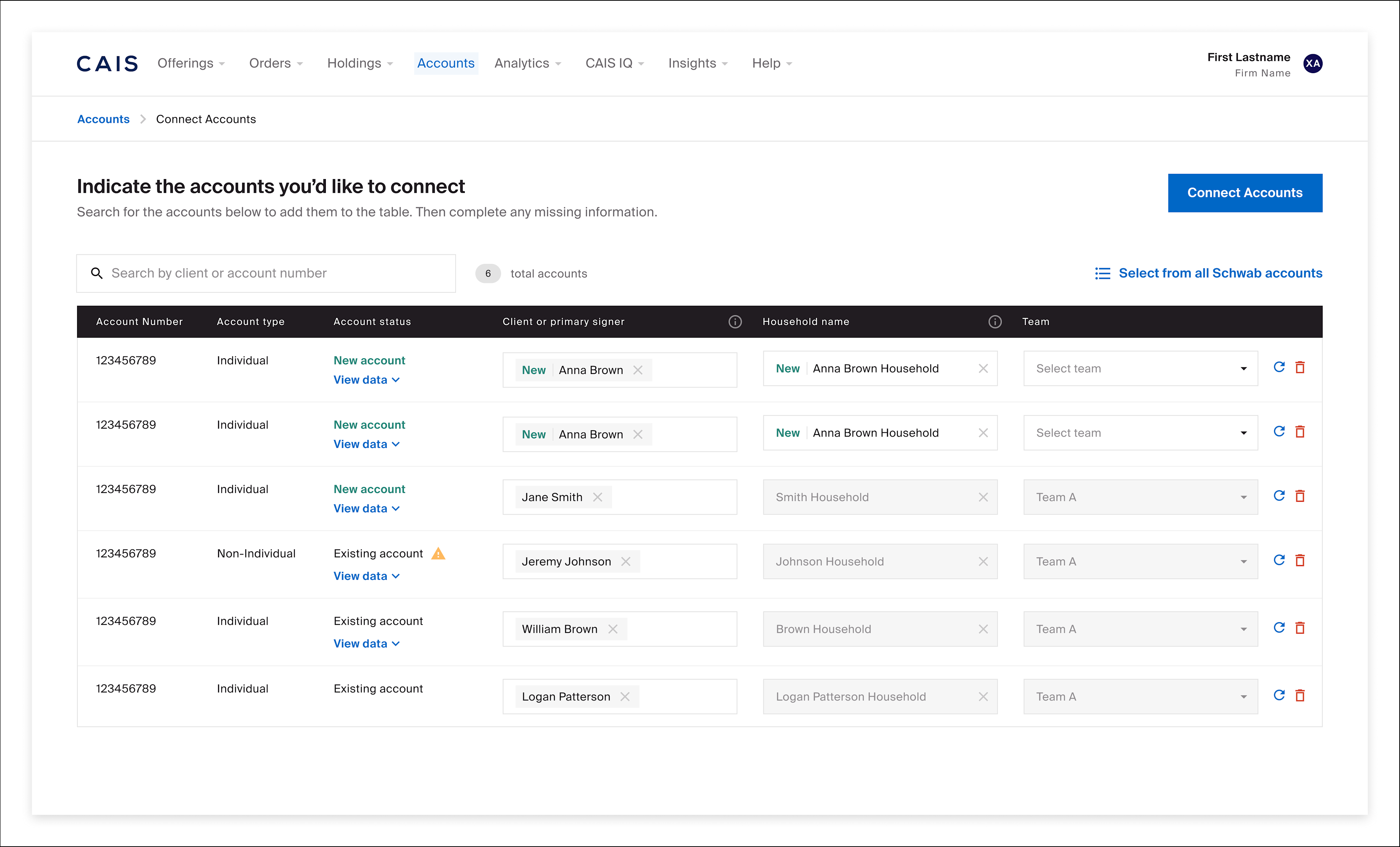

Integrate Schwab Account Profiles

With custodial data integration, advisors can directly import Schwab Advisor Center® account profile data into CAIS, with the flexibility to refresh data as needed. This reduces manual entry, automatically populates key fields, saving time for advisors.

With this enhanced CAIS–Schwab integration, advisors can now access a greater range of investment products on the CAIS platform, streamlining workflows and keeping the focus on time spent working with their clients.

A look at integrated Schwab account profiles

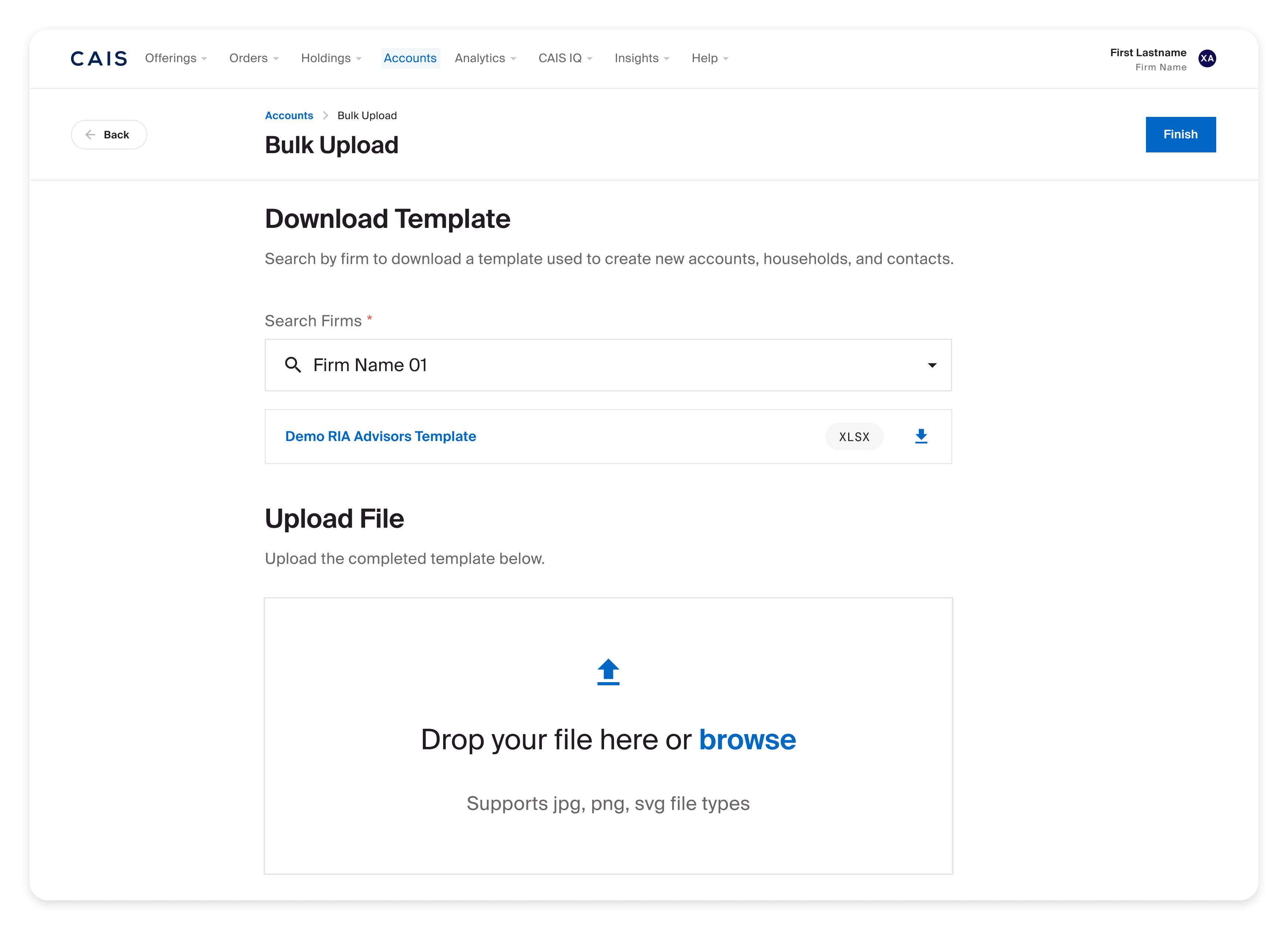

Faster Onboarding With Our Self-Service Investor Profile Upload

For advisors using the CAIS platform for funds and structured investments, you can now create multiple investor profiles using a do-it-yourself, fill-and-upload template—no integration needed. Download the template with built-in guidance, enter data at your pace, and upload directly into the platform to save time.

Prefer automation using your firm’s resources? The Investor Profile API connects CAIS to your CRM or internal systems for real-time updates.

A look at self-service investor profile upload

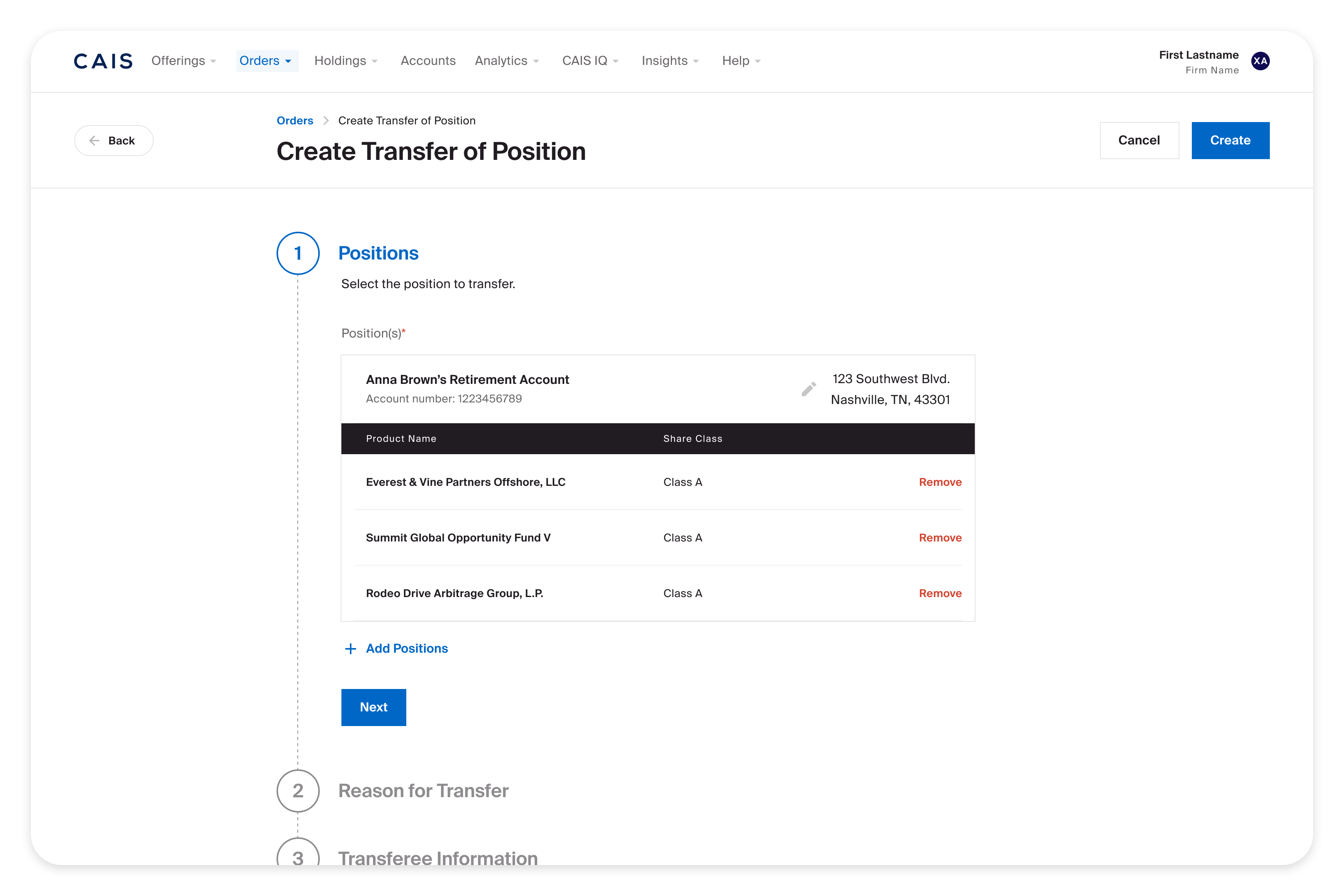

Improved Digital Transfers With Unified Tracking

Managing transfers is now faster and clearer directly through CAIS. From initiation to submission, you can now complete most transfers online, split positions across multiple transferees with each receiving a separate request, as well as track all transfer activity in our consolidated Orders view.

A look at digital Transfers with unified tracking

Continuing to Streamline Your Structured Investment Workflow

We continue to build on our platform technology to help users manage their book of structured notes. The Bulk Order Workflow tool now integrates with the Schwab Profile API, enabling users to import accounts directly within the order entry workflow.

This improvement delivers a more connected, efficient experience, helping advisors reduce time spent on account setup and order creation.

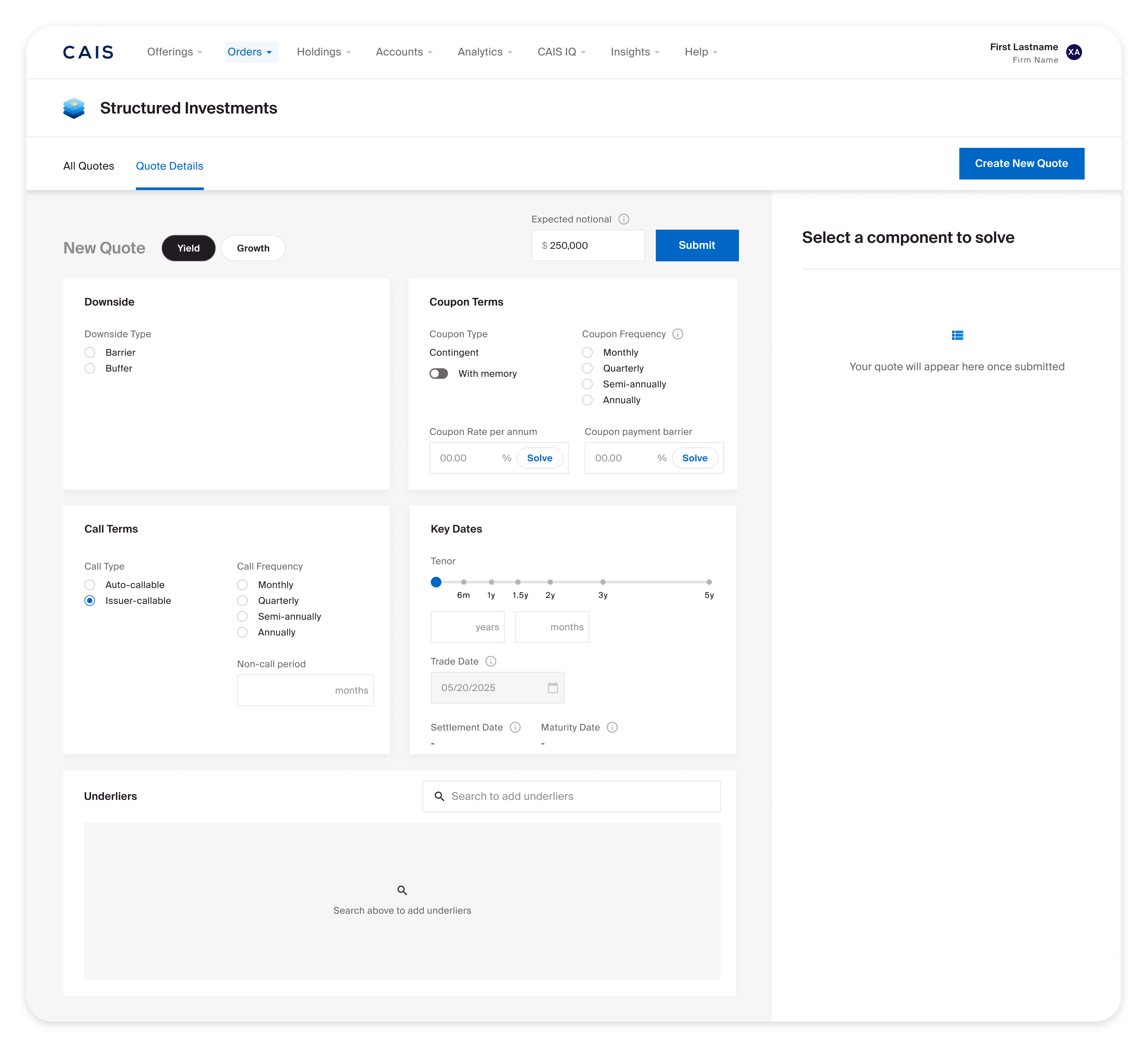

UBS AG Added as New Issuer for Structured Investments Pricing Tool

We continue to expand and enhance the Structured Investments Pricing Tool, enabling advisors to obtain real-time indicative quotes for a broader range of structured investments. This quarter, we’ve added UBS AG as a participating issuer, giving advisors access to even more pricing through the tool’s multi-issuer experience.

A look at the structured investment workflows

Issuer-Callable Yield Notes Now Supported in Structured Investments Pricing Tool

In addition, the tool now supports Issuer-Callable Yield Notes, providing greater flexibility in the types of structures advisors can compare. This enhancement, as well as the addition of UBS as a participating issuer, strengthens our commitment to delivering efficiency and expanded market connectivity, all in one intuitive interface.

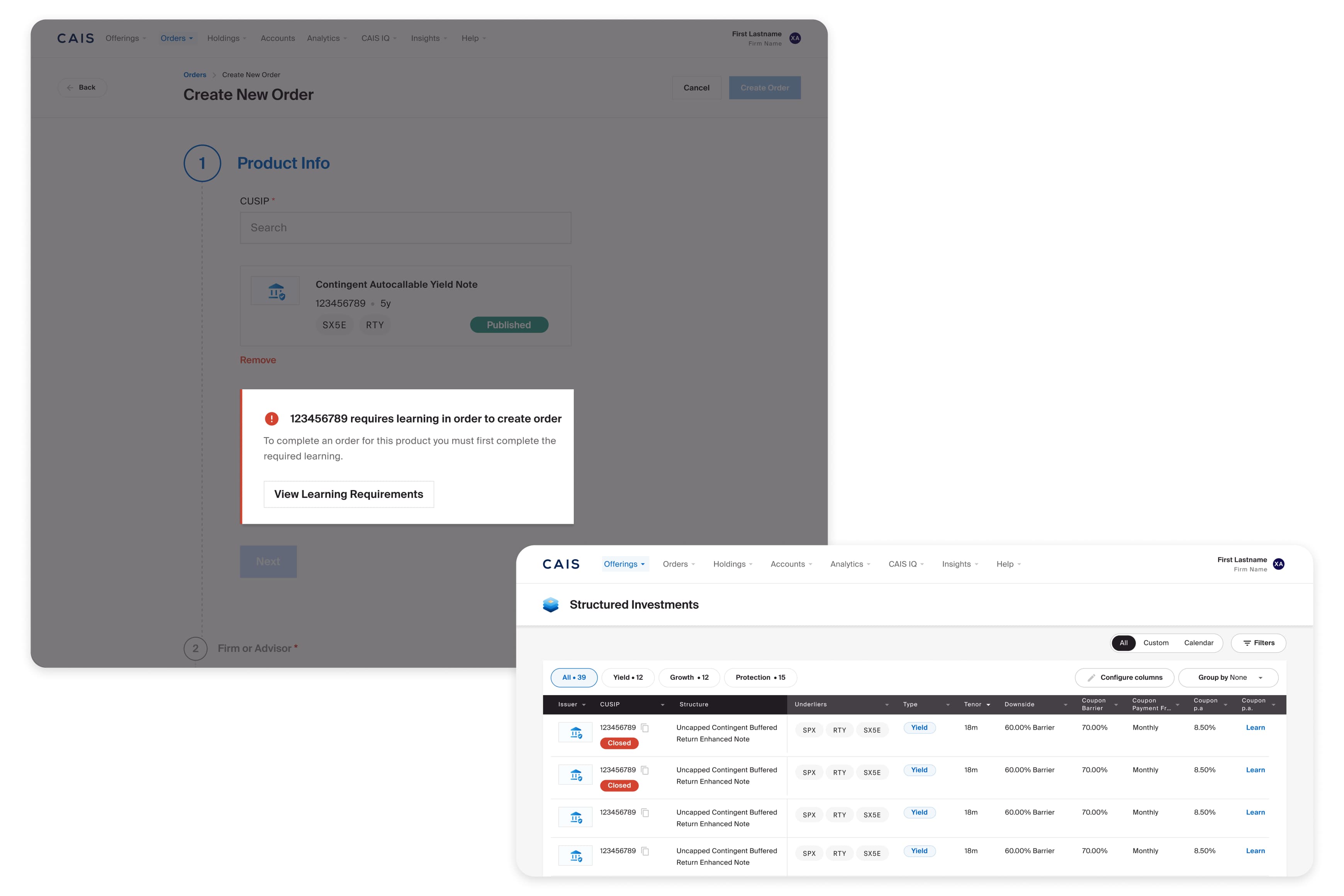

Education-Driven Access Controls

We’re introducing a new learning-based access feature that connects CAIS IQ advisor education directly to structured investment order creation workflow. Firms can now set learning requirements and manage advisor access to order creation based on completion status.

This integration between CAIS IQ and the order management workflow enhances oversight and ensures advisors complete course requirements before engaging in order creation, supporting both firm-level oversight and advisor readiness.

release notes 3q learn to invest

Coming Soon

CAISey—An AI Solution to Streamline Fund Discovery and Analysis

Expected to launch in early 2026, CAISey is an AI-powered solution designed to redefine how advisors navigate alternative investments on the CAIS platform. Debuted at the recent CAIS Summit in October, CAISey can help advisors surface, evaluate, and compare funds more efficiently across the CAIS platform by combining data intelligence with natural language.

CAISey will allow advisors to ask fund-specific questions and receive data-driven responses in seconds from documents on the CAIS platform. By bringing together vast amounts of fund information in one intelligent experience, Supported by CAIS IQ, it will also connect fund data with relevant educational content, helping advisors learn, compare, and apply insights within a single connected experience. CAISey reflects CAIS’ ongoing investment in technology that enhances advisor workflows and brings greater transparency to alternative investing.

Enterprise Configurability and Supervisory Controls for Structured Investments

We’ve introduced new enterprise-grade configurability controls providing firms more flexibility to tailor their advisors’ experiences and strengthen supervisory oversight across the CAIS platform.

Key enhancements include:

Conditional order creation controls: This enhancement provides the ability to restrict order creation when certain criteria, such as order minimums, product closing dates, and more, are not met.

Customizable notification: Firms can now personalize notification settings for lifecycle events and order activity, ensuring the right teams and individuals receive the updates they need.

These enhancements empower firms to deliver a more tailored and operationally efficient experience across their advisor network for structured investments.