The triple threat of persistently high inflation, rising interest rates and potentially looming economic slowdown has called into question the near-term attractiveness of private real estate. A recent sell-off in public real estate investment trusts (REITs) and the seemingly soured sentiment regarding redemption limits at the world’s two largest non-traded REITs have especially shaken confidence in the sector.1

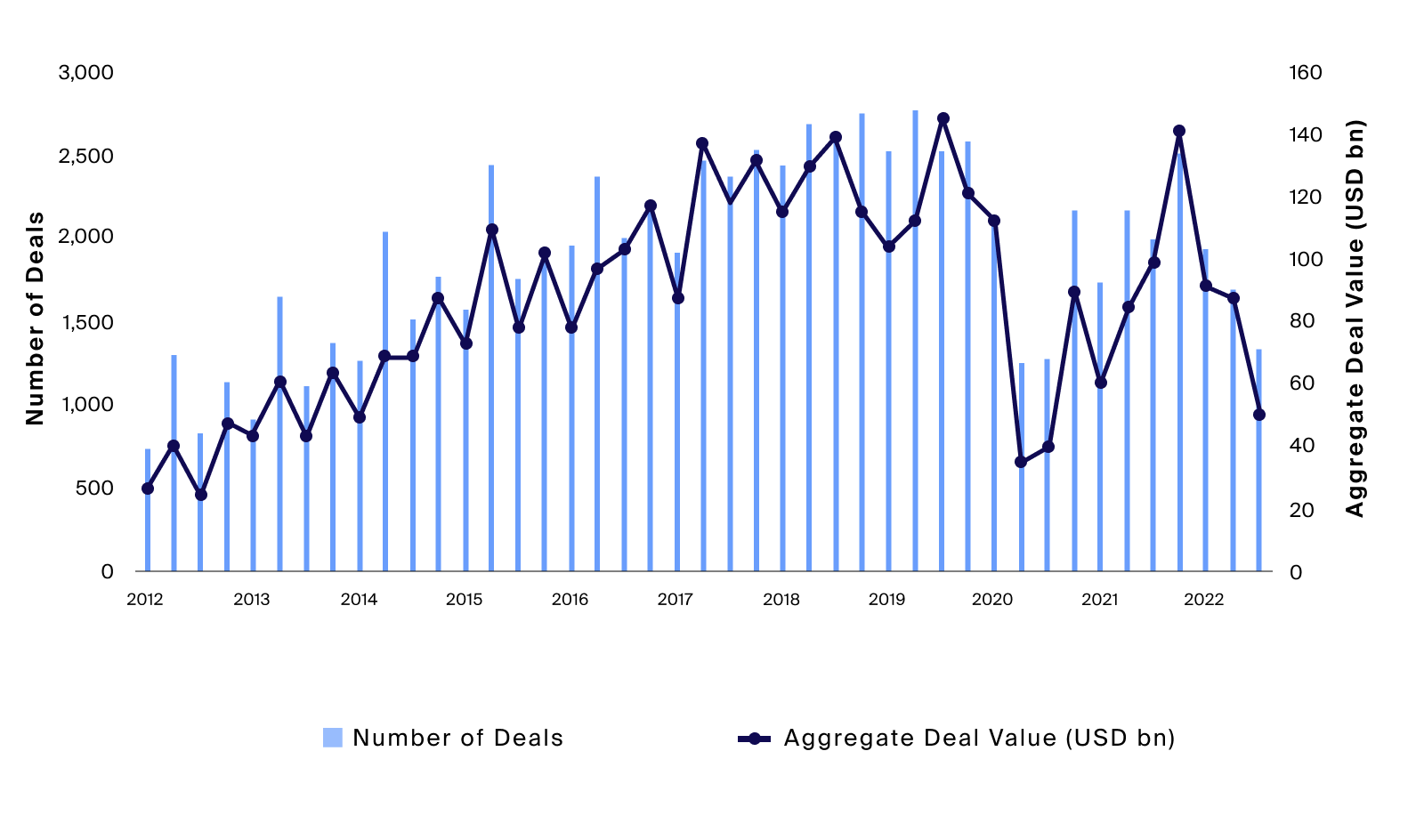

Private real estate was a top-performing asset class in 2021, fueled by near-zero interest rates and a flood of new capital. That year alone, real estate managers raised $214 billion2 in closed-end funds and $36 billion in unlisted REITs up from $156 billion and $11 billion in 2020, respectively. Now, transactions and fund flows are slowing (Exhibit 1) as fund managers and investors alike reassess the implications of this new environment.

In this article, we hope to provide some useful context for financial advisors who oversee existing exposures or those seeking to allocate client assets to private real estate. These advisors may consider looking more closely at the fundamentals of the asset class in the current environment and the potential catalysts, risk and opportunities that may emerge. First, we look at what may be causing stalled activity in private real estate. We then assess potential catalysts that may drive private real estate out of gridlock and into a newer, lower valuation equilibrium. Finally, we outline potential opportunities and risks that may be arriving as a result.

Private Real Estate Valuations: Frozen in Price Discovery

While publicly traded REITs have sold off nearly 27% as measured by the FTSE NAREIT Equity REITs index year to date, private real estate markets have not yet repriced to nearly the same extent.3 Public REIT prices typically rise and fall with the market and trade at a premium or discount to the net asset value of their portfolio. By contrast, values of non-traded REITs and closed-end real estate funds are determined solely by appraisals of the underlying real estate assets less liabilities, which are updated far less frequently than the daily trading activity conducted on exchanges.4 Appraisals of value are dependent on estimates of future net operating income, which may be challenging given current economic uncertainty, and comparable sales, which are currently few and far between (Exhibit 1).5

Source: Preqin, Historical Fundraising all Real Estate, as of Q3 2022.

The rapid shift into this regime of higher interest rates and broadening economic uncertainty has shifted the private real estate market into a price discovery phase, with transactions falling near COVID-era lows.

The rapid shift into this regime of higher interest rates and broadening economic uncertainty has shifted the private real estate market into a price discovery phase, with transactions falling near COVID-era lows (Exhibit 1). Potential sellers of commercial real estate assets have largely been reluctant to lower valuations to transact, holding out for potentially greater economic certainty and better pricing in the coming quarters. Buyers, on the other hand, have been unwilling to purchase assets at stale valuations that may not account for markedly higher debt-financing costs or depressed incomes in a slower-growth or recessionary scenario.6 As a result, this wide bid-ask spread has gripped the private real estate market with global transactions down 30% YoY in Q3 2022.7

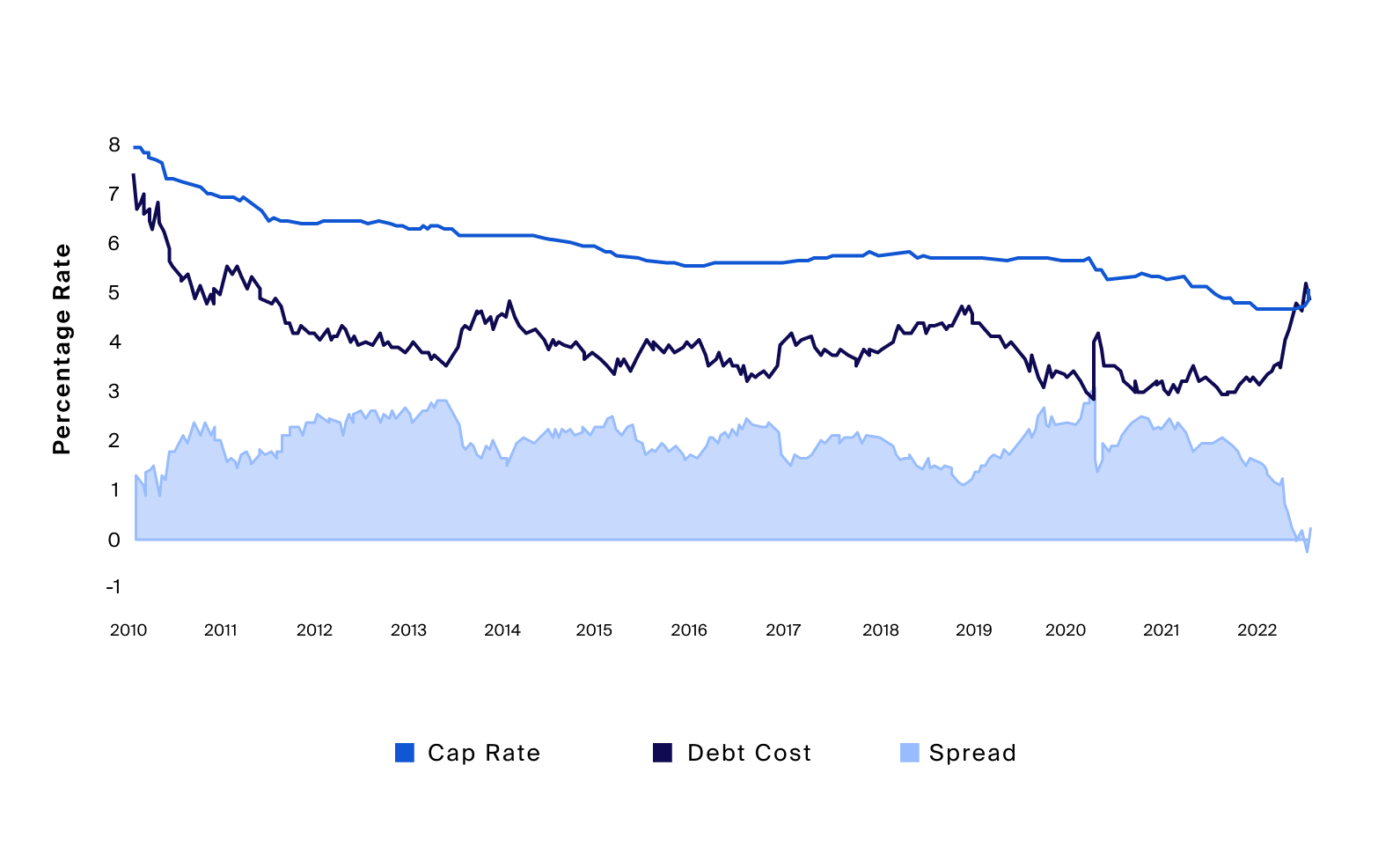

Transaction activity appears to have also been stymied by a lack of attractive financing options. The cost of debt financing has increased in some instances beyond the capitalization rate, which is the net operating income generated by the property as a percentage of the value of the property (Exhibit 2). Approximately $5.5 billion—nearly a third of all new commercial mortgage-backed securities—were completed with negative leverage in the third quarter.8

Negative leverage, which occurs when the costs of financing outweigh overall cash flow within a given period, deteriorates an investment’s levered internal rate of return in the short term. Some buyers may be willing to accept that outcome due to their longer-term optimism around high net operating income or property value growth, or potentially lower debt costs in the future. However, more broadly, negative leverage tends to drive bid prices lower so that potential buyers can meet their minimum return thresholds. That widened bid-ask spread, as described earlier, results in a stalled-out market.9

Source: Invesco; Debt cost based on data from Trepp/Green Street, 10-year loans, 50-59% loan-to-value (LTV), equal-weight average across sectors; Cap rates represent Green Street’s equal-weight nominal cap rate across sectors. Invesco Real Estate using data from Moody’s Analytics and Green Street, spread is calculated by Cap Rate minus Debt Cost, as of July 2022.

The cost of debt financing has increased in some instances beyond the capitalization rate, which is the net operating income generated by the property as a percentage of the value of the property.

Lack of transaction activity can make it difficult to gauge how much prices will fall. And without new transactions to spur repricing, negative leverage may persist until interest rates drop—which may be unlikely for the next few quarters given the Fed’s projected rate trajectory.10

Some noteworthy catalysts, which we describe in the following sections, may push the commercial real estate market out of this standstill and into a new equilibrium. They may also provide clues to the speed or extent of a broader valuation correction.

Potential Catalyst 1: Liquidity Needs, Negative Sentiment and the Denominator Effect

Liquidity-seeking Asian investors reportedly drove most of the initial bout of redemption requests from the largest non-listed REITs—70% in the case of Blackstone’s BREIT.11 According to Blackstone’s CEO, in Asia, where the use of leverage is more prevalent, investors facing margin calls given the sharp drawdown in their domestic equity markets found themselves seeking liquidity from the private real estate portion of their portfolios.12

Related reports indicated potential concern that this initial flood in redemptions may further derail investors’ confidence in certain funds and more broadly in the market.13 Indeed, even investors without liquidity needs as immediate as margin calls may still be motivated to seek redemptions given the news. By doing so, they could aim to lock in their gains while valuations are relatively elevated, with the intention to deploy into publicly traded assets that have already suffered larger corrections—thus perhaps leaving more room for potential upside.

Eventually, to meet these redemption requests, open-end private real estate funds may be forced to sell assets into a very illiquid market, which may push down valuations broadly and create a ripple effect across the asset class. This could eventually cause more selling, pushing down valuations, motivating more redemption activity, and so on.

An additional headwind to fund flows to private real estate may be a function of portfolio and risk management. The outperformance of private real estate in recent years relative to traditional asset classes, like publicly traded equities and fixed income, appears to have led to an overallocation to the asset class. Based on a survey of 173 institutions released mid-November 2022, 32% of investors said they’re overallocated to private real estate, up from 9% in the previous year.14

As these investors seek to rebalance their portfolios, this denominator effect,15 similar to the portfolio rebalancing trend driving the growing opportunity set in the private equity secondary market, may lead to a sustained pullback from private real estate allocations. Such a pullback may further motivate redemptions from open-end funds or secondary sales for closed-end funds.16

Source: Bloomberg, S&P 500 represented by the S&P 500 Index, Global Equities represented by the MSCI ACWI Index, Public REITs represented by the FTSE NAREIT All Equity REITS Index, US Core Commercial Real Estate represented by the NCREIF Fund Index ODCE Total Index Value, as of 12/16/2022.

The outperformance of private real estate in recent years relative to traditional asset classes, like publicly traded equities and fixed income, appears to have led to an overallocation to the asset class. Based on a survey of 173 institutions released mid-November 2022, 32% of investors said they’re overallocated to private real estate, up from 9% in the previous year.

Semi-liquid private real estate vehicles, which have expanded in recent years, could become a desired source of cash for investors seeking to rebalance.17 However, as redemptions increase, these investments may not provide the same level of liquidity that was typically available in more benign environments.

That said, an immediate surge of forced selling appears unlikely. Non-listed REITs typically have gating mechanisms that cap redemptions in a given period to a specific percentage of net asset value.18 While these mechanisms present a challenge for those investors seeking liquidity, they are generally designed to protect the broader investor base. Without such mechanisms in place, a fund manager could be forced to fire-sell these highly illiquid assets, possibly degrading the fund’s value.19 On a larger scale, these limits may also prevent a wider sell-off in response to recent events.

Forced selling may also be buffered to the extent to which funds are capitalized to meet requested redemptions. The longer they can continue issuing redemptions without selling assets, the less impact this will have on their portfolio and private real estate asset valuations broadly. BREIT and SREIT, the two largest non-traded REITs, are believed to be well-capitalized and large enough to “fund redemptions well into 2024 without selling assets.”20

Potential Catalyst 2: Impending Debt Maturities and Negative Leverage

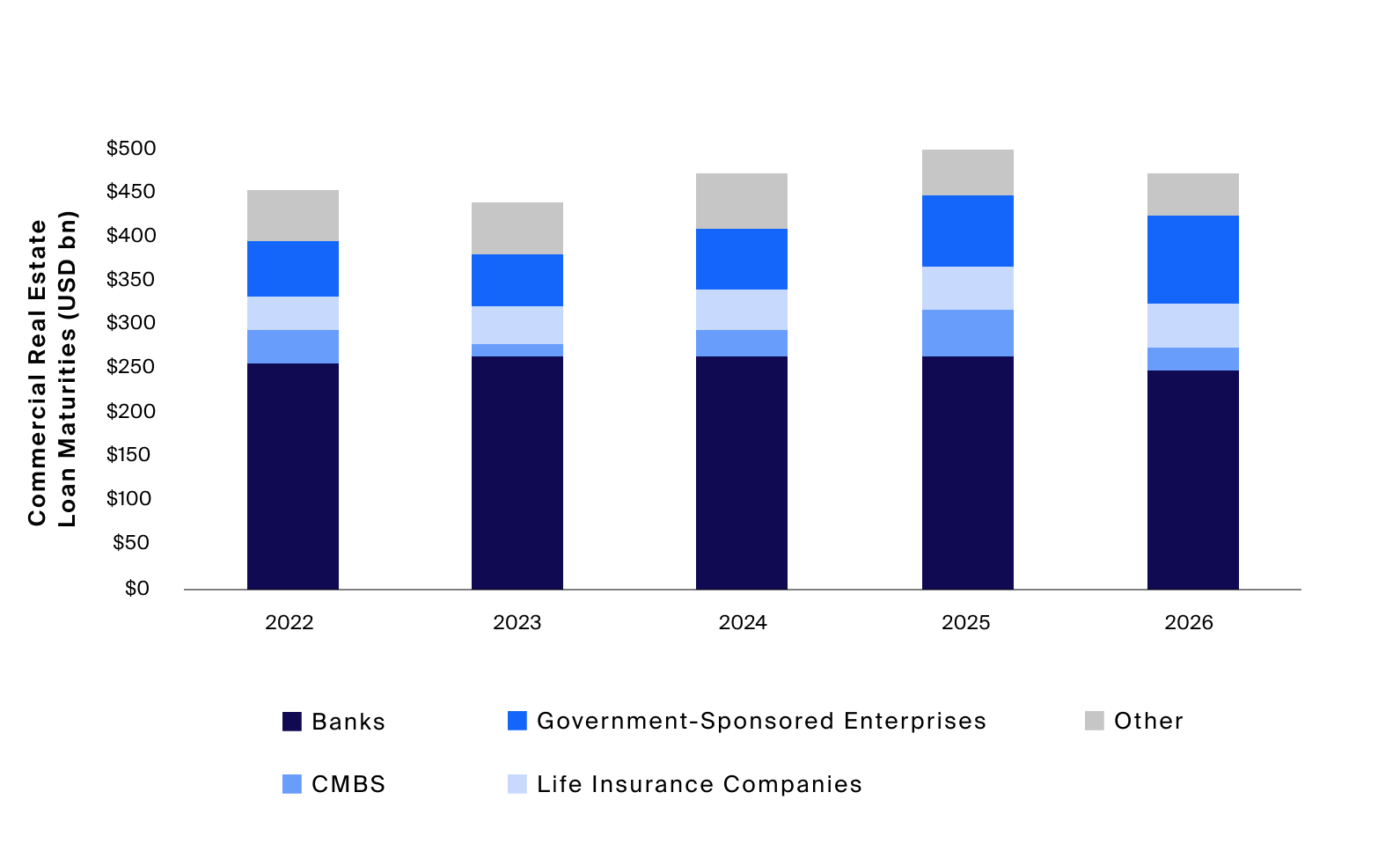

Upcoming commercial real estate debt maturities may force some property owners into selling. A property owner with a maturing loan typically has several options. They can choose to refinance the loan, make a principal repayment, commit new capital or sell the property.

The refinancing option has become potentially less attractive or even unavailable, with only 73.5% of commercial real estate properties refinancing loans near maturity in Q2 2022, down 11.2% from the previous quarter.21 Inability to refinance due to liquidity issues may result in increased loan delinquencies. However, the impending volume of maturities is nowhere near the size of the “wall of maturities” in commercial mortgage-backed securities that contributed to the Global Financial Crisis.22 Additionally, in most cases, borrowers do not appear to believe property values will fall below their loan balances.23 Loans maturing in the coming year are also almost exclusively originated post-crisis and as such have lower leverage and are backed by properties whose valuations have risen in recent years.24

Source: NAR Realtor, CoStar.

The underlying fundamentals of private real estate assets have remained relatively strong this year.

Increasingly though, property owners who struggle to keep up with their existing costs may seek to sell their assets rather than take on higher-priced debt. They may also be unable to find debt financing as lenders strengthen their protections around leverage and debt service coverage ratios.25

Potential Catalyst 3: Macroeconomic Factors and Operating Fundamentals

Thus far, our discussion on catalysts has been mostly technical in nature, rather than related directly to the underlying fundamentals of private real estate assets, which have remained relatively strong this year (Exhibit 5).

Source: Colliers Knowledge Leader, Colliers, Trepp.

Loans maturing in the coming year almost exclusively originated post-crisis and as such have lower leverage and are backed by properties whose valuations have risen in recent years.

Across real estate sectors, fundamentals remain relatively resilient. Industrial real estate vacancies remain at all-time lows, and newly built properties are leasing up more rapidly than in the past. In addition, following the federal stimulus in response to the COVID-19 crisis, personal consumption remains at record levels supporting retail. For the first time since 2016, store openings outpaced store closures.26 As of Q3 2022, office leasing in the United States has returned to nearly 80% of long-term averages and vacancies have decreased.27 While new construction has slowed, subleasing activity has increased. Newer, location-focused office buildings, which are intended for a more hybrid work environment, have seen considerable demand from tenants.28

Rent growth in multi-family, which had outpaced inflation years prior, has potentially finally succumbed to affordability limits, with 12-month rent growth falling from 10.4% in Q3 2021 to 5.7% in Q3 2022 (Exhibit 5).

Ultimately, sellers may need to see greater economic certainty before they reset their valuation expectations. Any potential price correction is also unlikely to be uniform, with performance divergence likely to increase across properties, sectors, and portfolios depending on quality and growth prospects.29

Where Might Risk and Opportunity Emerge in Private Real Estate?

While an immediate sharp downturn in valuations seems unlikely given the abovementioned factors, advisors may have to be more selective in seeking exposure to private real estate in their client portfolios in anticipation of an impending transition. Below, we outline some risk considerations, along with the opportunities within the private real estate landscape given the current state of the market and anticipated valuation rerating.

Risk Considerations in Private Real Estate

As we note earlier, taking advantage of any opportunity in this space will likely depend on the manager selected, the access that manager has to certain properties, and the skill, experience and resources they have to manage and improve the properties in their portfolios. It’s also worth noting that a manager’s track record from the past decade is not a reliable indication of their ability to perform in our current or future environment. Investors in certain private real estate funds may also face concentration risks and the J-curve typical in drawdown funds; therefore, it is important that investors aim to diversify across managers, geographies, vintage years, strategy types and property sectors. Finally, as mentioned before, most real estate investments tend to be relatively illiquid, both at the property level and the fund level. Advisors should consider their clients’ liquidity needs before investing in this space.

Improved Terms in Private Real Estate Debt

Similar to their private equity counterparts, private credit funds focused on real estate lending, like middle-market direct lenders, may have a unique opportunity to step in as debt capital providers as traditional sources of liquidity pull back.30 The scarcity of debt financing may contribute to lenders’ ability to command more protective terms and a higher spread for each loan.

Private credit in this space may be able to mitigate against potential decreases in commercial real estate valuations, given its priority claims to the properties’ operational cash flows.31 The real estate sector at large is also much more conservatively capitalized than it was leading into the GFC.32

Potentially Lower Entry Points for Drawdown Funds With Dry Powder

A potentially impending valuation correction may offer an opportunity to deploy new capital at a lower-priced entry point than in recent years. Drawdown funds may be an attractive vehicle for accessing this opportunity set given their ability to hold dry powder to deploy over a multi-year investment period. Similarly, newly launched non-listed REITs may have the opportunity to deploy funds into a potentially more attractively priced market with limited exposure to legacy assets, valued before recent rate hikes compared to fully deployed semi-liquid vehicles.

As we covered previously, private market vintages deploying into lower valuation environments and recessions have historically offered more attractive returns. The next phase of the private real estate market appears to be such an environment.

For advisors seeking to access the asset class for yield purposes, revalued properties in core strategies—particularly those capable of inflation adjustments in their contracts or shorter-term leases—may also become more attractive.33

Longer-Term Structural Growth Drivers

Recent events should serve as a reminder to investors that while offering some liquidity, open-ended private real estate vehicles could still potentially be considered a part of a long-term strategic allocation rather than a short-term trade and a reliable source of liquidity, depending on an investor's goals and risk tolerance. Investors should also be cognizant of the other investors in their funds and the mechanisms that can either limit liquidity or protect asset value. It is also important to know whether a fund is equipped to meet redemptions in a scenario like the one we are in now.

Advisors with longer time horizons may consider maintaining their clients’ existing exposures despite potential valuation headwinds, to take advantage of the abovementioned opportunities in the coming quarters. Investing in certain property types can provide investors exposure to long-term, acyclical or even counter-cyclical secular trends, like the growth of e-commerce and the digital economy through data centers, onshoring supply chains, and long-term supply and demand imbalances in particular sectors.34 35 These more durable structural growth drivers may support potential income and value growth, counteracting broader nearer-term cyclical headwinds to valuations.

While core private real estate performance may not return to this year’s historical highs in the near term,36 the asset class may continue to serve as an important part of a long-term strategic asset allocation for those seeking an inflation hedge,37 diversification through low correlation to both stocks and bonds,38 lower volatility than equities and public REITs,39 and potential tax benefits for taxable investors.40 As with all private market strategies, a long-term view is necessary in private real estate given the illiquid nature of the underlying assets, whether investing in a semi-liquid fund or an illiquid, private equity-style vehicle.