What Are Alternative Assets?

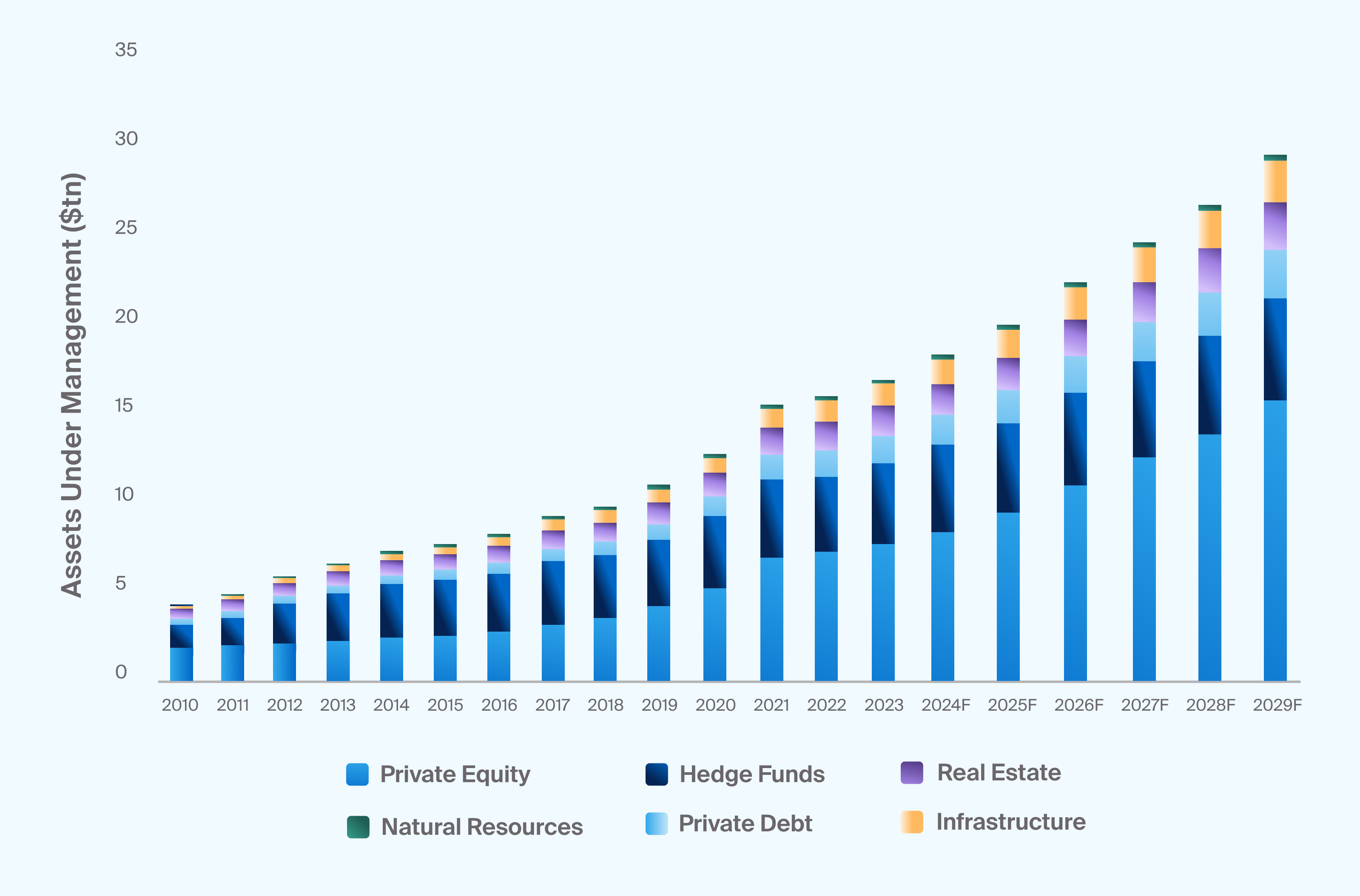

Alternative assets are generally defined as investments that fall outside traditional equity and bond investments. Assets under management (AUM) for alternatives have more than doubled over the last decade from just over $7.2 trillion in 2014 to an estimated $18.2 trillion in 2024. Preqin forecasts that alternatives AUM could jump to $29.2 trillion by 2029 (Exhibit 1).

Source: Preqin Future of Alternatives 2029; 2024-2029 are Preqin's forecasted figures.

Alternative investment AUM is expected to continue to grow (Exhibit 1)

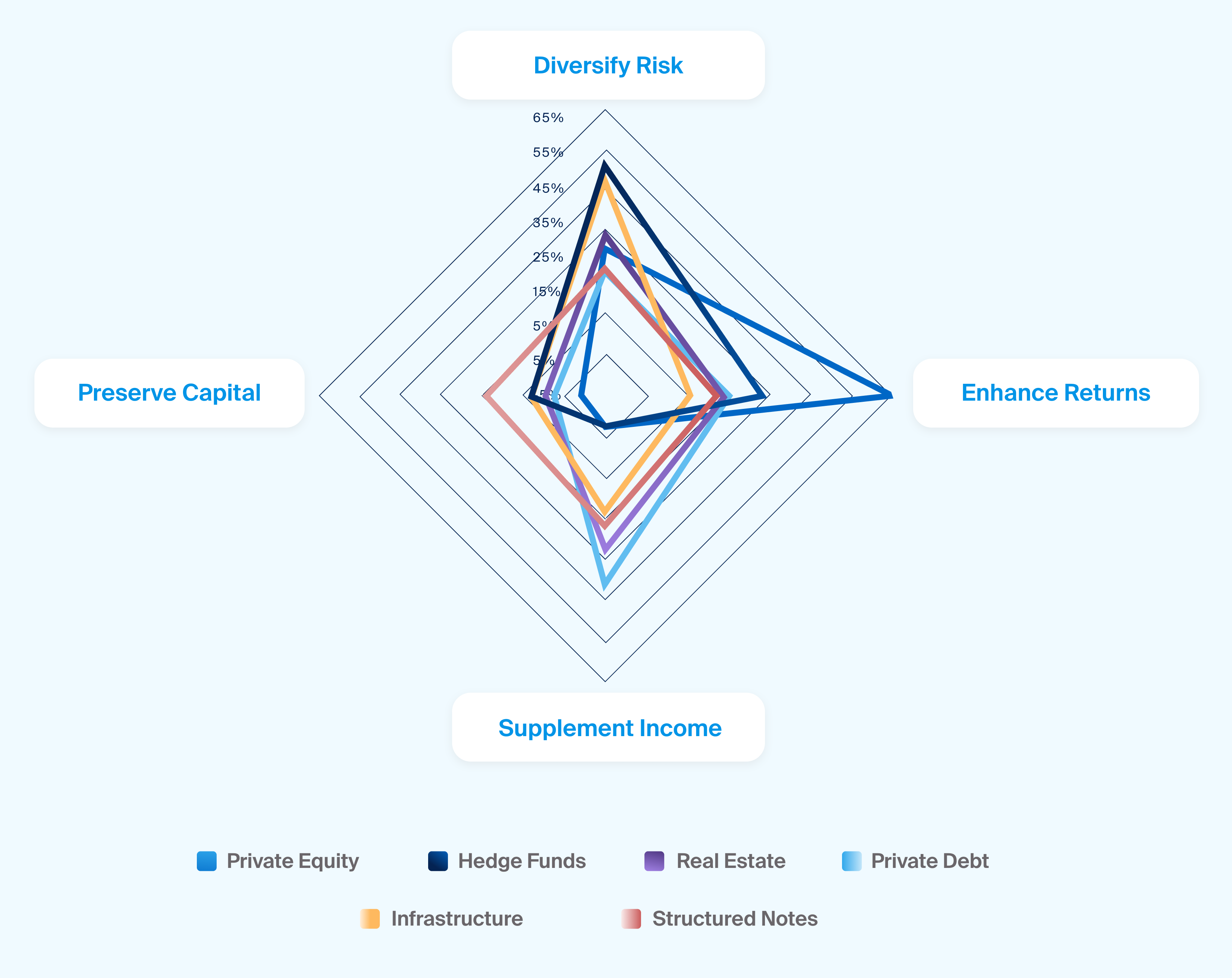

The continued growth of alternative investments may be broadly related to two themes. First, some advisors may be concerned that the returns from traditional asset classes in recent years may not be easily repeated in the coming years, particularly as inflation and interest rates remain uncertain. Certain alternative asset classes and strategies may offer the potential for higher returns because they tend to take on more risk. Other strategies may seek to mitigate risk through negotiated terms, contracts, or structures that may not be as readily available through public market investments. Some advisors may be exploring alternative asset classes as they seek differentiated sources of return that may be less correlated to traditional asset classes (Exhibit 2).

Source: CAIS and Mercer, “The State of Alternative Investments in Wealth Management 2023,” December 2023.

Investors reasons for exploring alternative asset classes as they seek differentiated sources of return that may be less correlated to traditional asset classes and could help diversify a portfolio.

Advisors may explore alternative asset classes in search of differentiated sources of return. These assets may be less correlated to traditional markets and could help diversify a portfolio with proper investment management.

These themes—potential for higher risk/reward and diversification—reflect some characteristics of alternatives that differ from traditional investments.

Alternative Investment Strategies and Considerations

Be Prepared for Longer-Term Investments

Many alternative investments need time for their value-creation strategies to play out, often requiring a multi-year investment horizon.

Understand Access to Less Conventional Investment Opportunities

Alternatives may offer advisors the opportunity to provide exposure to assets that can be harder to access through traditional investments, such as infrastructure, natural resources, early-stage and middle-market private companies, sports, media, and entertainment rights, and niche real estate, to name a few.

Explore Private Markets and Less Regulated Investment Vehicles

Alternative investments are generally private investments and subject to limited regulations compared to public investments. This contrasts notably with traditional assets like stocks and bonds, which can be traded directly on exchanges or owned in funds, such as mutual funds and exchange-traded funds (ETFs), both of which are relatively liquid, transparent, and regulated.

Liquidity Considerations

Alternative investments are generally less liquid than traditional asset classes because the funds and many of the underlying assets are not publicly traded and may lack a secondary market. In addition, in many cases, alternative funds require capital to be locked up for several years because of the time it takes to execute the investment strategy.

Limited to Accredited Investors

Ownership of alternative investments has historically been restricted to institutional investors or individuals with defined accreditation statuses based on their investable net worth, income, or industry licensing.

Understand Investment Minimums

Minimum investments may be set higher for alternative investments, effectively excluding those with fewer investable assets. These requirements are beginning to change, however, with newer structures and more innovative product development.

What Are Some of the Different Categories of Alternative Investments?

Alternative assets share some common characteristics that set them apart from traditional assets, as noted above. But it is important for advisors to understand that within alternatives, asset classes and strategies may function in a unique way from one another and offer a wide variety of risk and return profiles (Exhibit 3).

For example, while a long/short equity hedge fund and a private infrastructure fund may both be classified as alternatives, the underlying assets they own, the way they typically generate returns, and their resulting risk profiles are considerably different. We describe major alternative asset classes to illustrate the range of characteristics.

Source: Preqin, return represented by annualized return, risk represented by annualized risk, calculated between 12-2000 and 9-2024, the size of each circle represents the assets under management (AUM) for funds in each category, as of 6-2024

Alternative asset classes feature a wide range of risk and return profiles (Exhibit 3)

Private Equity

Private equity is the broad term for investing in a privately owned company rather than owning shares in a public company that can be traded on an exchange. Private equity encompasses a range of diverse strategies, including venture capital, growth, and buyout.. Because underlying portfolio companies tend to be less established than publicly listed companies, private equity can involve more risk with the potential to offer higher returns than stocks.

Private Debt

Private debt, also called private credit, typically refers to loans that are privately negotiated between two parties, as opposed to traditional syndicated loans or bond issues that are more broadly available in traditional fixed income. In the past, private debt may have been more comparable to non-investment grade syndicated leveraged loans and high yield bonds and in turn riskier. However, borrower demand for direct lending and asset-based has increased,1 strategies within this asset class have evolved and may include more preferable terms and covenants.

Real Estate

Real estate is generally defined as tangible property consisting of land, buildings, and related structures. Private real estate investments can be made through a direct transaction for a single property, direct acquisition of a portfolio of assets, or through a diversified commingled fund.

Infrastructure

Infrastructure assets are related to a wide variety of physical assets that tend to play critical roles in helping economies run, ranging from roads, gas pipelines, and power grids to airports, healthcare facilities, and data centers.

Natural Resources

Natural resources, along with infrastructure, make up a category of physical assets commonly referred to as real assets. Natural resource investments may be related to land involved in the development or processing of natural resources, such as forestry or agriculture, as well as the commodities themselves.

Hedge Funds

Hedge funds are commonly described as private, actively managed, pooled investment vehicles subject to less regulation than many traditional investments, such as mutual funds. This may allow hedge funds more flexibility in terms of the assets they can invest in, their investment style, and the management of the fund. This flexibility may be important because the goal for many hedge funds is to earn positive risk-adjusted performance in all market conditions.

How Is the Alternatives Market Evolving?

For years, many institutional investors have been increasing their allocations to alternatives (Exhibit 1), typically in search of higher returns and diversification. This has contributed to the growth of the alternatives market, in terms of assets under management and innovative product offerings.

Institutional investors have also helped alternatives become more transparent by demanding higher quality reporting and analysis, as well as carrying out their own due diligence. The increase in data and research on alternative asset classes by independent providers may also contribute to better information and could lead to further allocations.

As the alternatives industry matures, a wider audience may be able to access the asset class. Newer types of investment vehicles, notably evergreen fund structures like interval funds or business development companies (BDCs), may offer better liquidity than typical alternative investments and require smaller minimum investments. Alternative investment technology solutions, like the CAIS platform, are also helping to provide advisors with greater access to alternatives by centralizing and streamlining alternative investment operations.

Allocations to alternatives could grow further, as many advisors continue to seek differentiated sources of returns. Furthermore, continued product innovation and advancements in technology and operations could support growth in alternative assets under management and expand the investor base through improved access.

Risks of Investing in Alternatives

Alternative investments are associated with potential risks, such as loss of capital, illiquidity, manager risk, business risk, volatility, and reduced transparency compared to traditional investments, among other risks.

Explore the rest of our Introduction to Alternatives series to learn more about the unique attributes and risks associated with each alternative asset class.